Get Profit And Loss Form in PDF

The Profit and Loss form serves as a vital financial tool for businesses, providing a comprehensive overview of income and expenses over a specific period. This document not only highlights the total revenues generated but also details the costs incurred in the pursuit of those revenues, allowing for a clearer understanding of a company's financial health. By summarizing key figures such as gross profit, operating expenses, and net profit, the form enables stakeholders to assess profitability and make informed decisions. Additionally, it can reveal trends over time, offering insights into operational efficiency and areas for improvement. Whether used by small businesses, large corporations, or non-profit organizations, the Profit and Loss form plays an essential role in financial reporting and strategic planning, ultimately guiding organizations toward sustainable growth.

Dos and Don'ts

When filling out a Profit and Loss form, attention to detail is crucial. Here’s a list of essential dos and don’ts to guide you through the process.

- Do ensure all income sources are accurately reported. This includes sales, interest, and any other revenue streams.

- Do keep detailed records of all expenses. Categorizing them can help you identify areas for cost savings.

- Do review your entries for accuracy before submission. Mistakes can lead to discrepancies that may affect your financial reporting.

- Do consult with a financial advisor if you are unsure about any aspect of the form. Professional guidance can save you time and money.

- Do update your Profit and Loss form regularly. Frequent updates provide a clearer picture of your financial health.

- Don't overlook minor details. Even small errors can lead to significant issues down the line.

- Don't mix personal and business expenses. This can complicate your financial records and lead to potential legal issues.

- Don't wait until the last minute to complete the form. Procrastination can lead to rushed entries and mistakes.

- Don't ignore trends in your financial data. Understanding these can help you make informed decisions for your business.

- Don't forget to include all relevant documentation. Supporting documents are essential for verifying your entries.

By following these guidelines, you can ensure that your Profit and Loss form is filled out correctly and reflects the true state of your business finances. Taking the time to do it right can lead to better financial decisions and a more successful business overall.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize a business's revenues and expenses over a specific period, typically for tax reporting or financial analysis. |

| Components | This form generally includes sections for gross income, operating expenses, and net profit or loss. |

| Frequency | Businesses often complete this form on a monthly, quarterly, or annual basis, depending on their reporting requirements. |

| State-Specific Requirements | Some states may have specific forms or additional requirements for reporting profit and loss, governed by state tax laws. |

| Tax Implications | The information on the Profit and Loss form is crucial for determining tax liabilities and can impact a business's overall financial health. |

| Record Keeping | Accurate completion of this form is essential for maintaining proper financial records and supporting any claims made during audits. |

| Analysis Tool | This form serves as an important tool for business owners to assess performance, identify trends, and make informed financial decisions. |

Key takeaways

Understanding how to fill out and use a Profit and Loss (P&L) form is essential for managing your business finances effectively. Here are some key takeaways to consider:

- Purpose of the P&L Form: This document provides a clear overview of your business's revenues and expenses over a specific period, helping you assess profitability.

- Revenue Tracking: Accurately record all income sources. This includes sales, services, and any other revenue streams your business may have.

- Expense Categorization: Break down expenses into categories such as operating costs, salaries, and utilities. This helps in identifying areas where you can cut costs.

- Time Frame: Decide on the period you want to analyze—monthly, quarterly, or annually. Consistency in time frames allows for better comparison over time.

- Net Profit Calculation: Subtract total expenses from total revenues to determine your net profit or loss. This figure is crucial for understanding your business's financial health.

- Review Regularly: Regularly updating your P&L form helps you stay on top of your financial situation and make informed decisions.

- Use for Planning: The P&L can serve as a tool for future planning. Analyze trends to make predictions about future income and expenses.

- Tax Preparation: A well-maintained P&L form can simplify the tax filing process. It provides necessary documentation of income and expenses.

By keeping these points in mind, you can effectively utilize the Profit and Loss form to enhance your business's financial management.

Other PDF Templates

Boyfriend Sign Up Sheet - Interested in a connection based on mutual respect and understanding.

For individuals looking to secure their future wishes, a critical document is the important Last Will and Testament form that enables one to outline their desires regarding asset distribution and the guardianship of dependents. This form not only provides clarity but also serves to prevent unwarranted disputes among family members. For further details, you can visit the important Last Will and Testament guide.

Requesting a Continuance for Court Sample Letter - This procedure helps eliminate confusion about scheduled court dates.

What Documents Do I Need to Sell a Car - Make sure to verify that no modifications are made to the odometer section after signing.

Example - Profit And Loss Form

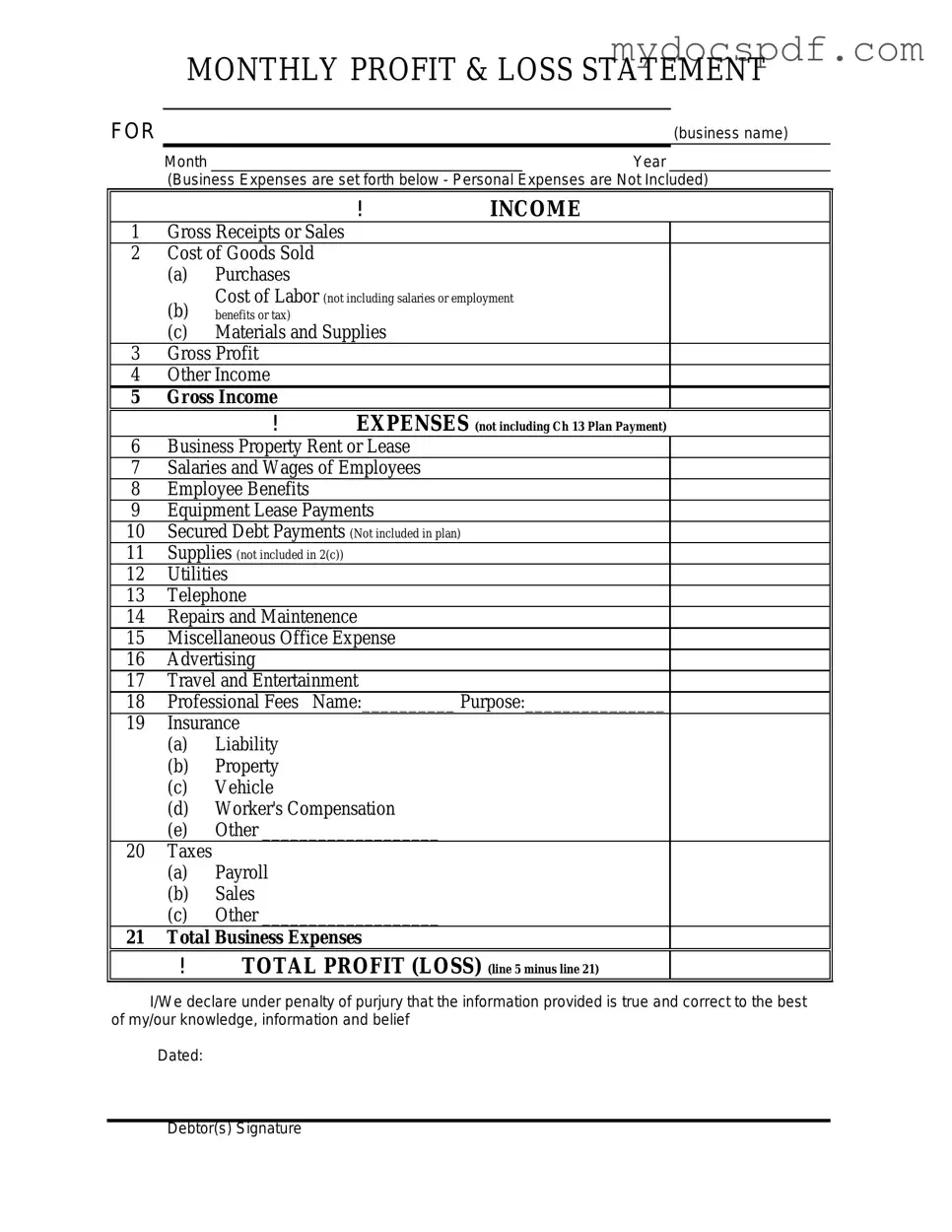

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Detailed Instructions for Writing Profit And Loss

Completing the Profit and Loss form is an important step in assessing financial performance. It requires gathering various financial data to accurately reflect income and expenses over a specific period. Follow these steps to fill out the form correctly.

- Begin with the title section. Write your business name and the period for which you are reporting.

- List all sources of income. Include sales revenue, service income, and any other earnings. Make sure to provide the total amount for each source.

- Add up all income sources to calculate the total income. Write this figure in the designated area.

- Move on to the expenses section. Itemize all business expenses, such as rent, utilities, salaries, and materials.

- Calculate the total expenses by summing all the individual expense amounts. Enter this total in the appropriate space.

- Subtract the total expenses from the total income to determine your net profit or loss. Record this final figure.

- Review the completed form for accuracy. Ensure all amounts are correct and calculations are verified.

- Sign and date the form to certify that the information provided is true and accurate.

Documents used along the form

When managing finances, several key documents complement the Profit and Loss form, providing a fuller picture of a business's financial health. Understanding these documents can help in making informed decisions and ensuring accurate financial reporting.

- Balance Sheet: This document summarizes a company's assets, liabilities, and equity at a specific point in time. It provides insight into what the company owns and owes, helping assess its financial stability.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business over a period. It highlights how well the company generates cash to meet its obligations and fund its operations.

- Budget: A budget outlines expected income and expenses for a future period. It serves as a financial plan, guiding spending and helping to ensure that the business remains on track financially.

- Tax Returns: These documents report income, expenses, and other tax-related information to the IRS. They are crucial for compliance and can also provide insights into a company’s profitability and financial practices.

- Asurion F-017-08 MEN Form: This essential document is used for managing claims and warranty services related to electronic devices, ensuring users can navigate their service options effectively. More details can be found in the Fast PDF Templates.

- Invoice: An invoice is a bill sent to customers for goods or services provided. It details what was sold, the amount due, and payment terms, playing a vital role in tracking sales and managing cash flow.

These documents work together to give a comprehensive view of a business's financial situation. By reviewing them alongside the Profit and Loss form, business owners can gain valuable insights and make better financial decisions.