Attorney-Approved Loan Agreement Template

When entering into a financial arrangement, a Loan Agreement form serves as a crucial tool that outlines the terms and conditions agreed upon by both the lender and the borrower. This document typically includes key elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it often specifies the rights and responsibilities of each party, ensuring that everyone is on the same page regarding expectations. The form may also address what happens in the event of default, providing clarity on the consequences and potential remedies. By capturing these important details, a Loan Agreement not only protects the interests of both parties but also fosters a sense of trust and accountability throughout the lending process. Understanding the significance of this form can help individuals and businesses navigate their financial commitments with confidence.

Dos and Don'ts

When filling out a Loan Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate personal information, including your full name and address.

- Do: Double-check your financial details, such as income and expenses.

- Do: Clearly state the purpose of the loan.

- Do: Review the terms and conditions thoroughly.

- Don't: Rush through the form; mistakes can lead to delays.

- Don't: Leave any required fields blank.

- Don't: Provide misleading or false information.

- Don't: Ignore the deadlines for submission.

- Don't: Forget to sign and date the agreement where indicated.

Loan AgreementTemplates for Particular US States

Loan Agreement Subtypes

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions under which a borrower receives funds from a lender. |

| Parties Involved | The form identifies the borrower and the lender, ensuring both parties are clearly named. |

| Loan Amount | The total sum of money being borrowed is specified in the agreement. |

| Interest Rate | The agreement states the interest rate, which can be fixed or variable, affecting how much the borrower will repay. |

| Governing Law | The agreement typically includes the state law that governs the contract, which can vary by location. |

| Repayment Terms | Details about how and when the borrower will repay the loan are clearly outlined, including any penalties for late payments. |

Key takeaways

When it comes to filling out and using a Loan Agreement form, understanding the key components can make a significant difference in the borrowing process. Here are five essential takeaways to keep in mind:

- Clearly Define the Loan Amount: Specify the exact amount being borrowed. This clarity helps prevent misunderstandings and ensures both parties are on the same page.

- Outline the Repayment Terms: Include details about how and when the loan will be repaid. This should cover the repayment schedule, interest rates, and any penalties for late payments.

- Include Personal Information: Both the lender and borrower should provide accurate contact details. This information is crucial for communication throughout the loan period.

- Specify the Purpose of the Loan: Clearly state what the loan will be used for. This can help establish trust and accountability between the parties involved.

- Seek Legal Advice if Necessary: If the loan amount is substantial or the terms are complex, consider consulting a legal expert. This step can help ensure that the agreement is fair and legally binding.

By paying attention to these aspects, both lenders and borrowers can create a solid foundation for their financial agreement, fostering a smoother transaction and reducing potential disputes.

Other Documents

Hurt Feelings Report - Provides a format for understanding and narrating one's emotional pain.

A Texas Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. This form is often utilized in situations such as transferring property between family members or clearing up title issues. Understanding its implications is essential for anyone considering property transactions in Texas, and for those seeking a template, resources like Texas Forms Online can be invaluable.

Form Fillable Character Sheet 5e - A charming diplomat with a talent for negotiation and persuasion.

Storage Rental Agreement - Important for understanding all costs involved in renting a unit.

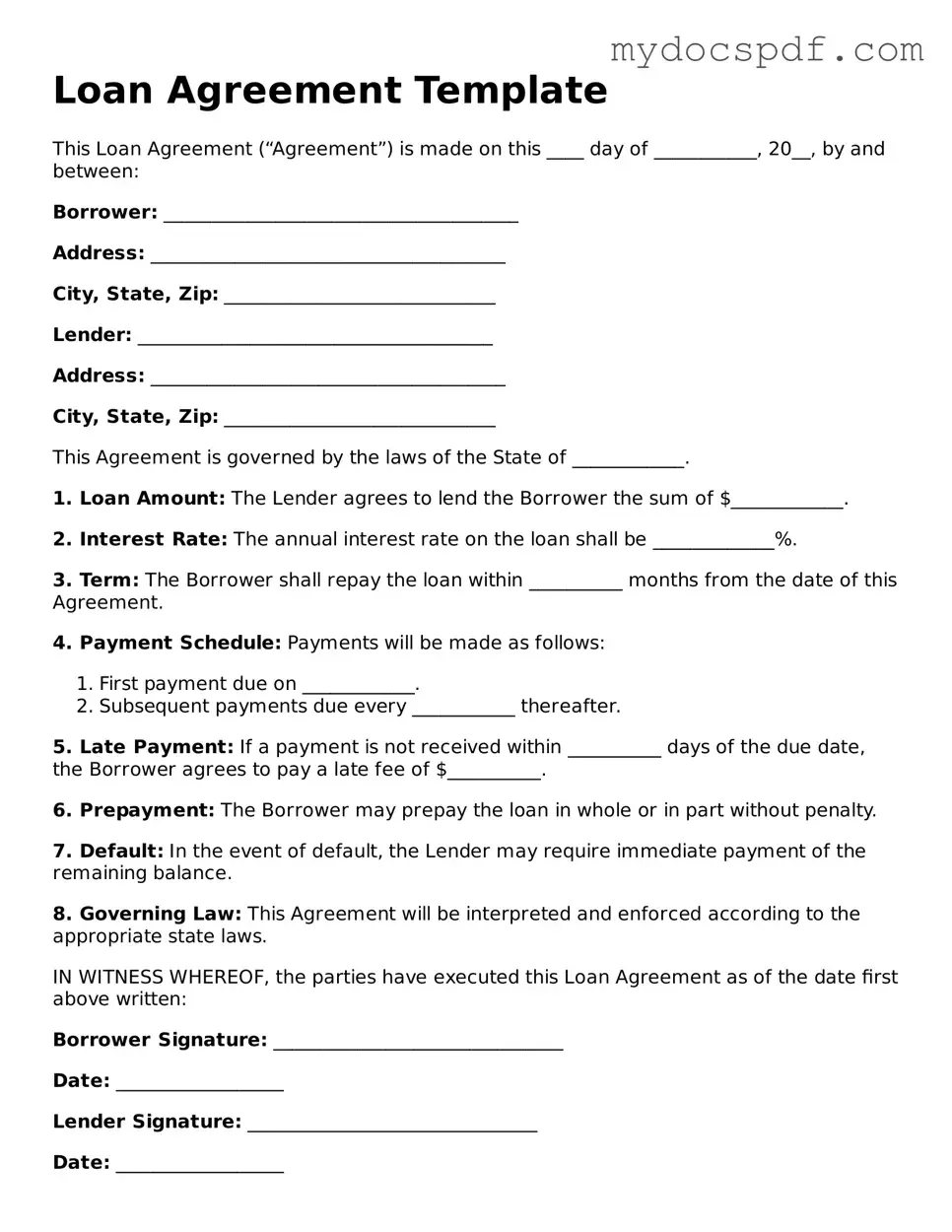

Example - Loan Agreement Form

Loan Agreement Template

This Loan Agreement (“Agreement”) is made on this ____ day of ___________, 20__, by and between:

Borrower: ______________________________________

Address: ______________________________________

City, State, Zip: _____________________________

Lender: ______________________________________

Address: ______________________________________

City, State, Zip: _____________________________

This Agreement is governed by the laws of the State of ____________.

1. Loan Amount: The Lender agrees to lend the Borrower the sum of $____________.

2. Interest Rate: The annual interest rate on the loan shall be _____________%.

3. Term: The Borrower shall repay the loan within __________ months from the date of this Agreement.

4. Payment Schedule: Payments will be made as follows:

- First payment due on ____________.

- Subsequent payments due every ___________ thereafter.

5. Late Payment: If a payment is not received within __________ days of the due date, the Borrower agrees to pay a late fee of $__________.

6. Prepayment: The Borrower may prepay the loan in whole or in part without penalty.

7. Default: In the event of default, the Lender may require immediate payment of the remaining balance.

8. Governing Law: This Agreement will be interpreted and enforced according to the appropriate state laws.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written:

Borrower Signature: _______________________________

Date: __________________

Lender Signature: _______________________________

Date: __________________

Detailed Instructions for Writing Loan Agreement

Filling out the Loan Agreement form is an important step in securing your financial arrangements. To ensure accuracy and clarity, follow these detailed steps carefully. Each section of the form is designed to gather essential information that will help both parties understand their responsibilities and commitments.

- Read the entire form thoroughly before starting. Familiarize yourself with all sections to avoid confusion later.

- Enter your personal information at the top of the form. This includes your full name, address, phone number, and email address.

- Provide the borrower’s details. If you are not the borrower, fill in their name and contact information in the designated area.

- Specify the loan amount. Clearly write the total amount of money being borrowed. Ensure this is accurate to avoid any misunderstandings.

- Outline the loan terms. Indicate the interest rate, repayment schedule, and any other specific conditions that apply to the loan.

- Detail any collateral if applicable. If the loan is secured with collateral, describe the asset and its value in the appropriate section.

- Sign and date the form. Ensure that both parties sign the document and include the date of signing to validate the agreement.

- Review the completed form for accuracy. Double-check all entries to confirm that there are no errors or omissions.

- Make copies of the signed form for your records. It’s important to keep a copy for future reference.

Once you have completed these steps, the Loan Agreement form will be ready for submission. Ensure that all parties involved have a clear understanding of the terms before proceeding further.

Documents used along the form

When entering into a loan agreement, several other forms and documents are commonly used to ensure clarity and protect the interests of all parties involved. Each document serves a specific purpose in the lending process.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rate, and repayment schedule.

- Loan Application: A formal request submitted by the borrower to the lender, providing necessary personal and financial information to evaluate creditworthiness.

- Credit Report: A detailed report of the borrower’s credit history, which helps lenders assess the risk of lending money.

- Collateral Agreement: If the loan is secured, this document specifies the assets pledged as collateral to protect the lender in case of default.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and any potential penalties.

- Vehicle Sale Receipt: When selling a vehicle, it's important to document the transaction to prevent disputes in the future. For a formalized record, consider utilizing a Vehicle Sale Receipt to outline the details of the sale, including the seller, buyer, and vehicle information.

- Personal Guarantee: A document in which an individual agrees to be personally responsible for the loan if the borrowing entity defaults.

- Loan Closing Statement: A summary of the final terms of the loan agreement, including any adjustments made prior to closing.

- Amortization Schedule: A table detailing each payment over the life of the loan, showing how much goes toward principal and interest.

Understanding these documents can help borrowers navigate the lending process more effectively. Each plays a crucial role in establishing the terms of the loan and ensuring both parties are on the same page.