Fillable Massachusetts Operating Agreement Document

When starting a business in Massachusetts, particularly a limited liability company (LLC), having a solid foundation is crucial for long-term success. One essential component of this foundation is the Massachusetts Operating Agreement form. This document serves as an internal guideline for the LLC, outlining the rights, responsibilities, and operational procedures for its members. It addresses key aspects such as the management structure, voting rights, profit distribution, and the process for adding or removing members. By clearly defining these elements, the Operating Agreement helps prevent misunderstandings and disputes among members, fostering a collaborative environment. Additionally, while Massachusetts law does not require an Operating Agreement, having one in place can provide significant legal protections and enhance the credibility of your business. Whether you’re a seasoned entrepreneur or a first-time business owner, understanding the nuances of this form is vital for navigating the complexities of running an LLC in the Bay State.

Dos and Don'ts

When filling out the Massachusetts Operating Agreement form, it is essential to approach the task with care and attention. Here are some guidelines to help ensure the process goes smoothly.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do ensure that all members sign the agreement.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't use ambiguous language; be clear and specific.

By following these guidelines, you can help ensure that your Operating Agreement is properly completed and serves its intended purpose effectively.

PDF Properties

| Fact Name | Details |

|---|---|

| Purpose | The Massachusetts Operating Agreement outlines the management structure and operational procedures for a Limited Liability Company (LLC). |

| Governing Law | This form is governed by the Massachusetts General Laws, Chapter 156C, which regulates LLCs in the state. |

| Flexibility | The agreement allows members to define their roles, responsibilities, and profit-sharing arrangements, providing flexibility tailored to the specific needs of the LLC. |

| Not Mandatory | While having an Operating Agreement is not legally required in Massachusetts, it is highly recommended to prevent disputes among members. |

Key takeaways

When filling out and using the Massachusetts Operating Agreement form, consider the following key takeaways:

- Ensure all members of the LLC are clearly identified. Include names and addresses to avoid confusion.

- Define the management structure. Specify whether the LLC will be member-managed or manager-managed.

- Outline the financial arrangements. Detail how profits and losses will be allocated among members.

- Include provisions for decision-making. Establish how decisions will be made and what constitutes a quorum.

- Address the process for adding or removing members. This helps maintain clarity as the LLC evolves.

Popular State-specific Operating Agreement Forms

Florida Operating Agreement Template - A comprehensive agreement can prevent unnecessary legal disputes down the line.

In New York, having a Durable Power of Attorney is essential for ensuring that your financial affairs are managed according to your wishes, especially in unforeseen circumstances. This thoughtful planning can provide peace of mind, knowing that a trusted individual can step in when needed. For those interested in creating this important document, you can find a helpful resource at newyorkform.com/free-durable-power-of-attorney-template.

Georgia Llc Operating Agreement - This agreement specifies the roles and responsibilities of the members of the LLC.

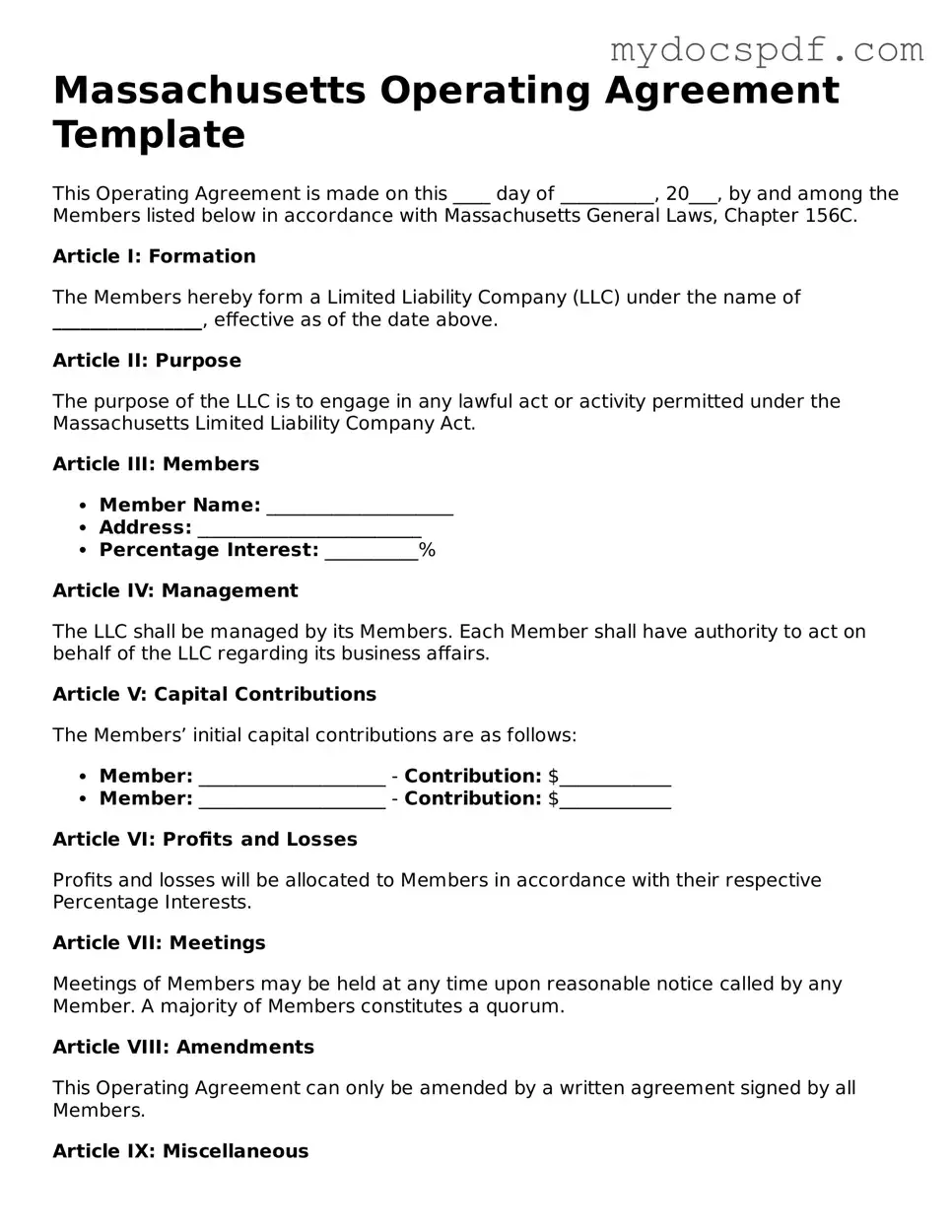

Example - Massachusetts Operating Agreement Form

Massachusetts Operating Agreement Template

This Operating Agreement is made on this ____ day of __________, 20___, by and among the Members listed below in accordance with Massachusetts General Laws, Chapter 156C.

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) under the name of ________________, effective as of the date above.

Article II: Purpose

The purpose of the LLC is to engage in any lawful act or activity permitted under the Massachusetts Limited Liability Company Act.

Article III: Members

- Member Name: ____________________

- Address: ________________________

- Percentage Interest: __________%

Article IV: Management

The LLC shall be managed by its Members. Each Member shall have authority to act on behalf of the LLC regarding its business affairs.

Article V: Capital Contributions

The Members’ initial capital contributions are as follows:

- Member: ____________________ - Contribution: $____________

- Member: ____________________ - Contribution: $____________

Article VI: Profits and Losses

Profits and losses will be allocated to Members in accordance with their respective Percentage Interests.

Article VII: Meetings

Meetings of Members may be held at any time upon reasonable notice called by any Member. A majority of Members constitutes a quorum.

Article VIII: Amendments

This Operating Agreement can only be amended by a written agreement signed by all Members.

Article IX: Miscellaneous

- This Agreement shall be governed by the laws of the Commonwealth of Massachusetts.

- If any provision of this Agreement is found to be invalid, the remaining provisions shall continue in full force and effect.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Member Signature: ____________________ Date: ____________________

Member Signature: ____________________ Date: ____________________

This template is a general guide and shall not substitute for legal advice. Consider consulting a legal professional for personalized guidance.

Detailed Instructions for Writing Massachusetts Operating Agreement

Filling out the Massachusetts Operating Agreement form is an important step for anyone looking to establish a limited liability company (LLC) in the state. This document outlines the management structure, responsibilities, and operational guidelines for the company. Once you have completed the form, you will be able to move forward with officially registering your LLC.

- Begin by downloading the Massachusetts Operating Agreement form from a reliable source or the state’s official website.

- Read through the entire form to familiarize yourself with the sections that need to be completed.

- In the first section, enter the name of your LLC exactly as it will appear in official documents.

- Provide the principal address of the LLC, ensuring it is a physical location in Massachusetts.

- List the names and addresses of all members (owners) of the LLC. Be thorough and accurate.

- Specify the management structure of the LLC. Indicate whether it will be member-managed or manager-managed.

- Outline the purpose of the LLC. This should be a brief description of what your company will do.

- Include details about how profits and losses will be allocated among members. This is crucial for financial transparency.

- Indicate how decisions will be made within the LLC. This can include voting procedures or other methods of decision-making.

- Review all the information you have entered to ensure accuracy and completeness.

- Once satisfied, sign and date the form. If there are multiple members, ensure that all required signatures are obtained.

- Make a copy of the completed form for your records before submitting it.

- Submit the form to the appropriate state agency, along with any required fees.

Documents used along the form

When forming a Limited Liability Company (LLC) in Massachusetts, the Operating Agreement is a crucial document. However, several other forms and documents complement it, ensuring that your business operates smoothly and legally. Below is a list of essential documents that you might need alongside the Massachusetts Operating Agreement.

- Certificate of Organization: This document is filed with the Massachusetts Secretary of the Commonwealth to officially create your LLC. It includes basic information such as the name of the LLC, its address, and the names of its members.

- Bill of Sale: This form is crucial for documenting the sale of personal property in Texas. For more information and a template, visit Texas Forms Online.

- Bylaws: While not always required, bylaws outline the internal rules and regulations for managing the LLC. They can cover topics like meeting procedures, member responsibilities, and voting rights.

- Member Consent Form: This form is used to document the agreement of members on specific decisions or actions taken by the LLC. It can be important for record-keeping and ensuring that all members are on the same page.

- Business License Application: Depending on your LLC's activities and location, you may need to apply for various business licenses or permits. This application ensures compliance with local regulations.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes and is often required to open a business bank account. You can obtain one from the IRS online.

- Operating Procedures Document: This document outlines the day-to-day operations of the LLC. It can include details about financial management, employee roles, and customer service standards.

- Annual Report: In Massachusetts, LLCs must file an annual report to keep their information up to date with the state. This report typically includes details about the LLC’s members and management structure.

Each of these documents plays a vital role in the establishment and ongoing operation of your LLC. Having them in order not only helps ensure compliance with state laws but also fosters clear communication and understanding among members. Proper documentation is key to a successful business venture.