Attorney-Approved Promissory Note Template

A Promissory Note is a crucial financial document that outlines a borrower's promise to repay a loan to a lender under specified terms. This form typically includes key details such as the principal amount, interest rate, repayment schedule, and any applicable fees. It serves as a legal record of the agreement between the parties involved. The note may also specify what happens in case of default, providing clarity and protection for both the borrower and the lender. Additionally, a Promissory Note can be secured or unsecured, depending on whether collateral is involved. Understanding this form is essential for anyone entering into a loan agreement, as it establishes the rights and responsibilities of each party, ensuring a smoother financial transaction.

Dos and Don'ts

When filling out a Promissory Note form, it’s important to follow certain guidelines to ensure accuracy and clarity. Here are eight things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do provide accurate information, including names, addresses, and amounts.

- Don't use vague terms; be specific about the loan terms.

- Do sign and date the document in the appropriate places.

- Don't forget to have a witness or notary if required.

- Do keep a copy of the signed Promissory Note for your records.

- Don't overlook the importance of understanding the repayment terms.

Promissory NoteTemplates for Particular US States

Promissory Note Subtypes

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time or on demand. |

| Governing Law | In the United States, the Uniform Commercial Code (UCC) governs promissory notes, with specific state laws applicable based on jurisdiction. |

| Key Components | A valid promissory note typically includes the principal amount, interest rate, maturity date, and the signatures of the borrower and lender. |

| Enforceability | Promissory notes are legally enforceable contracts, provided they meet the necessary legal requirements, such as clarity and mutual agreement. |

Key takeaways

When filling out and using a Promissory Note form, there are several important considerations to keep in mind. Below are key takeaways that can help ensure clarity and enforceability of the document.

- Understand the Purpose: A Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specified terms.

- Include Essential Details: Clearly state the amount borrowed, the interest rate, repayment schedule, and any penalties for late payments.

- Identify the Parties: Clearly identify the lender and borrower by including their full names and contact information.

- Specify the Loan Terms: Detail the repayment terms, including the due date and whether the loan is secured or unsecured.

- Consider Interest Rates: If applicable, specify the interest rate and whether it is fixed or variable, ensuring compliance with state usury laws.

- Sign and Date: Both parties must sign and date the document to make it legally binding. Consider having a witness or notary present.

- Keep Copies: After signing, both the borrower and lender should retain copies of the Promissory Note for their records.

- Review for Clarity: Before finalizing, review the document to ensure all terms are clear and unambiguous to avoid disputes later.

Other Documents

Hold Harmless Indemnity Agreement - By agreeing to hold harmless, parties can feel more secure in their transactions.

To ensure a clear understanding of the rental terms, landlords and tenants may find it beneficial to use a comprehensive resource, such as the free template available at https://newyorkform.com/free-residential-lease-agreement-template, which provides a structured framework for establishing the essential components of a New York Residential Lease Agreement.

Commercial Roof Inspection Form - The certification process aids in making the home more insurable and financially viable.

Asurion Revenue - Completing the form is a key step towards obtaining device support.

Example - Promissory Note Form

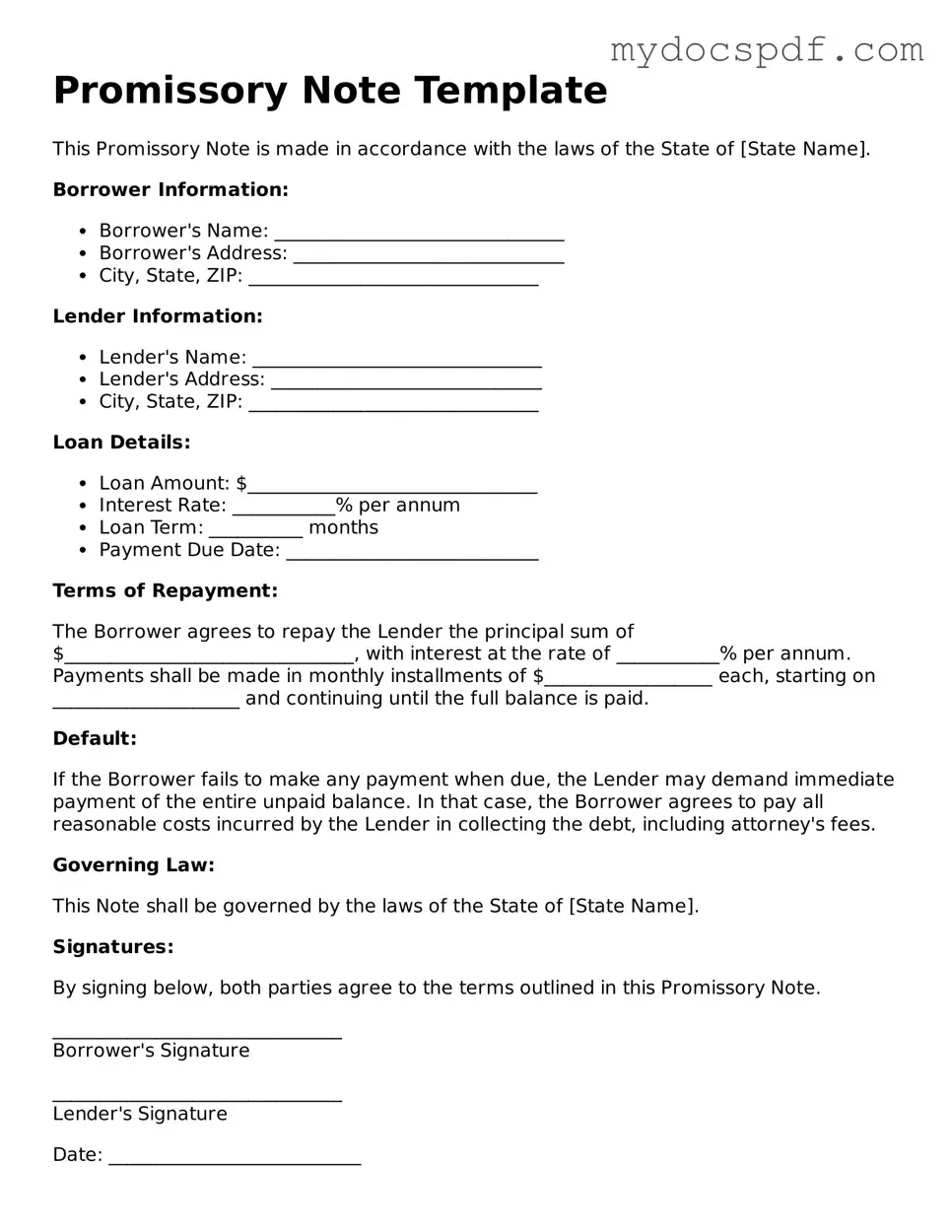

Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of [State Name].

Borrower Information:

- Borrower's Name: _______________________________

- Borrower's Address: _____________________________

- City, State, ZIP: _______________________________

Lender Information:

- Lender's Name: _______________________________

- Lender's Address: _____________________________

- City, State, ZIP: _______________________________

Loan Details:

- Loan Amount: $_______________________________

- Interest Rate: ___________% per annum

- Loan Term: __________ months

- Payment Due Date: ___________________________

Terms of Repayment:

The Borrower agrees to repay the Lender the principal sum of $_______________________________, with interest at the rate of ___________% per annum. Payments shall be made in monthly installments of $__________________ each, starting on ____________________ and continuing until the full balance is paid.

Default:

If the Borrower fails to make any payment when due, the Lender may demand immediate payment of the entire unpaid balance. In that case, the Borrower agrees to pay all reasonable costs incurred by the Lender in collecting the debt, including attorney's fees.

Governing Law:

This Note shall be governed by the laws of the State of [State Name].

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

_______________________________

Borrower's Signature

_______________________________

Lender's Signature

Date: ___________________________

Detailed Instructions for Writing Promissory Note

Once you have the Promissory Note form in front of you, it’s time to fill it out accurately. Follow these steps to ensure all necessary information is included and correctly formatted.

- Begin by entering the date at the top of the form. Use the format Month/Day/Year.

- Next, fill in the name of the borrower. This should be the full legal name of the person or entity borrowing the money.

- Provide the borrower's address. Include street, city, state, and zip code.

- Enter the name of the lender. This is the full legal name of the person or entity lending the money.

- Fill in the lender's address, including street, city, state, and zip code.

- Specify the principal amount of the loan. This is the total amount borrowed.

- Indicate the interest rate, if applicable. Clearly state whether it is fixed or variable.

- Outline the repayment terms. Include the payment schedule, such as monthly, quarterly, or annually.

- State any late fees or penalties for missed payments, if applicable.

- Sign and date the form at the bottom. Ensure both the borrower and lender sign.

After completing the form, make copies for both parties. Keep the original in a safe place. Review the document to confirm all information is accurate before proceeding with the next steps.

Documents used along the form

In the realm of finance and lending, a Promissory Note serves as a crucial document that outlines the borrower's promise to repay a loan under specified terms. However, it is often accompanied by several other forms and documents that help clarify the terms of the agreement and protect the interests of both parties involved. Below is a list of common documents that frequently accompany a Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this document outlines what that collateral is and the rights of the lender in the event of default. It establishes a legal claim to the asset until the loan is repaid.

- Disclosure Statement: This document provides borrowers with important information about the loan, including fees, interest rates, and other costs. It ensures transparency and helps borrowers make informed decisions.

- Personal Guarantee: In some cases, a borrower may be required to provide a personal guarantee, which makes them personally liable for the loan. This document adds an extra layer of security for the lender.

- Amortization Schedule: This is a table that outlines each payment over the life of the loan, breaking down how much goes toward interest and how much goes toward the principal. It helps borrowers understand their payment obligations over time.

- Loan Application: This form is completed by the borrower to provide the lender with information about their financial situation. It includes details about income, debts, and credit history, assisting the lender in assessing risk.

- Credit Report Authorization: This document allows the lender to obtain the borrower’s credit report, which is crucial for evaluating creditworthiness. It typically requires the borrower’s signature to proceed.

- Motor Vehicle Power of Attorney: This important document allows one individual to designate another to manage specific motor vehicle transactions on their behalf, making it easier to handle responsibilities like title transfers or vehicle registrations. For more information, you can refer to Texas Forms Online.

- Default Notice: In the event of non-payment, this document serves as a formal notification to the borrower regarding their default status. It outlines the consequences and potential actions the lender may take.

- Release of Liability: Once the loan is paid in full, this document is issued to release the borrower from any further obligations under the Promissory Note. It provides peace of mind that the debt has been satisfied.

Understanding these accompanying documents is vital for anyone entering into a loan agreement. Each form plays a specific role in ensuring that both the lender and the borrower have a clear understanding of their rights and responsibilities. By being informed about these documents, individuals can navigate the lending process more confidently and securely.