Attorney-Approved Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form is a vital document for anyone involved in financing or leasing a vehicle. This form outlines the terms and conditions of repayment, ensuring that both the borrower and lender understand their responsibilities. Key components include the total amount financed, interest rates, and the repayment schedule. It also specifies the consequences of missed payments and the rights of both parties in the event of a default. By clearly detailing these aspects, the agreement helps prevent misunderstandings and disputes. Completing this form accurately is essential for protecting your interests and maintaining a positive relationship between the borrower and lender. Whether you are purchasing a car or entering a lease, this document serves as a foundation for a smooth transaction.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, attention to detail is crucial. Here are some essential dos and don'ts to ensure the process goes smoothly.

- Do read the form carefully before starting.

- Do provide accurate information about the vehicle and repayment terms.

- Do double-check all entries for spelling and numerical errors.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't submit the form without making a copy for your records.

- Don't rush through the process; take your time to ensure accuracy.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves two parties: the borrower and the lender. |

| Governing Law | The laws governing the agreement may vary by state. For instance, in California, the California Civil Code applies. |

| Loan Amount | The form specifies the total amount of the loan that the borrower must repay. |

| Interest Rate | The agreement includes the interest rate, which affects the total amount to be repaid. |

| Payment Schedule | A detailed payment schedule outlines when payments are due and the amount of each payment. |

| Default Terms | The form describes the consequences if the borrower fails to make payments as agreed. |

| Signatures Required | Both parties must sign the agreement to make it legally binding. |

| Amendments | The agreement may include provisions for making changes, requiring mutual consent from both parties. |

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, consider the following key takeaways:

- Ensure all parties involved are clearly identified. This includes the borrower and the lender.

- Accurate vehicle information is essential. Include details such as the make, model, year, and VIN.

- Clearly outline the repayment terms. Specify the payment amount, due dates, and any interest rates if applicable.

- Both parties should sign and date the agreement. This confirms that everyone agrees to the terms laid out.

- Keep a copy of the signed agreement for your records. This is important for reference and any future disputes.

Other Documents

Broward County Animal Care - A space for the date of vaccination is provided.

The Texas Notice to Quit form is a critical legal document for landlords, serving to notify tenants of the necessity to terminate a rental agreement. This notice provides the tenant with a specified timeframe to vacate the premises, ensuring clarity in the rental process. For those seeking a reliable resource to obtain this form, Texas Forms Online offers a convenient template to help landlords and tenants navigate Texas rental laws effectively.

Da Form 7666 - This form can facilitate the resolution of issues encountered during service.

Example - Vehicle Repayment Agreement Form

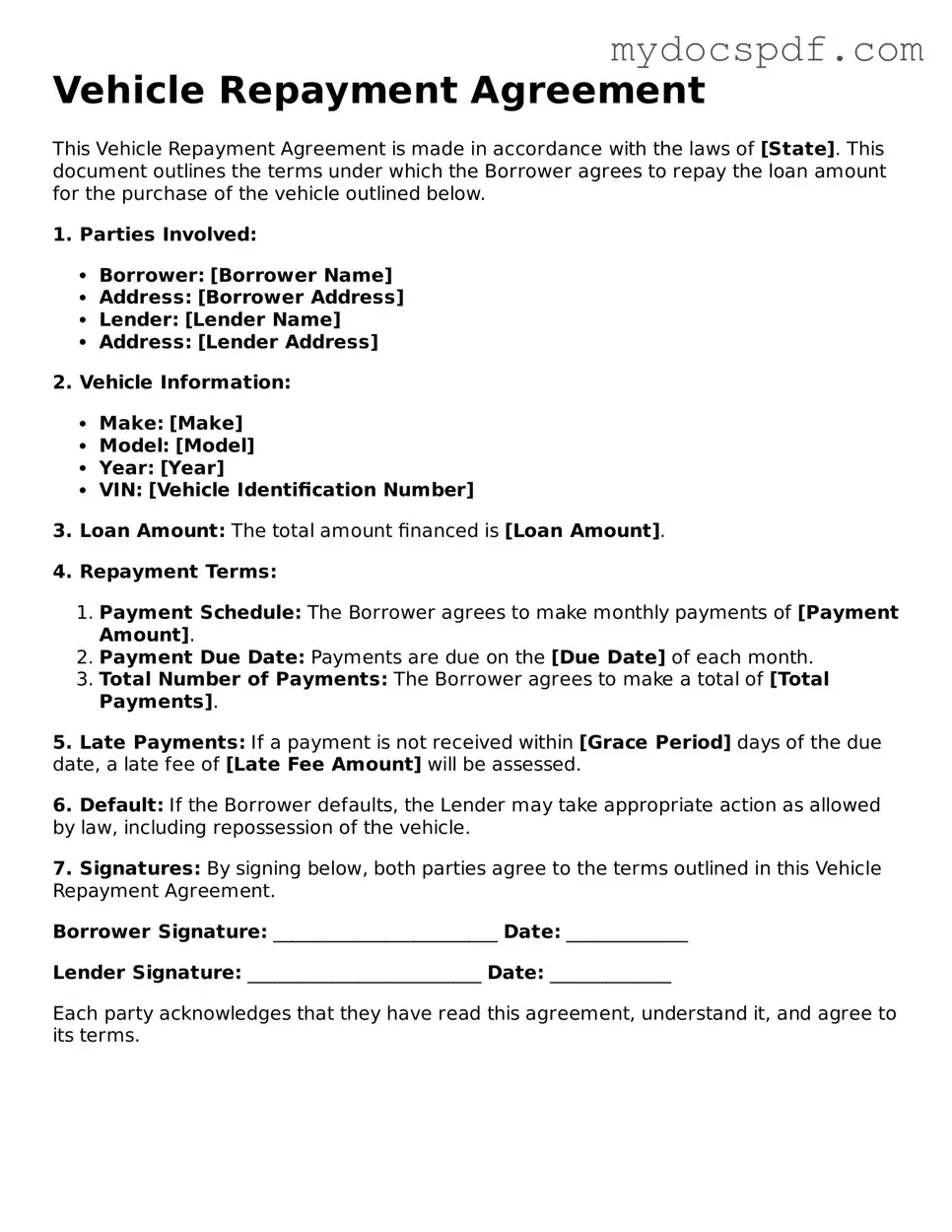

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made in accordance with the laws of [State]. This document outlines the terms under which the Borrower agrees to repay the loan amount for the purchase of the vehicle outlined below.

1. Parties Involved:

- Borrower: [Borrower Name]

- Address: [Borrower Address]

- Lender: [Lender Name]

- Address: [Lender Address]

2. Vehicle Information:

- Make: [Make]

- Model: [Model]

- Year: [Year]

- VIN: [Vehicle Identification Number]

3. Loan Amount: The total amount financed is [Loan Amount].

4. Repayment Terms:

- Payment Schedule: The Borrower agrees to make monthly payments of [Payment Amount].

- Payment Due Date: Payments are due on the [Due Date] of each month.

- Total Number of Payments: The Borrower agrees to make a total of [Total Payments].

5. Late Payments: If a payment is not received within [Grace Period] days of the due date, a late fee of [Late Fee Amount] will be assessed.

6. Default: If the Borrower defaults, the Lender may take appropriate action as allowed by law, including repossession of the vehicle.

7. Signatures: By signing below, both parties agree to the terms outlined in this Vehicle Repayment Agreement.

Borrower Signature: ________________________ Date: _____________

Lender Signature: _________________________ Date: _____________

Each party acknowledges that they have read this agreement, understand it, and agree to its terms.

Detailed Instructions for Writing Vehicle Repayment Agreement

After you have gathered the necessary information, it's time to fill out the Vehicle Repayment Agreement form. This form is essential for establishing the terms of repayment for your vehicle. Make sure to read each section carefully and provide accurate information to avoid any delays.

- Obtain the form: Download the Vehicle Repayment Agreement form from the official website or request a physical copy from your lender.

- Provide your personal information: Fill in your name, address, phone number, and email at the top of the form.

- Enter vehicle details: Include the make, model, year, and Vehicle Identification Number (VIN) of your vehicle.

- Specify loan information: Write down the total amount owed, the interest rate, and the repayment period.

- Outline payment terms: Clearly state the amount of each payment, the due date, and the method of payment (e.g., check, electronic transfer).

- Include any additional terms: If there are any specific conditions or agreements, list them in this section.

- Sign and date the form: Ensure that you sign and date the form at the bottom. If required, have a witness or co-signer sign as well.

- Submit the form: Send the completed form to your lender via mail or email, as instructed.

Documents used along the form

When entering into a Vehicle Repayment Agreement, several additional forms and documents may be necessary to ensure clarity and compliance for all parties involved. Each of these documents serves a specific purpose, helping to facilitate a smooth transaction and protect the rights of both the lender and the borrower.

- Loan Application Form: This document collects essential information about the borrower, including personal details, financial status, and the vehicle being financed. It helps the lender assess the borrower's eligibility for the loan.

- Credit Report Authorization: Borrowers typically need to authorize lenders to access their credit reports. This document allows the lender to evaluate the borrower's creditworthiness and determine the terms of the loan.

- Vehicle Title Transfer Form: This form is used to officially transfer ownership of the vehicle from the seller to the buyer. It is crucial for ensuring that the new owner has legal rights to the vehicle.

- Payment Schedule: This document outlines the repayment terms, including the amount due, due dates, and any applicable fees. It serves as a roadmap for the borrower to follow throughout the repayment period.

- General Bill of Sale: A key document that formalizes the transfer of ownership between the seller and buyer. For further details, you can refer to toptemplates.info/bill-of-sale/general-bill-of-sale.

- Insurance Verification Form: Lenders often require proof of insurance on the financed vehicle. This form confirms that the borrower has adequate coverage, protecting both the lender's and the borrower's interests.

- Default Notice: Should the borrower fail to make payments as agreed, this document serves as an official notice of default. It outlines the consequences of non-payment and the steps the lender may take to recover the owed amount.

- Release of Liability Form: This form is used when the vehicle is sold or transferred to another party. It releases the original owner from any future liability associated with the vehicle, ensuring that the new owner assumes all responsibilities.

These documents work in tandem with the Vehicle Repayment Agreement to create a comprehensive framework for the financing process. By understanding each component, all parties can navigate the agreement with confidence and clarity.