Get Mortgage Statement Form in PDF

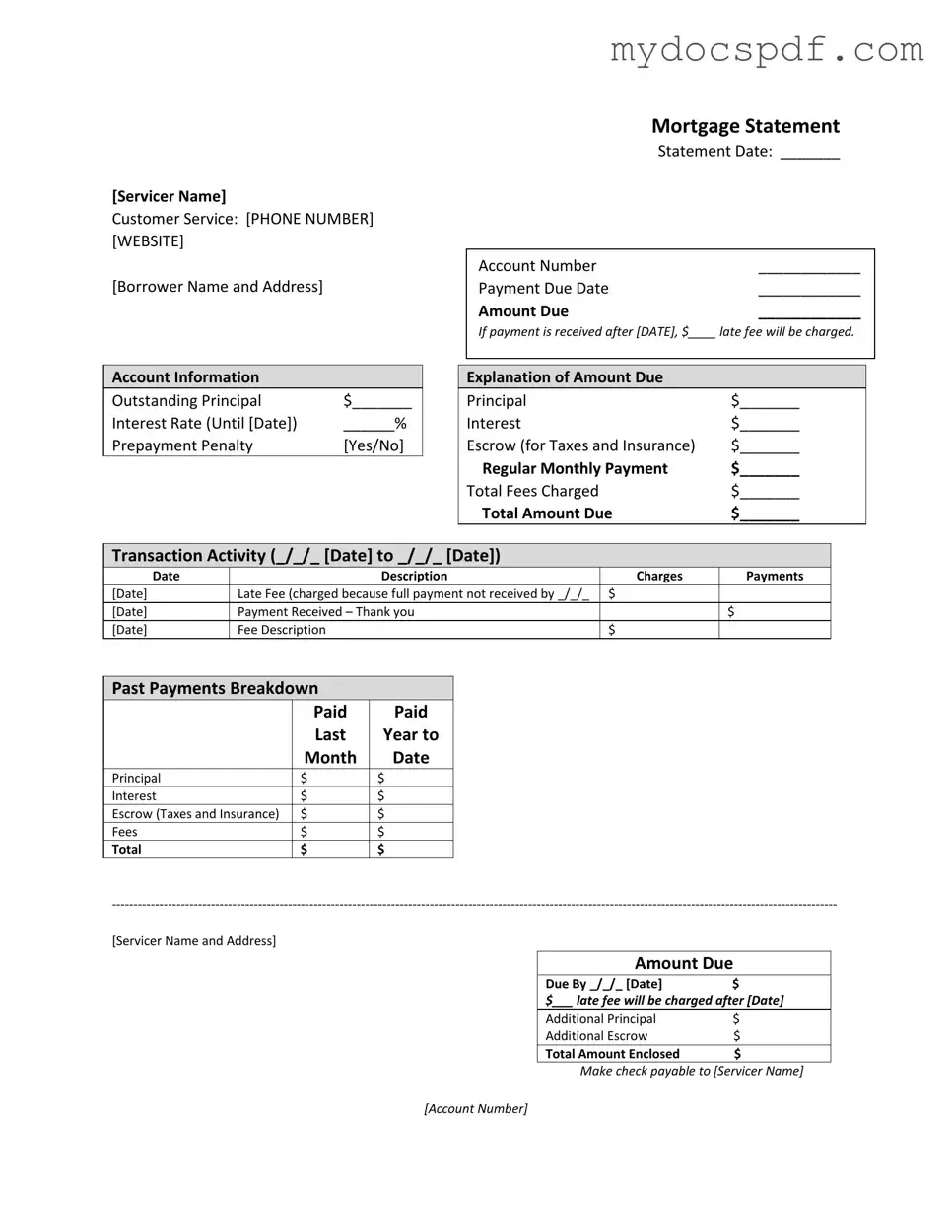

Understanding your mortgage statement is crucial for effective financial management and maintaining a healthy relationship with your lender. This form serves as a comprehensive summary of your mortgage account, providing key details that every homeowner should be familiar with. At the top, you'll find essential contact information for your loan servicer, including their customer service phone number and website, ensuring you can easily reach out for assistance if needed. The statement prominently displays your account number, payment due date, and the total amount due, along with any applicable late fees if payment is not received by the specified date. Dive deeper into the account information section, where you'll see a breakdown of your outstanding principal, interest rate, and whether a prepayment penalty applies. The explanation of the amount due itemizes your monthly payment components, including principal, interest, escrow for taxes and insurance, and any fees charged. Transaction activity details recent payments and charges, giving you a clear view of your account's history. Additionally, the statement highlights any delinquency notices, emphasizing the importance of timely payments to avoid fees or foreclosure. For those facing financial difficulties, helpful resources for mortgage counseling are also provided, making this statement not just a bill, but a vital tool for financial awareness and planning.

Dos and Don'ts

When filling out the Mortgage Statement form, attention to detail is crucial. Below are some important do's and don'ts to keep in mind.

- Do ensure that all personal information is accurate, including your name and address.

- Do double-check the account number to avoid any processing delays.

- Do write the payment amount clearly to prevent any confusion regarding the total due.

- Do review the payment due date and ensure you submit your payment on time to avoid late fees.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill out all required fields completely.

- Don't forget to sign and date the form where indicated.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't ignore any instructions provided on the form regarding payments or additional information.

- Don't submit the form without confirming that you have included the correct payment amount.

Document Attributes

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Account Details | Essential account information such as the statement date, account number, payment due date, and total amount due is clearly outlined. |

| Late Fees | A late fee will be charged if the payment is not received by the specified date. The amount of the late fee is indicated on the statement. |

| Outstanding Principal | The statement provides details on the outstanding principal, interest rate, and whether a prepayment penalty applies. |

| Transaction Activity | A breakdown of transaction activity is included, showing dates, descriptions, charges, and payments made within a specified period. |

| Delinquency Notice | If payments are late, the statement will indicate the number of days delinquent and warn of potential fees and foreclosure risks. |

Key takeaways

When filling out and using the Mortgage Statement form, it is essential to keep several key points in mind:

- Accurate Information: Ensure that all personal details, such as the borrower’s name and address, are filled out correctly. This helps in maintaining clear communication with the mortgage servicer.

- Payment Details: Pay close attention to the payment due date and the amount due. Payments made after the specified date may incur late fees, which can increase the total amount owed.

- Understanding Fees: Review the explanation of amounts due, including principal, interest, and escrow for taxes and insurance. Knowing what each charge represents can help in managing your finances effectively.

- Partial Payments Policy: Be aware that any partial payments made will not be applied to the mortgage. Instead, they will be held in a suspense account until the full payment is made.

By keeping these takeaways in mind, borrowers can navigate their mortgage statements more effectively and stay informed about their financial obligations.

Other PDF Templates

Cna Shower Sheet Template - Residents' skin conditions, including bruising and rashes, are to be carefully monitored.

For those navigating important decisions, understanding the implications of a Durable Power of Attorney is crucial. This form serves as a vital tool that enables you to designate a trusted individual to manage your affairs when you are unable to do so. For more information on this legal document, check the benefits of a Durable Power of Attorney.

Annual Physical Exam Template - Limitations or restrictions on activities ensure safe engagement in daily tasks.

What Documents Do I Need to Sell a Car - Each party involved in the transaction must certify the truthfulness of the information provided.

Example - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Detailed Instructions for Writing Mortgage Statement

Filling out the Mortgage Statement form is a straightforward process. This form contains important information about your mortgage account, including payment details and outstanding balances. Follow the steps below to ensure that you complete the form accurately.

- Contact Information: Write the name of your mortgage servicer at the top of the form. Include their customer service phone number and website.

- Borrower Information: Fill in your name and address in the designated section.

- Statement Details: Enter the statement date, your account number, payment due date, and amount due.

- Late Fee Information: Indicate the date after which a late fee will be charged and the amount of the fee.

- Account Information: Provide details about the outstanding principal, interest rate, and whether there is a prepayment penalty.

- Explanation of Amount Due: Break down the total amount due into principal, interest, escrow, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: List the dates, descriptions, charges, and payments for your account activity during the specified period.

- Past Payments Breakdown: Document the payments made last year, including principal, interest, escrow, and fees.

- Amount Due: Write the total amount due and the due date. Include any late fee information if applicable.

- Payment Information: State the total amount enclosed and make sure to note that the check should be payable to the servicer's name and include your account number.

- Important Messages: Read and understand any important messages, including information about partial payments and delinquency notices.

After completing the form, review it for accuracy. Make sure all information is correct before submitting it. This will help avoid any issues with your mortgage account.

Documents used along the form

When managing a mortgage, several documents often accompany the Mortgage Statement form. Each of these documents serves a specific purpose in the mortgage process, helping both borrowers and lenders keep track of important information and obligations. Here are five commonly used forms and documents:

- Loan Agreement: This is the initial contract between the borrower and lender outlining the terms of the mortgage. It includes details such as the loan amount, interest rate, repayment schedule, and any fees associated with the loan.

- Truth in Lending Disclosure: This document provides borrowers with key information about the cost of borrowing. It includes details on the annual percentage rate (APR), finance charges, and the total amount financed, ensuring transparency in lending practices.

- Property Appraisal Report: Conducted by a licensed appraiser, this report assesses the value of the property being financed. It is crucial for determining whether the loan amount is appropriate based on the property's market value.

- Motorcycle Bill of Sale: A crucial document for anyone buying or selling a motorcycle, the Motorcycle Bill of Sale outlines the agreement between the buyer and seller, ensuring the transaction is legally recognized. For template options, visit Texas Forms Online.

- Escrow Account Statement: This statement outlines the funds held in escrow for property taxes and insurance. It details the amounts collected and disbursed, ensuring that the borrower is aware of their obligations and the status of their escrow account.

- Payment History Statement: This document summarizes the borrower’s payment activity over a specified period. It includes information on principal and interest payments, any late fees incurred, and the current balance, helping borrowers track their payment performance.

Understanding these documents can empower borrowers to manage their mortgage effectively. Keeping them organized and accessible is essential for maintaining clear communication with the lender and ensuring compliance with loan obligations.