The IRS 1095-A form is a crucial document that provides information about your health insurance coverage obtained through the Health Insurance Marketplace. This form details the months you were covered, the premiums paid, and any premium tax credits you may...

The IRS 1096 form is a summary transmittal form used to report information returns to the Internal Revenue Service. It serves as a cover sheet for various types of information returns, such as 1099s, and must be filed alongside these...

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals or businesses that are not classified as wages. This form is essential for ensuring accurate income reporting and compliance with tax regulations....

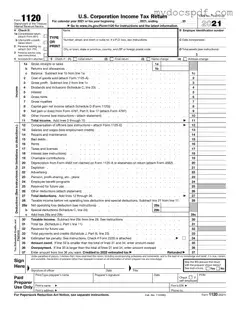

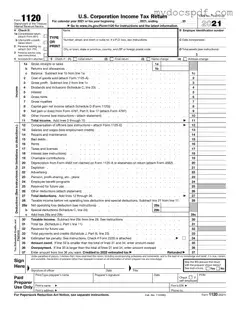

The IRS 1120 form is a crucial document that corporations use to report their income, gains, losses, deductions, and credits to the federal government. This form not only helps determine a corporation's tax liability but also ensures compliance with tax...

The IRS Form 2553 is a crucial document that allows eligible small businesses to elect S corporation status for tax purposes. By filing this form, business owners can potentially reduce their tax liability and enjoy various benefits associated with S...

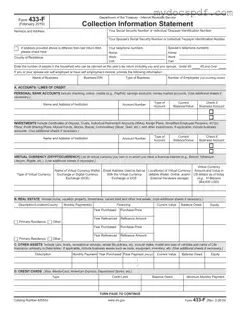

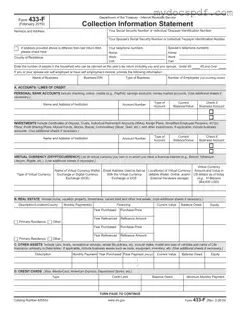

The IRS 433-F form is a financial statement used by individuals to provide the Internal Revenue Service with detailed information about their income, expenses, and assets. This form is essential for those seeking to negotiate payment plans or settle tax...

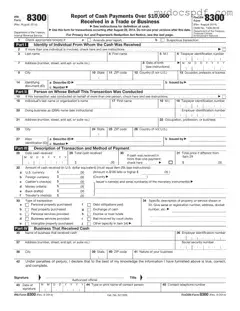

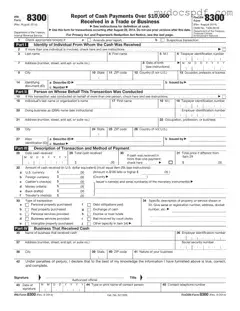

The IRS Form 8300 is a crucial document used by businesses to report cash transactions exceeding $10,000. This form helps the IRS track large cash payments and combat money laundering. Understanding its purpose and requirements is essential for any business...

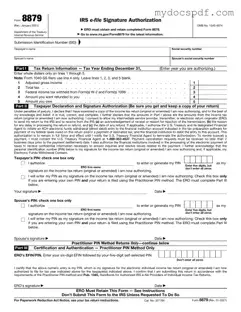

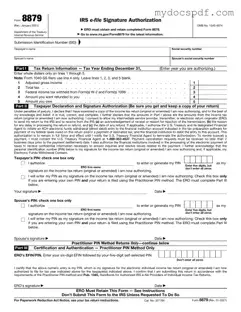

The IRS 8879 form, also known as the e-file Signature Authorization, is a document that allows taxpayers to authorize their tax preparer to electronically file their tax returns. This form ensures that the taxpayer's identity is verified and that they...

The IRS 940 form is an annual tax return that employers use to report their Federal Unemployment Tax Act (FUTA) liabilities. This form helps the IRS track the taxes employers owe for unemployment insurance. Understanding the requirements and deadlines associated...

The IRS 941 form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form provides the Internal Revenue Service with essential information regarding an employer's payroll...

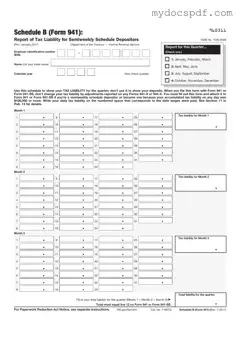

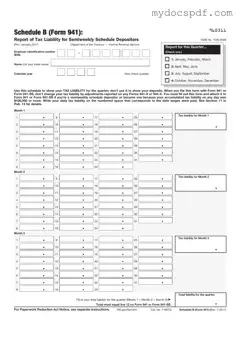

The IRS Schedule B (Form 941) is a document used by employers to report their tax liabilities related to federal income tax withholding, Social Security, and Medicare taxes. This form provides essential information about the employer's tax obligations for each...

The IRS Schedule C 1040 form is a crucial document for self-employed individuals and sole proprietors, allowing them to report income and expenses from their business activities. This form provides a detailed account of profits and losses, ensuring that taxpayers...