Attorney-Approved Personal Guarantee Template

When entering into business agreements, understanding the various forms and documents involved is essential for protecting your interests. One such important document is the Personal Guarantee form. This form serves as a commitment from an individual to be personally liable for the debts or obligations of a business. It is often required by lenders or suppliers as a way to mitigate risk. By signing this document, the guarantor assures that if the business fails to meet its financial obligations, the individual will step in to cover those debts. The Personal Guarantee form typically includes key details such as the names of the parties involved, the specific obligations being guaranteed, and any limitations or conditions that apply. It is crucial for anyone considering signing this form to fully understand the implications, as it can significantly impact personal finances and credit. Ensuring that you are informed about the responsibilities and potential risks associated with a Personal Guarantee can provide peace of mind as you navigate your business endeavors.

Dos and Don'ts

When filling out a Personal Guarantee form, attention to detail is crucial. Here are some important dos and don’ts to keep in mind:

- Do read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do provide your full legal name and any required identification numbers. This ensures that your guarantee is valid and traceable.

- Do double-check all information for accuracy. Mistakes can lead to complications down the line.

- Do consult a legal professional if you have any questions about the form. It's better to seek clarification than to make assumptions.

- Don't rush through the form. Taking your time can prevent errors that might affect your guarantee.

- Don't leave any required fields blank. Incomplete forms may be rejected or delayed.

- Don't provide false information. Misrepresentation can have serious legal consequences.

- Don't ignore the instructions provided with the form. They are there to guide you through the process.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A personal guarantee is a legal commitment made by an individual to repay a debt or fulfill an obligation if the primary borrower defaults. |

| Purpose | It provides lenders with additional security, ensuring that they can recover funds even if the business fails. |

| Common Use | Personal guarantees are often used in business loans, leases, and credit agreements. |

| Liability | By signing a personal guarantee, the individual accepts personal liability for the debt, which can affect personal assets. |

| State-Specific Forms | Different states may have specific forms or requirements for personal guarantees, reflecting local laws. |

| Governing Law | In California, for example, the personal guarantee is governed by the California Civil Code. |

| Duration | The obligation under a personal guarantee typically lasts until the debt is fully paid or the contract is terminated. |

| Enforceability | For a personal guarantee to be enforceable, it usually must be in writing and signed by the guarantor. |

| Impact on Credit | A personal guarantee can impact the guarantor's credit score if the borrower defaults and the lender seeks repayment. |

| Negotiation | Individuals can negotiate the terms of a personal guarantee, including limits on liability or duration. |

Key takeaways

When filling out and using the Personal Guarantee form, keep these key points in mind:

- Understand Your Commitment: A personal guarantee means you are personally liable for the debt or obligation. Be sure you are comfortable with this responsibility.

- Provide Accurate Information: Fill out the form completely and accurately. Any discrepancies could lead to complications later.

- Review Before Signing: Carefully read the entire document before signing. Ensure you understand all terms and conditions associated with the guarantee.

- Consult a Professional: If you have questions or concerns, consider seeking advice from a legal or financial advisor to fully understand the implications.

Popular Personal Guarantee Documents:

Purchase Agreement Addendum - It is a practical solution for managing the evolving dynamics of real estate transactions.

In order to facilitate a successful property transaction, utilizing a well-crafted Real Estate Purchase Agreement is crucial. This document outlines the responsibilities of each party, ensuring a smooth process and minimizing potential disputes. For those seeking guidance, our informative resource on the necessary components of a Real Estate Purchase Agreement can be invaluable.

Example - Personal Guarantee Form

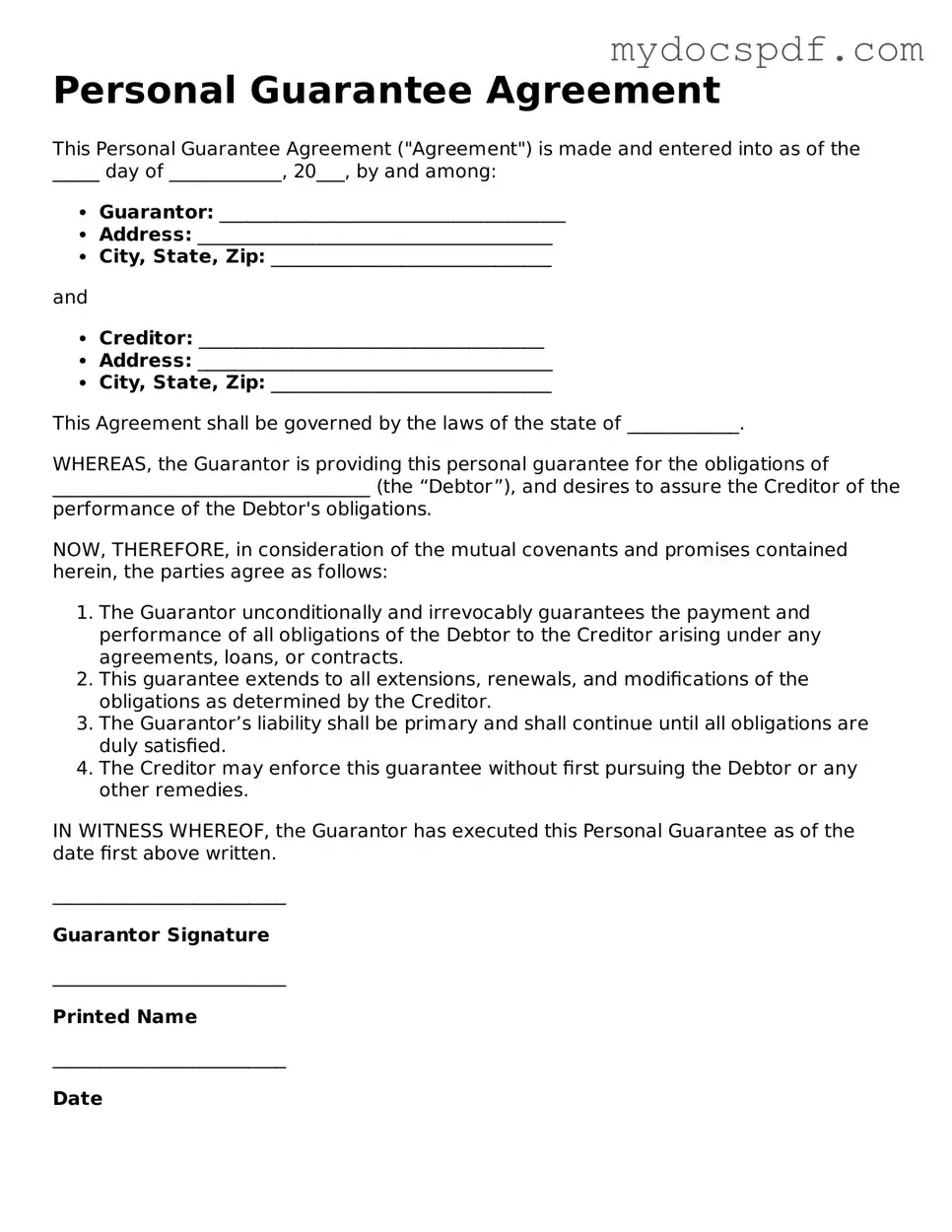

Personal Guarantee Agreement

This Personal Guarantee Agreement ("Agreement") is made and entered into as of the _____ day of ____________, 20___, by and among:

- Guarantor: _____________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

and

- Creditor: _____________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

This Agreement shall be governed by the laws of the state of ____________.

WHEREAS, the Guarantor is providing this personal guarantee for the obligations of __________________________________ (the “Debtor”), and desires to assure the Creditor of the performance of the Debtor's obligations.

NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the parties agree as follows:

- The Guarantor unconditionally and irrevocably guarantees the payment and performance of all obligations of the Debtor to the Creditor arising under any agreements, loans, or contracts.

- This guarantee extends to all extensions, renewals, and modifications of the obligations as determined by the Creditor.

- The Guarantor’s liability shall be primary and shall continue until all obligations are duly satisfied.

- The Creditor may enforce this guarantee without first pursuing the Debtor or any other remedies.

IN WITNESS WHEREOF, the Guarantor has executed this Personal Guarantee as of the date first above written.

_________________________

Guarantor Signature

_________________________

Printed Name

_________________________

Date

Detailed Instructions for Writing Personal Guarantee

After you receive the Personal Guarantee form, the next step is to complete it accurately. This form requires specific information to ensure that all parties are properly identified and that the agreement is legally binding. Follow the steps below to fill out the form correctly.

- Begin by entering your full legal name in the designated section at the top of the form.

- Provide your current address, including city, state, and zip code.

- Input your phone number and email address in the appropriate fields.

- Fill in the date on which you are completing the form.

- Clearly state the name of the business or entity for which you are providing the guarantee.

- Include the business address, ensuring that it matches the official records.

- Sign the form where indicated, confirming your agreement to the terms outlined.

- Print your name below your signature to ensure clarity.

- Review the entire form for accuracy and completeness before submission.

Once you have filled out the form, make sure to keep a copy for your records. Submit the completed form to the designated party as instructed.

Documents used along the form

A Personal Guarantee form is often used in various business transactions to provide assurance to lenders or creditors. Along with this form, several other documents may be required to ensure clarity and legal protection for all parties involved. Below is a list of commonly used forms and documents that often accompany a Personal Guarantee.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rates, and repayment schedule.

- Promissory Note: A written promise from the borrower to repay the loan under specified terms. It details the amount, interest, and repayment timeline.

- Business License: This document proves that the business is legally authorized to operate within a specific jurisdiction.

- Articles of Incorporation: For corporations, this document establishes the existence of the company and outlines its purpose, structure, and governance.

- Operating Agreement: Commonly used by LLCs, this document details the management structure and operational procedures of the business.

- Financial Statements: These provide a snapshot of the business's financial health, including income statements, balance sheets, and cash flow statements.

- Real Estate Purchase Agreement: This document is essential in real estate transactions, detailing the terms, conditions, and relevant information regarding the sale. For more details, visit All Nevada Forms.

- Credit Application: A form that potential borrowers fill out to provide lenders with information about their creditworthiness and financial history.

- Security Agreement: This document outlines collateral that secures the loan, detailing what the lender can claim if the borrower defaults.

- Personal Financial Statement: A summary of an individual’s financial position, including assets, liabilities, and net worth, often required from guarantors.

Each of these documents plays a vital role in the overall transaction process. They help clarify responsibilities, protect interests, and ensure that all parties understand their commitments. Having the right documentation in place can make a significant difference in the success of a business agreement.