Get Stock Transfer Ledger Form in PDF

When managing corporate stock, clarity and organization are paramount, and the Stock Transfer Ledger form plays a crucial role in achieving this. This essential document serves as a comprehensive record of stock issuance and transfers, ensuring that all transactions are meticulously documented. At the top of the form, you'll find a space to enter the corporation's name, establishing the context for all subsequent entries. Each stockholder's name and place of residence are captured, providing a clear link between individuals and their respective shares. The ledger meticulously tracks the certificates issued, including the certificate numbers and dates, which are vital for maintaining accurate records. Additionally, it details the number of shares issued, the parties involved in the transfer—whether it's an original issue or a subsequent transfer—and the amount paid for those shares. The form also includes a section for the date of transfer, ensuring that every transaction is time-stamped. Finally, it concludes with information about the certificates surrendered and the balance of shares held, offering a complete picture of stock ownership at any given moment. By utilizing the Stock Transfer Ledger form, corporations can enhance transparency and accountability in their stock management processes.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. Here are ten essential dos and don’ts to keep in mind:

- Do ensure you enter the corporation’s name accurately at the top of the form.

- Don’t leave any fields blank; every section must be completed for clarity.

- Do double-check the certificate numbers to avoid errors in record-keeping.

- Don’t use abbreviations or shorthand; write out full names and addresses.

- Do clearly indicate the number of shares being transferred.

- Don’t forget to include the date of transfer; this is vital for tracking ownership changes.

- Do specify the amount paid for the shares, if applicable.

- Don’t neglect to surrender the old certificates if required; this can complicate future transactions.

- Do keep a copy of the completed form for your records.

- Don’t rush through the process; take your time to ensure accuracy and compliance.

By following these guidelines, you can help ensure a smooth and efficient transfer process. Your diligence can prevent complications down the line.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to document the issuance and transfer of shares within a corporation. |

| Required Information | It requires details such as the corporation's name, stockholder information, certificate numbers, and the number of shares issued. |

| Transfer Documentation | When shares are transferred, the ledger must indicate from whom the shares were transferred and to whom they are being transferred. |

| Legal Compliance | In many states, maintaining an accurate Stock Transfer Ledger is required by corporate governance laws, such as the Delaware General Corporation Law. |

| Balance Tracking | The form also tracks the number of shares held by each stockholder, ensuring accurate records of ownership at all times. |

Key takeaways

Filling out and using the Stock Transfer Ledger form is a critical process for corporations managing stock transactions. Here are some key takeaways to consider:

- Accurate Information: Ensure that all fields are filled out accurately. This includes the corporation’s name, stockholder details, and certificate numbers. Inaccuracies can lead to complications in tracking ownership.

- Document Transfers: Record each transfer of shares meticulously. Include the date of transfer, the amount paid, and the parties involved in the transaction. This documentation is essential for maintaining a clear ownership history.

- Certificate Management: Keep track of surrendered certificates. When shares are transferred, the original certificates must be surrendered and noted in the ledger to prevent duplicate ownership claims.

- Balance Tracking: Regularly update the number of shares held by each stockholder. This helps in maintaining an accurate balance and ensures that the corporation has a clear understanding of its ownership structure.

Other PDF Templates

Official Cuddle Buddy Application - Meet fellow cuddle enthusiasts who value physical affection.

When navigating the complexities of parental responsibilities, utilizing resources such as Texas Forms Online can greatly assist in filling out the Child Support Texas form. This document not only defines the financial obligations required from parents but also helps clarify payment amounts and conditions for termination, ensuring that the welfare of the children is prioritized and legal compliance is maintained.

Planned Parenthood Abortion Receipt Template - Referrals will be provided for additional care if needed; you must manage those logistics.

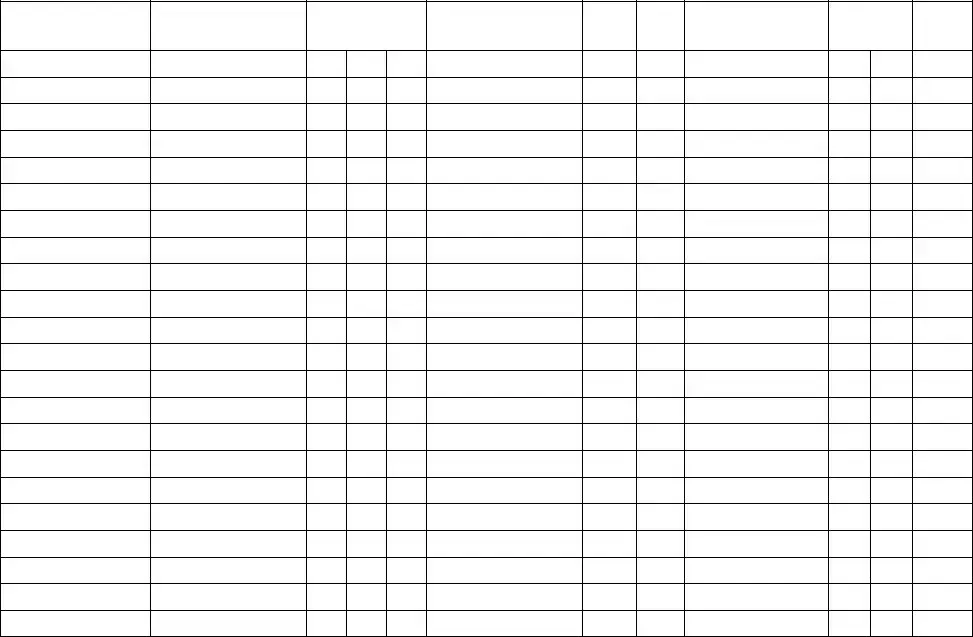

Example - Stock Transfer Ledger Form

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Detailed Instructions for Writing Stock Transfer Ledger

After completing the Stock Transfer Ledger form, you will have a comprehensive record of stock transfers, which is essential for maintaining accurate corporate records. This form will help ensure that all transactions are documented properly, providing clarity for future reference.

- Begin by entering the name of the corporation in the designated space at the top of the form.

- In the next section, list the name of the stockholder involved in the transfer.

- Provide the place of residence for the stockholder.

- Indicate the number of certificates issued to the stockholder.

- Record the certificate number for each issued stock certificate.

- Fill in the date when the shares were issued.

- Specify the number of shares that were transferred.

- Identify the party from whom the shares were transferred. If this is the original issue, clearly state "original issue."

- Enter the amount paid for the shares being transferred.

- Document the date of the transfer of shares.

- List the name of the individual or entity to whom the shares were transferred.

- Note any certificates that were surrendered as part of the transfer.

- Record the certificate number of the surrendered certificates.

- Indicate the number of shares being transferred.

- Finally, provide the number of shares held by the stockholder after the transfer to show the balance.

Documents used along the form

The Stock Transfer Ledger form is a vital document for tracking the issuance and transfer of shares within a corporation. However, it is often accompanied by other forms and documents that help ensure compliance with corporate governance and regulatory requirements. Below is a list of commonly used documents that work in conjunction with the Stock Transfer Ledger.

- Stock Certificate: This document serves as proof of ownership for shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the corporation's name.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders. It may cover aspects such as voting rights, transfer restrictions, and procedures for resolving disputes.

- Board Resolution: A formal decision made by the board of directors, this document may authorize the issuance of shares or approve a transfer of stock. It provides legal backing for actions taken by the board.

- Transfer Agent Agreement: This contract is between a corporation and a transfer agent, who manages the transfer of shares and maintains the shareholder records. It ensures that the transfer agent follows specific protocols.

- Durable Power of Attorney: A necessary document that allows a trusted individual to handle financial matters on behalf of another, especially useful in situations of incapacitation. For more information, visit newyorkform.com/free-durable-power-of-attorney-template/.

- Form 10-K: This annual report filed with the SEC provides a comprehensive overview of a company's financial performance. It often includes information about stock ownership and any changes in the number of shares outstanding.

- Form 8-K: This is a current report that companies must file with the SEC to announce major events. If a significant stock transfer occurs, it may trigger the need for an 8-K filing.

- Subscription Agreement: This document outlines the terms under which an investor agrees to purchase shares. It specifies the number of shares, the purchase price, and any conditions attached to the sale.

- Stock Power Form: This form allows a shareholder to transfer shares to another party. It acts as a written authorization for the transfer and is often required by the transfer agent.

- Dividend Declaration: This document announces the payment of dividends to shareholders. It includes details such as the amount of the dividend and the record date for shareholders eligible to receive it.

- Annual Meeting Minutes: These minutes record the proceedings of the annual meeting of shareholders. They may include discussions about stock transfers, issuance of new shares, and other corporate matters.

Understanding these documents can help shareholders and corporate officers navigate the complexities of stock ownership and transfer. Each document plays a unique role in maintaining transparency and ensuring that all transactions comply with legal requirements.