Attorney-Approved Letter of Intent to Purchase Business Template

A Letter of Intent to Purchase Business is an important document in the process of acquiring a business. This form outlines the preliminary agreement between a buyer and a seller, setting the stage for further negotiations. It typically includes key details such as the purchase price, payment terms, and any contingencies that may affect the sale. Additionally, the letter may address the timeline for due diligence and the closing process. By clearly stating the intentions of both parties, this document helps to establish a mutual understanding and can serve as a foundation for a more formal purchase agreement in the future. It is essential for both buyers and sellers to carefully consider the terms included in the letter, as they can influence the overall transaction and provide a framework for moving forward.

Dos and Don'ts

When filling out a Letter of Intent to Purchase a Business, it is crucial to approach the task with care and precision. Below is a list of things you should and shouldn't do to ensure your document is effective and legally sound.

- Do clearly state your intent to purchase the business.

- Do include specific details about the business, such as its name and address.

- Do outline the proposed terms of the sale, including price and payment structure.

- Do indicate any contingencies that must be met before the sale can proceed.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to include your contact information for follow-up discussions.

By adhering to these guidelines, you can create a comprehensive and clear Letter of Intent that serves as a solid foundation for your potential business acquisition.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Letter of Intent (LOI) outlines the preliminary agreement between a buyer and seller regarding the purchase of a business. |

| Purpose | The LOI serves to express interest and outline the basic terms before a formal purchase agreement is drafted. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it does not legally obligate either party to complete the transaction. |

| Key Components | Common components include purchase price, payment terms, due diligence period, and any contingencies. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| State-Specific Forms | LOIs may vary by state, with specific forms governed by local laws, such as the Uniform Commercial Code (UCC) in many states. |

| Due Diligence | The LOI often outlines a period for due diligence, allowing the buyer to investigate the business before finalizing the deal. |

| Expiration Date | LOIs typically include an expiration date, after which the terms may no longer be valid if the transaction has not progressed. |

| Negotiation Tool | The LOI can serve as a negotiation tool, helping to clarify intentions and expectations for both parties. |

| Legal Review | It is advisable for both parties to have legal counsel review the LOI to ensure that their interests are adequately represented. |

Key takeaways

When filling out and using the Letter of Intent to Purchase Business form, keep these key takeaways in mind:

- Clarity is Crucial: Clearly outline the terms of the proposed purchase. Ambiguity can lead to misunderstandings later.

- Include Essential Details: Make sure to include information such as the purchase price, payment terms, and any contingencies.

- Express Intent: This letter serves to express your serious intent to purchase. Make your intentions clear to the seller.

- Non-Binding Nature: Remember that a Letter of Intent is typically non-binding. It sets the stage for negotiations but doesn't finalize the deal.

- Consult Professionals: Before finalizing the letter, consider consulting with legal or financial professionals to ensure all bases are covered.

Popular Letter of Intent to Purchase Business Documents:

How to Write a Letter of Intent for a Lease - This form helps both parties understand their expectations before entering into a formal lease agreement.

Completing the Alabama Homeschool Letter of Intent accurately is vital for parents who wish to embark on their homeschooling journey, as it not only fulfills a legal requirement but also clarifies their educational plans to the local authorities. For further assistance and resources on this process, parents can visit homeschoolintent.com/, which offers helpful tools to ensure everything is in order.

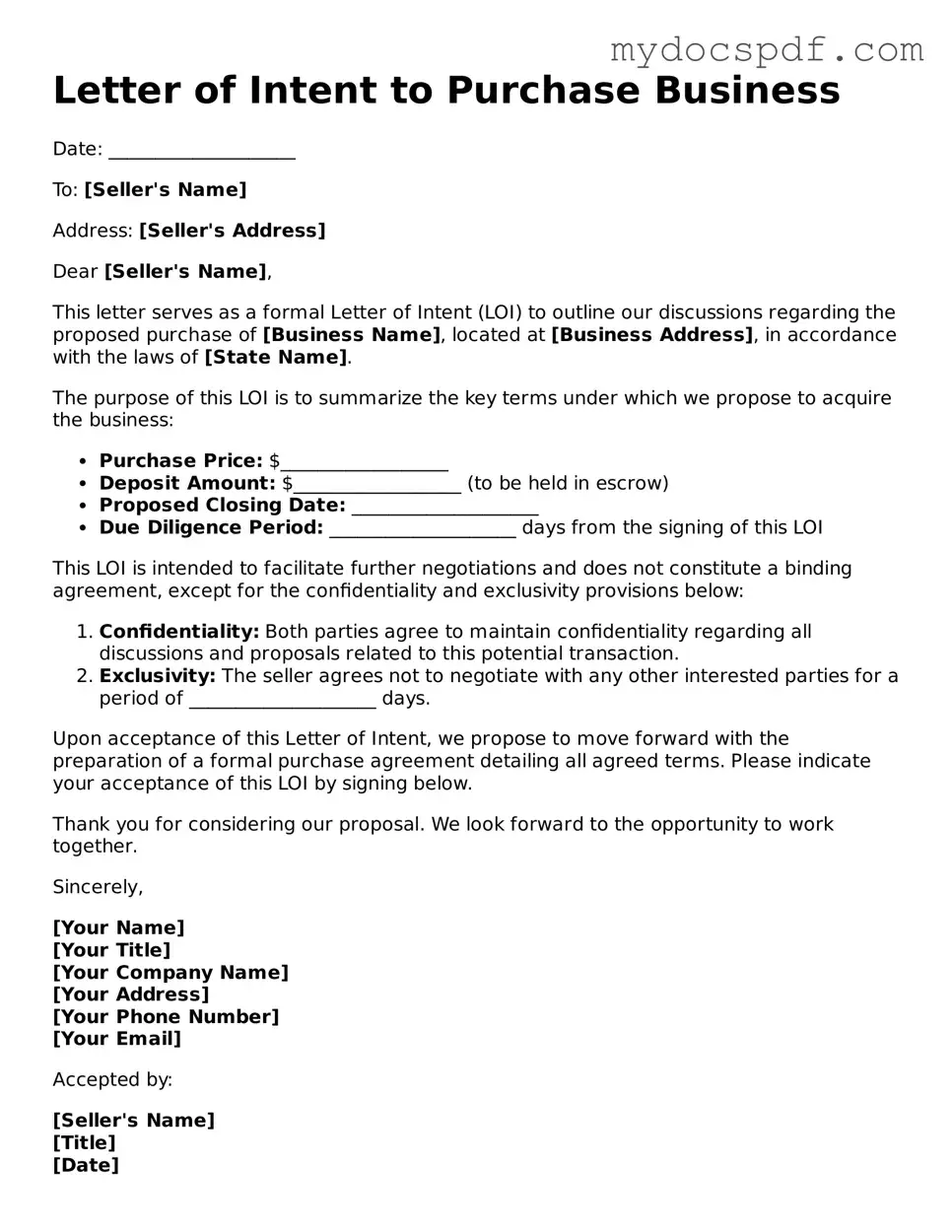

Example - Letter of Intent to Purchase Business Form

Letter of Intent to Purchase Business

Date: ____________________

To: [Seller's Name]

Address: [Seller's Address]

Dear [Seller's Name],

This letter serves as a formal Letter of Intent (LOI) to outline our discussions regarding the proposed purchase of [Business Name], located at [Business Address], in accordance with the laws of [State Name].

The purpose of this LOI is to summarize the key terms under which we propose to acquire the business:

- Purchase Price: $__________________

- Deposit Amount: $__________________ (to be held in escrow)

- Proposed Closing Date: ____________________

- Due Diligence Period: ____________________ days from the signing of this LOI

This LOI is intended to facilitate further negotiations and does not constitute a binding agreement, except for the confidentiality and exclusivity provisions below:

- Confidentiality: Both parties agree to maintain confidentiality regarding all discussions and proposals related to this potential transaction.

- Exclusivity: The seller agrees not to negotiate with any other interested parties for a period of ____________________ days.

Upon acceptance of this Letter of Intent, we propose to move forward with the preparation of a formal purchase agreement detailing all agreed terms. Please indicate your acceptance of this LOI by signing below.

Thank you for considering our proposal. We look forward to the opportunity to work together.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email]

Accepted by:

[Seller's Name]

[Title]

[Date]

Detailed Instructions for Writing Letter of Intent to Purchase Business

After gathering all necessary information, you are ready to fill out the Letter of Intent to Purchase Business form. This document will outline your intentions regarding the purchase and set the stage for further negotiations. Follow these steps carefully to ensure that all details are accurate and complete.

- Start with the date at the top of the form. Write the current date in the designated space.

- Fill in your name and contact information. This includes your address, phone number, and email address.

- Provide the name of the business you intend to purchase. Make sure to include the full legal name.

- Enter the seller's name and contact information. This should also include their address, phone number, and email address.

- Specify the proposed purchase price. Clearly state the amount you are willing to offer.

- Outline the terms of the sale. Include any conditions that must be met for the sale to proceed.

- Indicate the intended closing date. This is the date you hope to finalize the purchase.

- Sign the document. Your signature indicates your commitment to the terms outlined in the letter.

- Include the date of your signature.

Once you have completed the form, review it for any errors or omissions. It's important to ensure that all information is correct before moving forward. After that, you can present the form to the seller for their consideration.

Documents used along the form

A Letter of Intent (LOI) to Purchase a Business is often accompanied by several other important documents. These documents help clarify the terms of the transaction and protect the interests of both parties involved. Below is a list of commonly used forms and documents that work in conjunction with an LOI.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains private. Both parties agree not to disclose any proprietary information to third parties.

- Due Diligence Checklist: This list outlines the information and documents that the buyer needs to review before finalizing the purchase. It typically includes financial statements, contracts, and legal documents.

- Investment Letter of Intent: This preliminary agreement signals the intention to invest, highlighting key terms and conditions essential for the investment process. For more information, you may refer to Documents PDF Online.

- Purchase Agreement: Once terms are agreed upon, this formal contract outlines the details of the sale, including price, payment terms, and any contingencies.

- Business Valuation Report: This report provides an analysis of the business's worth, helping the buyer understand if the asking price is fair based on market conditions and financial performance.

- Letter of Authorization: This document allows the buyer to access the seller’s financial and operational information, often required for due diligence purposes.

- Financing Agreement: If the buyer is seeking financing to complete the purchase, this document outlines the terms of the loan or investment, including interest rates and repayment schedules.

- Transition Plan: This plan details how the business will be transitioned from the seller to the buyer, covering operational, staffing, and customer service aspects.

- Non-Compete Agreement: This agreement restricts the seller from starting a competing business for a specified period and within a certain geographic area, protecting the buyer's investment.

- Escrow Agreement: This document outlines the terms under which funds will be held in escrow until all conditions of the sale are met, ensuring security for both parties.

Each of these documents plays a crucial role in the business acquisition process. By understanding their purpose, both buyers and sellers can navigate the complexities of a transaction more effectively.