Attorney-Approved Release of Promissory Note Template

The Release of Promissory Note form serves as a crucial document in the realm of financial transactions, particularly when it comes to formalizing the conclusion of a loan agreement. This form is designed to provide a clear and concise statement that acknowledges the repayment of a loan, thereby releasing the borrower from any further obligations associated with the promissory note. Key components of the form typically include the names and addresses of both the lender and borrower, details of the original loan, and a declaration that the loan has been fully paid. Additionally, the form may require signatures from both parties to validate the release, ensuring that there is a mutual understanding and agreement regarding the closure of the financial obligation. By utilizing this form, individuals and businesses can protect their interests and maintain accurate records, fostering transparency and trust in financial dealings.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's important to approach the task with care. Here are some essential dos and don'ts to keep in mind:

- Do read the entire form carefully before you start filling it out.

- Do ensure that all parties involved in the promissory note are accurately identified.

- Do include the date of the release to establish a clear timeline.

- Do sign and date the form in the appropriate sections.

- Don't leave any required fields blank; this can lead to delays or complications.

- Don't forget to keep a copy of the completed form for your records.

By following these guidelines, you can help ensure that the process goes smoothly and that all necessary details are properly documented.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. |

| Purpose | This form is used to formally acknowledge that a borrower has fulfilled their obligation to repay a loan. |

| Parties Involved | The parties typically include the lender (creditor) and the borrower (debtor). |

| Governing Law | The laws governing the release of a promissory note vary by state. For example, in California, it falls under the California Civil Code. |

| Signature Requirement | Both parties must sign the form for it to be legally binding. |

| Notarization | Some states may require notarization to validate the release. |

| Record Keeping | It is important to keep a copy of the signed release for future reference. |

| Impact on Credit | A released promissory note can positively impact the borrower's credit history. |

| Additional Documentation | Additional documents, such as proof of payment, may be required to complete the release. |

Key takeaways

When dealing with a Release of Promissory Note form, it is crucial to understand its significance and how to complete it properly. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Release of Promissory Note serves to formally cancel the obligation outlined in the original promissory note. It signifies that the borrower has fulfilled their repayment responsibilities.

- Identify the Parties: Ensure that the names of both the borrower and lender are correctly stated. This clarity helps prevent any future disputes regarding the agreement.

- Include Relevant Details: Provide specific details about the original promissory note, including the date it was issued and the amount involved. This information solidifies the context of the release.

- Signatures Matter: Both parties must sign the form. Without the necessary signatures, the release may not be legally binding.

- Consider Notarization: While not always required, having the document notarized can add an extra layer of authenticity and may be necessary for certain jurisdictions.

- Keep Copies: Once completed, ensure that both parties retain a copy of the signed release. This serves as proof that the promissory note has been released.

- Check Local Laws: Different states may have specific requirements regarding the release of promissory notes. Familiarizing yourself with local regulations is essential.

- Act Promptly: If you are ready to release the promissory note, do not delay. Timely action helps maintain trust and clarity between the parties involved.

By following these key points, you can effectively navigate the process of filling out and using the Release of Promissory Note form. This ensures that all parties are protected and that the release is recognized legally.

Popular Release of Promissory Note Documents:

Promissory Note Auto Loan - Includes the consequences of defaulting on the car loan repayment.

In understanding the significance of a New York Promissory Note, it is essential to recognize its role in formalizing loan agreements and protecting the interests of both parties involved. For those looking for a reliable resource to create such a document, nyforms.com/promissory-note-template/ offers templates that streamline the process, ensuring that all necessary details are properly addressed while maintaining legal compliance.

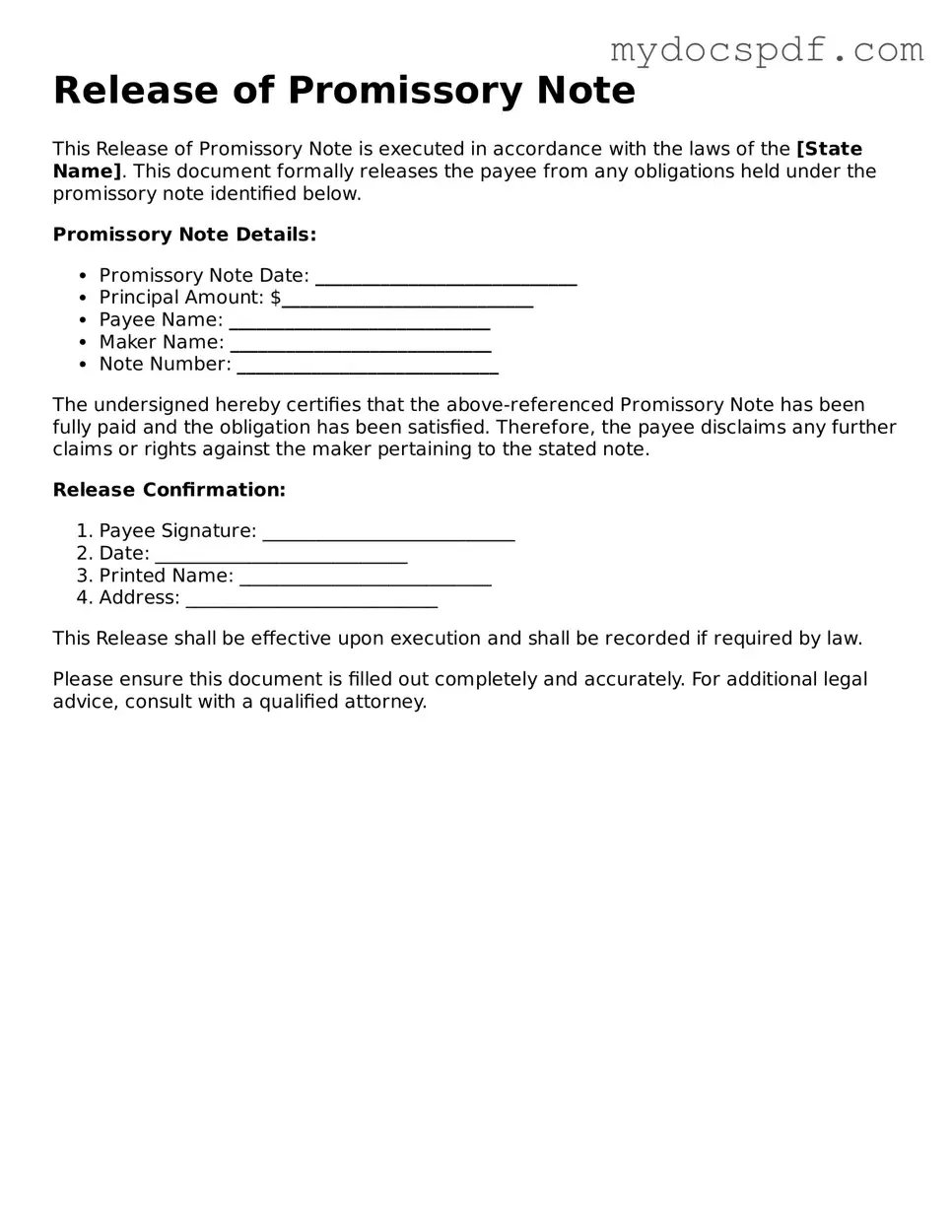

Example - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note is executed in accordance with the laws of the [State Name]. This document formally releases the payee from any obligations held under the promissory note identified below.

Promissory Note Details:

- Promissory Note Date: ____________________________

- Principal Amount: $___________________________

- Payee Name: ____________________________

- Maker Name: ____________________________

- Note Number: ____________________________

The undersigned hereby certifies that the above-referenced Promissory Note has been fully paid and the obligation has been satisfied. Therefore, the payee disclaims any further claims or rights against the maker pertaining to the stated note.

Release Confirmation:

- Payee Signature: ___________________________

- Date: ___________________________

- Printed Name: ___________________________

- Address: ___________________________

This Release shall be effective upon execution and shall be recorded if required by law.

Please ensure this document is filled out completely and accurately. For additional legal advice, consult with a qualified attorney.

Detailed Instructions for Writing Release of Promissory Note

After completing the Release of Promissory Note form, you will need to ensure that all parties involved receive a copy for their records. This helps maintain transparency and ensures that everyone is aware of the agreement reached. Once you have filled out the form, consider having it notarized for added authenticity.

- Obtain the Form: Start by acquiring the Release of Promissory Note form. You can find it online or at a legal office.

- Fill in the Date: Enter the date on which you are completing the form at the top.

- Identify the Parties: Clearly write the names and addresses of both the lender and the borrower in the designated sections.

- Reference the Promissory Note: Provide details about the original promissory note, including the date it was executed and any identifying numbers.

- State the Release: Indicate that the promissory note is being released and specify any conditions if applicable.

- Signatures: Ensure that both parties sign the form. Each signature should be dated to reflect when it was signed.

- Notarization: If required, take the signed form to a notary public to have it notarized.

- Distribute Copies: Make copies of the completed form for all parties involved and keep the original in a safe place.

Documents used along the form

The Release of Promissory Note form is a crucial document in financial transactions, particularly when a borrower has fulfilled their obligation to repay a loan. Alongside this form, several other documents may be required to ensure clarity and legal compliance. Below is a list of commonly used forms and documents that often accompany the Release of Promissory Note.

- Promissory Note: This is the original document that outlines the borrower's promise to repay the loan under specified terms, including the amount, interest rate, and repayment schedule.

- Loan Agreement: This document details the terms and conditions of the loan, including the rights and responsibilities of both the lender and borrower.

- Payment Schedule: This schedule outlines the timeline for payments, including due dates and amounts, helping both parties track repayment progress.

- Release of Lien: If the loan was secured by collateral, this document releases the lender's claim on the asset once the loan is paid in full.

- Promissory Note: This document outlines the borrower's promise to repay a loan under specified terms, including the amount, interest rate, and payment schedule. For more details, visit the Promissory Note resource.

- Borrower's Affidavit: This sworn statement from the borrower may confirm the satisfaction of the loan and provide additional assurances to the lender.

- Settlement Statement: This document summarizes the financial aspects of the transaction, detailing any fees, adjustments, or credits related to the loan.

- Tax Documents: These may include forms related to the interest paid on the loan, which can affect the borrower's tax filings.

Each of these documents plays a vital role in the financial transaction process. They help protect the interests of both parties and ensure that all legal obligations are met. Understanding these documents can lead to smoother transactions and clearer communication between lenders and borrowers.