Get Independent Contractor Pay Stub Form in PDF

In the world of freelance work and independent contracting, understanding payment documentation is essential for both contractors and clients. One critical piece of this puzzle is the Independent Contractor Pay Stub form, a document that serves as a detailed record of earnings for services rendered. This form typically includes vital information such as the contractor's name, the services provided, the payment period, and the total amount earned. It may also outline any deductions or withholdings, which can be particularly important for tax purposes. By providing a clear breakdown of earnings, the pay stub not only helps contractors keep track of their income but also ensures transparency between the contractor and the hiring entity. Furthermore, having this documentation on hand can simplify financial planning and tax filing, making it a valuable tool in the independent contractor's arsenal. Understanding the components of the pay stub empowers contractors to take charge of their finances and fosters a professional relationship with clients.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is essential to approach the task with care. Here are five important dos and don'ts to keep in mind:

- Do ensure that all personal information is accurate and up-to-date. This includes your name, address, and Social Security number.

- Do clearly list all services provided, along with the corresponding payment amounts. Transparency is crucial.

- Do calculate your total earnings accurately. Double-check your math to avoid errors.

- Do keep a copy of the completed pay stub for your records. Documentation is important for tax purposes.

- Do submit the pay stub in a timely manner to ensure prompt payment from the hiring party.

- Don't leave any sections blank. If a section does not apply, indicate that clearly instead of skipping it.

- Don't use vague descriptions for your services. Be specific to avoid confusion.

- Don't forget to include any deductions or taxes that may apply. This ensures a clear understanding of your net pay.

- Don't ignore the importance of professionalism. A well-organized pay stub reflects your commitment to your work.

- Don't submit the form without reviewing it first. Mistakes can lead to payment delays or disputes.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for an independent contractor for a specific pay period. |

| Purpose | This form serves to provide transparency regarding payment details, helping contractors keep accurate records for tax purposes. |

| Components | A typical pay stub includes the contractor's name, payment date, gross earnings, deductions, and net pay. |

| State-Specific Requirements | Some states have specific requirements for pay stubs, including California, which mandates that all deductions be clearly itemized according to the California Labor Code. |

| Tax Implications | Independent contractors must report their earnings on their tax returns, and the pay stub can serve as a record of income received throughout the year. |

| Legal Compliance | Employers must ensure that the information provided on the pay stub complies with both federal and state labor laws to avoid potential legal issues. |

| Record Keeping | Contractors are advised to keep copies of their pay stubs for at least three years, as they may be needed for tax audits or other financial reviews. |

Key takeaways

Filling out and using the Independent Contractor Pay Stub form can seem daunting, but it’s straightforward once you know what to focus on. Here are some key takeaways to keep in mind:

- Accurate Information: Always provide accurate personal and business information to avoid any issues with payments.

- Payment Details: Clearly outline the amount being paid for the services rendered. This ensures transparency.

- Tax Identification: Include your Tax Identification Number (TIN) or Social Security Number (SSN) to comply with tax regulations.

- Service Description: Describe the services provided. This helps both parties understand the nature of the work.

- Payment Date: Clearly indicate the payment date. This helps in tracking when payments are made.

- Signature: Don’t forget to sign the pay stub. A signature adds legitimacy to the document.

- Keep Copies: Always keep a copy of the pay stub for your records. This is useful for tax purposes and future reference.

- Check for Errors: Review the form for any mistakes before submitting it. Errors can lead to payment delays.

- Consult with a Professional: If unsure about any section, consider consulting with a tax professional for guidance.

- Understand Your Rights: Familiarize yourself with your rights as an independent contractor. This knowledge empowers you in your business dealings.

By keeping these takeaways in mind, you can fill out the Independent Contractor Pay Stub form with confidence and ease.

Other PDF Templates

Cna Shower Sheet Template - Attention to detail in this form can lead to timely interventions for skin care needs.

The Texas Motorcycle Bill of Sale form is essential for anyone looking to buy or sell a motorcycle, as it legally documents the sale and transfer of ownership. This form provides vital information regarding the parties involved and the motorcycle, ensuring a transparent transaction. For those in need of a convenient template, Texas Forms Online offers a helpful resource to facilitate this process and safeguard the interests of both the buyer and seller.

Acord Binder - The Acord 50 WM is a pivotal document in the event of a disputed claim.

Where to Find Medicare Number - The CMS-1763 provides a clear avenue for terminating Medicare enrollment.

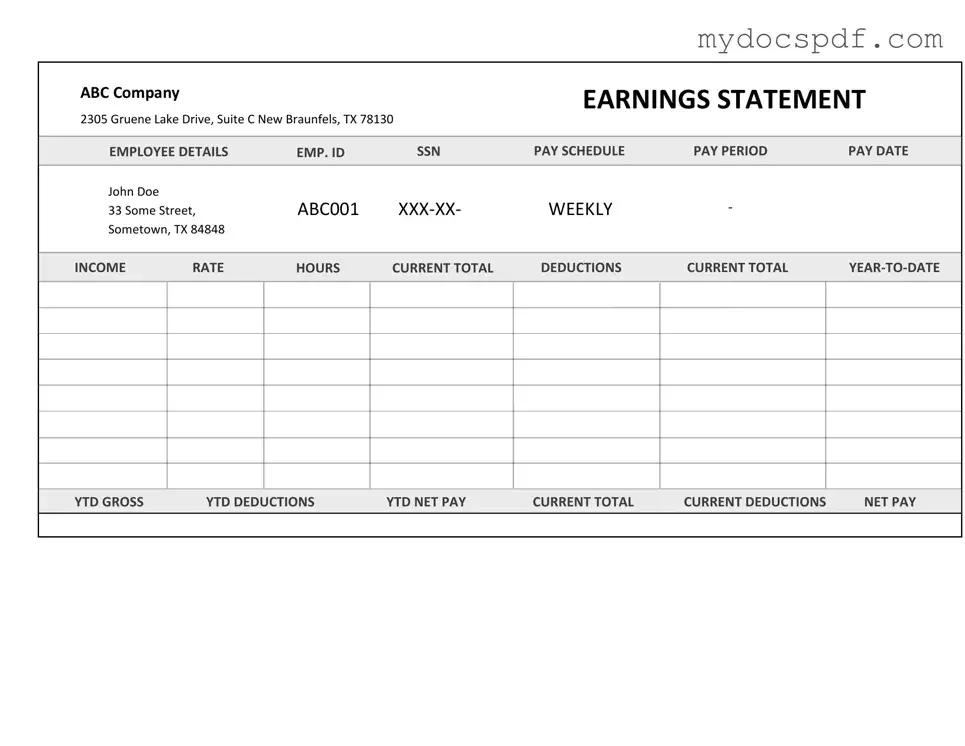

Example - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Detailed Instructions for Writing Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is straightforward. By following these steps, you can ensure that all necessary information is accurately recorded. This will help in maintaining clear records for both you and the contractor.

- Gather necessary information: Collect all relevant details such as the contractor's name, address, and Social Security number.

- Fill in the contractor's details: Write the contractor's name and address in the designated fields on the form.

- Enter the pay period: Specify the start and end dates of the pay period for which the payment is being made.

- Record the payment amount: Clearly state the total amount being paid to the contractor for the work completed during the pay period.

- Include any deductions: If applicable, list any deductions such as taxes or benefits that should be taken out of the payment.

- Review the information: Double-check all entries for accuracy. Ensure that names, dates, and amounts are correct.

- Sign the form: The pay stub should be signed by the person issuing the payment to confirm its authenticity.

- Distribute the pay stub: Provide a copy of the completed pay stub to the contractor for their records.

Documents used along the form

When working with independent contractors, several key documents often accompany the Independent Contractor Pay Stub form. Each of these documents plays a vital role in ensuring clarity and compliance in the contractor-client relationship. Understanding them can help both parties navigate their financial and legal obligations more smoothly.

- Independent Contractor Agreement: This document outlines the terms of the working relationship between the contractor and the client. It typically includes details such as the scope of work, payment terms, and confidentiality clauses. Having a clear agreement helps prevent misunderstandings down the line.

- California Employment Verification Form: To understand your rights as an employee, consult the important California Employment Verification form details that clarify employment status verification processes.

- W-9 Form: This form is used by independent contractors to provide their taxpayer identification number to the client. It is essential for tax reporting purposes, as the client will need this information when filing their taxes at the end of the year.

- Invoice: An invoice is a request for payment that the contractor submits to the client for services rendered. It usually includes details like the amount due, payment terms, and a breakdown of services provided. This document helps keep track of payments and ensures both parties are on the same page regarding financial transactions.

- 1099 Form: At the end of the tax year, clients must issue a 1099 form to independent contractors who have earned more than a certain amount. This form reports the total income paid to the contractor, which they will use when filing their taxes. It's an important document for tax compliance.

By familiarizing yourself with these documents, you can foster a more transparent and organized working relationship with independent contractors. Each form serves a specific purpose, and together they create a comprehensive framework for managing independent contractor engagements effectively.