Fillable Massachusetts Transfer-on-Death Deed Document

In Massachusetts, the Transfer-on-Death Deed (TODD) form serves as a valuable tool for property owners seeking to streamline the transfer of real estate upon their passing. This legal document allows individuals to designate beneficiaries who will automatically inherit the property, bypassing the often lengthy and costly probate process. By utilizing a TODD, property owners can maintain control over their assets during their lifetime while ensuring a seamless transition for their loved ones after death. Importantly, the form must be executed with proper legal formalities, including notarization and recording with the local registry of deeds, to be effective. Additionally, the TODD can be revoked or altered at any time, providing flexibility as circumstances change. Understanding the nuances of this deed can empower individuals to make informed decisions about their estate planning, ultimately providing peace of mind regarding the future of their property and the financial well-being of their heirs.

Dos and Don'ts

When filling out the Massachusetts Transfer-on-Death Deed form, it is essential to follow specific guidelines to ensure the process goes smoothly. Here are some important dos and don’ts to keep in mind:

- Do ensure that you have the correct legal description of the property. This information is crucial for the deed to be valid.

- Do clearly identify all parties involved, including the owner(s) and the beneficiary(ies). Accurate names and addresses are necessary.

- Do sign the deed in the presence of a notary public. This step is vital for the document's legal standing.

- Do keep a copy of the completed deed for your records. This will help you track the status of the transfer.

- Don’t use vague or ambiguous language. Clarity is key to avoid misunderstandings in the future.

- Don’t forget to record the deed with the appropriate local registry of deeds. Failing to do so may render the deed ineffective.

By adhering to these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and effectively. Take the time to review each step carefully.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon the individual's death without going through probate. |

| Governing Law | The Massachusetts Transfer-on-Death Deed is governed by Massachusetts General Laws Chapter 191B. |

| Eligibility | Any individual who owns real property in Massachusetts can create a Transfer-on-Death Deed. |

| Beneficiary Restrictions | A Transfer-on-Death Deed can name one or more beneficiaries, but it cannot name a trust or an entity. |

| Revocation | The deed can be revoked at any time by the grantor, provided that the revocation is executed and recorded. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded in the registry of deeds for the county where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes, as the transfer occurs only upon the death of the grantor. |

Key takeaways

When filling out and using the Massachusetts Transfer-on-Death Deed form, keep these key points in mind:

- Eligibility: Ensure that the property you wish to transfer is eligible for a Transfer-on-Death Deed. This typically includes residential real estate but excludes certain types of properties.

- Complete Information: Fill out the form accurately. Provide the names of both the current owner(s) and the beneficiary(ies), along with a clear legal description of the property.

- Signature Requirements: The deed must be signed by the owner(s) in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Recording the Deed: After completing the form, record it with the appropriate local registry of deeds. This ensures that the transfer is recognized and enforceable upon the owner’s death.

Popular State-specific Transfer-on-Death Deed Forms

How to Avoid Probate in California - Allows for the transfer of property without the need for a will.

For those seeking clarity on liability matters, understanding the "Hold Harmless Agreement" within your rental contracts is crucial. This form not only safeguards your interests but also clarifies responsibilities and potential risks involved in various agreements. You can find more insights and templates related to this critical document at the Hold Harmless Agreement form guide.

Tod Deed Georgia - It is a legally binding document that must comply with state-specific regulations.

Example - Massachusetts Transfer-on-Death Deed Form

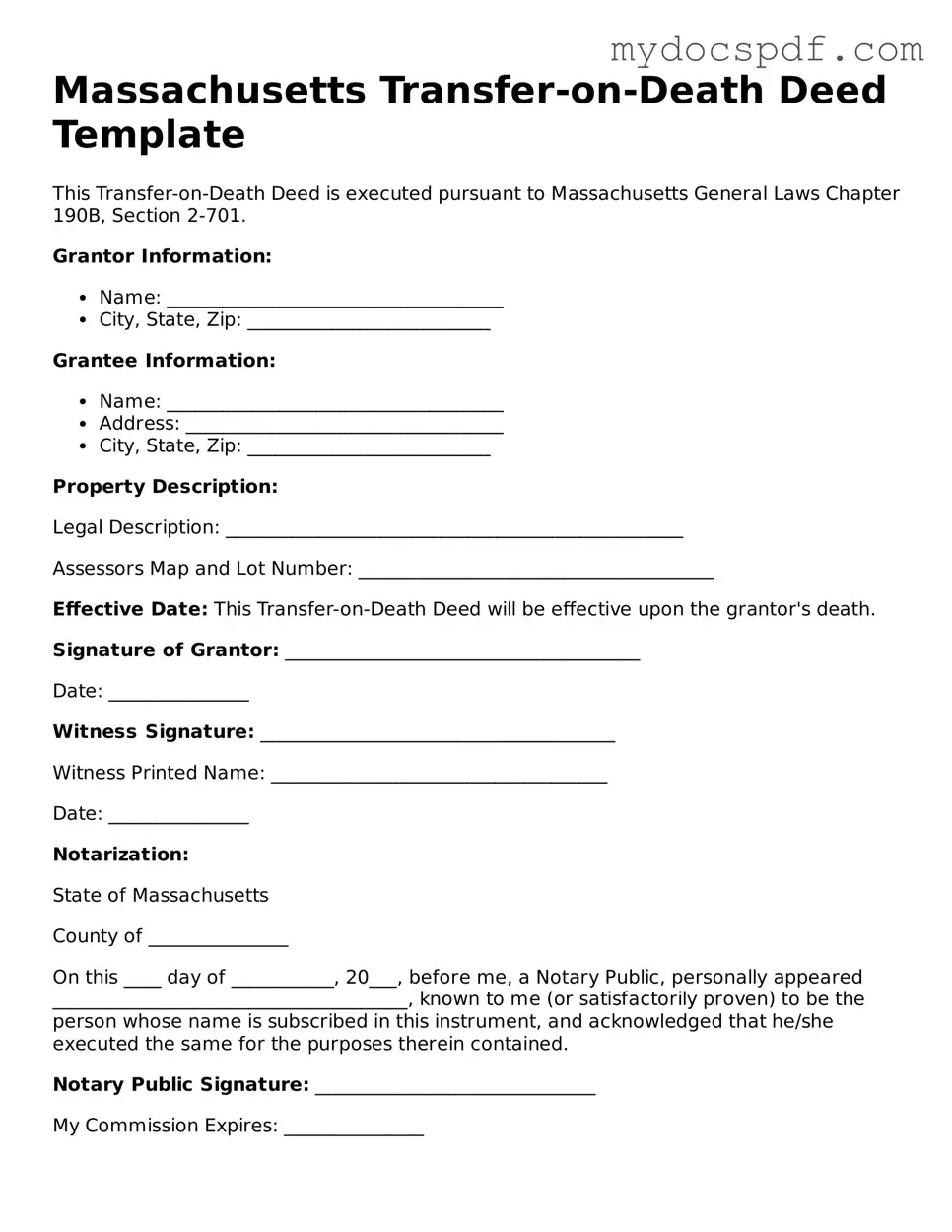

Massachusetts Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Massachusetts General Laws Chapter 190B, Section 2-701.

Grantor Information:

- Name: ____________________________________

- City, State, Zip: __________________________

Grantee Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: __________________________

Property Description:

Legal Description: _________________________________________________

Assessors Map and Lot Number: ______________________________________

Effective Date: This Transfer-on-Death Deed will be effective upon the grantor's death.

Signature of Grantor: ______________________________________

Date: _______________

Witness Signature: ______________________________________

Witness Printed Name: ____________________________________

Date: _______________

Notarization:

State of Massachusetts

County of _______________

On this ____ day of ___________, 20___, before me, a Notary Public, personally appeared ______________________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed in this instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Notary Public Signature: ______________________________

My Commission Expires: _______________

Detailed Instructions for Writing Massachusetts Transfer-on-Death Deed

After obtaining the Massachusetts Transfer-on-Death Deed form, you are ready to begin filling it out. This process involves providing specific information about the property and the beneficiaries. Follow these steps carefully to ensure the form is completed accurately.

- Gather necessary information: Collect details about the property, including the address, legal description, and the names of the beneficiaries.

- Fill in your information: At the top of the form, enter your name as the current owner of the property.

- Provide property details: Clearly write the full address of the property being transferred, including the city or town, state, and ZIP code.

- Include legal description: If available, add the legal description of the property. This can often be found on the property deed or tax documents.

- List beneficiaries: Write the names of the individuals or entities you wish to designate as beneficiaries. Be sure to include their relationship to you if applicable.

- Sign the form: As the property owner, sign and date the form in the designated area. Ensure that your signature matches the name you provided at the top.

- Have the form notarized: Take the completed form to a notary public. The notary will verify your identity and witness your signature.

- Record the deed: Finally, submit the notarized form to the appropriate local registry of deeds in Massachusetts. This step is crucial for the transfer to take effect.

Once the form is submitted, it will be recorded in the public records. This ensures that your wishes regarding the property transfer will be honored when the time comes. Keep a copy of the recorded deed for your records.

Documents used along the form

The Massachusetts Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. However, several other documents may accompany this deed to ensure a smooth transfer of property and clarify the owner’s intentions. Below is a list of related forms and documents commonly used in conjunction with the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can specify beneficiaries and may include instructions for handling debts and taxes.

- Affidavit of Heirship: This is a sworn statement that identifies the heirs of a deceased person. It can help establish ownership of property and clarify who is entitled to inherit.

- Operating Agreement: Essential for LLCs in Texas, the Operating Agreement defines the management structure and operating procedures, outlining member rights and obligations. For a comprehensive template, visit Texas Forms Online.

- Power of Attorney: This legal document allows one person to act on behalf of another in financial or legal matters. It can be crucial if the property owner becomes incapacitated before their death.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for certain types of accounts, such as bank accounts or retirement plans. They ensure that these assets pass directly to the named beneficiaries upon death.

- Quitclaim Deed: This document transfers ownership of property from one party to another without any warranties. It can be used to remove a former owner’s name from the title or to add a new owner.

- Estate Planning Documents: These can include trusts, healthcare proxies, and living wills. They help outline a person's wishes regarding their healthcare and financial matters, providing clarity for family members and ensuring that wishes are honored.

Each of these documents plays a vital role in estate planning and property transfer. Understanding their purpose can help individuals make informed decisions about their assets and beneficiaries, ultimately leading to a more organized and efficient transfer process.