Get Netspend Dispute Form in PDF

The Netspend Dispute Notification Form is a crucial tool for cardholders who need to address unauthorized credit or debit transactions. This form allows users to initiate a dispute process quickly and efficiently, ensuring that they can recover funds in a timely manner. To start, it must be completed and submitted to Netspend within 60 days of the disputed transaction. After receiving the form, Netspend commits to making a decision regarding the disputed funds within 10 business days. Providing supporting documentation, such as receipts or police reports, can significantly aid in the resolution process. If a cardholder's card is lost or stolen, it’s essential to report this promptly to limit liability for unauthorized transactions. The form includes sections for cardholder information, details about the disputed transactions, and a space for a detailed explanation of the incident. Additionally, cardholders are encouraged to indicate if they have contacted the merchant involved and whether a refund is anticipated. Completing this form accurately and thoroughly is vital for a successful dispute resolution.

Dos and Don'ts

When filling out the Netspend Dispute form, there are several important steps to follow. Here is a list of things you should and shouldn't do:

- Do complete the form as soon as possible, ideally within 60 days of the transaction.

- Do provide accurate and detailed information about each disputed transaction.

- Do include supporting documentation, such as receipts or emails, to strengthen your case.

- Do indicate if your card was lost or stolen to help block unauthorized activity.

- Do sign and date the form before submission to ensure it is valid.

- Don't delay in submitting the form, as this may affect your ability to dispute the transaction.

- Don't leave any sections of the form blank; fill out all required fields completely.

- Don't submit the form without a police report if your card was lost or stolen.

- Don't forget to include your contact information, as this is essential for follow-up.

- Don't assume that verbal communication with the merchant is sufficient; always document your interactions.

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose of Form | This form is used to dispute unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | The form must be submitted within 60 days from the date of the disputed transaction. |

| Decision Timeline | Netspend will make a decision regarding the dispute within 10 business days after receiving the completed form. |

| Liability for Unauthorized Use | If a card is lost or stolen, the cardholder may be liable for unauthorized transactions unless the card was reported as compromised. |

| Supporting Documentation | Providing supporting documents, such as a police report or receipts, can help in resolving the dispute. |

| State-Specific Governing Law | Disputes may be governed by state laws such as the Electronic Fund Transfer Act (EFTA) and applicable state consumer protection laws. |

Key takeaways

Filling out and using the Netspend Dispute form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to guide you through the process:

- Act Quickly: Complete and submit the form as soon as possible, ideally within 60 days of the disputed transaction.

- Include Supporting Documents: Attach any relevant documentation, such as receipts or emails, to strengthen your case.

- Detail Your Dispute: Provide a thorough explanation of what happened. If necessary, use additional pages to elaborate.

- Contact the Merchant: Indicate whether you have reached out to the merchant regarding the disputed transaction. This information can be crucial.

- Document Card Issues: If your card was lost or stolen, clearly note this on the form. This action is vital for protecting yourself from liability.

- Reset Your PIN: If your card was compromised, it’s advisable to change your PIN to prevent further unauthorized access.

- Follow Up: After submitting the form, expect a decision within 10 business days regarding the disputed funds.

- Keep Copies: Retain a copy of the completed form and all attached documents for your records.

By following these guidelines, you can navigate the dispute process more effectively and ensure that your concerns are addressed promptly.

Other PDF Templates

Cash Drawer Balance Sheet - Assists managers in monitoring cash flow within a business.

For those looking to understand the necessary documentation for homeschooling, the "important steps to file a Homeschool Letter of Intent" can be found at Homeschool Letter of Intent form that outlines the process required by California law.

Western Union Money Transfer Receipt PDF - Enjoy peace of mind with tracking features.

Example - Netspend Dispute Form

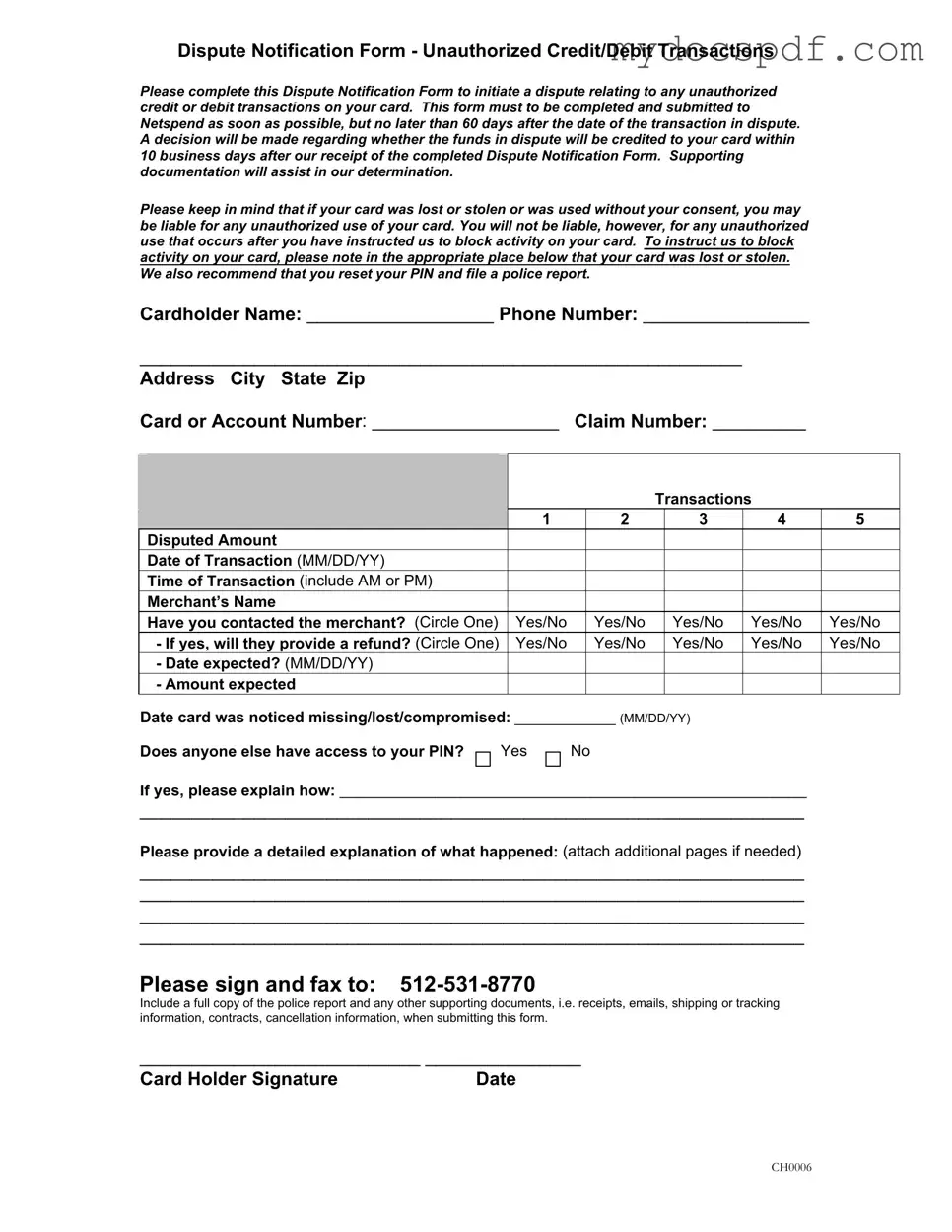

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Detailed Instructions for Writing Netspend Dispute

Once you have the Netspend Dispute form ready, follow these steps to fill it out completely. Make sure to provide accurate information, as this will help in processing your dispute effectively. After submitting the form, you can expect a decision regarding your dispute within 10 business days.

- Write your Cardholder Name in the designated space.

- Fill in your Phone Number.

- Provide your Address, including City, State, and Zip Code.

- Enter your Card or Account Number.

- Write your Claim Number if applicable.

- For each transaction you are disputing (up to 5), fill in the following details:

- Disputed Amount

- Date of Transaction (format MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant (Circle Yes or No).

- If yes, indicate if they will provide a refund (Circle Yes or No).

- If applicable, enter the Date expected for the refund (MM/DD/YY).

- Enter the Amount expected.

- Provide the Date card was noticed missing/lost/compromised (MM/DD/YY).

- Indicate if anyone else has access to your PIN (Circle Yes or No).

- If yes, explain how they have access.

- Write a detailed explanation of what happened. Attach additional pages if necessary.

- Sign and date the form at the bottom.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any supporting documents, such as receipts or emails, when submitting the form.

Documents used along the form

The Netspend Dispute Form is a crucial document for cardholders seeking to resolve issues related to unauthorized transactions. When submitting this form, it is often necessary to include additional documentation to support the claim. Below is a list of other forms and documents that may be required or helpful in conjunction with the Netspend Dispute Form.

- Police Report: A formal report filed with law enforcement detailing the loss or theft of the card. This document provides evidence of the incident and is essential for verifying claims of unauthorized use.

- Quitclaim Deed: Utilizing a Texas Forms Online can simplify the transfer of property ownership during disputes, ensuring that all legal requirements are met efficiently.

- Transaction Receipts: Copies of receipts for the disputed transactions. These documents help establish the legitimacy of the claim and can clarify the nature of the transactions in question.

- Merchant Correspondence: Any emails or letters exchanged with the merchant regarding the disputed transaction. This can demonstrate whether the cardholder attempted to resolve the issue directly with the merchant.

- Cancellation Confirmation: Documentation showing that a service or order was canceled, if applicable. This can support claims that a transaction was unauthorized or erroneous.

- Shipping or Tracking Information: Proof of shipping or tracking details, particularly for online purchases. This can help clarify the status of the transaction and whether the product was received.

- Account Statements: Recent bank or account statements that highlight the disputed transaction. This provides context and can help identify patterns of unauthorized use.

- Identity Verification Documents: Copies of identification, such as a driver’s license or passport, to confirm the identity of the cardholder. This is especially important in cases of identity theft.

- Affidavit of Unauthorized Use: A sworn statement from the cardholder declaring that the transaction was unauthorized. This document can strengthen the case for disputing the charges.

Including these additional documents can facilitate a smoother dispute process with Netspend. It is advisable to gather all relevant information and submit it promptly to ensure the best chance of resolving the issue effectively.