Get Release Of Lien Texas Form in PDF

The Release of Lien Texas form is a vital document in real estate transactions, particularly when it comes to settling debts secured by property. This form is specifically designed for use by lawyers and is prepared by the State Bar of Texas, ensuring that it meets legal standards. At its core, the form outlines essential details such as the date of the lien, the holder of the note and lien, and the original principal amount borrowed. It also specifies the property involved, including any improvements made to it. Importantly, the holder of the note acknowledges full payment of the debt, thereby releasing the property from any lien claims. This release extends to all liens held by the holder, regardless of how they were established. Furthermore, the document includes a waiver of rights to enforce the lien for any future debts, providing clarity and security for the borrower. Acknowledgments by a notary public are required, adding an extra layer of authenticity and legal weight to the form. The careful attention to detail in this document ensures that both parties can move forward without lingering financial encumbrances.

Dos and Don'ts

When filling out the Release of Lien form in Texas, attention to detail is crucial. Here are some important dos and don’ts to keep in mind:

- Do ensure all required fields are completed accurately.

- Do include the correct date of the release.

- Do verify the names and addresses of all parties involved.

- Do acknowledge the payment in full clearly in the document.

- Don’t leave any section blank unless it is optional.

- Don’t use incorrect or outdated information regarding the lien or property.

- Don’t forget to have the document notarized before submission.

- Don’t neglect to keep a copy of the completed form for your records.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Release of Lien form is designed to formally acknowledge the payment of a debt secured by a lien, thereby releasing the property from that lien. |

| Governing Law | This form is governed by Texas property law, specifically under the Texas Property Code. |

| Eligibility | Only licensed attorneys in Texas are authorized to prepare and execute this form, ensuring compliance with legal standards. |

| Contents | The form includes essential details such as the holder of the note, the borrower, the original principal amount, and property description. |

| Acknowledgment Requirement | The form must be acknowledged by a notary public, which adds a layer of authenticity and legal validity. |

| Future Rights Waiver | The holder of the lien waives all rights to enforce the lien for any future indebtedness, ensuring that the property is completely released. |

Key takeaways

Understanding the Release Of Lien Texas form is essential for anyone involved in property transactions in Texas. Here are some key takeaways to keep in mind:

- The form serves to officially release a lien on a property once the debt secured by that lien has been fully paid.

- It is important to include accurate details, such as the holder of the note and lien, the borrower, and the property description.

- The holder of the note must acknowledge that payment has been made in full, which is crucial for the legal validity of the release.

- By signing the form, the holder waives any future rights to enforce the lien for any further indebtedness.

- The document must be acknowledged before a notary public to ensure its authenticity and legal standing.

- After recording the form with the appropriate county office, it is advisable to keep a copy for personal records.

These points will help ensure that the process of releasing a lien is handled correctly and efficiently.

Other PDF Templates

Basketball Player Evaluation Form Pdf - Dribbling control measures skill under different game pressures.

Mv-1 Form Pa Pdf - All utility bill copies must reflect the most recent statements for business verification.

The New York Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for renting residential property in New York. This agreement serves as a crucial framework, ensuring that both parties understand their rights and responsibilities. By clearly defining the rental terms, the lease helps to foster a respectful and harmonious living environment. For templates and examples, you might want to check out NY Templates.

Trader Joe - Experienced in retail settings and familiar with inventory management and visual merchandising.

Example - Release Of Lien Texas Form

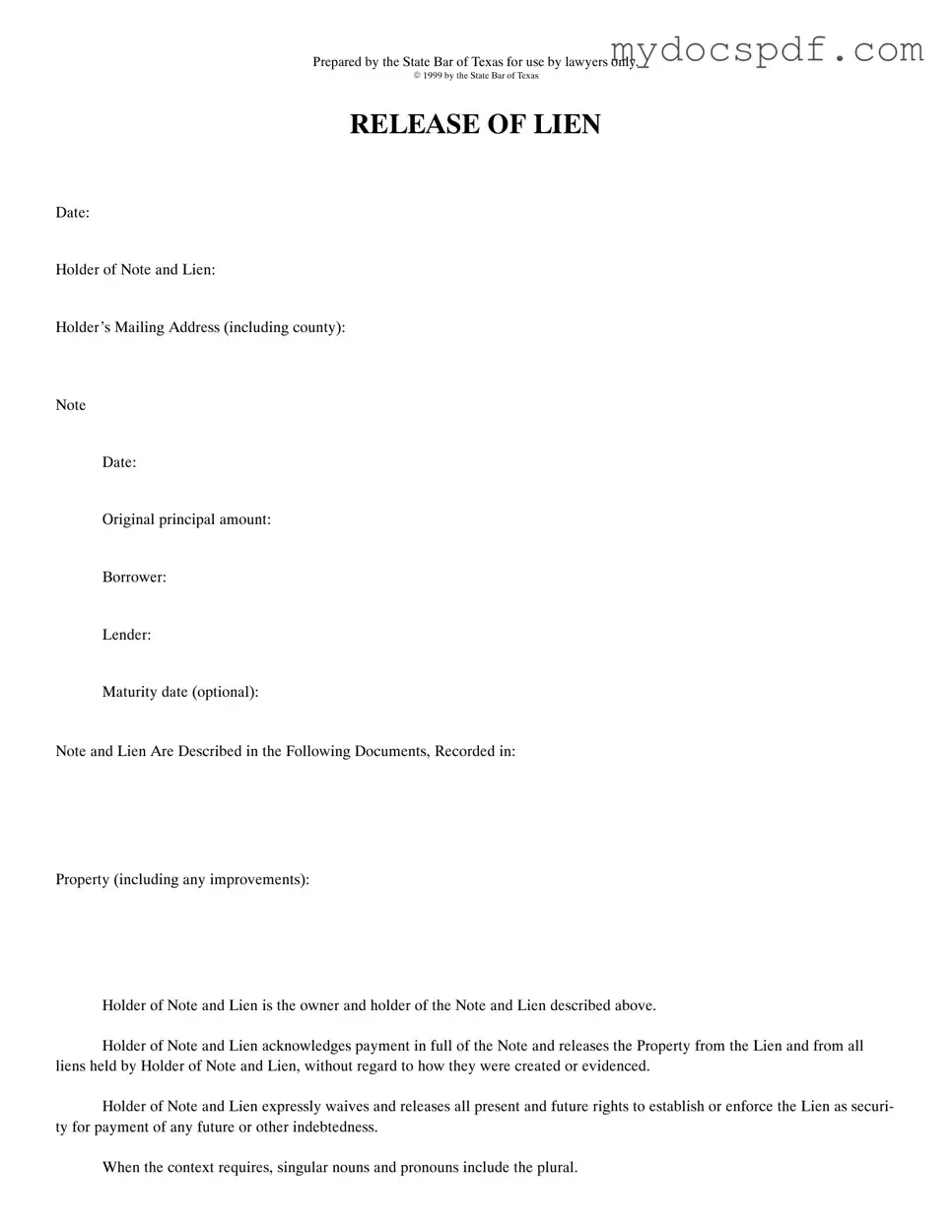

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Detailed Instructions for Writing Release Of Lien Texas

Filling out the Release of Lien form in Texas is an important step to ensure that a lien on a property is properly released. Once you have completed the form, you will need to file it with the appropriate county office to make the release official. Here’s how to fill out the form step by step.

- Date: Write the current date at the top of the form.

- Holder of Note and Lien: Enter the name of the individual or entity that holds the lien.

- Holder’s Mailing Address: Provide the complete mailing address of the lien holder, including the county.

- Note Date: Fill in the date when the original note was created.

- Original Principal Amount: Write the amount of the original loan or debt.

- Borrower: Enter the name of the borrower who is responsible for the debt.

- Lender: Specify the name of the lender who issued the loan.

- Maturity Date (optional): If applicable, write the date when the loan is due.

- Note and Lien Are Described in the Following Documents, Recorded in: Provide details about the documents that describe the note and lien, including where they are recorded.

- Property: Describe the property that is subject to the lien, including any improvements made to it.

- Holder of Note and Lien Acknowledgment: Confirm that the holder acknowledges payment in full and releases the property from the lien.

- Acknowledgment Section: Complete the acknowledgment section, including the state and county, date of acknowledgment, and the name of the person acknowledging the document.

- Notary Public: Leave space for the notary’s name and commission expiration date, which will be filled out when notarized.

- Corporate Acknowledgment (if applicable): If the holder is a corporation, fill out this section with the necessary details.

- After Recording Return To: Write the name and address of the law office or individual to whom the document should be returned after recording.

Documents used along the form

When dealing with the Release of Lien in Texas, several other forms and documents may be necessary to ensure a smooth transaction. These documents help clarify rights, responsibilities, and the status of the lien. Here’s a list of commonly used forms that accompany the Release of Lien:

- Promissory Note: This document outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule. It serves as evidence of the borrower's obligation to repay the lender.

- Deed of Trust: This is a security instrument that allows the lender to hold a lien on the property until the borrower repays the loan. It typically includes details about the property and the terms of the loan.

- Room Rental Agreement: This document is essential for setting clear expectations between landlords and tenants, ensuring that both parties are aware of their rights and responsibilities in the rental process. For more information, you can refer to the https://newyorkform.com/free-room-rental-agreement-template/.

- Loan Agreement: A comprehensive contract between the borrower and lender detailing the terms of the loan, including repayment terms, fees, and conditions for default.

- Notice of Default: This document is sent to the borrower when they fail to meet the terms of the loan. It outlines the default and provides a timeline for remedying the situation.

- Affidavit of Debt: A sworn statement by the lender confirming the amount owed by the borrower. This document can be used in legal proceedings if necessary.

- Subordination Agreement: This document establishes the priority of liens on a property. It can be used when a new loan is taken out, ensuring that the new lender's lien is prioritized over existing liens.

- Power of Attorney: This legal document allows one person to act on behalf of another in financial or legal matters, often necessary when the property owner cannot be present for the transaction.

- Quitclaim Deed: This document transfers any interest the grantor has in the property to another party without making any guarantees about the title. It is often used in family transactions.

- Title Insurance Policy: This insurance protects the lender and/or buyer against any losses due to defects in the title of the property. It is often required when closing a real estate transaction.

Understanding these documents can help ensure that all parties involved are protected and informed throughout the process. It's essential to have the right paperwork in place to avoid future disputes and ensure a clear title to the property.