Attorney-Approved Promissory Note for a Car Template

When purchasing a vehicle, many buyers opt to finance their purchase through a promissory note, a critical document that outlines the terms of the loan. This form serves as a written promise from the borrower to repay the lender for the amount borrowed, typically detailing the principal amount, interest rate, repayment schedule, and any applicable fees. In addition, the promissory note specifies the consequences of default, ensuring that both parties understand their obligations. It may also include provisions for late payments and prepayment options, allowing borrowers to pay off their loan early without penalties. Understanding the components of this form is essential for anyone entering into a vehicle financing agreement, as it protects both the lender's interests and the borrower's rights. Properly executed, a promissory note can facilitate a smooth transaction and provide clarity throughout the repayment process.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it is essential to ensure accuracy and clarity. Here are some important do's and don'ts to consider:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the loan amount.

- Do include the correct interest rate, if applicable.

- Do specify the repayment schedule clearly.

- Do sign and date the form at the end.

- Don't leave any required fields blank.

- Don't use ambiguous language that could lead to misunderstandings.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure everything is correct.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Key Components | It includes details such as the buyer's and seller's information, the vehicle description, payment terms, and interest rate. |

| Governing Law | In the United States, the laws governing promissory notes vary by state. For example, California follows the Uniform Commercial Code (UCC). |

| Enforceability | A properly executed promissory note is legally enforceable, provided it meets all state requirements. |

Key takeaways

When filling out and using the Promissory Note for a Car form, keep the following key takeaways in mind:

- Clearly state the loan amount. This ensures both parties understand the financial obligation.

- Include the interest rate. Specify whether it is fixed or variable to avoid confusion later.

- Define the payment schedule. Indicate when payments are due and the frequency of payments.

- Specify the loan term. Clearly outline how long the borrower has to repay the loan.

- Include a description of the vehicle. Provide details such as make, model, year, and VIN to identify the collateral.

- Outline the consequences of default. Both parties should understand the implications if payments are missed.

- Include a space for signatures. Both the borrower and lender must sign to validate the agreement.

- Consider having a witness or notary. This adds an extra layer of legitimacy to the document.

- Keep a copy for your records. Both parties should retain a signed copy for future reference.

- Review the document carefully. Ensure all information is accurate and complete before signing.

By following these takeaways, you can ensure that the Promissory Note for a Car is filled out correctly and serves its intended purpose effectively.

Popular Promissory Note for a Car Documents:

Release of Promissory Note Template - It demonstrates accountability and responsibility in financial dealings.

For those looking to create a binding financial agreement, utilizing a New York Promissory Note form is essential, and you can find a useful template at nyforms.com/promissory-note-template. This legal document clarifies the obligations of both parties, detailing the loan amount, interest rates, and repayment terms, thus minimizing the risk of misunderstandings.

Example - Promissory Note for a Car Form

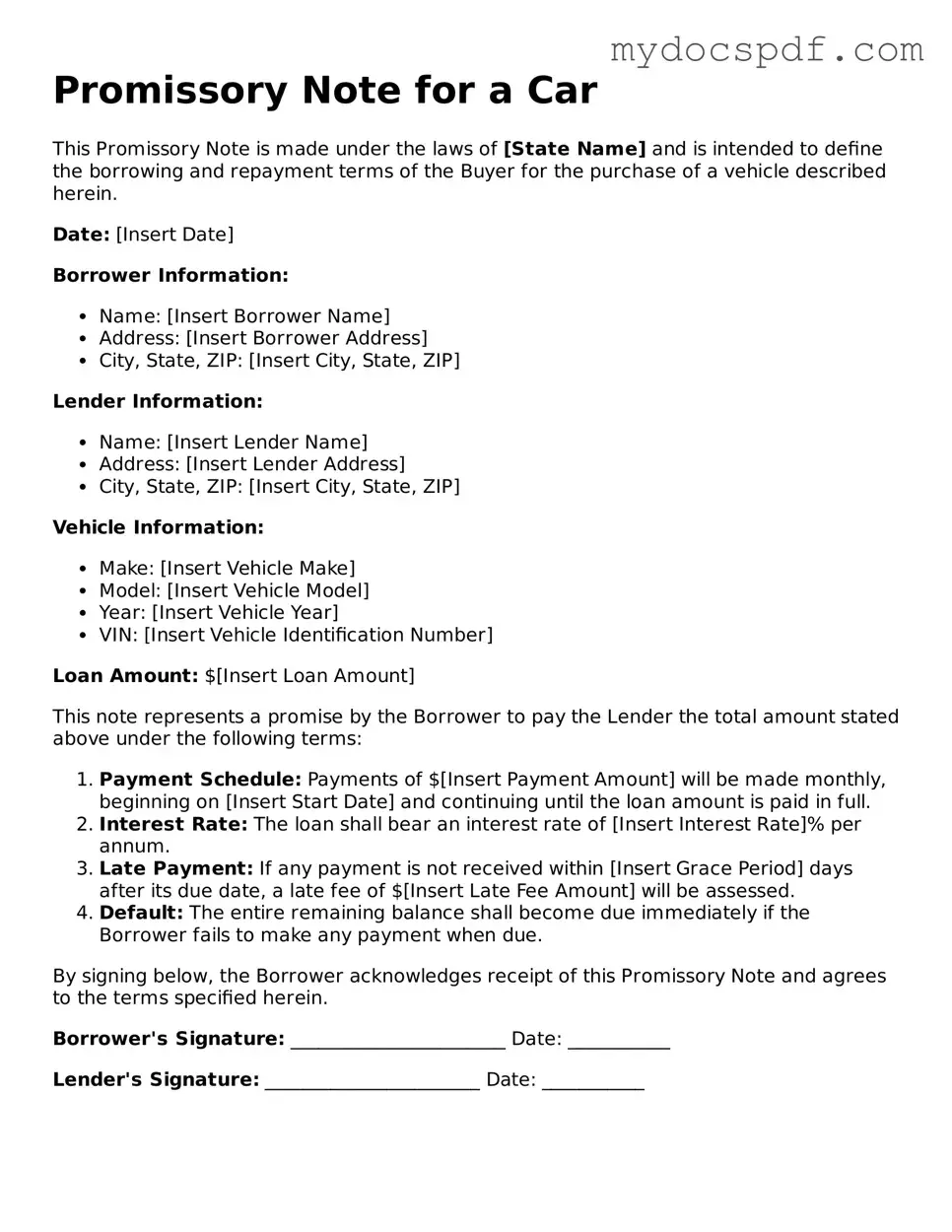

Promissory Note for a Car

This Promissory Note is made under the laws of [State Name] and is intended to define the borrowing and repayment terms of the Buyer for the purchase of a vehicle described herein.

Date: [Insert Date]

Borrower Information:

- Name: [Insert Borrower Name]

- Address: [Insert Borrower Address]

- City, State, ZIP: [Insert City, State, ZIP]

Lender Information:

- Name: [Insert Lender Name]

- Address: [Insert Lender Address]

- City, State, ZIP: [Insert City, State, ZIP]

Vehicle Information:

- Make: [Insert Vehicle Make]

- Model: [Insert Vehicle Model]

- Year: [Insert Vehicle Year]

- VIN: [Insert Vehicle Identification Number]

Loan Amount: $[Insert Loan Amount]

This note represents a promise by the Borrower to pay the Lender the total amount stated above under the following terms:

- Payment Schedule: Payments of $[Insert Payment Amount] will be made monthly, beginning on [Insert Start Date] and continuing until the loan amount is paid in full.

- Interest Rate: The loan shall bear an interest rate of [Insert Interest Rate]% per annum.

- Late Payment: If any payment is not received within [Insert Grace Period] days after its due date, a late fee of $[Insert Late Fee Amount] will be assessed.

- Default: The entire remaining balance shall become due immediately if the Borrower fails to make any payment when due.

By signing below, the Borrower acknowledges receipt of this Promissory Note and agrees to the terms specified herein.

Borrower's Signature: _______________________ Date: ___________

Lender's Signature: _______________________ Date: ___________

Detailed Instructions for Writing Promissory Note for a Car

Completing the Promissory Note for a Car form is an important step in formalizing your agreement regarding the loan for your vehicle. After filling out this form, both parties will have a clear understanding of the terms of the loan, including payment schedules and interest rates. It is essential to ensure that all information is accurate and clearly stated.

- Begin by entering the date at the top of the form. This should be the date when the agreement is being made.

- Next, provide the full name and address of the borrower. This is the individual who will be responsible for repaying the loan.

- Then, enter the full name and address of the lender. This is the individual or institution providing the loan.

- Clearly state the amount of the loan. This should be the total sum being borrowed for the purchase of the vehicle.

- Indicate the interest rate, if applicable. This is the percentage that will be charged on the outstanding loan balance.

- Specify the repayment schedule. Include details such as the frequency of payments (monthly, bi-weekly, etc.) and the total number of payments to be made.

- Include any late fees or penalties for missed payments, if applicable. This ensures both parties understand the consequences of late payments.

- Finally, both the borrower and lender should sign and date the form. This signifies that both parties agree to the terms outlined in the document.

Documents used along the form

When financing a vehicle, several important documents accompany the Promissory Note for a Car. Each of these forms serves a unique purpose, ensuring that both the borrower and lender are protected throughout the transaction. Below is a list of commonly used documents in conjunction with the promissory note.

- Vehicle Purchase Agreement: This document outlines the terms of the sale, including the purchase price, vehicle details, and any warranties or conditions agreed upon by both parties.

- Title Transfer Document: Required for transferring ownership of the vehicle, this document ensures that the title is legally passed from the seller to the buyer.

- Bill of Sale: This receipt serves as proof of the transaction, detailing the sale price, vehicle identification number (VIN), and the names of both the buyer and seller.

- Loan Application: This form collects information about the borrower’s financial status, credit history, and employment details, helping the lender assess the risk of the loan.

- Credit Disclosure Statement: This document provides the borrower with important information about the terms of the loan, including interest rates, fees, and payment schedules.

- Promissory Note: This document serves as the primary promise to repay the loan, detailing the amount owed and the payment schedule. For more information, visit the Promissory Note page.

- Insurance Verification: Proof of insurance is often required before finalizing the loan, ensuring that the vehicle is covered in case of accidents or damage.

- Guarantor Agreement: If a third party agrees to take responsibility for the loan if the borrower defaults, this document outlines the terms and conditions of that guarantee.

- Payment Schedule: This document details the repayment terms, including the amount of each installment, due dates, and the total duration of the loan.

Each of these documents plays a vital role in the financing process. Understanding their purpose can help ensure a smoother transaction and provide clarity for both the buyer and the lender.