Attorney-Approved Quitclaim Deed Template

A Quitclaim Deed is a crucial legal document that facilitates the transfer of property ownership between parties. Unlike other types of deeds, it does not guarantee that the property title is free from claims or liens; instead, it simply conveys whatever interest the grantor has in the property to the grantee. This form is often used in situations where the parties know each other well, such as family transfers, divorces, or estate settlements. The Quitclaim Deed includes essential details such as the names of the grantor and grantee, a description of the property, and the date of transfer. It is important to note that while this deed can expedite the transfer process, it offers no warranties regarding the title's validity. As such, it is advisable for grantees to conduct their due diligence before accepting a Quitclaim Deed. Understanding the implications of this form can help individuals navigate property transfers more effectively.

Dos and Don'ts

When filling out a Quitclaim Deed form, it's important to follow certain guidelines to ensure everything goes smoothly. Here are some do's and don'ts to keep in mind:

- Do make sure all names are spelled correctly.

- Do include the correct property description.

- Do sign the document in front of a notary public.

- Do keep a copy for your records.

- Don't leave any blank spaces on the form.

- Don't forget to check local laws regarding filing.

- Don't use outdated forms; always get the latest version.

- Don't rush the process; take your time to review everything.

Quitclaim DeedTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one person to another without any warranties about the property title. |

| Use Cases | Commonly used among family members, in divorce settlements, or to clear up title issues. |

| State-Specific Forms | Each state may have its own version of the quitclaim deed. For example, in California, it is governed by California Civil Code Section 1092. |

| Liability | The grantor does not guarantee that the title is free of claims or liens, meaning the grantee assumes the risk. |

| Filing Requirements | After signing, the quitclaim deed must be filed with the county recorder's office where the property is located to be effective. |

Key takeaways

Filling out and using a Quitclaim Deed form involves several important considerations. Here are key takeaways to keep in mind:

- Purpose: A Quitclaim Deed transfers ownership interest in a property from one party to another without any guarantees about the title.

- No Warranty: The grantor does not guarantee that they hold valid title to the property, which means the grantee assumes the risk.

- Simple Process: The form is typically straightforward and can often be completed without legal assistance, although consulting a professional is advisable.

- Signatures Required: The deed must be signed by the grantor. Depending on state laws, notarization may also be necessary.

- Recording: To provide public notice of the transfer, the Quitclaim Deed should be recorded with the appropriate county office.

- State-Specific Laws: Each state has its own requirements and regulations regarding Quitclaim Deeds, so it is essential to check local laws.

- Use Cases: Quitclaim Deeds are commonly used in divorce settlements, transferring property between family members, or clearing up title issues.

Popular Quitclaim Deed Documents:

What Is a Deed in Lieu of Foreclosure? - This option can prevent further damage to the property by encouraging a swift resolution of debts.

Lady Bird Document - The Lady Bird Deed is legal in several states, though not all.

In addition to knowing how to use the Texas Motor Vehicle Power of Attorney form effectively, it is also beneficial to have access to reliable resources; for example, you can find a helpful template at Texas Forms Online, which can guide you through the process of filling out the document correctly.

Transfer on Death Deed California - It’s available in many states, making it a popular option for estate planning across the country.

Example - Quitclaim Deed Form

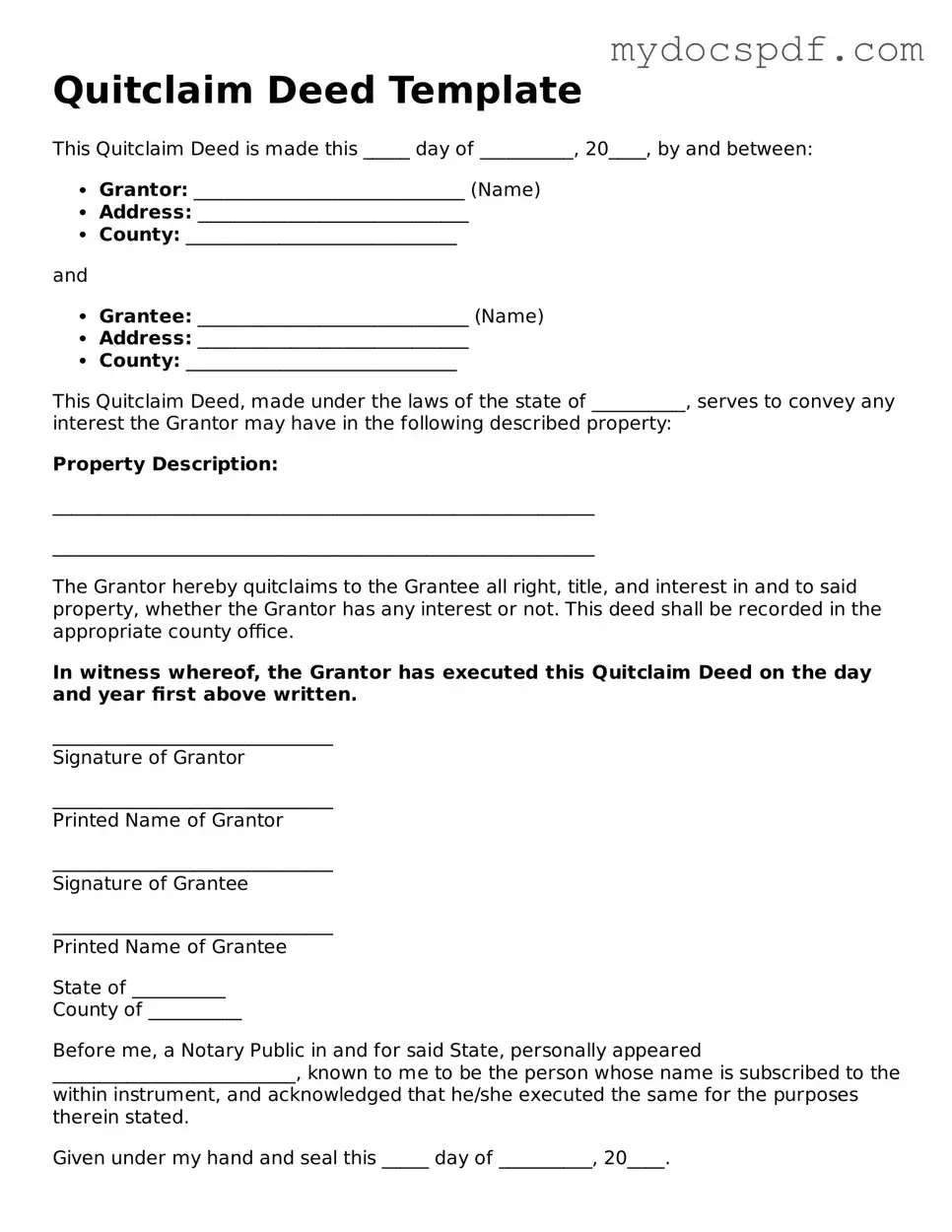

Quitclaim Deed Template

This Quitclaim Deed is made this _____ day of __________, 20____, by and between:

- Grantor: _____________________________ (Name)

- Address: _____________________________

- County: _____________________________

and

- Grantee: _____________________________ (Name)

- Address: _____________________________

- County: _____________________________

This Quitclaim Deed, made under the laws of the state of __________, serves to convey any interest the Grantor may have in the following described property:

Property Description:

__________________________________________________________

__________________________________________________________

The Grantor hereby quitclaims to the Grantee all right, title, and interest in and to said property, whether the Grantor has any interest or not. This deed shall be recorded in the appropriate county office.

In witness whereof, the Grantor has executed this Quitclaim Deed on the day and year first above written.

______________________________

Signature of Grantor

______________________________

Printed Name of Grantor

______________________________

Signature of Grantee

______________________________

Printed Name of Grantee

State of __________

County of __________

Before me, a Notary Public in and for said State, personally appeared __________________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein stated.

Given under my hand and seal this _____ day of __________, 20____.

______________________________

Notary Public

My commission expires: ____________

Detailed Instructions for Writing Quitclaim Deed

Once you have your Quitclaim Deed form ready, you'll need to fill it out accurately to ensure a smooth transfer of property. After completing the form, it will need to be signed, notarized, and filed with the appropriate local government office. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form.

- Next, fill in the names of the parties involved. The person transferring the property is the "Grantor," and the person receiving the property is the "Grantee." Make sure to include their full names as they appear on legal documents.

- Provide the address of the property being transferred. This should include the street address, city, state, and zip code.

- Include a legal description of the property. This can often be found on the property's deed or tax records. It should be detailed enough to identify the property clearly.

- State any consideration or payment being made for the property transfer. If it’s a gift, you can indicate that as well.

- Have the Grantor sign the form in the designated area. This signature must be done in front of a notary public.

- Once signed, the notary will complete their section, which includes their signature and seal.

- Finally, make copies of the completed Quitclaim Deed for your records before filing it with the local government office.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real property. When completing this process, several other forms and documents may be necessary to ensure a smooth transaction. Below is a list of commonly used forms that often accompany a Quitclaim Deed.

- Title Search Report: This document provides a detailed history of the property’s ownership and any liens or claims against it. It helps verify that the seller has the right to transfer ownership.

- Property Transfer Tax Form: Many states require this form to report the transfer of property and assess any applicable taxes. It is essential for compliance with local regulations.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and discloses any known issues. It serves to protect the buyer from potential claims.

- New York Dtf 84 Form: The New York Dtf 84 form is crucial for businesses to update their address with the state's tax department. More information can be found at https://newyorkform.com/free-new-york-dtf-84-template/.

- Purchase Agreement: This contract outlines the terms of the sale, including price and conditions. It serves as the foundation for the transaction between the buyer and seller.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document details all financial aspects of the transaction, including fees and adjustments, ensuring transparency for both parties.

- Power of Attorney: If the seller cannot be present for the signing, this document allows another person to act on their behalf. It must be properly executed to be valid.

- Notice of Transfer: Some jurisdictions require this form to officially notify local authorities of the property transfer. It helps update public records and ensures compliance with local laws.

- Deed of Trust: This document secures a loan by placing a lien on the property. It may be relevant if the buyer is financing the purchase and needs to establish security for the lender.

Having these documents ready can streamline the property transfer process and help avoid potential issues down the line. Always consult with a professional to ensure all necessary forms are completed accurately and in compliance with local laws.