Attorney-Approved Owner Financing Contract Template

Owner financing contracts serve as a vital tool for buyers and sellers in real estate transactions, particularly when traditional financing options are not viable. These contracts outline the terms under which the seller provides financing directly to the buyer, allowing for a more flexible approach to property purchases. Key components of the owner financing contract include the purchase price, down payment amount, interest rate, repayment schedule, and any contingencies that may apply. Additionally, the contract specifies the responsibilities of both parties, including maintenance obligations and what happens in the event of default. Understanding these elements is crucial for both buyers seeking to secure a home and sellers looking to facilitate a sale without relying on banks or mortgage companies. By clearly delineating the terms of the financing arrangement, this form helps to protect the interests of both parties while fostering a smoother transaction process.

Dos and Don'ts

When it comes to filling out an Owner Financing Contract form, there are several important dos and don'ts to keep in mind. These tips can help ensure that the process goes smoothly and that all parties are protected.

- Do read the entire contract thoroughly before filling it out. Understanding the terms is crucial.

- Do provide accurate information. Double-check names, addresses, and financial details.

- Do consult with a legal professional if you have any doubts or questions about the terms.

- Do include all necessary details, such as the purchase price, interest rate, and payment schedule.

- Don't rush through the form. Taking your time can prevent mistakes that might lead to issues later.

- Don't leave any blanks unless specifically instructed. Every section should be completed to avoid ambiguity.

By following these guidelines, you can help ensure that your Owner Financing Contract is filled out correctly, paving the way for a successful transaction.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer for the purchase of property. |

| Purpose | This type of contract allows buyers who may not qualify for traditional loans to purchase property directly from the seller. |

| Down Payment | Typically, a down payment is required, which can vary based on the agreement between the buyer and seller. |

| Interest Rate | The seller sets the interest rate, which may be higher or lower than conventional mortgage rates. |

| Payment Terms | Payment terms, including the duration of the loan and payment frequency, are negotiated between the parties. |

| Governing Law | In most states, the contract is governed by state real estate laws, which can vary significantly. |

| Default Consequences | If the buyer defaults, the seller may have the right to foreclose on the property, similar to a traditional mortgage. |

| Title Transfer | Title to the property may be transferred to the buyer at closing, or it may remain with the seller until the loan is paid off. |

| Legal Considerations | Both parties should consider legal advice to ensure the contract complies with applicable laws and protects their interests. |

| Market Trends | Owner financing can be an attractive option in tight credit markets, allowing sellers to reach a broader pool of potential buyers. |

Key takeaways

When filling out and using the Owner Financing Contract form, it's essential to keep several key points in mind. These takeaways will help ensure a smooth transaction and protect the interests of both parties involved.

- Understand the Terms: Familiarize yourself with the key terms of the contract. This includes the purchase price, interest rate, and repayment schedule.

- Clearly Define Responsibilities: Outline the responsibilities of both the seller and the buyer. This clarity helps prevent misunderstandings later on.

- Include Contingencies: Consider adding contingencies that can protect both parties. These might include clauses for inspections or financing approvals.

- Document Everything: Keep thorough records of all communications and agreements. This documentation can be invaluable in case of disputes.

- Consult a Professional: Seek advice from a real estate attorney or a qualified professional. Their expertise can provide valuable insights and ensure compliance with local laws.

- Review and Revise: Before finalizing the contract, review it carefully. Make any necessary revisions to ensure that it accurately reflects the agreed-upon terms.

By following these key takeaways, you can navigate the owner financing process with confidence and clarity.

Popular Owner Financing Contract Documents:

What Is a Personal Guarantee - It’s a safeguard for lenders that can help close a loan deal faster.

For those engaged in real estate transactions, a thorough understanding of the "Real Estate Purchase Agreement" is vital. This essential contract defines the obligations of both the buyer and seller, providing a solid foundation for property deals. To learn more about its critical components, visit the essential Colorado Real Estate Purchase Agreement resource.

Example - Owner Financing Contract Form

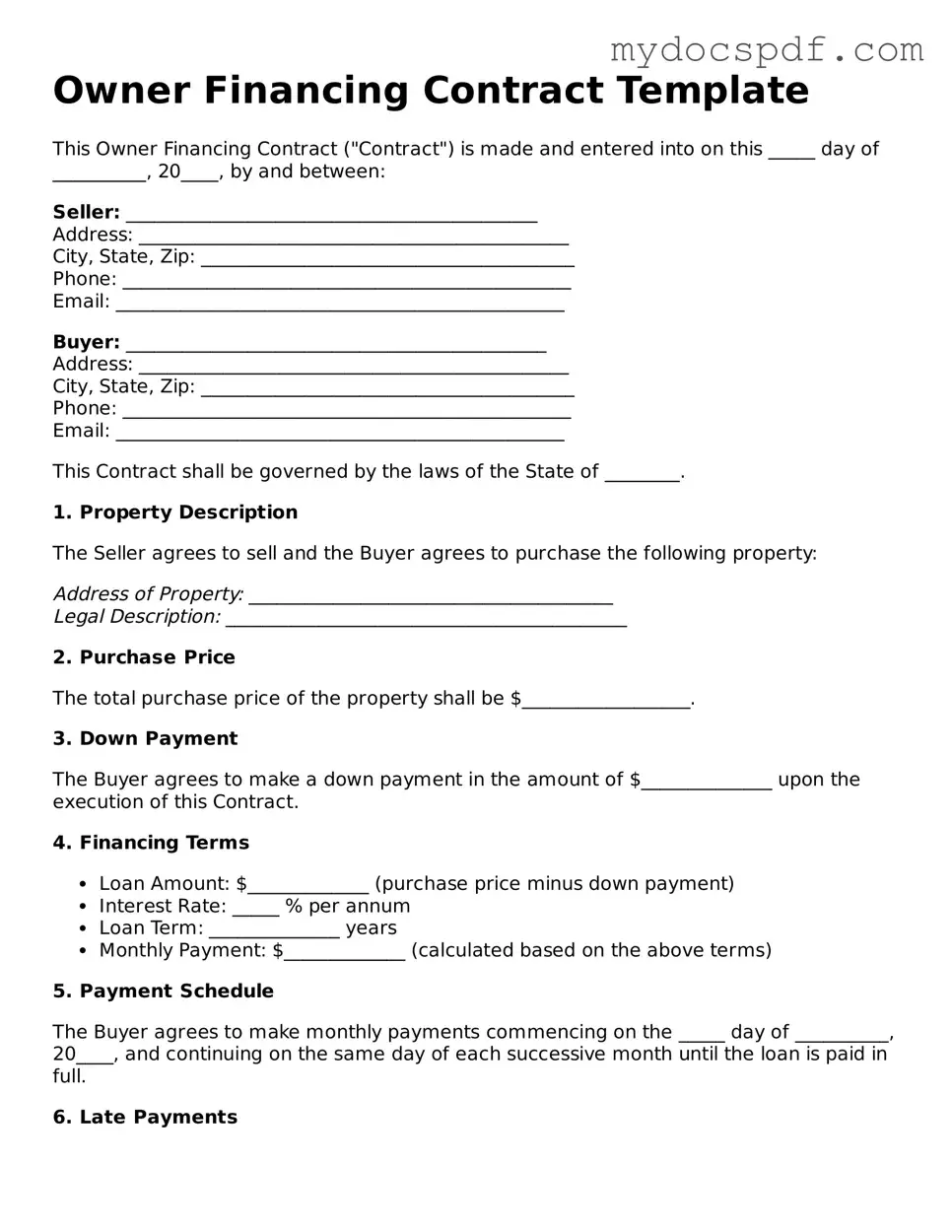

Owner Financing Contract Template

This Owner Financing Contract ("Contract") is made and entered into on this _____ day of __________, 20____, by and between:

Seller: ____________________________________________

Address: ______________________________________________

City, State, Zip: ________________________________________

Phone: ________________________________________________

Email: ________________________________________________

Buyer: _____________________________________________

Address: ______________________________________________

City, State, Zip: ________________________________________

Phone: ________________________________________________

Email: ________________________________________________

This Contract shall be governed by the laws of the State of ________.

1. Property Description

The Seller agrees to sell and the Buyer agrees to purchase the following property:

Address of Property: _______________________________________

Legal Description: ___________________________________________

2. Purchase Price

The total purchase price of the property shall be $__________________.

3. Down Payment

The Buyer agrees to make a down payment in the amount of $______________ upon the execution of this Contract.

4. Financing Terms

- Loan Amount: $_____________ (purchase price minus down payment)

- Interest Rate: _____ % per annum

- Loan Term: ______________ years

- Monthly Payment: $_____________ (calculated based on the above terms)

5. Payment Schedule

The Buyer agrees to make monthly payments commencing on the _____ day of __________, 20____, and continuing on the same day of each successive month until the loan is paid in full.

6. Late Payments

If any monthly payment is not received within _____ days of its due date, a late fee of $_____________ shall be assessed.

7. Prepayment

The Buyer may prepay the principal balance of this Contract, in whole or in part, without penalty.

8. Default

In the event of default by the Buyer, the Seller may pursue remedies allowed by law, including but not limited to, foreclosure on the property.

9. Transfer of Title

The Seller agrees to convey the title of the property to the Buyer upon receipt of the final payment and after all terms of this Contract are fulfilled.

10. Governing Law

This Contract shall be controlled by and construed in accordance with the laws of the State of ________.

11. Entire Agreement

This document constitutes the entire agreement between the parties and supersedes any prior understanding or agreements, written or oral. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Owner Financing Contract as of the date first above written.

Seller's Signature: _________________________ Date: ____________

Buyer's Signature: _________________________ Date: ____________

Detailed Instructions for Writing Owner Financing Contract

Filling out the Owner Financing Contract form is an important step in establishing a clear agreement between the buyer and seller regarding the terms of financing. This process ensures that both parties understand their responsibilities and the conditions of the sale. Below are the steps to complete the form accurately.

- Read the entire form: Before starting, take a moment to read through the entire contract to familiarize yourself with the sections and requirements.

- Provide the seller's information: Fill in the seller's full name, address, and contact information at the designated section.

- Enter the buyer's details: Similarly, include the buyer's full name, address, and contact information in the appropriate area.

- Specify the property details: Clearly describe the property being financed, including the address and any relevant identifying information.

- Detail the purchase price: Indicate the total purchase price of the property, ensuring accuracy to avoid confusion later.

- Outline the down payment: State the amount of the down payment the buyer will provide, as well as the percentage of the total purchase price it represents.

- Define the financing terms: Specify the interest rate, loan term, and payment schedule. This section should clearly outline how and when payments will be made.

- Include any additional terms: If there are any special conditions or agreements between the buyer and seller, make sure to include those in the designated area.

- Review for accuracy: Once all information is filled out, review the form carefully to ensure all details are correct and complete.

- Sign and date the contract: Both the buyer and seller must sign and date the contract to make it legally binding. Ensure that both parties keep a copy for their records.

Documents used along the form

When entering into an owner financing agreement, several other forms and documents may be necessary to ensure clarity and protection for all parties involved. These documents help outline the terms of the agreement, protect the buyer and seller, and provide legal backing for the transaction. Below is a list of key documents often used alongside the Owner Financing Contract.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specific terms, including interest rates, payment schedules, and consequences for default.

- Deed of Trust: This serves as security for the loan. It allows the lender to take possession of the property if the borrower fails to meet the repayment terms.

- Disclosure Statement: This document provides important information about the property and the financing terms. It helps ensure that the buyer understands what they are agreeing to.

- Real Estate Purchase Agreement: This essential document ensures that both buyer and seller are clear on the terms of the sale, including key elements such as price, contingencies, and closing details. For more information on the form, visit Minnesota PDF Forms.

- Purchase Agreement: This outlines the terms of the sale, including the purchase price, contingencies, and other essential details about the transaction.

- Title Search Report: Conducting a title search helps confirm that the seller has the legal right to sell the property and that there are no outstanding liens or claims against it.

- Insurance Policy: A homeowner's insurance policy protects both the buyer and the seller from potential losses due to damage or liability associated with the property.

- Amortization Schedule: This document breaks down the loan payments over time, showing how much of each payment goes toward interest and how much goes toward reducing the principal balance.

Utilizing these documents in conjunction with the Owner Financing Contract can provide a comprehensive framework for the transaction. Each piece plays a crucial role in safeguarding the interests of both the buyer and the seller, ensuring a smoother and more transparent process.