Fillable Massachusetts Deed Document

The Massachusetts Deed form is a crucial legal document used in real estate transactions throughout the state. It serves to transfer ownership of property from one party to another, ensuring that the rights and responsibilities associated with the property are clearly defined. This form includes essential information such as the names of the grantor and grantee, a description of the property being conveyed, and the consideration paid for the transfer. It is important to note that there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving a specific purpose and offering varying levels of protection for the parties involved. The form must be signed, notarized, and recorded with the local registry of deeds to be legally effective. Understanding the Massachusetts Deed form is vital for anyone involved in buying or selling real estate, as it lays the foundation for a secure and legally binding transfer of property rights.

Dos and Don'ts

When filling out the Massachusetts Deed form, attention to detail is crucial. Here are six important dos and don’ts to consider:

- Do ensure that all names are spelled correctly. Accuracy is vital to avoid future legal issues.

- Do include the correct property description. This should match the information on the property’s title.

- Do sign the deed in front of a notary public. This step is necessary for the deed to be legally binding.

- Do check for any local requirements. Some municipalities may have additional regulations.

- Don’t leave any fields blank. Every section of the form must be completed to prevent delays.

- Don’t forget to provide the date of the transaction. This information is essential for record-keeping.

PDF Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Massachusetts Deed form is governed by Massachusetts General Laws, Chapter 183. |

| Types of Deeds | Massachusetts recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Execution Requirements | A deed must be signed by the grantor (the person transferring the property) and should be witnessed by at least one individual. |

| Recording | To provide public notice of the property transfer, the deed must be recorded at the local Registry of Deeds. |

| Property Description | The deed must include a clear and accurate description of the property being transferred, often using a legal description. |

| Consideration | The deed should state the consideration, which is the value exchanged for the property, although it can be nominal. |

| Tax Implications | Massachusetts may impose a transfer tax on property transfers, which is typically paid by the seller at the time of recording. |

Key takeaways

When filling out and using the Massachusetts Deed form, there are several important points to keep in mind to ensure a smooth process.

- Understand the Types of Deeds: Familiarize yourself with the different types of deeds available in Massachusetts, such as warranty deeds and quitclaim deeds, as each serves a different purpose.

- Provide Accurate Information: Ensure that all information, including the names of the grantor and grantee, is accurate and matches official identification documents.

- Include a Legal Description: A precise legal description of the property is necessary. This description should be clear and match the information on the property’s title.

- Consider the Notarization Requirement: Most deeds must be notarized to be valid. A notary public will verify the identities of the parties involved.

- Check for Additional Signatures: Depending on the situation, additional signatures may be required, such as those from spouses or co-owners.

- Review Local Regulations: Local laws may impose specific requirements or forms. It’s essential to check with local authorities or a legal professional.

- File with the Registry of Deeds: After completing the deed, it must be filed with the appropriate Registry of Deeds to be legally recognized.

- Keep Copies for Records: Always retain copies of the completed deed for personal records and future reference.

- Consult a Professional if Needed: If there are uncertainties or complex situations, seeking advice from a real estate attorney or a qualified professional can be beneficial.

Popular State-specific Deed Forms

Georgia Quit Claim Deed - Not all deeds require a lawyer, but legal advice is often helpful.

A Texas Hold Harmless Agreement is a legal document designed to protect one party from liability for any injuries or damages that may occur during a specific activity or event. This form outlines the responsibilities of each party involved and ensures that the party being held harmless will not be held accountable for certain claims. For those looking to draft such an agreement, resources like Texas Forms Online can provide valuable templates and guidance. Understanding the importance of this agreement can help individuals and organizations mitigate risks effectively.

Florida Home Deed - Understanding how to read a deed is vital for anyone involved in property matters.

Grant Deed California - A clear and defined purpose for the deed will lead to smoother transactions.

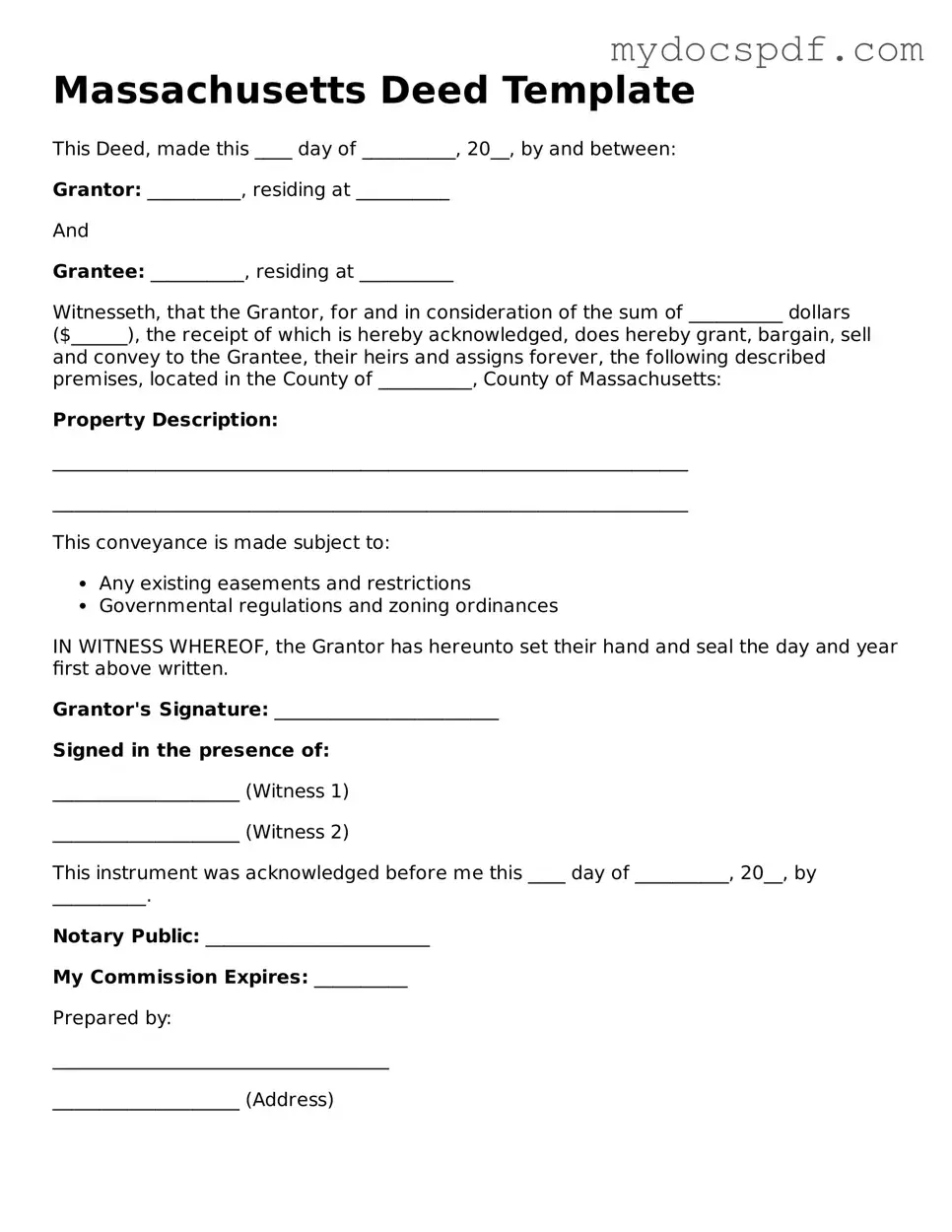

Example - Massachusetts Deed Form

Massachusetts Deed Template

This Deed, made this ____ day of __________, 20__, by and between:

Grantor: __________, residing at __________

And

Grantee: __________, residing at __________

Witnesseth, that the Grantor, for and in consideration of the sum of __________ dollars ($______), the receipt of which is hereby acknowledged, does hereby grant, bargain, sell and convey to the Grantee, their heirs and assigns forever, the following described premises, located in the County of __________, County of Massachusetts:

Property Description:

____________________________________________________________________

____________________________________________________________________

This conveyance is made subject to:

- Any existing easements and restrictions

- Governmental regulations and zoning ordinances

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal the day and year first above written.

Grantor's Signature: ________________________

Signed in the presence of:

____________________ (Witness 1)

____________________ (Witness 2)

This instrument was acknowledged before me this ____ day of __________, 20__, by __________.

Notary Public: ________________________

My Commission Expires: __________

Prepared by:

____________________________________

____________________ (Address)

Detailed Instructions for Writing Massachusetts Deed

Filling out the Massachusetts Deed form is a straightforward process, but it requires careful attention to detail. Once you complete the form, you'll be ready to file it with the appropriate registry of deeds, which is an important step in transferring property ownership.

- Start with the date at the top of the form. Write the date when the deed is being executed.

- Identify the parties involved. Clearly print the name of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the property description. This should include the address and any relevant details that define the property boundaries. Refer to the property’s legal description if available.

- Indicate the consideration. This is the amount of money or value exchanged for the property. Write the amount in both words and numbers for clarity.

- Include any additional clauses or conditions. If there are specific terms regarding the transfer, make sure to include them in this section.

- Sign the deed. The grantor must sign the document in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Have the deed notarized. The notary will verify the identity of the grantor and witness the signing of the deed.

- Review the completed form. Ensure all information is accurate and complete before proceeding to file.

After filling out the deed form, the next step is to file it with the local registry of deeds. This will officially record the transfer and make it part of the public record. Be sure to check if there are any additional fees or requirements specific to your locality.

Documents used along the form

When transferring property in Massachusetts, several documents often accompany the Deed form to ensure a smooth and legally sound transaction. Each of these forms serves a specific purpose, helping to clarify ownership, tax responsibilities, and other important details related to the property transfer.

- Title Insurance Policy: This document protects the buyer and lender from potential disputes over property ownership. It ensures that the title is clear and free from liens or other claims that could affect ownership.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and discloses any known issues that could affect the title. It provides assurance to the buyer regarding the seller's right to sell the property.

- Property Transfer Tax Form: This form is required to report the transfer of property and assess any applicable taxes. It ensures compliance with state and local tax regulations.

- Settlement Statement (HUD-1): This document outlines all costs associated with the property transaction, including fees, taxes, and other expenses. It provides transparency for both the buyer and seller during the closing process.

- Bill of Sale: While not always necessary, this document can be used to transfer personal property that may be included in the sale, such as appliances or fixtures. It helps clarify what is included in the transaction.

- California Bill of Sale Form: To ensure proper documentation during asset transfers, refer to our comprehensive California bill of sale form resources for an effective transaction process.

- Power of Attorney: If the seller cannot be present for the transaction, this document allows another person to act on their behalf. It ensures that the sale can proceed without delay.

- Notice of Sale: This document informs interested parties, such as tenants or neighbors, about the property transfer. It can help prevent disputes or misunderstandings regarding the new ownership.

Understanding these accompanying documents is crucial for anyone involved in a property transaction in Massachusetts. Each form plays a vital role in protecting the interests of all parties and ensuring that the transfer process is conducted legally and efficiently.