Fillable Idaho Promissory Note Document

When navigating the realm of personal and business financing, understanding the Idaho Promissory Note form is essential for both borrowers and lenders. This document serves as a written promise to repay a specified amount of money, detailing critical elements such as the principal amount, interest rate, repayment schedule, and any applicable late fees. Additionally, it outlines the rights and responsibilities of both parties involved, ensuring clarity and protection throughout the lending process. The form is designed to be straightforward, allowing individuals to customize terms to fit their unique agreements. By incorporating essential information such as the date of the loan, the names of the parties, and signatures, the Idaho Promissory Note establishes a legally binding contract that can be enforced in a court of law if necessary. Understanding these components can help parties make informed decisions and foster trust in their financial transactions.

Dos and Don'ts

When filling out the Idaho Promissory Note form, it’s important to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure that your document is completed accurately and effectively.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information, including names, addresses, and loan amounts.

- Do clearly state the interest rate and payment terms.

- Do sign and date the document in the appropriate sections.

- Do keep a copy of the signed Promissory Note for your records.

- Don’t leave any required fields blank; this can lead to confusion or disputes later.

- Don’t use unclear or vague language when describing the loan terms.

- Don’t forget to have witnesses or notarization if required.

- Don’t assume that verbal agreements will suffice; everything should be documented.

By following these guidelines, you can help ensure that your Idaho Promissory Note is clear, enforceable, and serves its intended purpose.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | An Idaho Promissory Note is a written promise by one party to pay a specific amount of money to another party at a designated time or on demand. |

| Governing Laws | The Idaho Promissory Note is governed by Idaho Code Title 28, Chapter 22, which covers negotiable instruments. |

| Types of Notes | Promissory Notes can be secured or unsecured. A secured note is backed by collateral, while an unsecured note is not. |

| Interest Rates | Idaho law allows parties to agree on interest rates, but they must comply with state usury laws to avoid excessive charges. |

| Enforceability | A properly executed promissory note is legally enforceable in court, provided it meets all necessary legal requirements. |

Key takeaways

When filling out and using the Idaho Promissory Note form, it's important to keep several key points in mind:

- Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are properly identified.

- Specify the loan amount. This figure should be accurate and reflect the total amount being borrowed.

- Include the interest rate, if applicable. This rate should be stated clearly to avoid any misunderstandings later on.

- Outline the repayment schedule. Detail when payments are due and the frequency of those payments, whether monthly, quarterly, or otherwise.

- Indicate any late fees or penalties for missed payments. This helps to set expectations for both parties regarding payment timelines.

- Include a section for signatures. Both the borrower and lender should sign and date the document to validate the agreement.

- Keep a copy of the signed note for your records. This provides proof of the agreement and can be referenced in the future if needed.

Popular State-specific Promissory Note Forms

Notarized Promissory Note - The document provides peace of mind for the lender, knowing the borrower’s obligations.

Georgia Promissory Note - It's important to clearly articulate the purpose of the loan within the document.

When considering the necessity of a Power of Attorney, it's important to explore available resources, such as the one provided by NY Templates, which can assist individuals in understanding and properly drafting this critical legal document to ensure their financial and legal matters are effectively managed.

Promissory Note Template California Word - Promissory notes are useful tools for tracking personal loans, as they formalize the agreement.

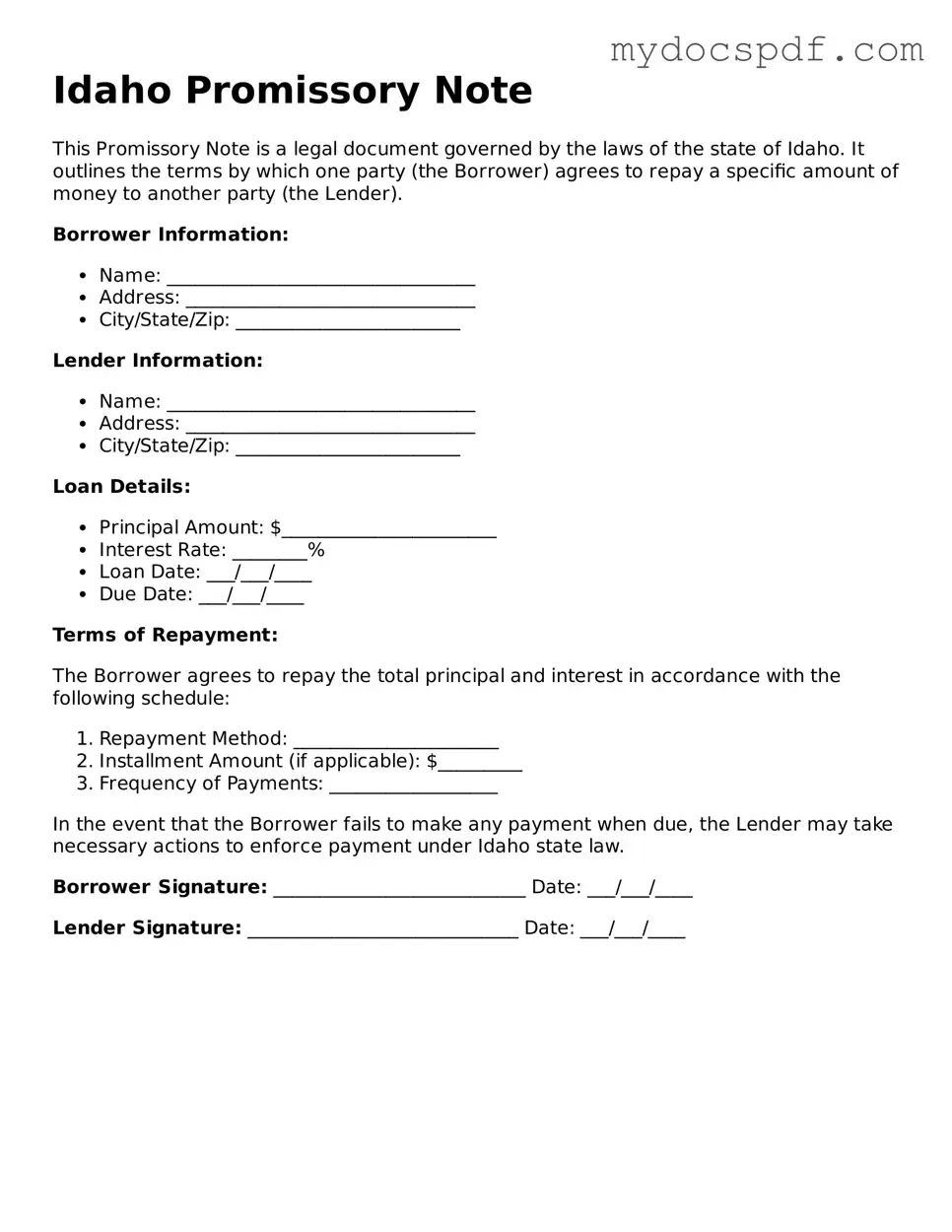

Example - Idaho Promissory Note Form

Idaho Promissory Note

This Promissory Note is a legal document governed by the laws of the state of Idaho. It outlines the terms by which one party (the Borrower) agrees to repay a specific amount of money to another party (the Lender).

Borrower Information:

- Name: _________________________________

- Address: _______________________________

- City/State/Zip: ________________________

Lender Information:

- Name: _________________________________

- Address: _______________________________

- City/State/Zip: ________________________

Loan Details:

- Principal Amount: $_______________________

- Interest Rate: ________%

- Loan Date: ___/___/____

- Due Date: ___/___/____

Terms of Repayment:

The Borrower agrees to repay the total principal and interest in accordance with the following schedule:

- Repayment Method: ______________________

- Installment Amount (if applicable): $_________

- Frequency of Payments: __________________

In the event that the Borrower fails to make any payment when due, the Lender may take necessary actions to enforce payment under Idaho state law.

Borrower Signature: ___________________________ Date: ___/___/____

Lender Signature: _____________________________ Date: ___/___/____

Detailed Instructions for Writing Idaho Promissory Note

Once you have the Idaho Promissory Note form ready, you will need to fill it out accurately to ensure that all necessary information is included. This process is straightforward, and following the steps below will help you complete the form correctly.

- Begin by entering the date at the top of the form. Make sure to use the format month, day, and year.

- Next, write the name and address of the borrower. This information should be clear and complete.

- Now, enter the name and address of the lender. Ensure that this information is also accurate.

- Specify the principal amount being borrowed. This is the total sum that the borrower agrees to repay.

- Indicate the interest rate, if applicable. If there is no interest, you can leave this section blank.

- Fill in the repayment terms. This includes the schedule of payments, such as monthly or quarterly, and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable. This helps clarify what happens if payments are not made on time.

- Next, both the borrower and lender should sign and date the form. This signifies agreement to the terms outlined in the note.

After completing the form, keep a copy for your records. It is also wise to provide a copy to the other party involved. This ensures that everyone is on the same page regarding the terms of the loan.

Documents used along the form

A promissory note is a critical document in lending agreements, particularly in Idaho. It serves as a written promise to repay a specified amount of money, under agreed-upon terms. However, several other forms and documents often accompany a promissory note to ensure clarity and legal compliance. Below are some of these documents that may be used in conjunction with the Idaho Promissory Note form.

- Loan Agreement: This document outlines the terms of the loan, including the interest rate, repayment schedule, and any conditions that both parties must adhere to. It provides a comprehensive understanding of the obligations involved.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged to guarantee repayment. It protects the lender's interests in the event of default.

- Disclosure Statement: This document provides essential information about the loan, such as fees, interest rates, and the total cost of borrowing. It ensures that the borrower is fully informed before entering into the agreement.

- Motorcycle Bill of Sale: This essential document ensures a transparent transfer of motorcycle ownership, covering vital details of the transaction, and can be found at newyorkform.com/free-motorcycle-bill-of-sale-template/.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the loan, adding an extra layer of security for the lender.

Understanding these accompanying documents is vital for both lenders and borrowers. Each plays a specific role in the lending process, helping to clarify expectations and protect the interests of all parties involved.