Attorney-Approved Single-Member Operating Agreement Template

When it comes to managing a single-member LLC, having a well-structured operating agreement is crucial. This document serves as a foundational blueprint, outlining the rights and responsibilities of the sole member while establishing the framework for the business's operations. Key elements typically included in a Single-Member Operating Agreement are the purpose of the LLC, management structure, and financial arrangements. Additionally, it addresses how profits and losses will be allocated, the process for making decisions, and what happens in the event of dissolution. By clearly delineating these aspects, the agreement not only helps to protect the member’s personal assets but also ensures compliance with state regulations. A well-crafted operating agreement can also enhance the credibility of the business in the eyes of banks, investors, and potential partners.

Dos and Don'ts

When filling out a Single-Member Operating Agreement form, careful attention is essential. Below are five important do's and don'ts to guide you through the process.

- Do: Clearly state the name of your business. This establishes the identity of your LLC and is crucial for legal recognition.

- Do: Include your personal information accurately. This ensures that the agreement reflects the correct ownership and contact details.

- Do: Specify the purpose of the LLC. Outlining the business activities can help clarify your intentions and protect your interests.

- Do: Review the document for completeness. Ensure that all sections are filled out and that there are no missing signatures or dates.

- Do: Keep a copy of the completed agreement. This serves as a reference and can be important for future legal or business matters.

- Don't: Rush through the form. Taking your time can prevent mistakes that may lead to complications later.

- Don't: Use vague language. Be specific in your descriptions to avoid ambiguity that could lead to misunderstandings.

- Don't: Forget to check for state-specific requirements. Different states may have unique regulations that you must follow.

- Don't: Ignore the importance of legal advice. Consulting with a legal professional can provide valuable insights and ensure compliance.

- Don't: Leave any sections blank. Incomplete forms can result in delays or rejection of your application.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational guidelines for a single-member LLC. |

| Purpose | This document serves to clarify the rights and responsibilities of the sole member, protecting personal assets from business liabilities. |

| Legal Requirement | While not always legally required, having an operating agreement is highly recommended for single-member LLCs to establish legitimacy. |

| Governing Law | Each state has specific laws governing LLCs. For example, in California, the relevant laws are found in the California Corporations Code. |

| Flexibility | The agreement allows the member to customize the management and operational structure according to personal preferences. |

| Tax Implications | Single-member LLCs are typically treated as disregarded entities for tax purposes, meaning profits and losses are reported on the member's personal tax return. |

| Transfer of Ownership | The agreement can specify conditions under which ownership can be transferred, ensuring clarity in case of future changes. |

| Dispute Resolution | It can include provisions for resolving disputes, which can help avoid lengthy legal battles should disagreements arise. |

| Amendments | Members can amend the agreement as needed, allowing for adjustments as the business evolves or as laws change. |

| Record Keeping | Maintaining this document is essential for record-keeping and can be beneficial during audits or legal inquiries. |

Key takeaways

Filling out a Single-Member Operating Agreement is crucial for establishing the framework of your business. Here are some key takeaways to keep in mind:

- Define Your Business Structure: Clearly outline the structure of your business. This includes identifying the owner and the business name.

- Detail Management Responsibilities: Specify who will manage the business and what their responsibilities will be. This helps in avoiding confusion down the line.

- Outline Financial Arrangements: Include information on how profits and losses will be handled. This ensures transparency in financial matters.

- Consider Future Changes: Plan for potential changes in ownership or structure. This can save time and legal complications in the future.

Completing this agreement is not just a formality; it is a vital step in protecting your interests as a business owner.

Popular Single-Member Operating Agreement Documents:

How to Write an Operating Agreement - The agreement can address the responsibilities of members in maintaining the business’s compliance with applicable laws.

For those setting up a limited liability company, understanding the importance of an LLC's operating agreements is vital. This document provides necessary guidelines and clarity, ensuring that all members are on the same page. To learn more about this key paperwork, explore our essential guide on the Operating Agreement form.

Example - Single-Member Operating Agreement Form

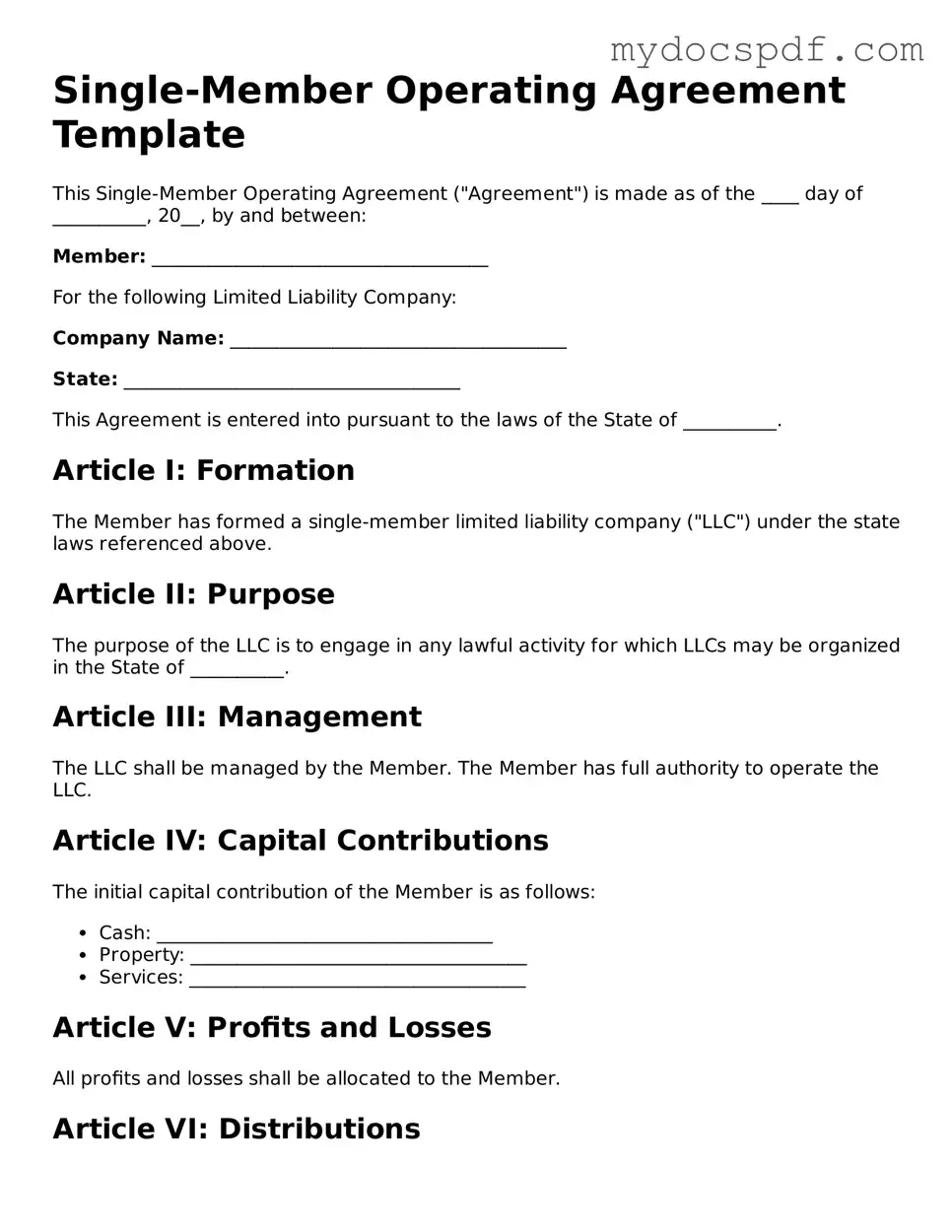

Single-Member Operating Agreement Template

This Single-Member Operating Agreement ("Agreement") is made as of the ____ day of __________, 20__, by and between:

Member: ____________________________________

For the following Limited Liability Company:

Company Name: ____________________________________

State: ____________________________________

This Agreement is entered into pursuant to the laws of the State of __________.

Article I: Formation

The Member has formed a single-member limited liability company ("LLC") under the state laws referenced above.

Article II: Purpose

The purpose of the LLC is to engage in any lawful activity for which LLCs may be organized in the State of __________.

Article III: Management

The LLC shall be managed by the Member. The Member has full authority to operate the LLC.

Article IV: Capital Contributions

The initial capital contribution of the Member is as follows:

- Cash: ____________________________________

- Property: ____________________________________

- Services: ____________________________________

Article V: Profits and Losses

All profits and losses shall be allocated to the Member.

Article VI: Distributions

Distributions shall be made at the discretion of the Member.

Article VII: Record Keeping

The LLC shall maintain complete and accurate books and records as required by law.

Article VIII: Indemnification

The Member shall be indemnified for any acts performed on behalf of the LLC, except in cases of gross negligence or willful misconduct.

Article IX: Amendments

Any amendments to this Agreement must be in writing and signed by the Member.

Article X: Governing Law

This Agreement shall be governed by the laws of the State of __________.

In witness whereof, the undersigned Member has executed this Single-Member Operating Agreement as of the date first above written.

Signature of Member: ________________________________

Printed Name of Member: ________________________________

Date: ________________________________

Detailed Instructions for Writing Single-Member Operating Agreement

Completing the Single-Member Operating Agreement form is an important step for individuals establishing a limited liability company (LLC). This document outlines the structure and operations of your business, ensuring clarity and legal protection. Below are the steps to fill out the form accurately.

- Begin by entering your name as the sole member of the LLC.

- Next, provide the name of your LLC. Ensure that it complies with state naming requirements.

- Indicate the principal business address. This should be a physical location where your business operates.

- Specify the purpose of the LLC. Describe what type of business activities the company will engage in.

- Detail the management structure. As a single-member LLC, you will typically be the sole manager.

- Outline the initial capital contributions. State the amount of money or assets you are investing in the LLC.

- Include provisions for profit distribution. Explain how profits will be allocated to you as the member.

- Sign and date the document. Your signature confirms that you agree to the terms laid out in the agreement.

Once you have completed these steps, you will have a comprehensive operating agreement that reflects your business intentions. It is advisable to keep this document in a safe place, as it may be required for legal or financial purposes in the future.

Documents used along the form

A Single-Member Operating Agreement is a vital document for anyone running a single-member LLC. It outlines the structure, management, and operational guidelines for the business. However, several other forms and documents are often used in conjunction with this agreement to ensure smooth operations and compliance. Below is a list of these essential documents, each serving a unique purpose.

- Articles of Organization: This document is filed with the state to officially create your LLC. It includes basic information such as the business name, address, and the registered agent's details.

- Employer Identification Number (EIN): Obtained from the IRS, this number is necessary for tax purposes and to open a business bank account. It identifies your business for federal tax obligations.

- Bylaws: Although more common in corporations, bylaws can also be useful for LLCs. They outline the rules governing the internal management of the business.

- Membership Certificate: This document certifies ownership of the LLC. It serves as proof of membership and can be important for financial transactions.

- Operating Procedures: This internal document details the day-to-day operational processes and policies of the LLC, ensuring consistency in how the business is run.

- Operating Agreement: The Florida PDF Forms provides an easy way to access and fill out this essential document that dictates the management structure and operational procedures of your LLC.

- Bank Resolution: This document authorizes specific individuals to open and manage the business bank accounts. It provides clarity on who has the authority to handle finances.

- Business Licenses and Permits: Depending on the industry and location, various licenses may be required to legally operate your business. These documents ensure compliance with local regulations.

- Non-Disclosure Agreement (NDA): If you plan to share sensitive information with employees or partners, an NDA protects your business’s confidential information from being disclosed.

- Tax Documents: These include forms and schedules required for federal and state tax filings. Keeping these organized helps ensure compliance with tax obligations.

Each of these documents plays a crucial role in establishing and maintaining your LLC's legal and operational framework. By understanding their purposes and ensuring you have them in place, you can focus on growing your business with confidence.