Attorney-Approved Lady Bird Deed Template

The Lady Bird Deed, also known as an enhanced life estate deed, serves as a powerful tool for property owners looking to manage their real estate while retaining control during their lifetime. This unique legal instrument allows individuals to transfer their property to their heirs without going through the often lengthy and costly probate process. By using this deed, property owners can maintain the right to live in and use the property for as long as they wish, ensuring that they can continue to enjoy their home without interruption. Upon the owner’s passing, the property automatically transfers to the designated beneficiaries, simplifying the transition and providing peace of mind. Additionally, a Lady Bird Deed can offer certain tax advantages and protect the property from creditors in some situations. Understanding the nuances of this deed is essential for anyone considering estate planning options, as it can significantly impact how assets are managed and distributed after death.

Dos and Don'ts

When filling out a Lady Bird Deed form, it’s important to approach the process carefully to ensure that all information is accurate and meets legal requirements. Below is a list of things you should and shouldn't do while completing this form.

Things You Should Do:

- Review the form thoroughly before starting to fill it out.

- Provide complete and accurate information about the property.

- Include the names of all individuals involved in the deed.

- Consult with a legal professional if you have any questions.

- Sign the deed in the presence of a notary public.

Things You Shouldn't Do:

- Do not leave any sections of the form blank.

- Avoid using abbreviations or shorthand in the names or addresses.

- Do not rush through the process; take your time to ensure accuracy.

- Refrain from making any alterations or corrections without proper procedures.

- Do not forget to keep a copy of the completed form for your records.

By following these guidelines, you can help ensure that your Lady Bird Deed is completed correctly and serves its intended purpose.

Lady Bird DeedTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Ownership Retention | The property owner retains the right to sell, mortgage, or change the deed without the beneficiaries' consent. |

| Governing Law | In Texas, the Lady Bird Deed is governed by Texas Property Code § 112.008. |

| Tax Implications | Property transferred via a Lady Bird Deed may receive a step-up in basis for tax purposes upon the owner's death. |

| Medicaid Planning | This type of deed can be used as a strategy for Medicaid planning, potentially protecting assets from being counted as resources. |

| Revocability | A Lady Bird Deed can be revoked at any time by the property owner, allowing for flexibility in estate planning. |

| Beneficiary Designation | Multiple beneficiaries can be named in the deed, allowing for shared ownership after the owner's passing. |

| State Variations | While Texas has specific laws regarding Lady Bird Deeds, other states may have different rules or may not recognize them at all. |

Key takeaways

Here are key takeaways about filling out and using the Lady Bird Deed form:

- Understand the Purpose: The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- Retain Rights: The property owner maintains the right to sell, use, or change the property without needing the beneficiary's consent.

- Consider Tax Implications: This deed may help avoid probate and can have tax advantages, but it's important to consult with a tax professional.

- Complete the Form Accurately: Ensure all information is filled out correctly, including names, addresses, and legal descriptions of the property.

- Sign and Notarize: The deed must be signed in front of a notary public to be legally valid.

- Record the Deed: After signing, the deed should be recorded with the county clerk's office to ensure it is legally recognized.

Popular Lady Bird Deed Documents:

Transfer on Death Deed California - The deed is a way to avoid will challenges related to property transfer after death.

To successfully establish a corporation in California, it is important to understand the requirements of the necessary documentation, including the vital Articles of Incorporation form, which serves as a foundational legal instrument for this process. For more information, visit the comprehensive guide on Articles of Incorporation available here.

Blank Deed of Trust - It is important for all parties to keep a copy of the Deed of Trust for their records.

Example - Lady Bird Deed Form

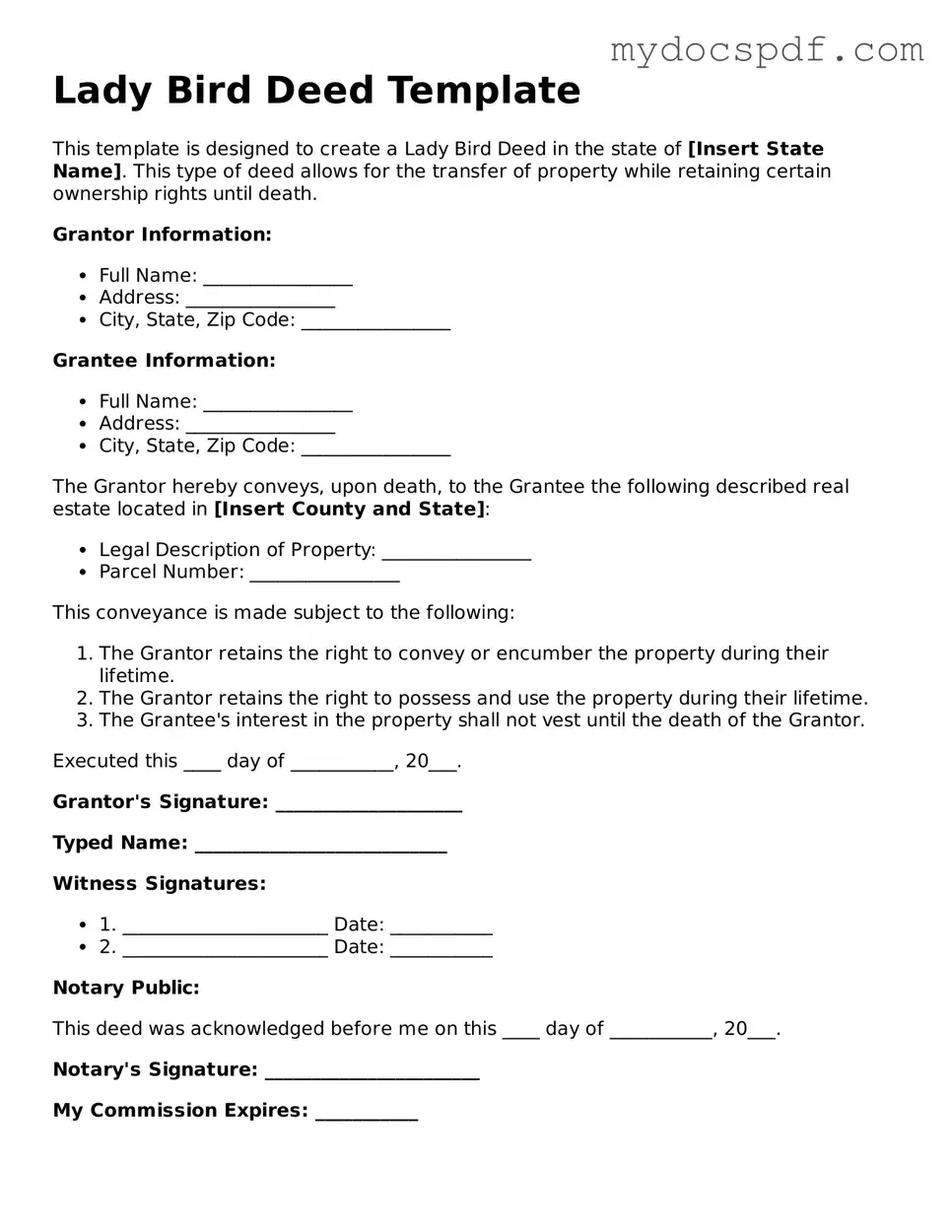

Lady Bird Deed Template

This template is designed to create a Lady Bird Deed in the state of [Insert State Name]. This type of deed allows for the transfer of property while retaining certain ownership rights until death.

Grantor Information:

- Full Name: ________________

- Address: ________________

- City, State, Zip Code: ________________

Grantee Information:

- Full Name: ________________

- Address: ________________

- City, State, Zip Code: ________________

The Grantor hereby conveys, upon death, to the Grantee the following described real estate located in [Insert County and State]:

- Legal Description of Property: ________________

- Parcel Number: ________________

This conveyance is made subject to the following:

- The Grantor retains the right to convey or encumber the property during their lifetime.

- The Grantor retains the right to possess and use the property during their lifetime.

- The Grantee's interest in the property shall not vest until the death of the Grantor.

Executed this ____ day of ___________, 20___.

Grantor's Signature: ____________________

Typed Name: ___________________________

Witness Signatures:

- 1. ______________________ Date: ___________

- 2. ______________________ Date: ___________

Notary Public:

This deed was acknowledged before me on this ____ day of ___________, 20___.

Notary's Signature: _______________________

My Commission Expires: ___________

Detailed Instructions for Writing Lady Bird Deed

Filling out a Lady Bird Deed form requires careful attention to detail to ensure that all necessary information is accurately provided. After completing the form, it will need to be signed and notarized before being filed with the appropriate county office.

- Begin by obtaining the Lady Bird Deed form. This can usually be found online or through a local legal office.

- Enter the name of the current property owner at the top of the form. Ensure the name matches the title of the property.

- Provide the property address, including street number, street name, city, state, and zip code.

- Identify the beneficiaries by entering their full names and relationship to the property owner. List all intended beneficiaries.

- Specify any conditions or limitations regarding the transfer of the property to the beneficiaries, if applicable.

- Include a description of the property. This should match the legal description found in the property deed.

- Sign the form in the designated area. The signature should be that of the current property owner.

- Have the form notarized. This step is crucial for validating the document.

- File the completed and notarized form with the county clerk's office where the property is located.

Documents used along the form

A Lady Bird Deed, also known as an enhanced life estate deed, is a useful tool for property owners looking to transfer real estate while retaining certain rights. When utilizing this deed, there are several other forms and documents that may be necessary to ensure a smooth and legally compliant process. Below is a list of commonly used documents associated with the Lady Bird Deed.

- Quitclaim Deed: This document transfers any interest the grantor has in the property to another party without making any guarantees about the title. It is often used to clear up title issues or transfer property between family members.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. This document offers more protection to the grantee.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal or financial matters. It can be particularly useful if the property owner is unable to sign documents due to health or other reasons.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person’s estate. It can help clarify ownership and facilitate the transfer of property without going through probate.

- Child Support Texas Form: Understanding the Texas Forms Online can assist you in managing your financial responsibilities towards your children effectively.

- Living Trust: A living trust allows property to be held and managed for the benefit of the grantor during their lifetime and then transferred to beneficiaries upon death, avoiding probate. This can work in conjunction with a Lady Bird Deed.

- Property Tax Exemption Application: In some states, transferring property via a Lady Bird Deed may affect tax exemptions. This application can help ensure that the property retains any applicable tax benefits.

- Title Insurance Policy: Title insurance protects against losses from defects in the title. Obtaining a policy can provide peace of mind for both the grantor and grantee during the transfer process.

- Deed of Trust: This document secures a loan by placing a lien on the property. It involves three parties: the borrower, the lender, and a trustee. Understanding this document is crucial if the property is mortgaged.

In summary, while the Lady Bird Deed serves a specific purpose in property transfer, understanding the related documents can enhance the process. Each document plays a distinct role and can help facilitate a smooth transition of property rights and responsibilities.