Fillable Massachusetts Promissory Note Document

When dealing with loans or borrowed money, having a clear agreement is crucial. In Massachusetts, the Promissory Note form serves as a vital tool for both lenders and borrowers. This written document outlines the borrower's promise to repay a specific amount of money, detailing the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It ensures that both parties understand their rights and obligations, providing a framework for repayment. The form also allows for flexibility, as it can be customized to fit the unique needs of the transaction. Understanding the key components of this form can help individuals navigate the lending process with confidence and clarity.

Dos and Don'ts

When filling out the Massachusetts Promissory Note form, it’s important to ensure accuracy and clarity. Here are some guidelines to follow:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Do state the repayment terms in simple language.

- Don't leave any blank spaces; fill in all required fields.

- Don't use vague terms; be specific about dates and amounts.

- Don't forget to sign and date the document.

- Don't ignore state laws that may affect your agreement.

- Don't rush through the process; take your time to review.

Following these guidelines can help ensure that your Promissory Note is valid and enforceable in Massachusetts.

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Massachusetts Uniform Commercial Code (UCC) governs promissory notes in Massachusetts. |

| Parties Involved | Typically, a promissory note involves two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, depending on the agreement. |

| Payment Terms | Payment terms should clearly state when and how payments will be made, including any grace periods. |

| Default Conditions | The note should outline what constitutes a default and the remedies available to the payee. |

| Transferability | Promissory notes are generally transferable, allowing the payee to sell or assign the note to another party. |

| Signature Requirement | The maker must sign the note for it to be legally binding, indicating their agreement to the terms. |

| Notarization | While notarization is not always required, it can enhance the enforceability of the note. |

| Legal Enforceability | If properly executed, a promissory note is a legally enforceable contract under Massachusetts law. |

Key takeaways

When dealing with the Massachusetts Promissory Note form, it’s essential to understand its purpose and the implications of its use. Here are key takeaways to keep in mind:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to the lender under specified terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender to avoid any confusion.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should be precise and accurate.

- Detail the Interest Rate: Include the interest rate being charged on the loan. This can be fixed or variable but must be clearly defined.

- Outline the Repayment Terms: Clearly describe how and when the borrower will repay the loan. This includes payment frequency, due dates, and any grace periods.

- Include Default Terms: Specify what happens in the event of a default. This could involve late fees, acceleration of the loan, or other consequences.

- Signatures Required: Both parties must sign the document for it to be legally binding. Ensure that the date of signing is also included.

- Keep Copies: Once completed, both the borrower and lender should retain copies of the signed promissory note for their records.

By following these guidelines, you can ensure that the Massachusetts Promissory Note form serves its intended purpose effectively and protects the interests of both parties involved.

Popular State-specific Promissory Note Forms

Georgia Promissory Note - Borrowers may wish to seek additional funding options if they anticipate issues with repayment.

Promissory Note Template Florida Pdf - A well-drafted note can provide clarity about what happens in case of disputes.

Promissory Note Template California Word - Revisions or amendments to the original note should be documented in writing and signed.

To ensure that all terms are clearly defined and understood, utilizing resources like the NY Templates can be beneficial for both landlords and tenants when drafting their Room Rental Agreement form.

Idaho Promissory Note Descargar - The note can also outline what happens in the event of default or missed payments.

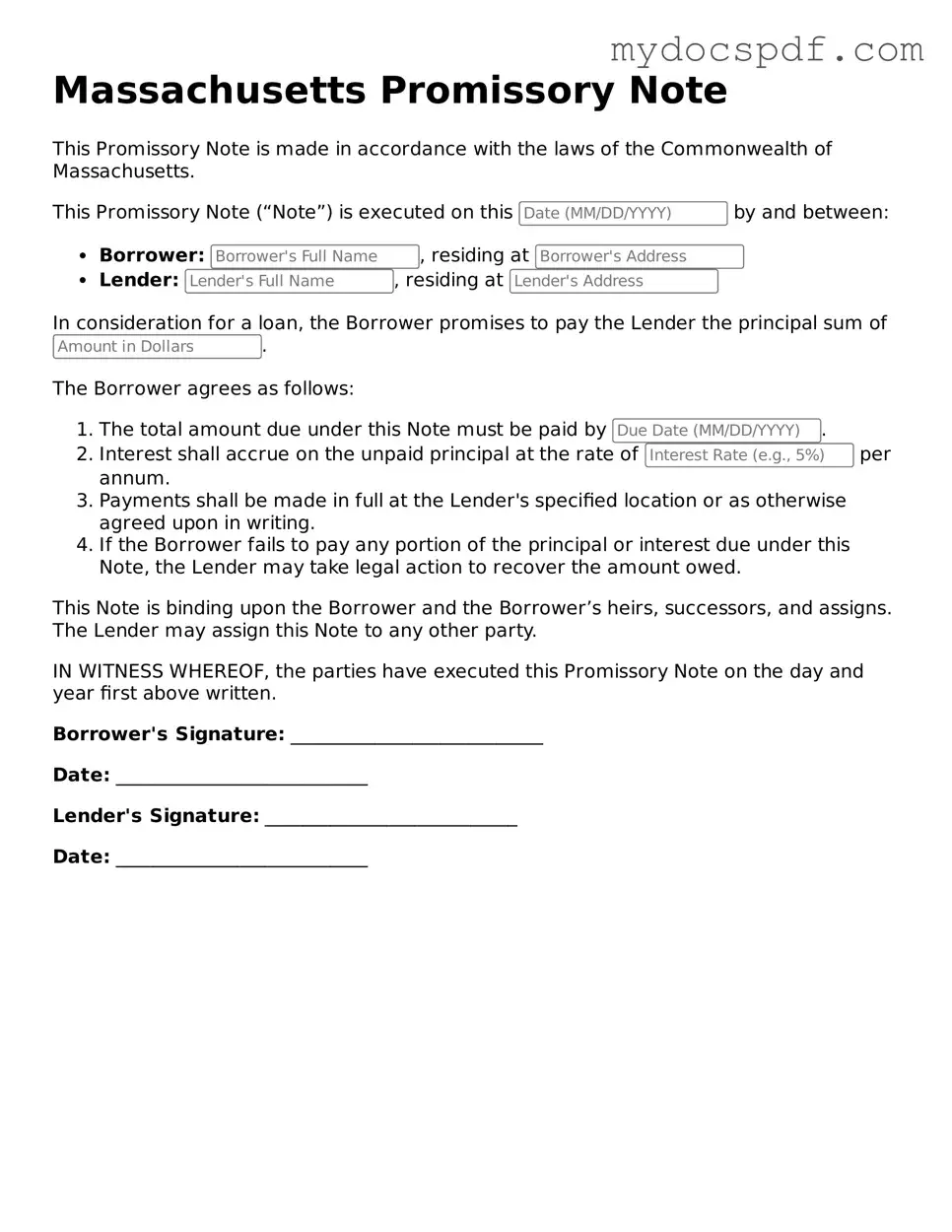

Example - Massachusetts Promissory Note Form

Massachusetts Promissory Note

This Promissory Note is made in accordance with the laws of the Commonwealth of Massachusetts.

This Promissory Note (“Note”) is executed on this by and between:

- Borrower: , residing at

- Lender: , residing at

In consideration for a loan, the Borrower promises to pay the Lender the principal sum of .

The Borrower agrees as follows:

- The total amount due under this Note must be paid by .

- Interest shall accrue on the unpaid principal at the rate of per annum.

- Payments shall be made in full at the Lender's specified location or as otherwise agreed upon in writing.

- If the Borrower fails to pay any portion of the principal or interest due under this Note, the Lender may take legal action to recover the amount owed.

This Note is binding upon the Borrower and the Borrower’s heirs, successors, and assigns. The Lender may assign this Note to any other party.

IN WITNESS WHEREOF, the parties have executed this Promissory Note on the day and year first above written.

Borrower's Signature: ___________________________

Date: ___________________________

Lender's Signature: ___________________________

Date: ___________________________

Detailed Instructions for Writing Massachusetts Promissory Note

After you have gathered all necessary information, you are ready to fill out the Massachusetts Promissory Note form. This form will require specific details about the loan agreement between the borrower and the lender. Make sure to review the completed form for accuracy before signing.

- Begin by entering the date at the top of the form. This should be the date when the note is being created.

- Next, fill in the name and address of the borrower. This identifies who is responsible for repaying the loan.

- Then, provide the name and address of the lender. This identifies who is providing the loan.

- In the next section, state the principal amount of the loan. This is the total amount borrowed.

- Specify the interest rate. This is the rate at which the loan will accrue interest.

- Indicate the repayment terms. This includes how often payments will be made (e.g., monthly, quarterly) and the total duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Finally, both the borrower and lender should sign and date the form. This indicates agreement to the terms outlined in the note.

Documents used along the form

When dealing with a Massachusetts Promissory Note, several other forms and documents may be necessary to ensure a complete understanding of the transaction. These documents help clarify the terms, provide security, and outline the responsibilities of all parties involved. Below is a list of commonly used forms that accompany a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any conditions that must be met by the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets that back the loan. It explains what happens if the borrower defaults.

- ATV Bill of Sale: To ensure a smooth transaction when buying or selling an All-Terrain Vehicle in New York, it’s important to complete an ATV Bill of Sale. This document not only provides proof of ownership but also records transaction details. For more information and a template, visit newyorkform.com/free-atv-bill-of-sale-template.

- Personal Guarantee: This form may be signed by a third party, promising to repay the loan if the borrower fails to do so. It adds an extra layer of security for the lender.

- Disclosure Statement: This document provides important information about the loan, including the total cost, terms, and any fees associated with the borrowing process. It ensures transparency for the borrower.

- Payment Schedule: A detailed outline of when payments are due, including the amount and method of payment. This helps both parties keep track of the repayment process.

These documents work together with the Massachusetts Promissory Note to create a clear and comprehensive understanding of the loan agreement. It is essential for both borrowers and lenders to review and understand these forms to protect their interests throughout the loan process.