Get Payroll Check Form in PDF

The Payroll Check form is a critical document in the realm of employee compensation, serving as a record of payment issued to employees for their work. This form typically includes essential information such as the employee's name, identification number, and the payment period covered. Additionally, it details the gross pay, deductions for taxes and benefits, and the net pay that the employee will receive. Employers often use this form not only to ensure accurate payments but also to comply with federal and state regulations regarding payroll processing. The Payroll Check form may also feature the employer’s information, including their name and address, which helps maintain transparency in financial transactions. By providing a clear breakdown of earnings and deductions, this form plays a pivotal role in fostering trust between employers and employees, ensuring that both parties are aligned on compensation matters.

Dos and Don'ts

When filling out the Payroll Check form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are seven important dos and don'ts to consider:

- Do double-check all personal information for accuracy.

- Do ensure that the payment amount is clearly stated.

- Do sign the form where required.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use correction fluid to fix mistakes; instead, cross out the error and write the correct information.

- Don't submit the form without reviewing it for any errors or omissions.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to document employee payments for services rendered. |

| Frequency | Payroll checks can be issued weekly, bi-weekly, or monthly, depending on company policy. |

| Employee Information | The form typically includes the employee's name, address, and Social Security number. |

| Gross Pay | Gross pay is the total earnings before any deductions are applied. |

| Deductions | Common deductions include taxes, retirement contributions, and health insurance premiums. |

| Net Pay | Net pay is the amount the employee receives after all deductions have been made. |

| State-Specific Forms | Some states require specific payroll check formats. For example, California mandates compliance with the California Labor Code. |

| Record Keeping | Employers must keep payroll records for at least three years, as required by federal law. |

| Electronic Payroll | Many employers now use electronic payroll systems, which can streamline the payment process. |

| Legal Compliance | Failure to comply with payroll laws can result in penalties for employers, including fines and back pay obligations. |

Key takeaways

When filling out and using the Payroll Check form, it's essential to keep several key points in mind. Here’s a helpful list to guide you through the process:

- Accurate Information: Ensure all employee details, such as name, address, and Social Security number, are correct to avoid delays.

- Payment Amount: Double-check the gross pay, deductions, and net pay to confirm accuracy.

- Pay Period: Clearly indicate the start and end dates of the pay period to ensure proper record-keeping.

- Signature Requirement: The form must be signed by an authorized person before processing to validate the payment.

- Tax Withholdings: Review the federal and state tax withholdings to ensure compliance with current tax laws.

- Overtime Calculation: If applicable, verify that any overtime hours are calculated correctly according to company policy.

- Direct Deposit Option: If the employee opts for direct deposit, include the correct bank account information.

- Record Keeping: Maintain copies of all payroll checks and forms for future reference and auditing purposes.

- Timely Submission: Submit the completed Payroll Check form promptly to ensure employees are paid on time.

- Review Company Policies: Familiarize yourself with your company's payroll policies to ensure compliance and accuracy.

By following these guidelines, you can help ensure a smooth payroll process for all employees involved.

Other PDF Templates

American Automobile Association - International acceptance of the IDP enhances the confidence of drivers navigating unfamiliar roads.

For individuals seeking to understand workplace documentation, the necessary Employment Verification paperwork is crucial for confirming current or past employment status. This form facilitates important processes such as loan applications and housing verification, enabling employees to assert their job-related credentials.

Lien Release Requirements by State - Contractors should keep a signed copy of this waiver for their records to document completed work.

Example - Payroll Check Form

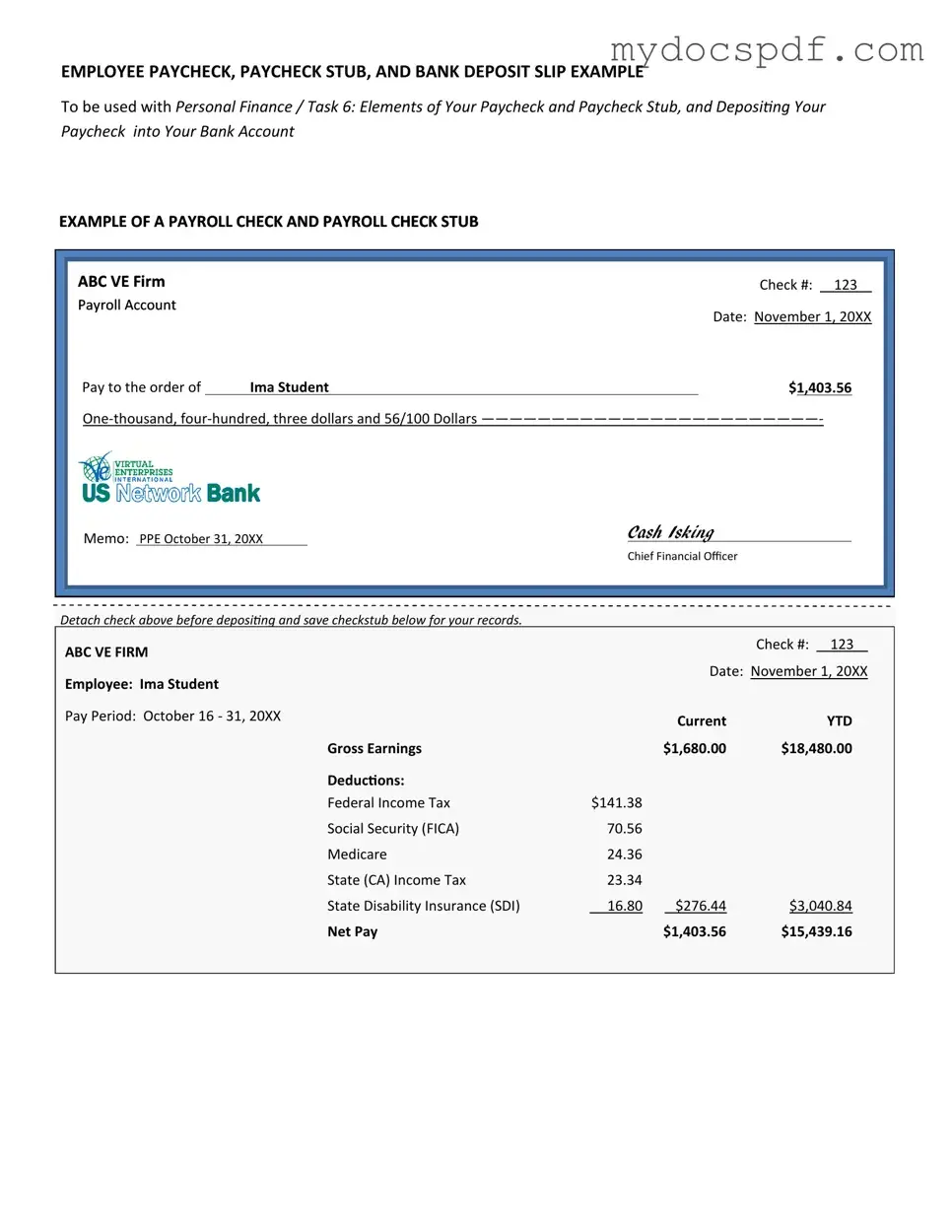

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

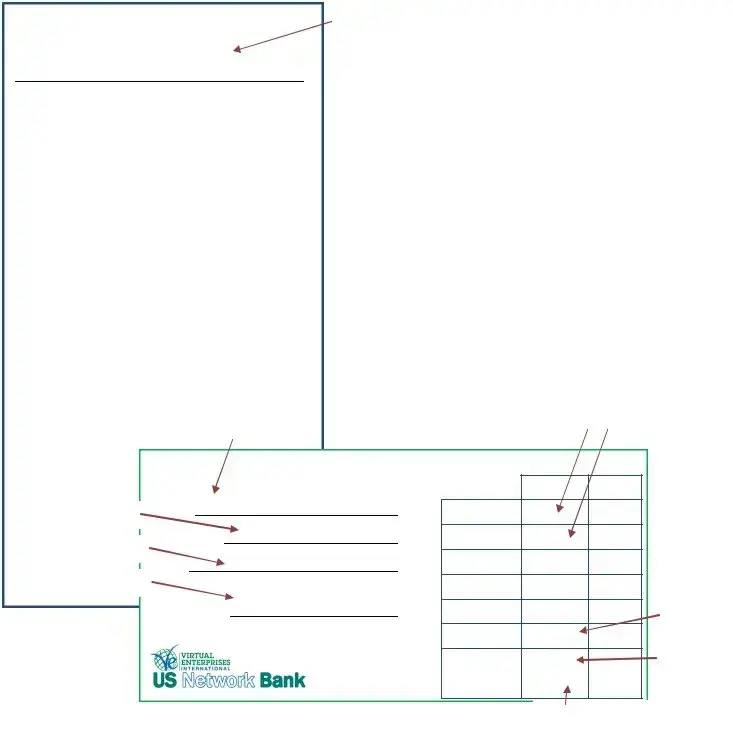

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Detailed Instructions for Writing Payroll Check

Completing the Payroll Check form accurately is essential for ensuring that employees receive their payments on time. After filling out the form, it will be processed by the payroll department, leading to timely distribution of checks or direct deposits. Follow these steps to fill out the form correctly.

- Begin by entering the employee's name in the designated field. Ensure the spelling is correct.

- Next, input the employee's identification number or Social Security number. This number is crucial for record-keeping.

- In the payment period section, specify the dates that the payment covers. Use the format MM/DD/YYYY.

- Indicate the hours worked during the pay period. If applicable, separate regular hours from overtime hours.

- Fill in the hourly wage or salary amount. Double-check for accuracy.

- Calculate the total amount due by multiplying the hours worked by the hourly wage or entering the salary amount.

- In the deductions section, list any applicable deductions such as taxes, insurance, or retirement contributions.

- Finally, sign and date the form at the bottom to confirm that all information is accurate and complete.

Documents used along the form

When managing payroll, several key documents often accompany the Payroll Check form to ensure accurate processing and compliance. Each document plays a vital role in maintaining clear records and facilitating smooth transactions. Below is a list of common forms and documents that are frequently used alongside the Payroll Check form.

- Employee Time Sheet: This document records the hours worked by each employee during a specific pay period. It is essential for calculating wages accurately.

- W-4 Form: Employees complete this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Payroll Register: This is a summary report that lists all employees' earnings, deductions, and net pay for a specific pay period. It serves as a comprehensive record for payroll processing.

- Notice to Quit: The Texas Notice to Quit form is a legal document used by landlords to inform tenants of their intention to terminate a rental agreement, providing the tenant with a specified timeframe to vacate the premises. Understanding this form is essential for both landlords and tenants to ensure compliance with Texas rental laws. For more information, visit Texas Forms Online.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank accounts. It streamlines the payment process and enhances convenience.

- Pay Stub: Accompanying the Payroll Check, this document provides a detailed breakdown of an employee's earnings, deductions, and net pay for the pay period. It serves as a record for both the employer and employee.

Utilizing these documents in conjunction with the Payroll Check form ensures a thorough and organized payroll process. Each form contributes to transparency and accuracy, ultimately benefiting both employers and employees.