Fillable Massachusetts Durable Power of Attorney Document

The Massachusetts Durable Power of Attorney form is a crucial legal document that empowers individuals to designate someone they trust to make financial and legal decisions on their behalf, especially in situations where they may become incapacitated. This form remains effective even if the person who created it becomes unable to manage their affairs, ensuring that their wishes are honored and their needs are met. By completing this form, you can specify the range of powers granted to your chosen agent, which may include handling bank transactions, managing real estate, or making investment decisions. It's important to understand that the authority granted can be broad or limited, depending on your preferences. Additionally, the form requires specific language and must be signed in accordance with Massachusetts law to be valid. Understanding the implications of this document and the responsibilities it entails can provide peace of mind for both you and your loved ones, making it a vital part of any comprehensive estate planning strategy.

Dos and Don'ts

When filling out the Massachusetts Durable Power of Attorney form, it is crucial to approach the task with care. Here are six essential do's and don'ts to consider:

- Do ensure that you are of sound mind and legal age to create the document.

- Do clearly specify the powers you are granting to your agent.

- Do have the document signed in the presence of a notary public.

- Don't leave any sections blank; incomplete forms can lead to confusion or disputes.

- Don't choose an agent who may have conflicting interests or may not act in your best interest.

- Don't forget to provide copies of the completed form to your agent and any relevant institutions.

By following these guidelines, you can help ensure that your Durable Power of Attorney is valid and effective when needed.

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to manage their financial and legal affairs, even if they become incapacitated. |

| Governing Law | The form is governed by Massachusetts General Laws, Chapter 190B, Section 5-501 through 5-507. |

| Durability | This form remains effective even if the principal becomes incapacitated, unlike a regular power of attorney. |

| Principal and Agent | The individual creating the document is referred to as the principal, while the person appointed to act on their behalf is known as the agent. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are competent. |

| Execution Requirements | The form must be signed by the principal and acknowledged by a notary public or signed by two witnesses. |

Key takeaways

Filling out and using a Massachusetts Durable Power of Attorney (DPOA) form is an important step in ensuring that your financial and legal affairs are managed according to your wishes, especially in the event that you become incapacitated. Here are some key takeaways to consider:

- Definition: A Durable Power of Attorney allows you to appoint someone, known as your agent or attorney-in-fact, to make decisions on your behalf regarding financial matters.

- Durability: The term "durable" means that the authority granted to your agent remains effective even if you become incapacitated.

- Choosing an Agent: It is crucial to select a trustworthy individual as your agent, as they will have significant control over your financial decisions.

- Specific Powers: You can specify which powers you grant to your agent, such as managing bank accounts, paying bills, or selling property.

- Revocation: You can revoke the Durable Power of Attorney at any time, as long as you are mentally competent to do so.

- Witnesses and Notarization: The form must be signed in the presence of two witnesses or a notary public to be legally valid in Massachusetts.

- Limitations: Be aware that the DPOA does not grant your agent the authority to make healthcare decisions for you; that requires a separate document.

- Record Keeping: It is advisable to keep a copy of the executed DPOA in a safe place and provide copies to your agent and relevant financial institutions.

- Legal Advice: Consulting with an attorney can help ensure that the form is filled out correctly and that it meets your specific needs.

Understanding these key points can help you navigate the process of creating and using a Durable Power of Attorney effectively, ensuring that your wishes are respected even when you cannot express them yourself.

Popular State-specific Durable Power of Attorney Forms

Power of Attorney Forms California - It can streamline decision-making during emergencies.

Understanding the importance of having a safety net for financial decisions, many choose to utilize a New York Durable Power of Attorney form. This document allows someone to manage another person's financial affairs and remains valid even if the individual becomes incapacitated. For those interested in creating their own document, resources are available, such as this one: https://newyorkform.com/free-durable-power-of-attorney-template/, which can help guide you through the process and ensure that your wishes are honored.

Power of Attorney Form Idaho - With this form, you can specify the powers you want to grant your agent.

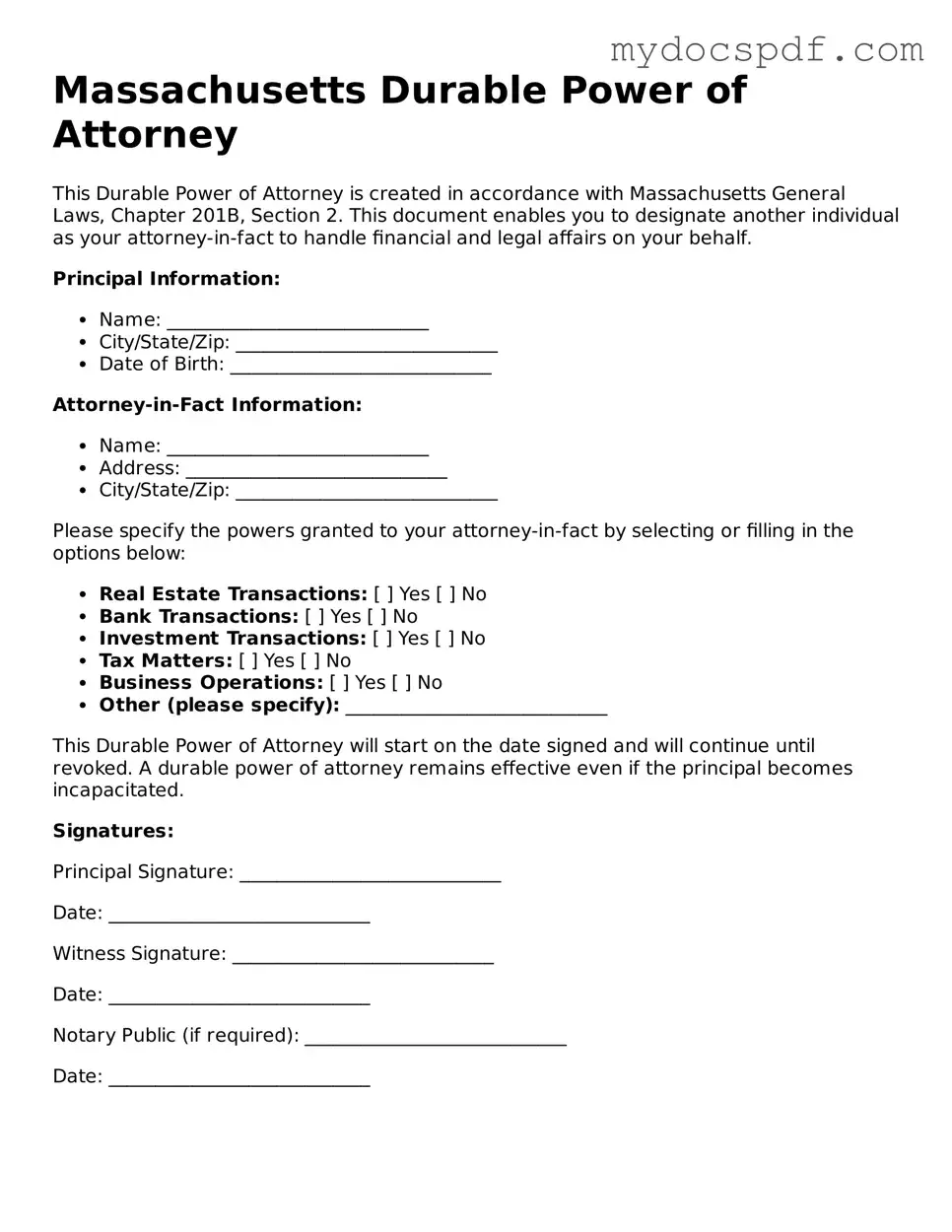

Example - Massachusetts Durable Power of Attorney Form

Massachusetts Durable Power of Attorney

This Durable Power of Attorney is created in accordance with Massachusetts General Laws, Chapter 201B, Section 2. This document enables you to designate another individual as your attorney-in-fact to handle financial and legal affairs on your behalf.

Principal Information:

- Name: ____________________________

- City/State/Zip: ____________________________

- Date of Birth: ____________________________

Attorney-in-Fact Information:

- Name: ____________________________

- Address: ____________________________

- City/State/Zip: ____________________________

Please specify the powers granted to your attorney-in-fact by selecting or filling in the options below:

- Real Estate Transactions: [ ] Yes [ ] No

- Bank Transactions: [ ] Yes [ ] No

- Investment Transactions: [ ] Yes [ ] No

- Tax Matters: [ ] Yes [ ] No

- Business Operations: [ ] Yes [ ] No

- Other (please specify): ____________________________

This Durable Power of Attorney will start on the date signed and will continue until revoked. A durable power of attorney remains effective even if the principal becomes incapacitated.

Signatures:

Principal Signature: ____________________________

Date: ____________________________

Witness Signature: ____________________________

Date: ____________________________

Notary Public (if required): ____________________________

Date: ____________________________

Detailed Instructions for Writing Massachusetts Durable Power of Attorney

Filling out the Massachusetts Durable Power of Attorney form is an important step in ensuring that your financial and legal matters can be managed according to your wishes, especially if you become unable to make decisions for yourself. Completing this form accurately is crucial, as it designates someone you trust to act on your behalf. Here are the steps to guide you through the process.

- Begin by obtaining the Massachusetts Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- At the top of the form, enter your full name and address. This identifies you as the principal.

- Next, designate an agent by writing their full name and address. This person will have the authority to act on your behalf.

- Decide whether you want to give your agent general authority or limited authority. If you choose limited authority, specify the powers you wish to grant.

- Include any special instructions or limitations regarding the agent’s powers, if applicable. Be clear and specific to avoid confusion later.

- Sign and date the form in the designated area. Your signature must be witnessed by at least one person who is not your agent.

- Have the witness sign and date the form as well, confirming they saw you sign it.

- If required, consider having the document notarized to enhance its validity. This step may not be mandatory but can provide extra assurance.

- Make copies of the completed form for your records and provide a copy to your agent and any relevant institutions.

Once you have completed the form, it is essential to keep it in a safe place and inform your agent where to find it. Regularly review the document to ensure it still reflects your wishes, especially if your circumstances change.

Documents used along the form

When establishing a Durable Power of Attorney (DPOA) in Massachusetts, it is often beneficial to consider additional documents that can complement this important legal tool. Each of these documents serves a distinct purpose and can provide further clarity and support in managing one’s affairs, especially in times of incapacity. Below is a list of commonly used forms and documents that may accompany a DPOA.

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they become unable to do so. It ensures that health care preferences are respected.

- Living Will: A living will outlines an individual’s wishes regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and family members about the person's desires in critical situations.

- Will: A will is a legal document that specifies how a person's assets will be distributed upon their death. It can also name guardians for minor children, ensuring that one's wishes are honored after passing.

- Revocable Trust: This trust allows individuals to place assets into a trust that they can modify or revoke during their lifetime. It can help avoid probate and ensure smoother asset management.

- Advance Directive: Similar to a living will, an advance directive provides instructions regarding medical care preferences and can include both health care proxies and living wills.

- Financial Power of Attorney: While a DPOA typically covers financial matters, a separate financial power of attorney can be used for specific transactions or to appoint different individuals for distinct financial responsibilities.

- Child Support Texas Form: This document is essential for outlining a parent's financial responsibilities towards their children. It clarifies the amount to be paid and the conditions under which payments may cease. Understanding this form is critical for ensuring children receive the needed support, while Texas Forms Online can provide easy access to the necessary templates.

- HIPAA Authorization: This document allows designated individuals to access medical records and information, ensuring that family members or agents can make informed decisions about health care.

- Property Transfer Documents: These may include deeds or title transfers that facilitate the transfer of property ownership, often used in conjunction with estate planning.

- Beneficiary Designations: This document designates who will receive assets such as life insurance or retirement accounts upon the individual’s death, ensuring that wishes are clear and legally binding.

- Guardianship Documents: If minors are involved, guardianship documents outline who will take care of children in the event of incapacity or death, providing peace of mind about their future care.

Incorporating these documents alongside a Durable Power of Attorney can create a comprehensive plan for managing one’s affairs during incapacity or after death. Each document plays a crucial role in ensuring that personal wishes are honored and that legal and financial matters are handled smoothly.