Fillable Idaho Transfer-on-Death Deed Document

In the realm of estate planning, the Idaho Transfer-on-Death Deed (TODD) offers a straightforward and effective way for property owners to ensure their real estate is passed on to their chosen beneficiaries without the need for probate. This legal tool allows individuals to designate one or more beneficiaries who will automatically receive the property upon the owner’s death, streamlining the transfer process. By filling out and recording this deed, property owners can maintain control of their assets during their lifetime while providing clarity and ease for their heirs. The form requires essential information, such as the property description and the names of the beneficiaries, and must be executed according to Idaho law to be valid. Moreover, this deed does not affect the owner's rights to the property while they are alive, allowing for continued use and enjoyment. Understanding the nuances of the Idaho Transfer-on-Death Deed can empower individuals to make informed decisions about their estate, ultimately leading to a smoother transition for their loved ones after they are gone.

Dos and Don'ts

When filling out the Idaho Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are some dos and don'ts to keep in mind:

- Do ensure that you are eligible to use the Transfer-on-Death Deed in Idaho.

- Do clearly identify the property you wish to transfer, including its legal description.

- Do provide accurate information about the beneficiaries, including their full names and addresses.

- Do sign the deed in the presence of a notary public.

- Do file the completed deed with the county recorder's office where the property is located.

- Don't leave out any required information on the form.

- Don't use vague descriptions of the property; be as specific as possible.

- Don't forget to check for any local requirements that may apply.

- Don't assume that verbal agreements about the deed are sufficient; everything must be in writing.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | The Idaho Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Idaho Code § 15-2-2501 to 15-2-2508. |

| Eligibility | Any individual who owns real property in Idaho can create a Transfer-on-Death Deed. |

| Revocation | The property owner can revoke the deed at any time before their death by executing a new deed or a written revocation. |

| Recording Requirements | The deed must be recorded with the county recorder's office in the county where the property is located to be effective. |

| Beneficiary Rights | Beneficiaries do not have rights to the property until the owner's death, ensuring the owner retains full control during their lifetime. |

Key takeaways

When filling out and using the Idaho Transfer-on-Death Deed form, keep these key takeaways in mind:

- Eligibility: Ensure that you own the property outright and that it is not subject to any liens or encumbrances that could complicate the transfer.

- Beneficiary Designation: Clearly specify the beneficiary or beneficiaries who will receive the property upon your death. Be precise to avoid confusion.

- Signature Requirements: The deed must be signed by the owner in front of a notary public. This step is crucial for the deed to be valid.

- Filing the Deed: After signing, file the deed with the county recorder's office where the property is located. This action officially records the transfer-on-death designation.

- Revocation: You can revoke the deed at any time before your death. Ensure that any revocation is properly documented and filed.

Popular State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Form Florida - Can enhance planning for elder citizens focused on legacy and property distribution.

The Texas Motorcycle Bill of Sale form is a crucial legal document that not only records the sale and transfer of ownership of a motorcycle but also provides both the buyer and seller with peace of mind. By using resources like Texas Forms Online, individuals can ensure that their transactions are documented accurately, detailing all necessary information about the motorcycle and its new owner.

Problems With Transfer on Death Deeds Ohio - A Transfer-on-Death Deed allows you to transfer real estate to a beneficiary upon your death without going through probate.

Example - Idaho Transfer-on-Death Deed Form

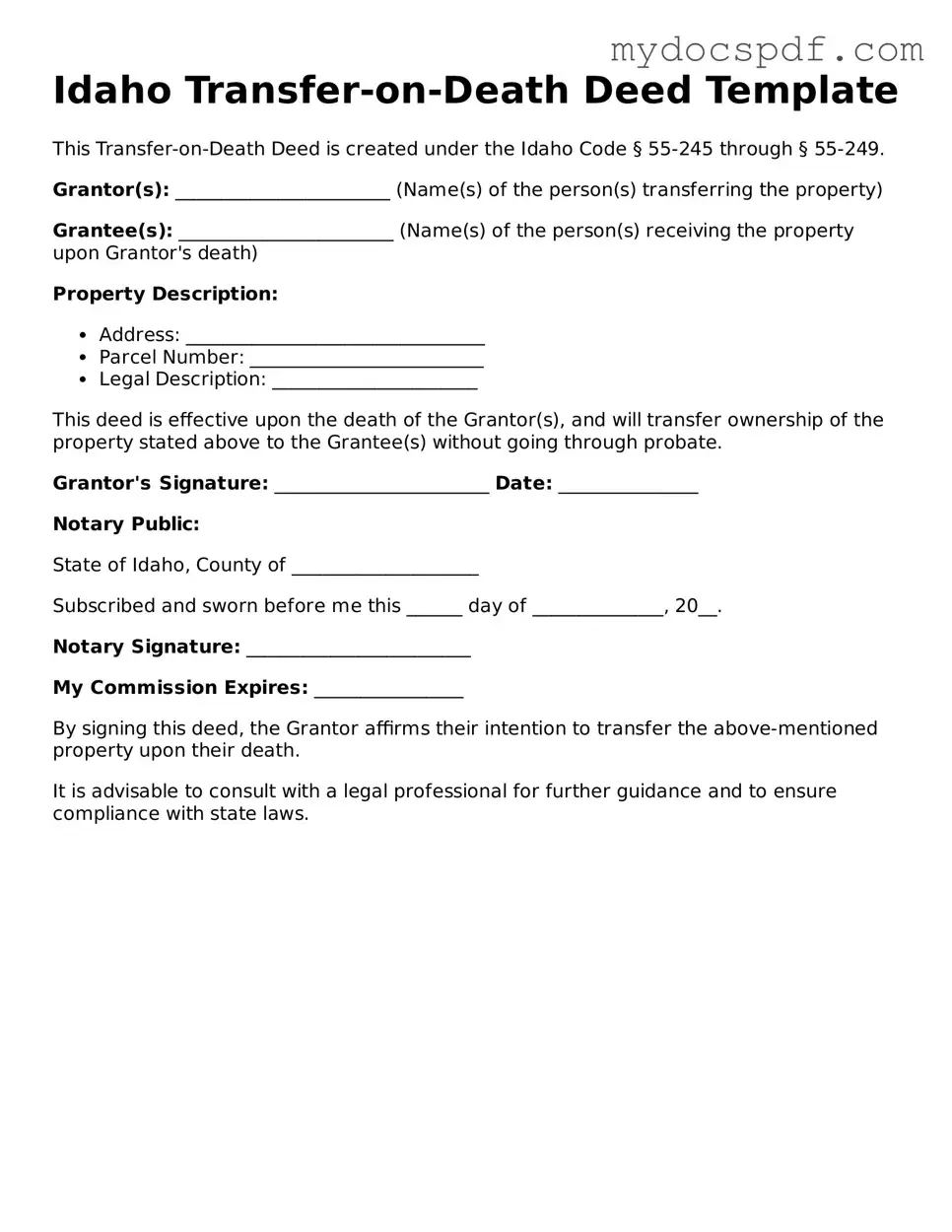

Idaho Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created under the Idaho Code § 55-245 through § 55-249.

Grantor(s): _______________________ (Name(s) of the person(s) transferring the property)

Grantee(s): _______________________ (Name(s) of the person(s) receiving the property upon Grantor's death)

Property Description:

- Address: ________________________________

- Parcel Number: _________________________

- Legal Description: ______________________

This deed is effective upon the death of the Grantor(s), and will transfer ownership of the property stated above to the Grantee(s) without going through probate.

Grantor's Signature: _______________________ Date: _______________

Notary Public:

State of Idaho, County of ____________________

Subscribed and sworn before me this ______ day of ______________, 20__.

Notary Signature: ________________________

My Commission Expires: ________________

By signing this deed, the Grantor affirms their intention to transfer the above-mentioned property upon their death.

It is advisable to consult with a legal professional for further guidance and to ensure compliance with state laws.

Detailed Instructions for Writing Idaho Transfer-on-Death Deed

Once you have the Idaho Transfer-on-Death Deed form in hand, it's time to fill it out accurately. This form allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Follow these steps to ensure that the form is completed correctly.

- Gather Necessary Information: Collect the full names and addresses of both the property owner(s) and the beneficiary(ies). Ensure you have the legal description of the property, which can typically be found on your property tax statement or deed.

- Fill in the Property Owner Information: Start by entering the names of the current property owner(s) in the designated section of the form. Include any middle names or initials to avoid confusion.

- Provide Beneficiary Details: Next, write the full name and address of the beneficiary you wish to designate. If there are multiple beneficiaries, list them all clearly.

- Describe the Property: In this section, provide the legal description of the property. This should include the address and any specific identifiers, such as parcel numbers.

- Sign the Document: The property owner(s) must sign the deed in front of a notary public. Ensure that the notary public also signs and stamps the document to validate it.

- Record the Deed: After completing and notarizing the form, take it to the county recorder's office where the property is located. Pay any required fees to have the deed officially recorded.

- Keep a Copy: Finally, make copies of the recorded deed for your records and provide a copy to the beneficiary, if appropriate.

Documents used along the form

The Idaho Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit real estate upon their death, bypassing probate. When utilizing this deed, several other forms and documents may be necessary to ensure a smooth transfer of property and to address related legal matters. Below is a list of common documents that often accompany the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed upon their death. It can complement the Transfer-on-Death Deed by detailing other assets not covered by the deed.

- New York Dtf 84 Form: This essential document can be accessed at https://newyorkform.com/free-new-york-dtf-84-template/ and is crucial for businesses in New York to update their address with the tax department efficiently.

- Beneficiary Designation Forms: These forms are used for various financial accounts, such as life insurance policies or retirement accounts, allowing individuals to name beneficiaries directly.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal or financial matters. It may be useful if the property owner becomes incapacitated.

- Affidavit of Heirship: This sworn statement identifies heirs to a deceased person's estate, which can clarify ownership and rights to property not transferred via the deed.

- Quitclaim Deed: This form is used to transfer property ownership without any warranties. It can serve to clarify ownership interests or to add or remove names from the title.

- Deed of Trust: This document secures a loan with real estate as collateral. It may be relevant if there are existing mortgages on the property being transferred.

- Property Tax Exemption Forms: Depending on the property type and the beneficiaries, these forms can help ensure that the property remains eligible for certain tax benefits after the transfer.

Understanding these additional documents is essential for a seamless property transfer process. Each serves a unique purpose and can help avoid complications during the transition of ownership.