Get Intent To Lien Florida Form in PDF

The Intent to Lien Florida form serves as a crucial document for contractors, subcontractors, and suppliers who have not received payment for services or materials provided on a property. This form is designed to notify property owners of the intent to file a lien, which can lead to serious financial consequences if the matter is not resolved. It includes essential details such as the date of notice, the names and addresses of the property owner and general contractor, and a description of the property in question. The form also specifies the amount owed and outlines the legal implications of non-payment, including the potential for foreclosure and additional costs. Importantly, it must be sent at least 45 days before a lien is recorded, giving the property owner a chance to respond. The sender emphasizes the desire to resolve the issue amicably, encouraging prompt communication to avoid further legal action. Overall, understanding the Intent to Lien Florida form is vital for all parties involved in property improvements to protect their rights and interests.

Dos and Don'ts

When filling out the Intent To Lien Florida form, consider the following do's and don'ts:

- Do ensure all property owner names are spelled correctly.

- Do include the full mailing address of the property owner.

- Do specify the exact amount owed for the work performed.

- Do send the notice at least 45 days before filing a lien.

- Don't leave any sections of the form incomplete.

- Don't forget to sign and date the certificate of service.

Document Attributes

| Fact Name | Fact Description |

|---|---|

| Purpose | The Intent to Lien form serves as a notification to property owners that a lien may be filed due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien in Florida. |

| Notice Period | According to Florida law, the notice must be served at least 45 days before a lien is recorded against the property. |

| Response Time | Property owners have 30 days to respond to the notice. Failure to do so may result in the filing of a lien. |

| Consequences of Non-Payment | If a lien is recorded, the property may be subject to foreclosure proceedings, and the owner may incur additional costs such as attorney fees. |

Key takeaways

Filling out and using the Intent To Lien Florida form requires careful attention to detail. Here are four key takeaways to consider:

- Timeliness is crucial. The notice must be sent at least 45 days before filing a Claim of Lien. This timeframe is mandated by Florida law.

- Provide complete information. Ensure that all fields, including the property owner's name, mailing address, and the amount due, are filled out accurately to avoid complications.

- Understand the consequences of non-payment. If payment is not made within 30 days of sending the notice, a lien may be recorded, which can lead to foreclosure and additional costs.

- Keep a record of service. Document how the notice was delivered, whether by certified mail, hand delivery, or other methods. This serves as proof of compliance with legal requirements.

Other PDF Templates

Form Fillable Character Sheet 5e - A determined explorer who quests for ancient ruins and treasures.

Filling out the Child Support Texas form accurately is essential for both parents, as it ensures that their obligations are clearly defined and adhered to. For those seeking assistance or templates for this process, resources such as Texas Forms Online can be invaluable in helping to navigate child support requirements effectively.

Soccer Training Session Plan - Use small-sided games to encourage strategic thinking.

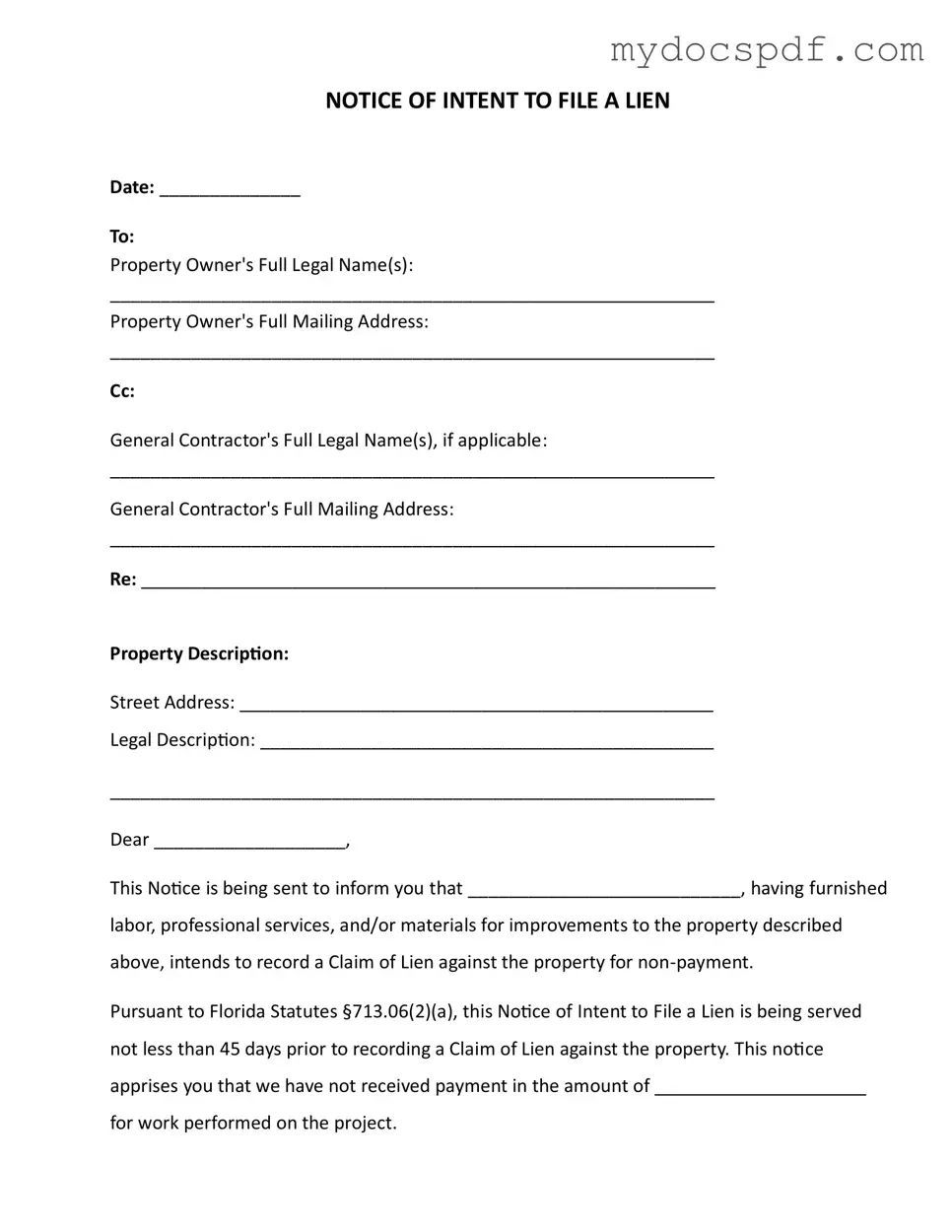

Example - Intent To Lien Florida Form

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Detailed Instructions for Writing Intent To Lien Florida

After completing the Intent To Lien form, it is important to ensure that all information is accurate and properly formatted before sending it to the property owner. The next steps involve serving the notice and keeping a record of the service method used. Follow the steps below to fill out the form correctly.

- Date: Write the current date at the top of the form.

- Property Owner's Full Legal Name(s): Fill in the full legal name(s) of the property owner.

- Property Owner's Full Mailing Address: Provide the complete mailing address of the property owner.

- General Contractor's Full Legal Name(s): If applicable, enter the full legal name(s) of the general contractor.

- General Contractor's Full Mailing Address: Include the complete mailing address of the general contractor, if applicable.

- Property Description: Write the street address of the property.

- Legal Description: Fill in the legal description of the property.

- Dear: Address the property owner by name.

- Furnisher's Name: Enter the name of the person or entity that provided labor, services, or materials.

- Amount Due: Specify the amount owed for the work performed.

- Signature: Sign the form with your name, title, phone number, and email address.

- Certificate of Service: Complete this section by indicating the date the notice was served, the name of the person it was served to, and the method of service used.

- Signature: Sign the certificate of service with your name and signature.

Documents used along the form

The Intent to Lien form is an important document used in Florida to notify property owners of an impending lien due to non-payment for services or materials provided. Several other forms and documents often accompany this form to ensure compliance with legal requirements and to protect the rights of all parties involved.

- Claim of Lien: This document is filed after the Notice of Intent to File a Lien if payment is not received. It formally establishes a lien against the property and provides a legal claim for the unpaid amount.

- Notice of Commencement: This document is typically filed at the beginning of a construction project. It provides essential information about the project, including the property owner, contractor, and a description of the work being done. It helps protect the rights of contractors and subcontractors.

- Durable Power of Attorney: This legal document allows an individual to act on another's behalf regarding financial matters and is crucial for estate planning, especially for those considering a newyorkform.com/free-durable-power-of-attorney-template.

- Release of Lien: Once payment has been received, this document is executed to remove the lien from the property. It formally indicates that the debt has been satisfied and that the property is no longer encumbered by the lien.

- Affidavit of Non-Payment: This document may be used to support a claim of lien. It provides evidence that payment was not received for services rendered or materials supplied, and it can strengthen the claim if legal action is necessary.

Understanding these documents can help individuals navigate the complexities of property liens and ensure that their rights are protected. It is advisable to seek assistance if any questions or concerns arise during the process.