Get Louisiana act of donation Form in PDF

The Louisiana act of donation form serves as a crucial legal document in the state, facilitating the transfer of property from one individual to another without the exchange of money. This form is particularly important for individuals looking to gift real estate, personal property, or other assets to family members, friends, or charitable organizations. It outlines the specifics of the donation, including the names of the donor and the recipient, a detailed description of the property being donated, and any conditions that may apply to the transfer. Additionally, the form requires the signatures of both parties and may need to be notarized to ensure its validity. Understanding the requirements and implications of this form is essential for anyone considering making a donation, as it helps to clarify the intentions of the parties involved and provides legal protection for both the donor and the recipient.

Dos and Don'ts

Filling out the Louisiana Act of Donation form can be a straightforward process if you keep a few important points in mind. Here’s a helpful list of things to do and avoid when completing this form.

- Do read the instructions carefully before starting.

- Don't rush through the form; take your time to ensure accuracy.

- Do provide complete and accurate information about the donor and the recipient.

- Don't leave any sections blank unless instructed to do so.

- Do sign and date the form where required.

- Don't forget to have the form notarized if required.

- Do keep a copy of the completed form for your records.

- Don't submit the form without double-checking for errors.

- Do consult with a legal professional if you have questions.

By following these guidelines, you can help ensure that your Act of Donation form is filled out correctly and efficiently. This will ultimately make the process smoother for everyone involved.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1469 to 1471, which outline the rules for donations. |

| Types of Donations | Donations can be inter vivos (during the donor's lifetime) or mortis causa (effective upon the donor's death). |

| Requirements | The form must be signed by the donor and, in some cases, by witnesses or a notary public to be legally binding. |

| Revocation | Donations can be revoked under certain conditions, such as if the donee fails to fulfill specific obligations set forth in the donation. |

| Tax Implications | Donations may have tax implications for both the donor and the donee, including potential gift taxes, which should be considered. |

| Public Record | While not required, filing the Act of Donation with the local parish clerk can provide public notice of the property transfer. |

Key takeaways

When filling out and using the Louisiana act of donation form, consider the following key takeaways:

- Ensure that all parties involved are clearly identified. This includes the donor and the recipient.

- Complete the form accurately and thoroughly to avoid any potential legal issues in the future.

- Include a detailed description of the property being donated. This helps to clarify what is being transferred.

- Sign the form in the presence of a notary public. This step is crucial for the form's validity.

- Keep a copy of the completed form for your records. This can serve as proof of the donation.

- Consult with a legal advisor if you have questions about the process or implications of the donation.

Other PDF Templates

Load Calculation Formula - This form is essential for compliance with the National Electrical Code.

In addition to ensuring a clear understanding of rental terms, utilizing a comprehensive lease agreement, such as the one provided by NY Templates, can significantly enhance the landlord-tenant relationship by promoting transparency and minimizing potential disputes.

Roof Certification Form Florida - Certification helps lenders assess property quality during assessments.

Example - Louisiana act of donation Form

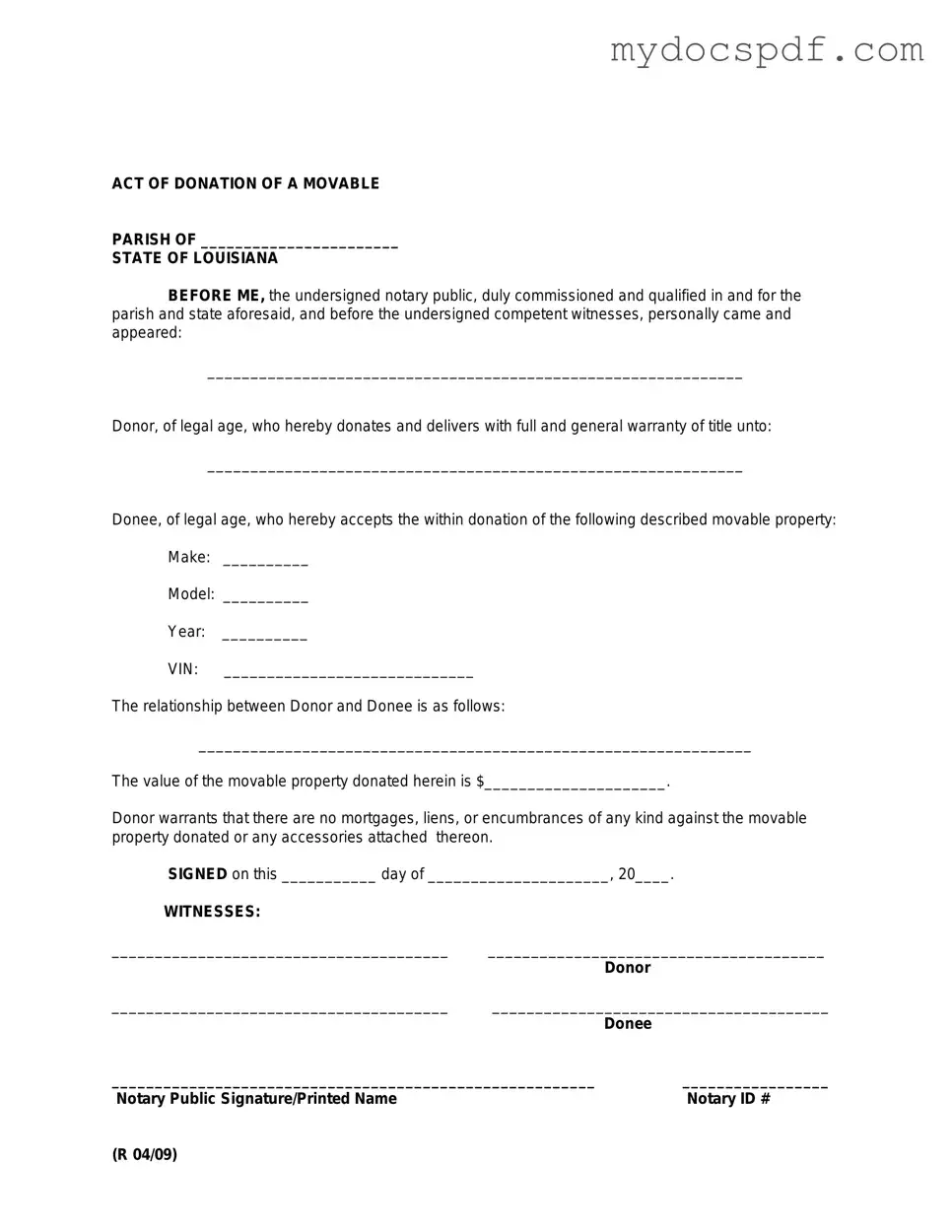

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Detailed Instructions for Writing Louisiana act of donation

Completing the Louisiana Act of Donation form is a straightforward process. This form allows individuals to legally transfer ownership of property or assets to another person without compensation. To ensure accuracy and compliance with state requirements, follow the steps outlined below carefully.

- Obtain the Louisiana Act of Donation form. This can be found online or at local government offices.

- Begin by filling in the date at the top of the form. Ensure the date is accurate.

- Identify the donor. Provide the full name, address, and any necessary identification details of the person donating the property.

- Next, identify the recipient. Include the full name, address, and any required identification details of the person receiving the property.

- Describe the property being donated. Be specific about the type of property, its location, and any relevant details that clarify what is being transferred.

- Include any conditions or restrictions regarding the donation, if applicable. Clearly state any terms that the recipient must adhere to.

- Both the donor and recipient must sign the form. Ensure that signatures are legible and dated.

- Have the signatures notarized. A notary public must witness the signing and provide their seal on the document.

- Make copies of the completed form for both the donor and recipient. This ensures that both parties have a record of the transaction.

After filling out the form, it is advisable to file it with the appropriate local government office to ensure the donation is officially recognized. Retaining copies for personal records is also important for future reference.

Documents used along the form

The Louisiana Act of Donation form is a legal document used to transfer ownership of property or assets from one party to another, typically without compensation. When engaging in this process, several other forms and documents may be required or beneficial to ensure a smooth transaction. Below is a list of related documents that are often used alongside the Louisiana Act of Donation form.

- Property Deed: This document serves as the official record of property ownership. It outlines the details of the property being transferred and is essential for establishing legal ownership.

- Affidavit of Identity: This sworn statement verifies the identity of the parties involved in the donation. It helps prevent fraud and ensures that the correct individuals are participating in the transaction.

- Gift Tax Return (Form 709): This IRS form is required if the value of the donated property exceeds a certain threshold. It reports the gift for tax purposes and helps the donor comply with federal tax laws.

- Title Search Report: This document provides a history of the property’s ownership. A title search can reveal any liens or claims against the property, ensuring the donor has the right to transfer ownership.

- Power of Attorney: If the donor cannot be present for the transaction, a power of attorney allows another person to act on their behalf. This document must be carefully drafted to ensure the authority is clear.

- Notarized Affidavit of Donation: This document confirms that the donation was made voluntarily and without coercion. Notarization adds a layer of authenticity and can be useful in case of disputes.

- Bill of Sale: If the donation involves personal property, a bill of sale may be necessary. This document records the transfer of ownership and details the items being donated.

- Dirt Bike Bill of Sale: A legal document essential for recording the sale of a dirt bike in New York, ensuring a clear transfer of ownership. For more details, refer to https://newyorkform.com/free-dirt-bike-bill-of-sale-template.

- Transfer Tax Form: Depending on the value of the property and local laws, a transfer tax form may need to be filed. This ensures that any applicable taxes are paid during the transfer process.

- Declaration of Value: This document states the estimated value of the property being donated. It may be required for tax purposes and helps both parties understand the value of the transaction.

Utilizing these documents in conjunction with the Louisiana Act of Donation form can help ensure that the donation process is legally sound and transparent. Always consider consulting with a legal professional to navigate these forms effectively and comply with all applicable laws and regulations.