Fillable Massachusetts Last Will and Testament Document

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Massachusetts, this legal document serves as a formal declaration of how you wish to distribute your assets, appoint guardians for minor children, and designate an executor to manage your estate. The Massachusetts Last Will and Testament form outlines specific requirements, such as the necessity for the testator— the person making the will— to be at least 18 years old and of sound mind. Additionally, the form must be signed in the presence of two witnesses, who must also sign the document to validate it. By addressing these key elements, the form not only provides clarity regarding your intentions but also helps to minimize potential disputes among heirs. Understanding the intricacies of this form can empower individuals to take control of their legacy, ensuring that their loved ones are cared for according to their wishes.

Dos and Don'ts

When filling out the Massachusetts Last Will and Testament form, it is essential to approach the task with care and attention to detail. Here is a list of things you should and shouldn't do to ensure that your will is valid and reflects your intentions.

- Do: Clearly identify yourself, including your full name and address, to avoid any confusion about your identity.

- Do: Specify your wishes regarding the distribution of your assets, including specific bequests to individuals or organizations.

- Do: Appoint an executor who will be responsible for carrying out the terms of your will. This person should be trustworthy and organized.

- Do: Sign your will in the presence of at least two witnesses who are not beneficiaries. Their signatures are crucial for the will's validity.

- Don't: Forget to date your will. This helps establish the most current version of your intentions.

- Don't: Use vague language. Be as clear and specific as possible to avoid misunderstandings among your heirs.

- Don't: Leave out important details, such as how to handle debts or taxes, which can impact the distribution of your estate.

- Don't: Attempt to make changes to the will without following proper procedures. Any amendments should be made with the same formalities as the original will.

By adhering to these guidelines, you can help ensure that your Last Will and Testament accurately reflects your wishes and is legally sound.

PDF Properties

| Fact Name | Details |

|---|---|

| Governing Law | The Massachusetts Last Will and Testament is governed by Massachusetts General Laws Chapter 190B. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Massachusetts. |

| Signature Requirement | The testator must sign the will at the end of the document. |

| Witnesses | Two witnesses are required to sign the will in the presence of the testator. |

| Holographic Wills | Massachusetts recognizes holographic wills, which are handwritten and signed by the testator. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Self-Proving Wills | A self-proving affidavit can be included to simplify the probate process. |

| Residency Requirement | The testator does not need to be a resident of Massachusetts to create a will in the state. |

| Distribution of Assets | The will specifies how the testator's assets will be distributed upon death. |

| Executor Appointment | The testator can appoint an executor to manage the estate and ensure the will is executed according to their wishes. |

Key takeaways

When it comes to preparing a Last Will and Testament in Massachusetts, understanding the process is crucial. Here are some key takeaways to keep in mind:

- Legal Age Requirement: You must be at least 18 years old to create a valid will in Massachusetts.

- Written Document: The will must be in writing. Oral wills are not recognized in this state.

- Signature Requirement: You must sign the will at the end of the document. If you are unable to sign, you can direct someone else to sign on your behalf in your presence.

- Witnesses: At least two witnesses must be present when you sign your will. They should not be beneficiaries to avoid any potential conflicts.

- Revocation of Previous Wills: A new will automatically revokes any previous wills unless stated otherwise. Be clear about your intentions.

- Storage and Accessibility: Store your will in a safe place and inform your executor or a trusted person about its location. This ensures it can be easily found when needed.

- Updating Your Will: Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your will. Regular reviews are advisable.

Understanding these key points can help ensure that your wishes are honored and that the process goes smoothly for your loved ones after your passing.

Popular State-specific Last Will and Testament Forms

Wills in Georgia - A straightforward method to communicate final wishes.

Last Will and Testament Form Idaho - Your Last Will is an important step in ensuring that your legacy is honored and protected in accordance with your wishes.

By using the New York Room Rental Agreement form, landlords and tenants can ensure clarity in their rental arrangements, significantly reducing the possibility of misunderstandings. For a comprehensive template, you can visit https://newyorkform.com/free-room-rental-agreement-template/ to streamline the process and protect your interests effectively.

Will and Testament Florida - Residential and personal properties can be specifically allocated for the intended heirs.

Example - Massachusetts Last Will and Testament Form

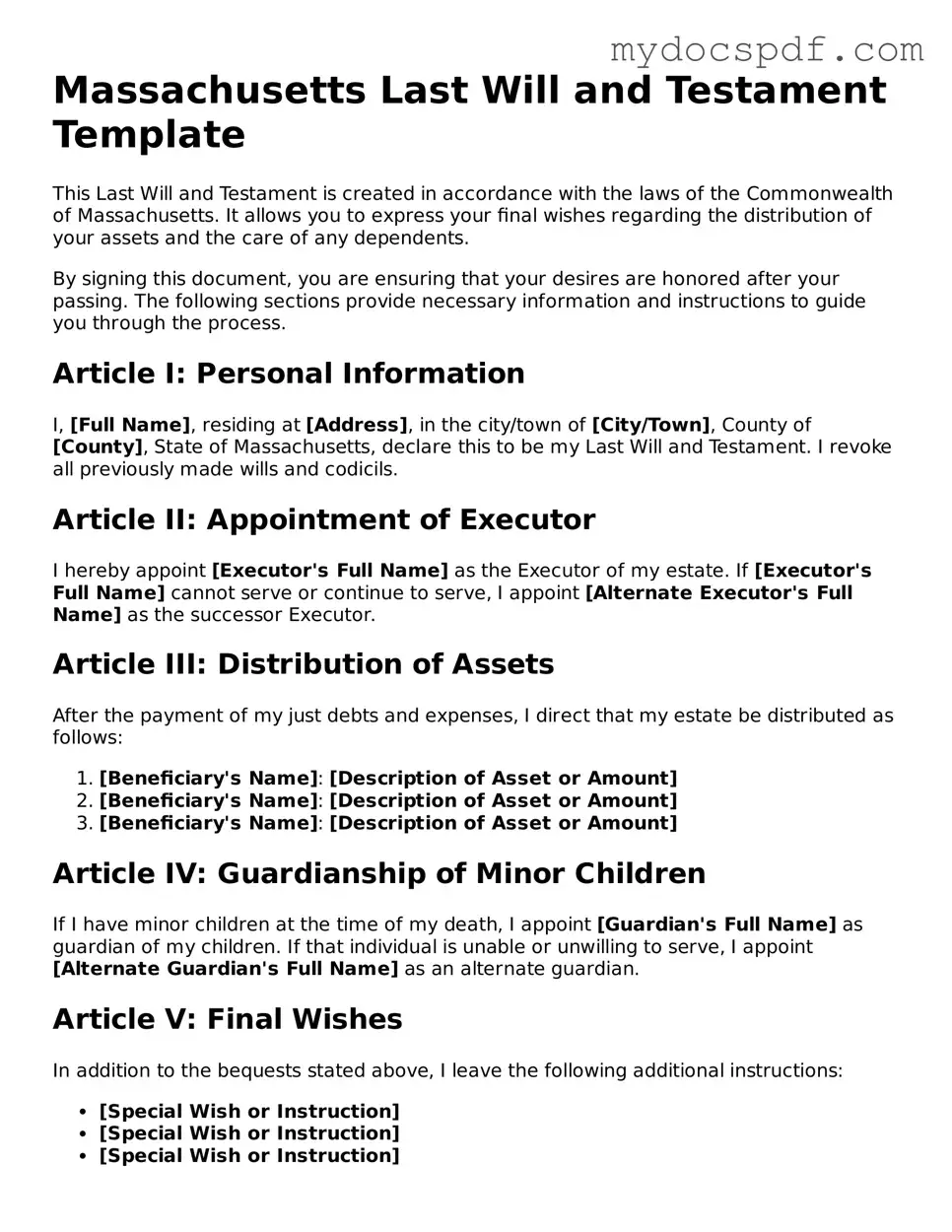

Massachusetts Last Will and Testament Template

This Last Will and Testament is created in accordance with the laws of the Commonwealth of Massachusetts. It allows you to express your final wishes regarding the distribution of your assets and the care of any dependents.

By signing this document, you are ensuring that your desires are honored after your passing. The following sections provide necessary information and instructions to guide you through the process.

Article I: Personal Information

I, [Full Name], residing at [Address], in the city/town of [City/Town], County of [County], State of Massachusetts, declare this to be my Last Will and Testament. I revoke all previously made wills and codicils.

Article II: Appointment of Executor

I hereby appoint [Executor's Full Name] as the Executor of my estate. If [Executor's Full Name] cannot serve or continue to serve, I appoint [Alternate Executor's Full Name] as the successor Executor.

Article III: Distribution of Assets

After the payment of my just debts and expenses, I direct that my estate be distributed as follows:

- [Beneficiary's Name]: [Description of Asset or Amount]

- [Beneficiary's Name]: [Description of Asset or Amount]

- [Beneficiary's Name]: [Description of Asset or Amount]

Article IV: Guardianship of Minor Children

If I have minor children at the time of my death, I appoint [Guardian's Full Name] as guardian of my children. If that individual is unable or unwilling to serve, I appoint [Alternate Guardian's Full Name] as an alternate guardian.

Article V: Final Wishes

In addition to the bequests stated above, I leave the following additional instructions:

- [Special Wish or Instruction]

- [Special Wish or Instruction]

- [Special Wish or Instruction]

Article VI: Signatures

In witness whereof, I have hereunto set my hand and seal this [Day] of [Month], [Year].

_________________________

[Full Name], Testator

We, the undersigned, hereby certify that the Testator, [Full Name], signed this document in our presence. We declare that we witnessed the signing and that the Testator appeared to be of sound mind and under no undue influence.

_________________________

[Witness 1 Name], Witness

_________________________

[Witness 2 Name], Witness

Detailed Instructions for Writing Massachusetts Last Will and Testament

Once you have the Massachusetts Last Will and Testament form in hand, the next step is to fill it out carefully. This document will help ensure your wishes are respected after you pass away. Take your time to provide accurate information and consider seeking assistance if you have any questions.

- Title the Document: Start by writing "Last Will and Testament" at the top of the page.

- Identify Yourself: Clearly state your full name and address. This helps to confirm your identity as the person creating the will.

- Declare Your Intent: Include a statement that indicates this document is your last will and testament. A simple phrase like “This is my Last Will and Testament” will suffice.

- Appoint an Executor: Choose someone you trust to carry out your wishes. Write their full name and address in the designated section.

- List Your Beneficiaries: Identify the people or organizations who will inherit your assets. Include their names and relationships to you.

- Detail Your Assets: Clearly describe your assets and how you want them distributed among your beneficiaries. Be specific to avoid confusion.

- Include Guardianship Provisions: If you have minor children, designate a guardian for them. Write down the guardian's name and address.

- Sign the Document: At the end of the will, sign your name. This signature is crucial as it validates the document.

- Have Witnesses: In Massachusetts, you need at least two witnesses. They should watch you sign the will and then sign it themselves, including their addresses.

- Store the Will Safely: After completing the form, keep it in a safe place. Inform your executor and loved ones where it is located.

Documents used along the form

When preparing a Last Will and Testament in Massachusetts, it is often beneficial to consider additional documents that can support your estate planning goals. These documents help clarify your wishes and ensure that your assets are managed according to your preferences. Below is a list of forms commonly used alongside a Last Will and Testament.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. It is effective immediately or upon the occurrence of a specified event.

- Health Care Proxy: A health care proxy designates an individual to make medical decisions for you if you are unable to communicate your wishes. This document ensures that your health care preferences are respected.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you are terminally ill or permanently unconscious. This document provides guidance to your health care providers and loved ones.

- Revocable Trust: A revocable trust holds your assets during your lifetime and allows for their distribution upon your death. This can help avoid probate and provide privacy regarding your estate.

- Notice to Quit: This document is essential for landlords in Arizona, as it serves to formally notify tenants that they must vacate the property. For more information about this document, visit arizonapdfs.com/.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. This ensures that these assets pass to your chosen individuals without going through probate.

Incorporating these documents into your estate planning can provide clarity and peace of mind. Each serves a unique purpose, contributing to a comprehensive approach to managing your affairs and ensuring your wishes are honored.