Attorney-Approved Investment Letter of Intent Template

The Investment Letter of Intent (LOI) serves as a crucial preliminary document in the investment process, outlining the intentions of the parties involved before final agreements are reached. This form typically includes key details such as the amount of investment, the structure of the transaction, and any specific conditions that must be met prior to closing. It often addresses confidentiality, exclusivity, and timelines, ensuring that both the investor and the recipient are aligned on expectations. By clarifying the fundamental terms and intentions, the LOI helps to facilitate smoother negotiations and lays the groundwork for a more formal agreement. Understanding this document is essential for anyone looking to navigate the complexities of investment transactions effectively.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it’s essential to approach the task with care and attention. Here are some dos and don’ts to guide you through the process.

- Do read the entire form carefully before starting.

- Do provide accurate and up-to-date information.

- Do double-check your contact information for accuracy.

- Do clarify any terms or sections you don’t understand.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't use jargon or unclear language.

- Don't submit the form without reviewing it for errors.

- Don't forget to sign and date the form where required.

By following these guidelines, you can help ensure that your Investment Letter of Intent is completed correctly and efficiently. Taking the time to do it right can make a significant difference in the investment process.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent form outlines the preliminary agreement between parties interested in making an investment. |

| Binding Nature | This form is generally non-binding, meaning it expresses intent rather than creating enforceable obligations. |

| Governing Law | For state-specific forms, the governing law may vary. For example, in California, the law of the state of California governs the agreement. |

| Key Components | Common components include investment amount, terms of the investment, and timelines for completion. |

| Importance | It serves as a foundation for negotiations and helps clarify expectations between the parties involved. |

Key takeaways

Filling out an Investment Letter of Intent (LOI) is an important step in the investment process. Here are some key takeaways to keep in mind:

- Understand the Purpose: The LOI outlines the basic terms of a proposed investment. It serves as a starting point for negotiations.

- Be Clear and Concise: Use straightforward language. Clearly state your intentions to avoid misunderstandings later on.

- Include Essential Details: Make sure to include key information such as the amount of investment, the type of security, and the timeline for the transaction.

- Consider Legal Implications: Although the LOI is generally non-binding, it can still have legal consequences. Be mindful of the commitments you make.

- Review Before Submission: Take the time to review the form thoroughly. Errors or omissions can lead to complications down the line.

- Seek Professional Guidance: If you have any doubts, consult with a legal or financial advisor. Their expertise can help ensure you’re on the right track.

- Follow Up: After submitting the LOI, keep the lines of communication open. Regular follow-ups can help maintain momentum in the negotiation process.

By keeping these points in mind, you can navigate the Investment Letter of Intent process with confidence and clarity.

Popular Investment Letter of Intent Documents:

Real Estate Letter of Intent Sample - The Letter of Intent can be easily modified to suit both parties’ needs.

Example - Investment Letter of Intent Form

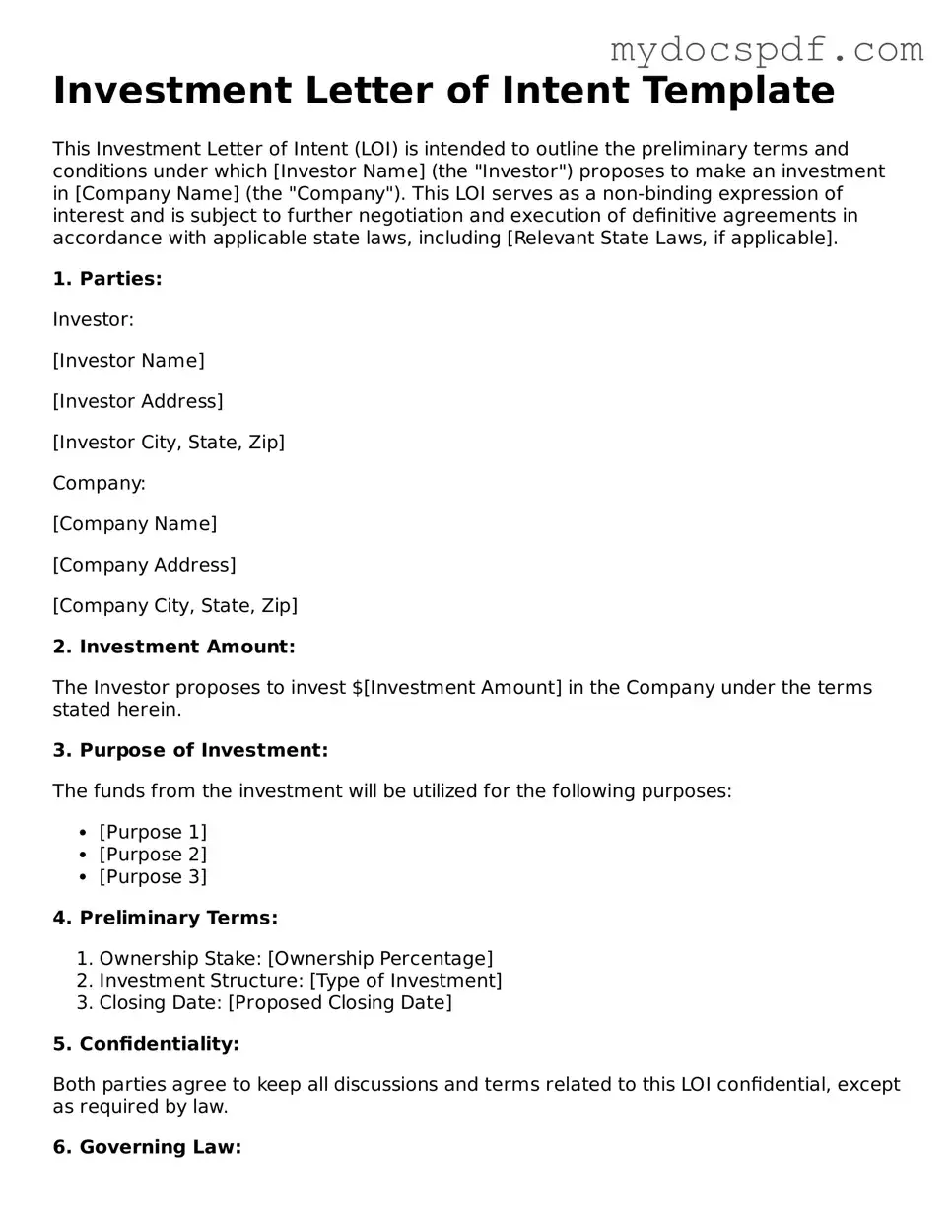

Investment Letter of Intent Template

This Investment Letter of Intent (LOI) is intended to outline the preliminary terms and conditions under which [Investor Name] (the "Investor") proposes to make an investment in [Company Name] (the "Company"). This LOI serves as a non-binding expression of interest and is subject to further negotiation and execution of definitive agreements in accordance with applicable state laws, including [Relevant State Laws, if applicable].

1. Parties:

Investor:

[Investor Name]

[Investor Address]

[Investor City, State, Zip]

Company:

[Company Name]

[Company Address]

[Company City, State, Zip]

2. Investment Amount:

The Investor proposes to invest $[Investment Amount] in the Company under the terms stated herein.

3. Purpose of Investment:

The funds from the investment will be utilized for the following purposes:

- [Purpose 1]

- [Purpose 2]

- [Purpose 3]

4. Preliminary Terms:

- Ownership Stake: [Ownership Percentage]

- Investment Structure: [Type of Investment]

- Closing Date: [Proposed Closing Date]

5. Confidentiality:

Both parties agree to keep all discussions and terms related to this LOI confidential, except as required by law.

6. Governing Law:

This LOI shall be governed by the laws of the State of [State].

7. Next Steps:

If the terms outlined in this LOI are acceptable, please sign below and return a copy to the Investor by [Response Date].

8. Signatures:

______________________________

[Investor Name] - Investor

Date: _______________

______________________________

[Company Name] - Company Representative

Date: _______________

Detailed Instructions for Writing Investment Letter of Intent

After you have gathered all necessary information, you are ready to complete the Investment Letter of Intent form. This form is crucial for outlining your investment intentions clearly. Follow these steps to ensure that you fill it out accurately and efficiently.

- Begin by entering your personal information at the top of the form. Include your full name, address, phone number, and email address.

- Next, provide details about the investment opportunity. Specify the type of investment you are interested in and the amount you intend to invest.

- In the designated section, outline your investment goals. Be clear and concise about what you hope to achieve.

- Indicate your preferred timeline for the investment. Include any deadlines or time frames that are relevant to your plans.

- Review the form for any additional information required. Ensure that you have filled out all sections completely.

- Sign and date the form at the bottom. Your signature indicates your commitment to the investment.

- Finally, make a copy of the completed form for your records before submitting it as instructed.

Once you have filled out the form, it will be reviewed by the appropriate parties. They will assess your intentions and reach out for any further information if needed. Be prepared for follow-up communication regarding the next steps in the investment process.

Documents used along the form

The Investment Letter of Intent (LOI) serves as a preliminary agreement outlining the key terms and intentions of parties involved in a potential investment. However, several other forms and documents often accompany the LOI to ensure a comprehensive understanding of the investment process and to protect the interests of all parties involved. Below are seven common documents that may be used alongside the Investment Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains confidential. It protects proprietary data and trade secrets during negotiations and discussions.

- Term Sheet: A term sheet outlines the basic terms and conditions of the investment. It serves as a summary of the key points that will be elaborated upon in the final agreement, including valuation, ownership percentages, and funding amounts.

- Due Diligence Checklist: This checklist is a tool used to evaluate the financial, operational, and legal aspects of a potential investment. It helps investors assess risks and opportunities before committing resources.

- Subscription Agreement: A subscription agreement is a contract between an investor and a company, detailing the terms under which the investor agrees to purchase shares or interests in the company. It typically includes information about the investment amount and the rights of the investor.

- Operating Agreement: For limited liability companies (LLCs), an operating agreement outlines the management structure and operating procedures. It defines the roles and responsibilities of members and managers, ensuring clarity in governance.

- Shareholder Agreement: This agreement is crucial for corporations, as it governs the relationship between shareholders. It includes provisions about share transfers, voting rights, and management decisions, helping to prevent disputes among investors.

- Investment Agreement: The investment agreement is a more detailed document that formalizes the investment terms, including the rights and obligations of both parties. It typically follows the LOI and serves as the binding contract once signed.

In summary, while the Investment Letter of Intent lays the groundwork for potential investment discussions, these accompanying documents play essential roles in clarifying terms, protecting interests, and ensuring a smooth transaction process. Each document contributes to a more structured and informed investment journey, paving the way for successful partnerships.