Fillable Idaho Last Will and Testament Document

Creating a Last Will and Testament is a critical step in ensuring that your wishes regarding your estate are honored after your passing. In Idaho, the Last Will and Testament form serves as a legal document that outlines how your assets will be distributed, who will manage your estate, and any specific wishes you may have regarding guardianship for minor children. This form is designed to reflect your personal intentions, allowing you to designate beneficiaries, specify funeral arrangements, and even include provisions for pets. Understanding the requirements and components of the Idaho Last Will and Testament is essential, as it not only helps to clarify your desires but also aids in minimizing potential disputes among family members. Additionally, this form must be executed according to Idaho law, which includes signing it in the presence of witnesses, ensuring that it holds up in court. By taking the time to craft a comprehensive will, individuals can provide peace of mind for themselves and their loved ones, knowing that their affairs will be managed according to their wishes.

Dos and Don'ts

When filling out the Idaho Last Will and Testament form, it is essential to approach the task with care and attention to detail. Here are some important dos and don'ts to consider:

- Do clearly state your intentions regarding the distribution of your assets.

- Do ensure that you are of sound mind and at least 18 years old when signing the will.

- Do sign the will in the presence of two witnesses who are not beneficiaries.

- Do keep the will in a safe place and inform your executor of its location.

- Don't use vague language that could lead to confusion about your wishes.

- Don't forget to update your will after significant life events, such as marriage or the birth of a child.

PDF Properties

| Fact Name | Details |

|---|---|

| Governing Law | The Idaho Last Will and Testament is governed by Idaho Code Title 15, Chapter 2. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Idaho. |

| Witness Requirement | A will must be signed by at least two witnesses who are present at the same time. |

| Signature | The testator must sign the will, or someone else can sign on their behalf in their presence. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Holographic Wills | Idaho recognizes holographic wills, which are handwritten and signed by the testator. |

| Self-Proving Wills | Wills can be made self-proving by including a notarized affidavit from the witnesses. |

| Probate Process | The will must go through the probate process in Idaho to ensure its validity and distribute assets. |

Key takeaways

When filling out and using the Idaho Last Will and Testament form, keep the following key points in mind:

- Make sure you are at least 18 years old and of sound mind to create a valid will.

- Clearly identify yourself at the beginning of the document to avoid confusion.

- List all your assets and specify how you want them distributed among your beneficiaries.

- Choose an executor who will carry out your wishes as stated in the will.

- Sign the will in the presence of at least two witnesses who also need to sign it.

- Consider having your will notarized for added legal protection, though it is not required in Idaho.

- Keep the original copy of the will in a safe place, and inform your executor about its location.

- Review and update your will regularly, especially after major life changes like marriage or the birth of a child.

Popular State-specific Last Will and Testament Forms

Free Will Template Massachusetts - Can appoint an executor to manage the distribution of the estate.

Wills in Georgia - Acts as a final expression of personal values and beliefs.

Using the Texas Affidavit of Correction form is crucial for individuals who need to rectify errors in public records. This legal document ensures that mistakes, whether they are typographical errors or incorrect information, are amended efficiently. By submitting the affidavit, one can uphold the accuracy and integrity of their official records. For those seeking a reliable source to obtain this form, Texas Forms Online provides a valuable template to assist in the correction process.

Lawyer to Write a Will - Without a Last Will, your estate may go through a lengthy legal process called probate, which can be costly and time-consuming.

Example - Idaho Last Will and Testament Form

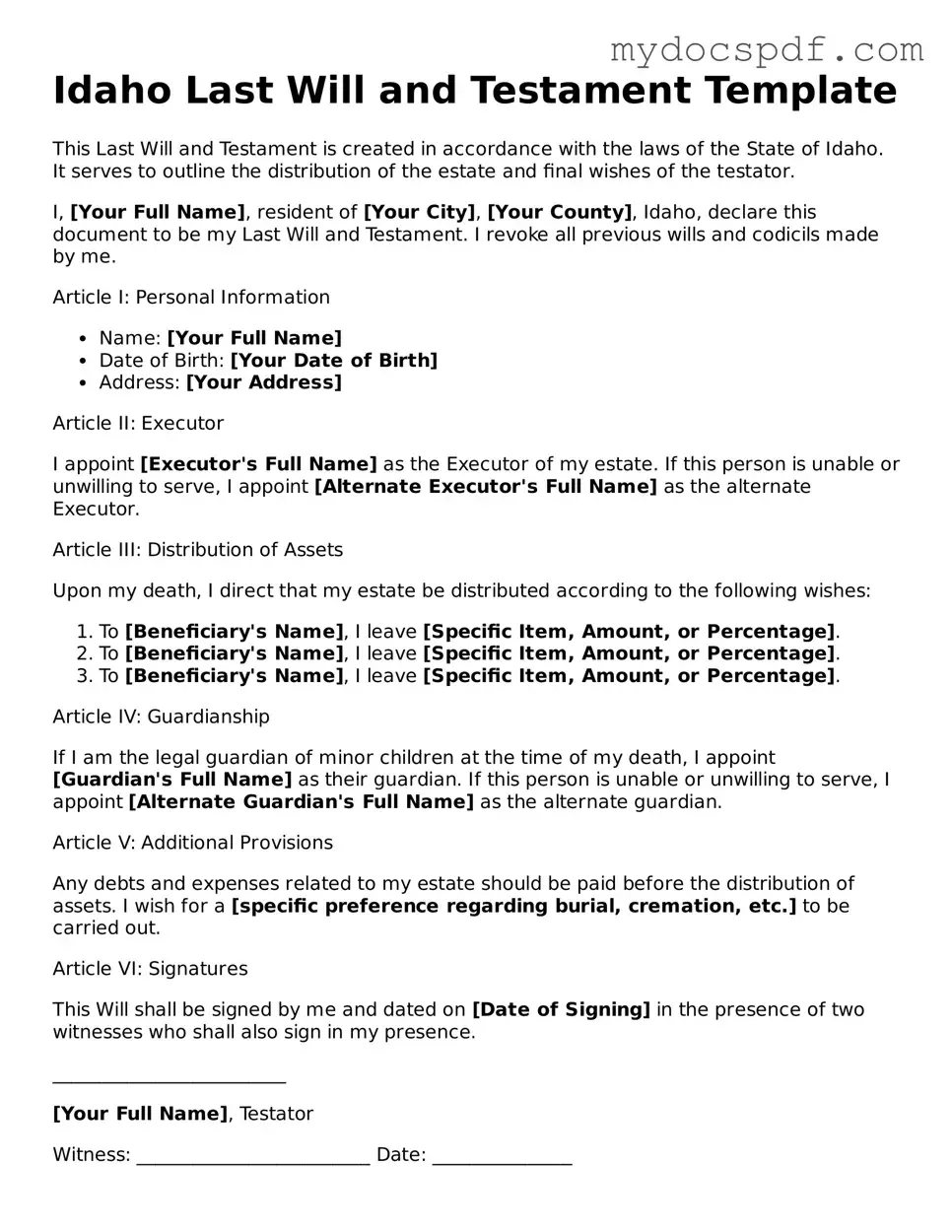

Idaho Last Will and Testament Template

This Last Will and Testament is created in accordance with the laws of the State of Idaho. It serves to outline the distribution of the estate and final wishes of the testator.

I, [Your Full Name], resident of [Your City], [Your County], Idaho, declare this document to be my Last Will and Testament. I revoke all previous wills and codicils made by me.

Article I: Personal Information

- Name: [Your Full Name]

- Date of Birth: [Your Date of Birth]

- Address: [Your Address]

Article II: Executor

I appoint [Executor's Full Name] as the Executor of my estate. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

Article III: Distribution of Assets

Upon my death, I direct that my estate be distributed according to the following wishes:

- To [Beneficiary's Name], I leave [Specific Item, Amount, or Percentage].

- To [Beneficiary's Name], I leave [Specific Item, Amount, or Percentage].

- To [Beneficiary's Name], I leave [Specific Item, Amount, or Percentage].

Article IV: Guardianship

If I am the legal guardian of minor children at the time of my death, I appoint [Guardian's Full Name] as their guardian. If this person is unable or unwilling to serve, I appoint [Alternate Guardian's Full Name] as the alternate guardian.

Article V: Additional Provisions

Any debts and expenses related to my estate should be paid before the distribution of assets. I wish for a [specific preference regarding burial, cremation, etc.] to be carried out.

Article VI: Signatures

This Will shall be signed by me and dated on [Date of Signing] in the presence of two witnesses who shall also sign in my presence.

_________________________

[Your Full Name], Testator

Witness: _________________________ Date: _______________

Witness: _________________________ Date: _______________

By signing this document, I confirm that I am at least 18 years old and of sound mind.

Detailed Instructions for Writing Idaho Last Will and Testament

Completing the Idaho Last Will and Testament form is an important step in ensuring that your wishes regarding your estate are clearly documented. After filling out the form, you will need to sign it in front of witnesses to make it legally binding. This process helps to ensure that your intentions are honored after your passing.

- Begin by obtaining the Idaho Last Will and Testament form. You can find it online or through legal offices.

- Read through the entire form carefully to understand the sections that need to be completed.

- Fill in your full legal name and address at the top of the form.

- Identify your beneficiaries by listing their names and addresses. Be specific about what each person will receive.

- Designate an executor. This is the person responsible for managing your estate. Include their full name and address.

- If you have minor children, appoint a guardian for them. Provide the guardian’s name and address.

- Include any specific bequests you wish to make, detailing any particular items or amounts of money you want to leave to certain individuals.

- Review the form to ensure all information is accurate and complete.

- Sign the form in the presence of at least two witnesses. Ensure that they also sign the document.

- Store the completed will in a safe place, and inform your executor and family members of its location.

Documents used along the form

When preparing a Last Will and Testament in Idaho, several other documents may be beneficial to ensure that your wishes are clearly expressed and legally upheld. Each of these documents serves a unique purpose in the estate planning process.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. It grants the agent the authority to make decisions on your behalf, ensuring that your financial matters are handled according to your wishes.

- Healthcare Power of Attorney: Similar to a durable power of attorney, this document designates an individual to make medical decisions for you if you are unable to do so. It is crucial for ensuring that your healthcare preferences are respected.

- Living Will: A living will outlines your preferences regarding medical treatment and life-sustaining measures in the event that you are terminally ill or incapacitated. This document helps guide your healthcare providers and loved ones in making decisions that align with your values.

- Trust Documents: A trust can be established to manage your assets during your lifetime and after your death. Trusts can help avoid probate and provide more control over how your assets are distributed, often leading to quicker and more private transfers to beneficiaries.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. Keeping these designations updated is essential, as they can override your will in the distribution of those assets.

- Rental Application Form: Essential for landlords to gather details from potential tenants, the NY Templates provide a comprehensive template to streamline this process.

- Letter of Intent: This informal document is not legally binding but can provide guidance to your executor or loved ones. It can outline your wishes regarding funeral arrangements, distribution of personal items, or other specific instructions that may not be detailed in your will.

Incorporating these documents into your estate planning can provide clarity and help ensure that your wishes are honored. Each plays a significant role in managing your affairs and protecting your loved ones during difficult times.