Get IRS Schedule B 941 Form in PDF

The IRS Schedule B (Form 941) is an essential document for employers who must report their payroll taxes. This form provides a detailed account of the taxes withheld from employee wages, including federal income tax, Social Security tax, and Medicare tax. Employers must file Schedule B if they have a tax liability that exceeds a certain threshold during a quarter. It is important to note that this form is not submitted on its own; rather, it accompanies the Form 941, which is the employer's quarterly federal tax return. By completing Schedule B, employers can accurately report their tax liabilities and ensure compliance with federal regulations. Additionally, this form helps the IRS track the timing of tax deposits, making it easier for them to monitor compliance and identify any discrepancies. Understanding the nuances of Schedule B is crucial for employers, as failure to file correctly can lead to penalties and interest on unpaid taxes.

Dos and Don'ts

When filling out the IRS Schedule B (Form 941), it is important to follow specific guidelines to ensure accuracy and compliance. Here are some essential dos and don'ts:

- Do ensure that you have the correct tax period for which you are filing.

- Do accurately report the total amount of federal income tax withheld from employee wages.

- Do double-check the calculations for the total taxes before submitting the form.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; fill in all required information.

- Don't forget to sign and date the form before submission.

- Don't use incorrect or outdated versions of the form.

- Don't ignore instructions provided by the IRS for completing the form.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule B (Form 941) is used to report the total income tax withheld from employees' wages and the employer's share of Social Security and Medicare taxes. |

| Filing Frequency | This form is filed quarterly by employers who withhold income tax and pay Social Security and Medicare taxes. |

| Due Dates | Schedule B must be submitted with Form 941 by the last day of the month following the end of each quarter. |

| Who Must File | All employers who withhold federal income tax, Social Security tax, or Medicare tax must file this form. |

| State-Specific Requirements | Some states have additional forms or requirements for reporting withheld taxes. Check state laws for specifics. |

| Recordkeeping | Employers must keep records of employment taxes for at least four years from the date the tax becomes due. |

| Penalties | Failure to file Schedule B on time can result in penalties, including interest on unpaid taxes and late filing fees. |

Key takeaways

When dealing with the IRS Schedule B (Form 941), it’s essential to understand its purpose and how to complete it accurately. Here are some key takeaways to consider:

- Purpose of Schedule B: This form is used to report the allocation of your employment tax liability for the quarter. It provides the IRS with a breakdown of your tax obligations.

- Who Needs to File: Employers who report tax liabilities of $100,000 or more during a deposit period must complete Schedule B along with Form 941.

- Filing Frequency: Schedule B is submitted quarterly. Ensure you file it along with your Form 941 by the due date to avoid penalties.

- Accurate Record Keeping: Maintain accurate records of your payroll and tax deposits. This information is crucial for completing Schedule B correctly.

- Deposit Schedule: Familiarize yourself with your deposit schedule. This helps in determining when your tax liabilities are due and how to report them on the form.

- Corrections: If you make an error after filing, you can correct it by filing an amended Form 941. Be sure to include an updated Schedule B if necessary.

- Consulting Resources: Utilize IRS resources or consult with a tax professional if you have questions about completing Schedule B. It's important to get it right.

Understanding these key points can help ensure compliance and streamline the filing process for your business.

Other PDF Templates

Do I Need to Remove Lienholder From Title - The accurate identification of the property, including improvements, is necessary for precise record-keeping.

Utilizing the Arizona Trailer Bill of Sale form, available at arizonapdfs.com, is essential for anyone looking to facilitate a clear and lawful transfer of trailer ownership, ensuring that all necessary details are documented and both buyer and seller are protected throughout the transaction process.

What Is Form 8300 - Requires both the name and social security number of the payer.

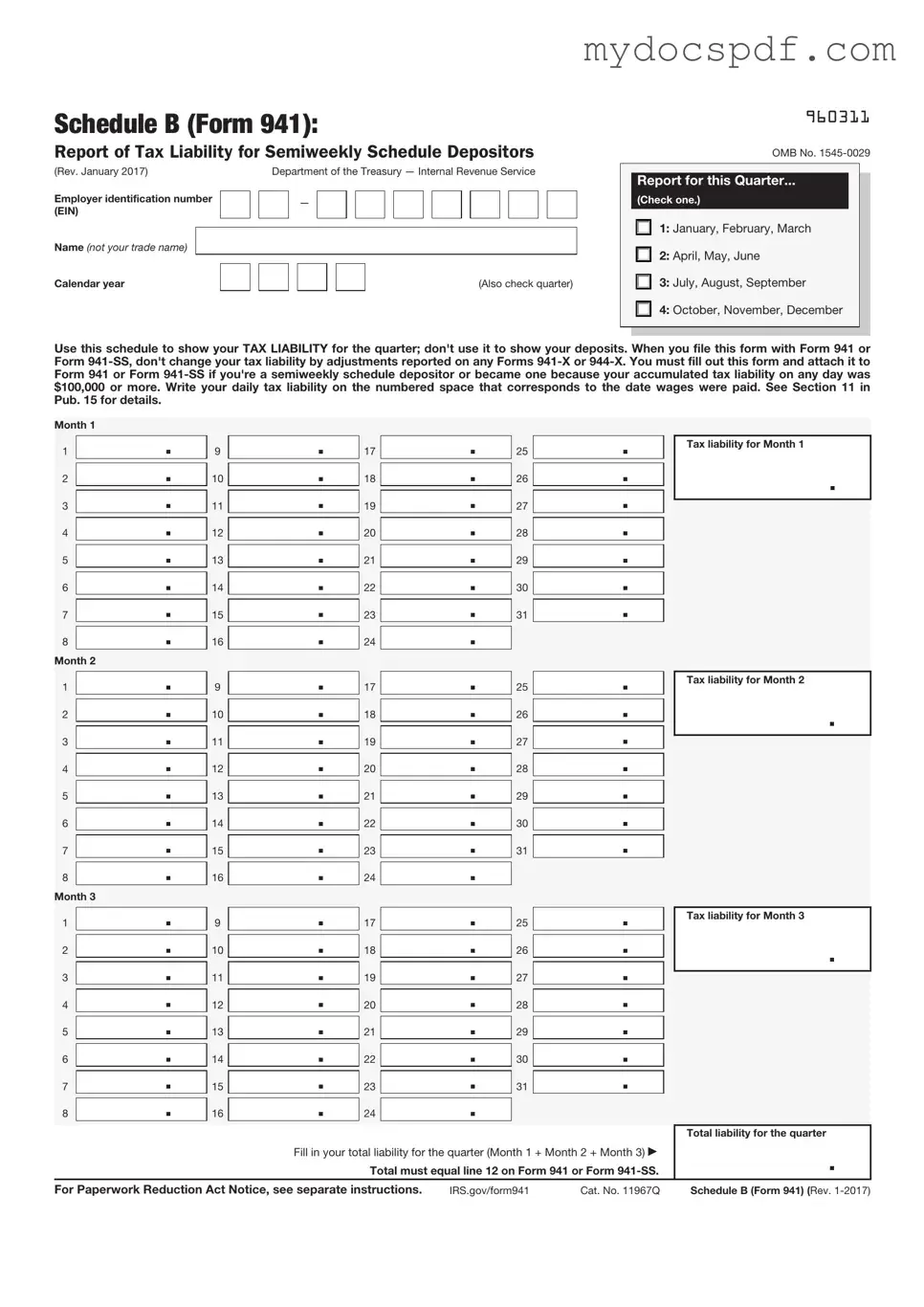

Example - IRS Schedule B 941 Form

Schedule B (Form 941):

Report of Tax Liability for Semiweekly Schedule Depositors

(Rev. January 2017) |

|

|

Department of the Treasury — Internal Revenue Service |

|||||||||||||||||||

Employer identification number |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Also check quarter) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

960311

OMB No.

Report for this Quarter...

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form

Month 1

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 2

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 3

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

Tax liability for Month 1

.

Tax liability for Month 2

.

1 |

|

. |

9 |

|

. |

17 |

|

|

. |

25 |

|

. |

|

Tax liability for Month 3 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2 |

|

. |

10 |

|

. |

18 |

|

|

. |

26 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

. |

11 |

|

. |

19 |

|

|

. |

27 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

. |

12 |

|

. |

20 |

|

|

. |

28 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

. |

13 |

|

. |

21 |

|

|

. |

29 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

. |

14 |

|

. |

22 |

|

|

. |

30 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

. |

15 |

|

. |

23 |

|

|

. |

31 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

. |

16 |

|

. |

24 |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability for the quarter |

|

|

|

|

Fill in your total liability for the quarter (Month 1 + Month 2 + Month 3) |

. |

|||||||||

|

|

|

|

|

|

Total must equal line 12 on Form 941 or Form |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

IRS.gov/form941 |

Cat. No. 11967Q |

Schedule B (Form 941) (Rev. |

|||||||||||

Detailed Instructions for Writing IRS Schedule B 941

Filling out the IRS Schedule B (Form 941) is an important task for employers who need to report their tax liabilities. After completing this form, you will submit it along with your Form 941 to ensure compliance with federal tax regulations. Follow these steps to fill out the form accurately.

- Begin with your business information at the top of the form. Enter your name, address, and Employer Identification Number (EIN).

- In the first section, indicate the quarter for which you are filing. This could be the first, second, third, or fourth quarter of the year.

- Next, check the box that applies to your situation. This may include whether you are a seasonal employer or if you have any adjustments to report.

- Report the total number of employees you had during the quarter in the designated space.

- Fill in the total wages paid to your employees during the quarter. Be sure to include all taxable wages.

- Calculate the total amount of federal income tax withheld from your employees’ wages. Enter this amount in the appropriate box.

- Provide information about any adjustments for fractions of cents, sick pay, or tips. This section is crucial for accurate reporting.

- Once all the information is filled in, double-check for any errors or omissions. Accuracy is key.

- Sign and date the form at the bottom. This certifies that the information provided is true and complete.

- Finally, keep a copy of the completed form for your records before submitting it with your Form 941.

Documents used along the form

The IRS Schedule B (Form 941) is a critical document for employers, providing detailed information about employment taxes. However, it is often accompanied by several other forms and documents that serve various purposes related to payroll and tax reporting. Understanding these forms can help ensure compliance and streamline the filing process.

- Form 941: This is the employer's quarterly federal tax return, where employers report wages paid, tips received, and taxes withheld from employees. It serves as the primary document for reporting payroll taxes.

- Form 940: This form is used to report annual Federal Unemployment Tax Act (FUTA) taxes. Employers must file it if they pay wages of $1,500 or more in any calendar quarter or have at least one employee for some part of a day in any 20 or more weeks during the year.

- Form W-2: Employers use this form to report wages, tips, and other compensation paid to employees, along with the taxes withheld. It is essential for employees when filing their personal tax returns.

- Durable Power of Attorney Form: To manage your financial affairs even during incapacity, consider our essential Durable Power of Attorney documentation for comprehensive legal planning.

- Form W-3: This is a summary form that accompanies the W-2 forms when they are submitted to the Social Security Administration. It provides a summary of total wages and taxes withheld for all employees.

- Form 1099-MISC: This form is used to report payments made to independent contractors and other non-employees. It is essential for businesses that hire freelancers or contractors.

- Form 1096: This is a summary form that must accompany paper submissions of certain information returns, including 1099 forms. It provides the IRS with a summary of the information being reported.

- Form SS-4: This application is used to apply for an Employer Identification Number (EIN), which is necessary for businesses to report taxes and hire employees legally.

- Form 8822: This form is used to notify the IRS of a change of address. Employers must keep their address current to ensure they receive important tax information and notices.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return from the IRS. Employers may need this to verify income or tax information for employees.

Each of these forms plays a significant role in the broader context of payroll and tax compliance. By understanding their purposes and how they interconnect, employers can better navigate the complexities of tax reporting and ensure they meet their obligations effectively.