Fillable Massachusetts Articles of Incorporation Document

The Massachusetts Articles of Incorporation form serves as a crucial document for individuals and groups seeking to establish a corporation within the state. This form outlines essential information about the corporation, including its name, purpose, and the address of its principal office. Additionally, it requires the identification of the initial directors and the number of shares the corporation is authorized to issue. The form also mandates the inclusion of the corporation's registered agent, who will serve as the official point of contact for legal documents. By completing this form, applicants not only fulfill a legal requirement but also lay the groundwork for their corporate governance and operational framework. The process of filing the Articles of Incorporation is a significant step in the journey of entrepreneurship, marking the transition from an idea to a recognized legal entity. Understanding the various components of this form is essential for ensuring compliance with state regulations and for setting a solid foundation for future business endeavors.

Dos and Don'ts

When filling out the Massachusetts Articles of Incorporation form, it's important to approach the task with care. Here are some key dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and other details.

- Do include the purpose of your corporation clearly. This helps define your business's mission and activities.

- Do provide the correct number of shares and their par value if applicable. This is crucial for your corporation's structure.

- Do sign and date the form. An unsigned form may delay the incorporation process.

- Do keep a copy of the completed form for your records. Having a reference can be helpful in the future.

- Don't leave any required fields blank. Incomplete forms can lead to rejection or delays.

- Don't use vague language when describing your business purpose. Clarity is key for regulatory approval.

- Don't forget to check the filing fee. Ensure you include the correct payment with your submission.

- Don't rush through the form. Take your time to ensure accuracy and completeness.

- Don't ignore state-specific requirements. Familiarize yourself with Massachusetts laws to avoid pitfalls.

PDF Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Massachusetts Articles of Incorporation are governed by the Massachusetts General Laws, Chapter 156D. |

| Purpose | The form is used to officially create a corporation in Massachusetts. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for establishing a corporation. |

| Information Needed | The form requires the corporation's name, purpose, and registered agent information. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Duration | The Articles can specify a duration for the corporation, or it can be perpetual. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. |

| Signature Requirement | The form must be signed by the incorporators, who are responsible for the formation of the corporation. |

| Online Filing | Massachusetts allows for online submission of the Articles of Incorporation through the Secretary of the Commonwealth's website. |

| Amendments | Changes to the Articles may require filing an amendment form with the state. |

Key takeaways

Filling out and using the Massachusetts Articles of Incorporation form is an important step in establishing a business. Here are some key takeaways to keep in mind:

- Make sure to provide accurate information. This includes the name of your corporation, its purpose, and the address of its principal office.

- Choose a unique name for your corporation. The name must not be similar to any existing corporation in Massachusetts.

- Designate a registered agent. This person or business will receive legal documents on behalf of your corporation.

- Specify the number of shares your corporation is authorized to issue. This is crucial for understanding ownership and investment opportunities.

- Consider the filing fee. There is a fee associated with submitting the Articles of Incorporation, so be prepared to pay this when you file.

- Once filed, keep a copy of the Articles for your records. This document is essential for future legal and business matters.

By paying attention to these details, you can help ensure a smoother incorporation process in Massachusetts.

Popular State-specific Articles of Incorporation Forms

Florida Dept of State Division of Corporations - The articles typically require signatures from the incorporators.

For landlords in Texas, utilizing a Texas Notice to Quit form is crucial when it comes to properly notifying tenants about the termination of a rental agreement. For those looking for reliable templates to facilitate this process, Texas Forms Online offers comprehensive resources that ensure compliance with Texas rental laws while clarifying the rights and responsibilities of both parties involved.

Articles of Incorporation Georgia Template - Details regarding the classes of shares and their rights are presented here.

Starting an Llc in Idaho - Publication requirements may apply in certain jurisdictions following filing.

Example - Massachusetts Articles of Incorporation Form

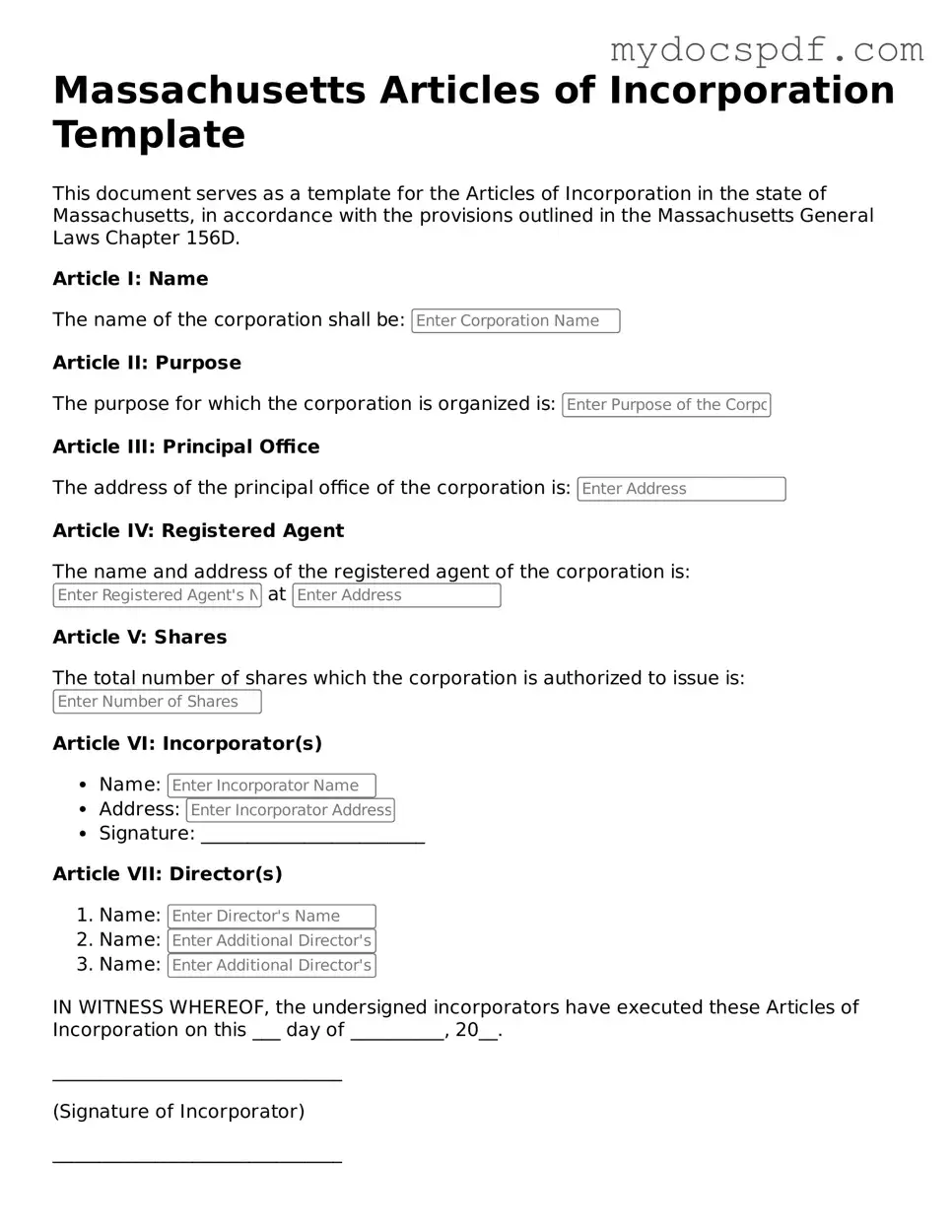

Massachusetts Articles of Incorporation Template

This document serves as a template for the Articles of Incorporation in the state of Massachusetts, in accordance with the provisions outlined in the Massachusetts General Laws Chapter 156D.

Article I: Name

The name of the corporation shall be:

Article II: Purpose

The purpose for which the corporation is organized is:

Article III: Principal Office

The address of the principal office of the corporation is:

Article IV: Registered Agent

The name and address of the registered agent of the corporation is: at

Article V: Shares

The total number of shares which the corporation is authorized to issue is:

Article VI: Incorporator(s)

- Name:

- Address:

- Signature: ________________________

Article VII: Director(s)

- Name:

- Name:

- Name:

IN WITNESS WHEREOF, the undersigned incorporators have executed these Articles of Incorporation on this ___ day of __________, 20__.

_______________________________

(Signature of Incorporator)

_______________________________

(Printed Name)

Detailed Instructions for Writing Massachusetts Articles of Incorporation

Once you have gathered the necessary information, you can begin filling out the Massachusetts Articles of Incorporation form. This process will require attention to detail, as accuracy is crucial for successful submission. After completing the form, you will submit it to the appropriate state office for review and processing.

- Start with the name of your corporation. Ensure that it is unique and complies with Massachusetts naming requirements.

- Provide the principal office address. This should be a physical location, not a P.O. Box.

- List the purpose of your corporation. Be clear and concise about what your business will do.

- Indicate the number of shares your corporation is authorized to issue. Include any par value if applicable.

- Identify the name and address of the registered agent. This person or business will receive legal documents on behalf of the corporation.

- Include the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that all required signatures are included.

- Review the completed form for accuracy. Make sure all information is correct and complete.

- Prepare the filing fee. Check the current fee schedule to ensure you include the correct amount.

- Submit the form and payment to the appropriate state office, either online or by mail.

Documents used along the form

When forming a corporation in Massachusetts, the Articles of Incorporation is a crucial document. However, it is often accompanied by several other forms and documents that help ensure compliance with state regulations and facilitate smooth operations. Here are six important documents that you may need to consider.

- Bylaws: These are the internal rules that govern the management of the corporation. Bylaws outline the roles and responsibilities of directors and officers, meeting procedures, and how decisions are made within the company.

- Initial Report: This document provides the state with essential information about the corporation, including its address, the names of its officers, and other key details. It is typically required to be filed shortly after the Articles of Incorporation.

- NYCERS F170 form: This form enables eligible EMT members from Tier 1, Tier 2, or Tier 4 to elect participation in the 25-Year Retirement Program. More information can be found at https://newyorkform.com/free-nycers-f170-template.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is vital for tax purposes. This number is used to identify the corporation for federal tax obligations and is often required when opening a bank account or hiring employees.

- Statement of Information: In Massachusetts, corporations must file a Statement of Information, which updates the state on the corporation's current status, including any changes in address or management. This is usually required annually.

- Business License: Depending on the type of business and its location, a local business license may be necessary. This document ensures that the business complies with local regulations and zoning laws.

- Shareholder Agreements: While not mandatory, these agreements can be very helpful in defining the rights and responsibilities of shareholders. They can address issues like share transfers, voting rights, and dispute resolution.

Being aware of these additional documents can streamline the incorporation process and help avoid potential pitfalls. Each form plays a vital role in ensuring that your corporation operates smoothly and remains compliant with state laws. Taking the time to prepare and file these documents correctly will set a solid foundation for your business's future.