Attorney-Approved Real Estate Purchase Agreement Template

The Real Estate Purchase Agreement form is a crucial document in the process of buying or selling property. It serves as a binding contract that outlines the terms and conditions agreed upon by both the buyer and the seller. Key components of this agreement include the purchase price, the legal description of the property, and the closing date. Additionally, it addresses contingencies such as financing, inspections, and the transfer of ownership. Both parties must also consider earnest money deposits, which demonstrate the buyer's serious intent to proceed with the transaction. The form can include specific provisions regarding repairs, disclosures, and any personal property included in the sale. Understanding these elements is essential for a smooth real estate transaction, as they help protect the interests of both parties and ensure clarity throughout the process.

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it’s important to approach the task with care. This document is a crucial part of the home buying process. Here are some key dos and don'ts to keep in mind:

- Do: Read the entire agreement carefully before signing.

- Do: Ensure that all parties involved are clearly identified.

- Do: Include all necessary details about the property, such as address and legal description.

- Do: Specify the purchase price and any contingencies that may apply.

- Do: Consult with a real estate professional or attorney if you have questions.

- Do: Keep a copy of the signed agreement for your records.

- Do: Be honest about your financial situation when disclosing information.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any blanks; fill in all required fields.

- Don't: Assume that verbal agreements are sufficient; everything should be in writing.

- Don't: Ignore deadlines for submitting the agreement.

- Don't: Forget to discuss any special conditions or requests with the seller.

- Don't: Sign the agreement without fully understanding its terms.

- Don't: Overlook the importance of due diligence before finalizing the purchase.

By following these guidelines, you can help ensure that your Real Estate Purchase Agreement is completed correctly and protects your interests throughout the buying process.

Real Estate Purchase AgreementTemplates for Particular US States

Real Estate Purchase Agreement Subtypes

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding document outlining the terms of a property sale between a buyer and seller. |

| Key Components | Typically includes purchase price, property description, closing date, and contingencies. |

| Contingencies | Common contingencies may include financing, inspections, and appraisal conditions that must be met before closing. |

| Earnest Money | Buyers often provide earnest money as a sign of good faith, which is usually held in escrow until closing. |

| State-Specific Forms | Each state may have its own version of the Real Estate Purchase Agreement, governed by local real estate laws. |

| Legal Requirements | Most states require the agreement to be in writing to be enforceable, as per the Statute of Frauds. |

| Disclosure Obligations | Sellers are often required to disclose known issues with the property, such as structural defects or pest infestations. |

| Closing Process | The agreement typically outlines the closing process, including the transfer of title and payment of fees. |

| Dispute Resolution | Many agreements include clauses for dispute resolution, such as mediation or arbitration, to handle conflicts that may arise. |

Key takeaways

When filling out and using a Real Estate Purchase Agreement, several key points should be kept in mind to ensure a smooth transaction. Here are some important takeaways:

- Understand the Purpose: The Real Estate Purchase Agreement outlines the terms of the sale, including price and conditions. It serves as a legal document that protects both buyer and seller.

- Identify the Parties: Clearly state the names and addresses of both the buyer and seller. This ensures that all parties are correctly identified in the agreement.

- Property Description: Provide a detailed description of the property being sold. This includes the address, lot number, and any relevant features.

- Purchase Price: Clearly specify the total purchase price. Include any deposits or earnest money that may be required upfront.

- Contingencies: Outline any contingencies that must be met for the sale to proceed. Common contingencies include financing and inspections.

- Closing Date: Establish a closing date when the sale will be finalized. This is the date when ownership is transferred to the buyer.

- Signatures Required: Ensure that both parties sign the agreement. Without signatures, the document is not legally binding.

- Review State Laws: Different states have specific laws regarding real estate transactions. Familiarize yourself with these laws to avoid potential issues.

- Seek Professional Help: Consider consulting with a real estate agent or attorney. Their expertise can help navigate any complexities in the agreement.

Other Documents

Good Moral Character Letter - This letter speaks to the applicant’s ability to foster strong, meaningful relationships.

Health Insurance Marketplace Statement - Reporting information from the 1095-A can prevent tax issues later on.

The Texas Operating Agreement form is a crucial document that outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. This agreement serves to define the rights, responsibilities, and obligations of the members involved. By establishing clear guidelines, it helps prevent disputes and ensures smooth operations within the company, which is why many turn to resources like Texas Forms Online for templates and assistance.

Power of Attorney Dmv - The Vehicle POA REG 260 can streamline processes at the Department of Motor Vehicles.

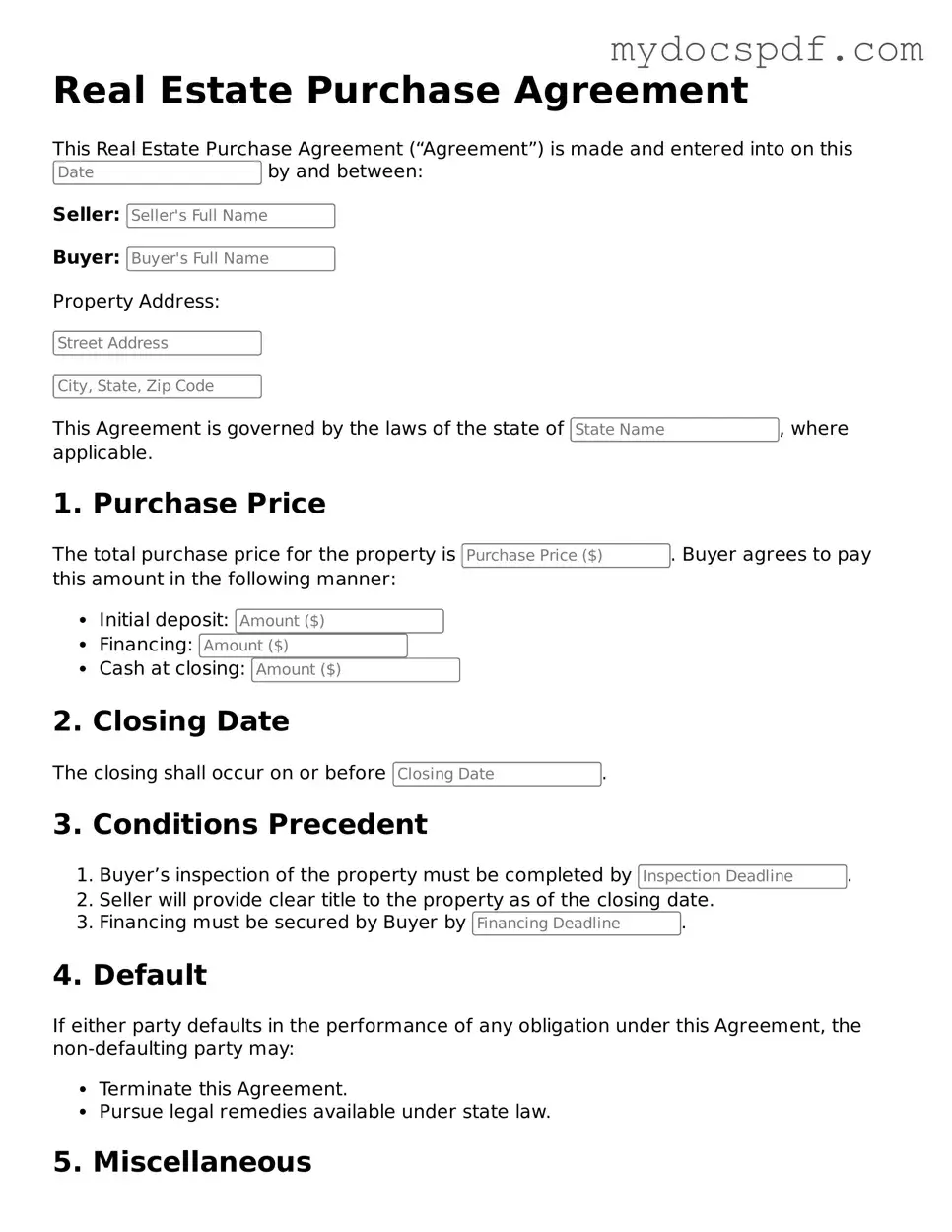

Example - Real Estate Purchase Agreement Form

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into on this by and between:

Seller:

Buyer:

Property Address:

This Agreement is governed by the laws of the state of , where applicable.

1. Purchase Price

The total purchase price for the property is . Buyer agrees to pay this amount in the following manner:

- Initial deposit:

- Financing:

- Cash at closing:

2. Closing Date

The closing shall occur on or before .

3. Conditions Precedent

- Buyer’s inspection of the property must be completed by .

- Seller will provide clear title to the property as of the closing date.

- Financing must be secured by Buyer by .

4. Default

If either party defaults in the performance of any obligation under this Agreement, the non-defaulting party may:

- Terminate this Agreement.

- Pursue legal remedies available under state law.

5. Miscellaneous

This Agreement constitutes the entire understanding between the parties, superseding all prior agreements. It may only be modified by a written agreement signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Real Estate Purchase Agreement as of the date first above written.

Seller's Signature: _______________________ Date: ____________

Buyer's Signature: ______________________ Date: ____________

Detailed Instructions for Writing Real Estate Purchase Agreement

After gathering all necessary information, you are ready to fill out the Real Estate Purchase Agreement form. This document is essential for outlining the terms of the property transaction. Follow these steps to ensure accuracy and completeness.

- Identify the Parties: Enter the full names and addresses of both the buyer and the seller at the top of the form.

- Property Description: Provide a detailed description of the property, including the address and any relevant identifying information, such as parcel numbers.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Earnest Money Deposit: Specify the amount of the earnest money deposit and the date it will be paid.

- Financing Contingency: If applicable, indicate whether the purchase is contingent upon financing and detail any terms related to it.

- Closing Date: Enter the proposed closing date for the transaction.

- Inspection Period: Outline the timeframe for any inspections and the process for addressing issues that may arise.

- Signatures: Ensure that both parties sign and date the agreement to make it legally binding.

Once the form is filled out completely, both parties should review it for accuracy before proceeding with the next steps in the purchasing process.

Documents used along the form

When engaging in a real estate transaction, several key documents often accompany the Real Estate Purchase Agreement. These documents help clarify the terms of the sale, protect the interests of all parties involved, and ensure a smooth transfer of ownership. Below is a list of commonly used forms and documents that you may encounter in this process.

- Property Disclosure Statement: This document provides information about the property's condition and any known issues. Sellers are typically required to disclose defects or problems that could affect the buyer's decision.

- Asurion F-017-08 MEN Form: This essential document aids in processing warranty claims and service requests efficiently. For further details, refer to the Sworn Affidavit & Proof of Loss Statement.

- Title Report: This report outlines the legal ownership of the property and identifies any liens, encumbrances, or claims against it. Buyers should review this document to ensure clear title before finalizing the purchase.

- Purchase Offer: This document is submitted by the buyer to express interest in purchasing the property. It outlines the proposed price and any contingencies that must be met for the sale to proceed.

- Counteroffer: If the seller does not accept the initial purchase offer, they may respond with a counteroffer. This document modifies the original terms and presents new conditions for the buyer to consider.

- Closing Disclosure: This form details the final terms of the mortgage, including loan terms, monthly payments, and closing costs. It must be provided to the buyer at least three days before closing.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to complete the transaction officially.

- Home Inspection Report: After a home inspection, this report summarizes the findings regarding the property's condition. It can influence negotiations and help buyers make informed decisions.

Understanding these documents is crucial for anyone involved in a real estate transaction. Each form serves a specific purpose and contributes to a transparent and successful buying process. Familiarity with these documents can empower buyers and sellers alike, ensuring that all parties are well-informed and protected throughout the transaction.