Get P 45 It Form in PDF

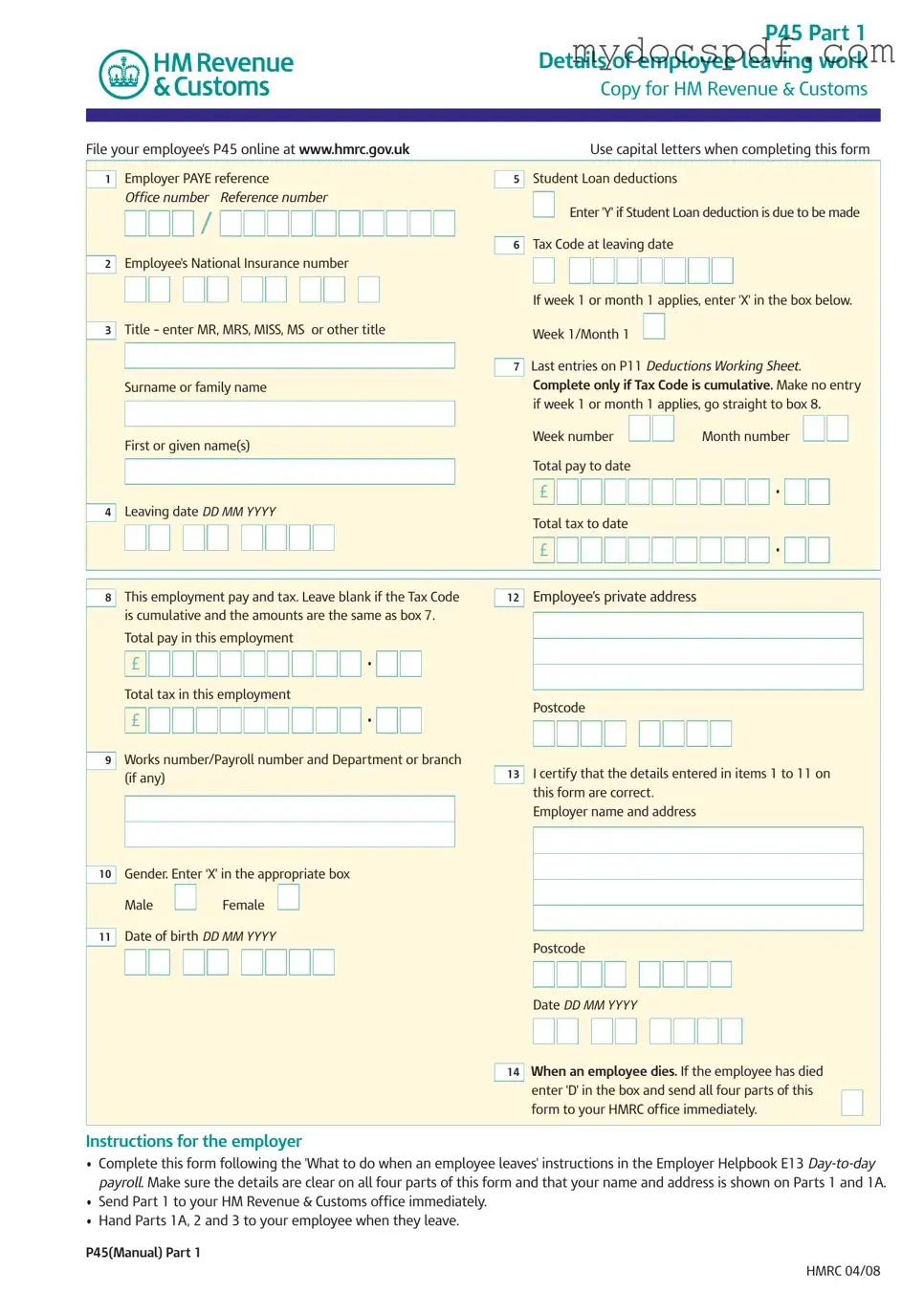

The P45 form is a crucial document for both employers and employees in the UK, serving as a record of an employee's tax and income details upon leaving a job. This form is divided into three parts, each designed for specific purposes: Part 1 for HM Revenue & Customs (HMRC), Part 1A for the employee, and Parts 2 and 3 for the new employer. When an employee leaves their position, the employer must complete the P45 accurately, including details such as the employee's National Insurance number, tax code, and total pay and tax to date. It is essential for the employer to provide the employee with Parts 1A, 2, and 3 immediately upon departure, ensuring that the employee can manage their tax affairs effectively. The P45 also includes important information regarding student loan deductions, if applicable, and serves as a reference for the new employer to avoid emergency tax codes. Understanding the P45 form and its components is vital for maintaining accurate tax records and ensuring a smooth transition for employees moving to new jobs or claiming benefits.

Dos and Don'ts

Things to Do When Filling Out the P45 It Form:

- Use capital letters for all entries.

- Ensure the employer's PAYE reference is correct.

- Enter the employee's National Insurance number accurately.

- Specify the leaving date in the correct format (DD MM YYYY).

- Complete the total pay and tax amounts for the employment.

- Mark 'X' in the appropriate box if week 1 or month 1 applies.

- Verify that the details are clear and legible on all parts of the form.

- Send Part 1 to HM Revenue & Customs immediately.

- Hand Parts 1A, 2, and 3 to the employee upon leaving.

Things Not to Do When Filling Out the P45 It Form:

- Do not leave any required fields blank.

- Avoid using lowercase letters or unclear handwriting.

- Do not enter tax amounts if the Tax Code is cumulative and amounts are the same as box 7.

- Do not forget to certify the details entered on the form.

- Do not alter Parts 2 and 3 in any way.

- Do not delay sending the form to HMRC.

- Do not forget to keep a copy of Parts 2 and 3 for your records.

- Do not enter incorrect information regarding student loan deductions.

- Do not ignore the instructions for completing the form as outlined in the Employer Helpbook E13.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The P45 form is used to provide details about an employee who is leaving work, including their pay and tax information. |

| Parts | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Filing Requirement | Employers must send Part 1 to HMRC immediately after an employee leaves and provide Parts 1A, 2, and 3 to the employee. |

| Governing Law | The P45 form is governed by UK tax law, specifically under the Income Tax (Pay As You Earn) Regulations. |

Key takeaways

When filling out and using the P45 IT form, it is important to keep several key points in mind:

- The P45 form is divided into four parts: Part 1, Part 1A, Part 2, and Part 3. Each part serves a specific purpose.

- Employers must complete Part 1 and send it to HM Revenue & Customs (HMRC) immediately after an employee leaves.

- Parts 1A, 2, and 3 should be handed to the employee when they leave. These parts contain important information for the employee's next steps.

- Use capital letters when filling out the form to ensure clarity and legibility.

- Be sure to enter the employee's National Insurance number and PAYE reference accurately. Mistakes can lead to complications.

- If the employee has a Student Loan, indicate this on the form by entering 'Y' where required.

- Employees should keep Part 1A safe, as it may be needed for tax returns or to claim benefits.

- If the employee is going to a new job, they must provide Parts 2 and 3 to their new employer to avoid emergency tax deductions.

Other PDF Templates

Fillable W-9 Form 2023 - Businesses request a W-9 from vendors to ensure proper tax reporting.

For those looking to buy or sell a motorcycle in New York, it is essential to utilize the New York Motorcycle Bill of Sale form to formalize the transaction. This document provides a clear and concise record of the sale, detailing important information about both the motorcycle and the parties involved. Ensuring that all necessary information is captured not only aids in the smooth transition of ownership but also mitigates any potential misunderstandings in the future. You can find a helpful resource for this document at https://newyorkform.com/free-motorcycle-bill-of-sale-template.

Citibank Direct Deposit Time - The direct deposit form is a necessary step for convenient banking.

Example - P 45 It Form

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 1 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of employee leaving work |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy for HM Revenue & Customs |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Office number |

Reference number |

|

|

|

|

Enter 'Y' if Student Loan deduction is due to be made |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|

||||||||||||||||||||||||

|

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

||||||||||||||||||||||||||

|

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. Make no entry |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if week 1 or month 1 applies, go straight to box 8. |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

8 |

|

This employment pay and tax. Leave blank if the Tax Code |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

is cumulative and the amounts are the same as box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When an employee dies. If the employee has died |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter 'D' in the box and send all four parts of this |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

form to your HMRC office immediately. |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for the employer

•Complete this form following the 'What to do when an employee leaves' instructions in the Employer Helpbook E13

•Send Part 1 to your HM Revenue & Customs office immediately.

•Hand Parts 1A, 2 and 3 to your employee when they leave.

P45(Manual) Part 1

HMRC 04/08

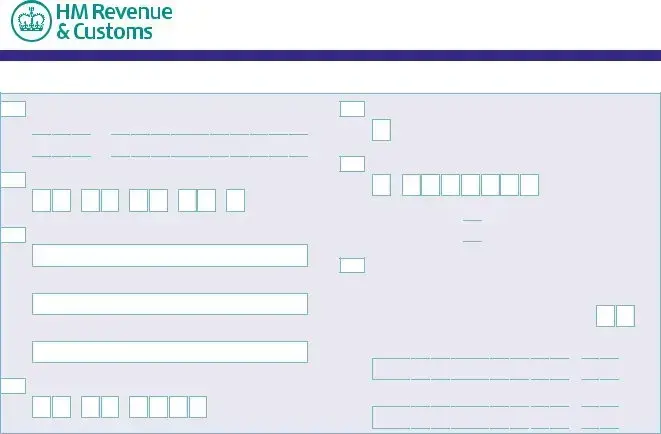

P45 Part 1A

Details of employee leaving work

Copy for employee

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

Office number |

Reference number |

|

|

|

|

Student Loan deductions to continue |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6 there will be no entries here. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

||||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

8 |

|

This employment pay and tax. If no entry here, the amounts |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

are those shown at box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the employee

The P45 is in three parts. Please keep this part (Part 1A) safe. Copies are not available. You might need the information in Part 1A to fill in a Tax Return if you are sent one.

Please read the notes in Part 2 that accompany Part 1A. The notes give some important information about what you should do next and what you should do with Parts 2 and 3 of this form.

Tax credits

Tax credits are flexible. They adapt to changes in your life, such as leaving a job. If you need to let us know about a change in your income, phone 0845 300 3900.

To the new employer

If your new employee gives you this Part 1A, please return it to them. Deal with Parts 2 and 3 as normal.

P45(Manual) Part 1A |

HMRC 04/08 |

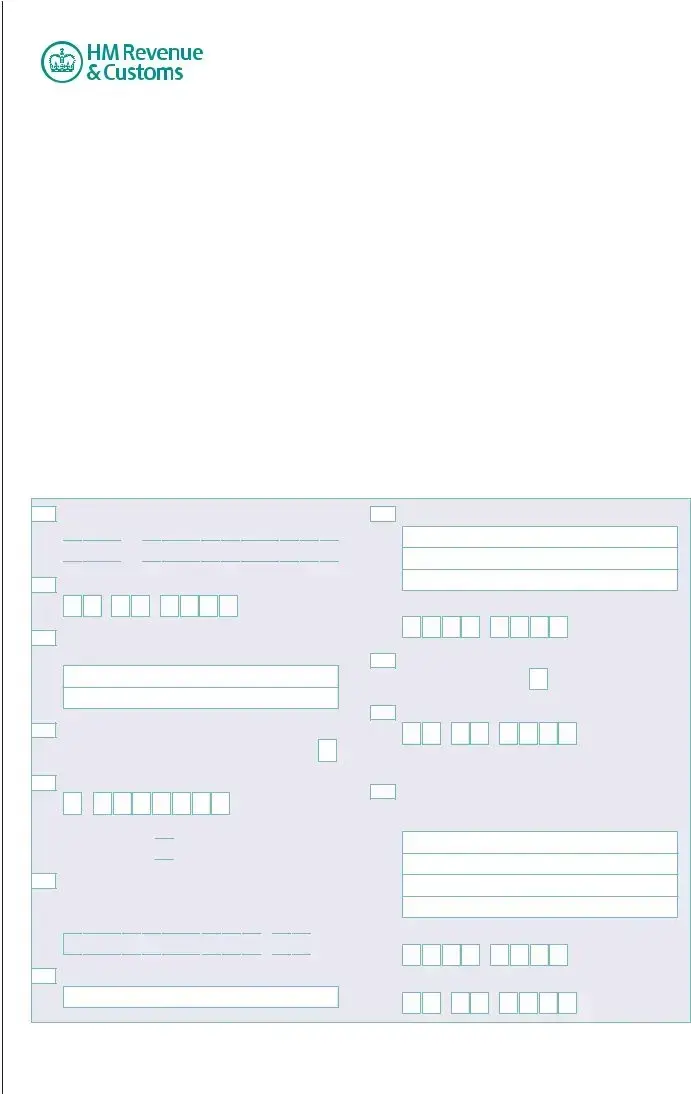

P45 Part 2 Details of employee leaving work

Copy for new employer

1

2

3

4

Employer PAYE reference

Office number Reference number

/

/

Employee's National Insurance number

Title - enter MR, MRS, MISS, MS or other title

Surname or family name

First or given name(s)

Leaving date DD MM YYYY

5Student Loan deductions

Student Loan deductions to continue

6Tax Code at leaving date

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

7Last entries on P11 Deductions Working Sheet. Complete only if Tax Code is cumulative. If there is an ‘X’ at box 6, there will be no entries here.

Week number |

|

|

Month number |

Total pay to date |

|

|

|

£

•

•

Total tax to date

£

•

•

To the employee

This form is important to you. Take good care of it and keep it safe. Copies are not available. Please keep

Parts 2 and 3 of the form together and do not alter them in any way.

Going to a new job

Claiming Jobseeker's Allowance or

Employment and Support Allowance (ESA)

Take this form to your Jobcentre Plus office. They will pay you any tax refund you may be entitled to when your claim ends, or at 5 April if this is earlier.

Give Parts 2 and 3 of this form to your new employer, or you will have tax deducted using the emergency code and may pay too much tax. If you do not want your new employer to know the details on this form, send it to your HM Revenue & Customs (HMRC) office immediately with a letter saying so and giving the name and address of your new employer. HMRC can make special arrangements, but you may pay too much tax for a while as a result of this.

Going abroad

Not working and not claiming Jobseeker's Allowance or Employment and Support Allowance (ESA)

If you have paid tax and wish to claim a refund ask for form P50 Claiming Tax back when you have stopped working from any HMRC office or Enquiry Centre.

Help

If you need further help you can contact any HMRC office or Enquiry Centre. You can find us in The Phone Book under HM Revenue & Customs or go to www.hmrc.gov.uk

If you are going abroad or returning to a country

outside the UK ask for form P85 Leaving the United Kingdom from any HMRC office or Enquiry Centre.

Becoming

You must register with HMRC within three months of becoming

to get a copy of the booklet SE1 Are you thinking of working for yourself?

To the new employer

Check this form and complete boxes 8 to 18 in Part 3 and prepare a form P11 Deductions Working Sheet. Follow the instructions in the Employer Helpbook E13

P45(Manual) Part 2 |

HMRC 04/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 3 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New employee details |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For completion by new employer |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

1 |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Office number Reference number |

|

|

|

|

|

Student Loan deductions to continue |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2 |

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS or other title |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

3 |

|

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6, there will be no entries here. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

|

|

Month number |

|

|

|

|

||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8

New employer PAYE reference

Office number Reference number

/

/

15

Employee's private address

9Date new employment started DD MM YYYY

10Works number/Payroll number and Department or branch (if any)

11Enter 'P' here if employee will not be paid by you between the date employment began and the next 5 April.

12Enter Tax Code in use if different to the Tax Code at box 6

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

13If the tax figure you are entering on P11 Deductions Working Sheet differs from box 7 (see the E13 Employer Helpbook

figure here.

£

•

•

14New employee's job title or job description

Postcode

16Gender. Enter ‘X’ in the appropriate box

Male |

|

Female |

17Date of birth DD MM YYYY

Declaration

18I have prepared a P11 Deductions Working Sheet in accordance with the details above.

Employer name and address

Postcode

Date DD MM YYYY

P45(Manual) Part 3 |

HMRC 04/08 |

Detailed Instructions for Writing P 45 It

Completing the P45 IT form is an important step when an employee leaves a job. It is essential to provide accurate information to ensure proper tax handling. Follow the steps below carefully to fill out the form correctly.

- Start with Part 1 of the form. Use capital letters throughout.

- Fill in the employer's PAYE reference, office number, and reference number in boxes 1 to 3.

- Enter the employee's National Insurance number in box 2.

- In box 3, select the employee's title (MR, MRS, MISS, MS, or other).

- Provide the employee's surname in box 4 and first name(s) in box 5.

- Enter the leaving date in box 6 using the format DD MM YYYY.

- Fill in the employee's private address and postcode in box 7.

- In box 8, record the total pay to date and total tax to date. If the tax code is cumulative, ensure that this information is accurate.

- Indicate the employee's gender in box 9 by marking 'X' in the appropriate box.

- Enter the employee's date of birth in box 10 using the format DD MM YYYY.

- Complete the certification statement in box 11, confirming that the details are correct.

- Sign and date the form in the designated area.

- Send Part 1 to HM Revenue & Customs immediately.

- Provide Parts 1A, 2, and 3 to the employee upon their departure.

After filling out the form, ensure that all parts are clear and legible. It is crucial to handle this process promptly to avoid any tax issues for the employee. Keep copies of the form for your records, as they may be needed for future reference.

Documents used along the form

The P45 IT form is an important document used when an employee leaves a job in the UK. It provides essential information regarding the employee's tax and pay history. Along with the P45, several other forms and documents may be required to ensure a smooth transition for both the employee and the employer. Below is a list of these documents, each with a brief description.

- P60: This document summarizes an employee's total pay and deductions for the tax year. It is issued by the employer at the end of the tax year and is essential for tax return purposes.

- Durable Power of Attorney: This legal document allows a designated individual to make decisions on your behalf if you become incapacitated. It is crucial for managing financial and medical matters in accordance with your wishes. For further information, visit https://arizonapdfs.com.

- P50: Used to claim a tax refund after stopping work. Employees can request this form from HMRC to recover any overpaid tax.

- P85: This form is for individuals leaving the UK to live or work abroad. It helps notify HMRC of the change in residency and may assist in claiming tax refunds.

- P11D: Employers use this form to report benefits and expenses provided to employees. It is important for calculating the employee's taxable income.

- Jobseeker's Allowance Claim Form: If the employee is seeking unemployment benefits, this form is necessary to apply for Jobseeker's Allowance or Employment and Support Allowance.

- Self-Employment Registration: If the individual plans to become self-employed, they must register with HMRC within three months to avoid penalties.

Each of these documents plays a vital role in managing employment transitions and ensuring compliance with tax regulations. Understanding their purpose can help both employees and employers navigate the process effectively.