Attorney-Approved Mortgage Lien Release Template

The Mortgage Lien Release form plays a crucial role in the world of real estate transactions. When a homeowner pays off their mortgage, this form is the official document that signifies the lender’s release of their claim to the property. It marks the end of the financial obligation, allowing the homeowner to fully own their property free and clear of any liens. Typically, this form includes essential details such as the names of the borrower and lender, the property address, and the loan information. Once completed and signed, it must be filed with the appropriate county office to ensure public records reflect the change. This process not only provides peace of mind for the homeowner but also clears the title for any future transactions, such as selling or refinancing the property. Understanding the importance of this form can empower homeowners to navigate their financial responsibilities with confidence and clarity.

Dos and Don'ts

When filling out the Mortgage Lien Release form, it’s essential to be careful and thorough. Here are some important dos and don’ts to keep in mind:

- Do double-check all your information for accuracy.

- Do ensure that the form is signed by all necessary parties.

- Do keep a copy of the completed form for your records.

- Do submit the form to the correct office or agency.

- Don’t leave any required fields blank.

- Don’t rush through the process; take your time to review everything.

Following these guidelines can help ensure a smooth process when releasing a mortgage lien. Accuracy and attention to detail are key!

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a legal document that removes a lien from a property after the mortgage has been paid off. |

| Purpose | This form serves to notify the public that the debt secured by the mortgage has been satisfied, allowing for clear ownership of the property. |

| Governing Law | Each state has its own laws governing the release of mortgage liens, such as the Uniform Commercial Code (UCC) and specific state statutes. |

| Filing Requirement | In most states, the Mortgage Lien Release must be filed with the county recorder’s office to be effective. |

| Signature Requirement | The form typically requires the signature of the lender or mortgage holder to validate the release. |

| Timeframe | After the mortgage is paid off, lenders are generally required to issue the release within a specific timeframe, often 30 days. |

| Impact on Credit | Once the Mortgage Lien Release is filed, it positively impacts the borrower's credit report by indicating that the debt has been settled. |

| State-Specific Forms | Some states may have unique forms for the Mortgage Lien Release, and it's essential to use the correct one according to local regulations. |

Key takeaways

When it comes to filling out and using the Mortgage Lien Release form, it's essential to understand the key steps and considerations involved. Here are some important takeaways to keep in mind:

- Understand the Purpose: The Mortgage Lien Release form is used to officially remove a mortgage lien from a property title once the debt has been paid off.

- Gather Necessary Information: Before filling out the form, collect all relevant details, including the property address, loan number, and the names of the borrower and lender.

- Check State Requirements: Different states may have specific rules regarding the release of a mortgage lien. Ensure you are aware of your state’s requirements.

- Complete the Form Accurately: Fill out the form carefully, ensuring that all information is correct and matches the original mortgage documents.

- Signatures Matter: The form typically requires signatures from both the lender and the borrower. Make sure all necessary parties sign the document.

- Notarization May Be Required: Some states require the form to be notarized. Check if this applies to your situation.

- File the Form Promptly: After completing the form, file it with the appropriate county or local office to ensure the lien is officially released.

- Keep Copies: Always keep a copy of the completed Mortgage Lien Release form for your records. This can be important for future reference.

- Monitor Your Title: After filing, check your property title to confirm that the lien has been removed. This protects you from any potential disputes later on.

By following these steps, you can navigate the process of using a Mortgage Lien Release form with confidence and ease.

Popular Mortgage Lien Release Documents:

Online Media Release Form - By signing, you help facilitate the smooth operation of media-making activities.

The FedEx Release Form is a document that authorizes FedEx to leave your package at a designated location when you are not available to receive it. Completing this form ensures your shipment can still be delivered safely and securely, even in your absence. For further information on how to properly fill out this form, visit Top Forms Online to prevent any delivery issues.

Example - Mortgage Lien Release Form

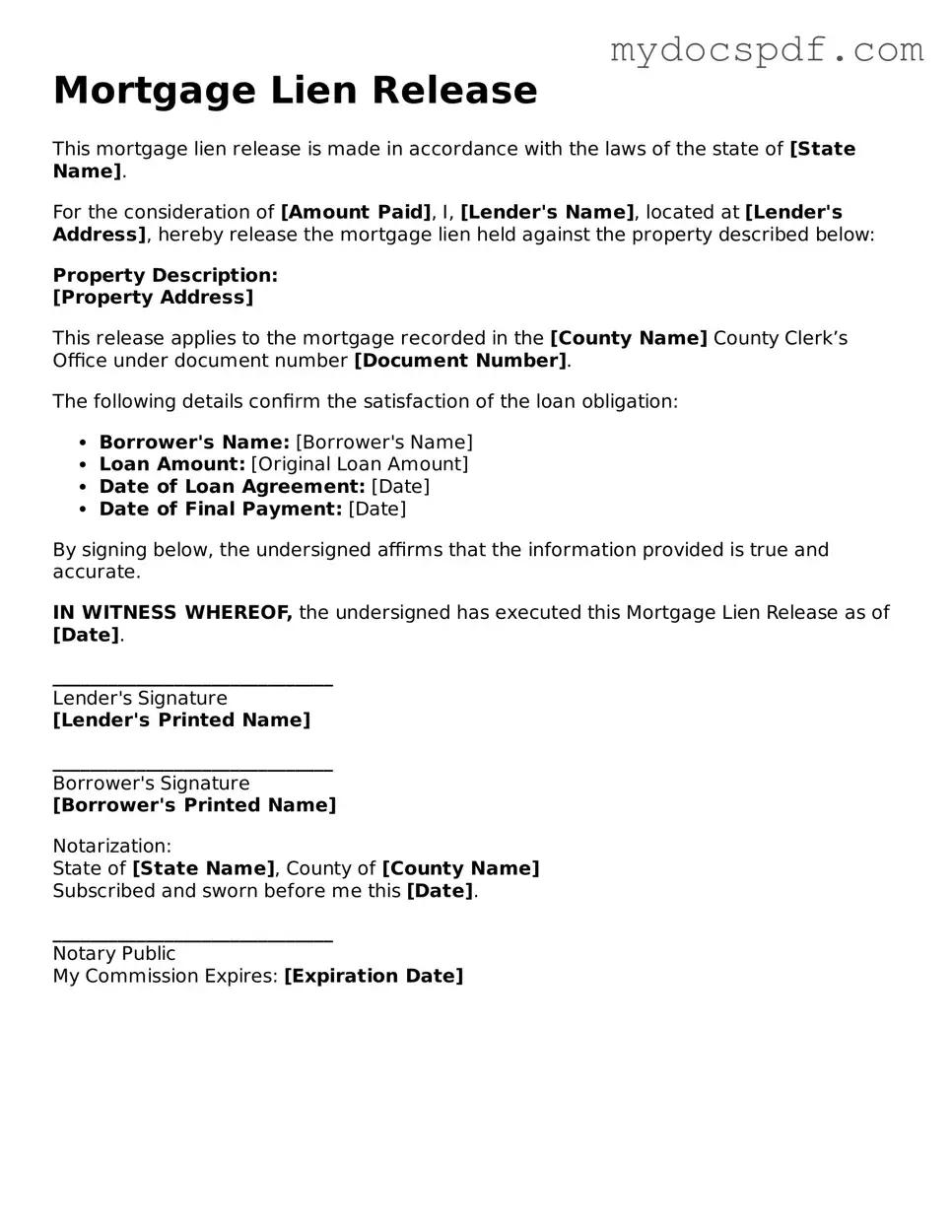

Mortgage Lien Release

This mortgage lien release is made in accordance with the laws of the state of [State Name].

For the consideration of [Amount Paid], I, [Lender's Name], located at [Lender's Address], hereby release the mortgage lien held against the property described below:

Property Description:

[Property Address]

This release applies to the mortgage recorded in the [County Name] County Clerk’s Office under document number [Document Number].

The following details confirm the satisfaction of the loan obligation:

- Borrower's Name: [Borrower's Name]

- Loan Amount: [Original Loan Amount]

- Date of Loan Agreement: [Date]

- Date of Final Payment: [Date]

By signing below, the undersigned affirms that the information provided is true and accurate.

IN WITNESS WHEREOF, the undersigned has executed this Mortgage Lien Release as of [Date].

______________________________

Lender's Signature

[Lender's Printed Name]

______________________________

Borrower's Signature

[Borrower's Printed Name]

Notarization:

State of [State Name], County of [County Name]

Subscribed and sworn before me this [Date].

______________________________

Notary Public

My Commission Expires: [Expiration Date]

Detailed Instructions for Writing Mortgage Lien Release

Once you have completed the Mortgage Lien Release form, the next step involves submitting it to the appropriate county office. This process will officially remove the lien from your property records. Make sure to keep a copy for your records and confirm that the release has been recorded properly.

- Begin by downloading the Mortgage Lien Release form from a reliable source.

- Fill in your name and address in the designated fields at the top of the form.

- Provide the name and address of the borrower, if different from yours.

- Enter the details of the mortgage, including the loan number and property address.

- Indicate the date when the mortgage was paid off or satisfied.

- Sign the form in the designated signature line. If applicable, have a witness sign as well.

- Include the date of your signature.

- Check that all information is accurate and complete before submitting.

Documents used along the form

When processing a Mortgage Lien Release form, several other documents may also be required to ensure a smooth transaction. These documents provide additional information and support the release of the lien. Here are four commonly associated forms:

- Mortgage Agreement: This document outlines the terms of the loan between the borrower and lender. It includes details such as the loan amount, interest rate, and repayment schedule.

- Release of Liability form: This important document allows individuals or organizations to protect themselves from legal claims during activities, ensuring participants acknowledge potential risks and agree not to hold organizers responsible. For an example of such a form, you can visit documentonline.org/blank-release-of-liability.

- Payoff Statement: Issued by the lender, this statement details the total amount needed to pay off the mortgage. It includes principal, interest, and any fees associated with the early payoff.

- Deed of Trust: This document secures the loan with the property as collateral. It outlines the rights and responsibilities of both the borrower and the lender.

- Affidavit of Satisfaction: This sworn statement confirms that the mortgage has been paid in full. It serves as evidence that the lien on the property should be released.

Having these documents ready can facilitate the process of releasing a mortgage lien. Ensuring all necessary paperwork is complete helps avoid delays and potential complications.