Fillable Idaho Articles of Incorporation Document

Incorporating a business in Idaho is a critical step for entrepreneurs looking to establish a legal entity that can protect their personal assets and enhance credibility. The Idaho Articles of Incorporation form serves as the foundational document for this process, outlining essential information about the corporation. This includes the corporation's name, which must be unique and compliant with state regulations, as well as the purpose of the business. Additionally, the form requires details about the registered agent, who will serve as the official point of contact for legal matters. The number of shares the corporation is authorized to issue and the names and addresses of the initial directors are also vital components. Completing this form accurately is crucial, as any errors can lead to delays or complications in the incorporation process. Entrepreneurs must ensure they meet all state requirements to successfully file their Articles of Incorporation and begin their journey toward building a thriving business in Idaho.

Dos and Don'ts

When filling out the Idaho Articles of Incorporation form, it's important to follow certain guidelines to ensure your submission is successful. Here are six key do's and don'ts to keep in mind:

- Do provide accurate and complete information. Double-check names, addresses, and other details to avoid delays.

- Do include the purpose of your corporation. Be clear and concise about what your business will do.

- Do ensure that the registered agent's information is correct. This person or entity will receive legal documents on behalf of your corporation.

- Do file the form with the appropriate fee. Check the latest fee schedule to avoid any surprises.

- Don't leave any required fields blank. Missing information can lead to rejection of your application.

- Don't use overly complex language. Keep your descriptions straightforward and easy to understand.

PDF Properties

| Fact Name | Details |

|---|---|

| Governing Law | The Idaho Articles of Incorporation are governed by Title 30, Chapter 29 of the Idaho Code. |

| Purpose | This form is used to officially create a corporation in Idaho. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations in Idaho. |

| Filing Fee | The standard filing fee for the Articles of Incorporation is $100. |

| Minimum Information | The form requires the corporation's name, duration, and registered agent information. |

| Registered Agent | A registered agent must have a physical address in Idaho and be available during business hours. |

| Effective Date | The corporation can specify an effective date for the Articles, which can be up to 90 days in the future. |

| Submission Method | Articles can be filed online, by mail, or in person at the Idaho Secretary of State's office. |

| Amendments | Changes to the Articles of Incorporation require filing an amendment with the Secretary of State. |

Key takeaways

Filling out the Idaho Articles of Incorporation form is an essential step in establishing a corporation in the state. Understanding the requirements and processes involved can help ensure a smooth incorporation experience. Here are some key takeaways to consider:

- Ensure that you have a unique name for your corporation. The name must not be similar to any existing entities registered in Idaho.

- Designate a registered agent who will be responsible for receiving legal documents on behalf of the corporation. This agent must have a physical address in Idaho.

- Clearly define the purpose of your corporation. This should be a brief statement outlining the business activities you intend to pursue.

- Provide the names and addresses of the initial directors. This information is crucial for establishing the leadership of your corporation.

- Include the number of shares your corporation is authorized to issue. Specify the classes of shares if applicable, as this affects ownership structure.

- Be prepared to pay the required filing fee. This fee is necessary for the processing of your Articles of Incorporation.

- Once submitted, keep a copy of the Articles for your records. This document serves as proof of your corporation's legal existence.

By following these guidelines, you can navigate the incorporation process with confidence. Each step is designed to help establish a solid foundation for your new business venture.

Popular State-specific Articles of Incorporation Forms

Articles of Incorporation Georgia Template - The principal office address of the corporation is specified in the Articles.

Ma Secretary of State Annual Report - The form identifies the type of corporation being formed, such as a nonprofit or for-profit entity.

The Texas Power of Attorney form is a crucial legal instrument that enables individuals to appoint someone to make decisions on their behalf when they are unable to do so. This encompasses various issues, including financial management and healthcare decisions. To properly utilize this form and ensure that your preferences are respected, it is beneficial to reference templates and resources, such as Texas Forms Online, which provide helpful guidance and formats for completion.

Florida Dept of State Division of Corporations - It specifies the purpose of the business operation.

How to Form an Llc in California - The Articles help define the relationship between shareholders and the corporation.

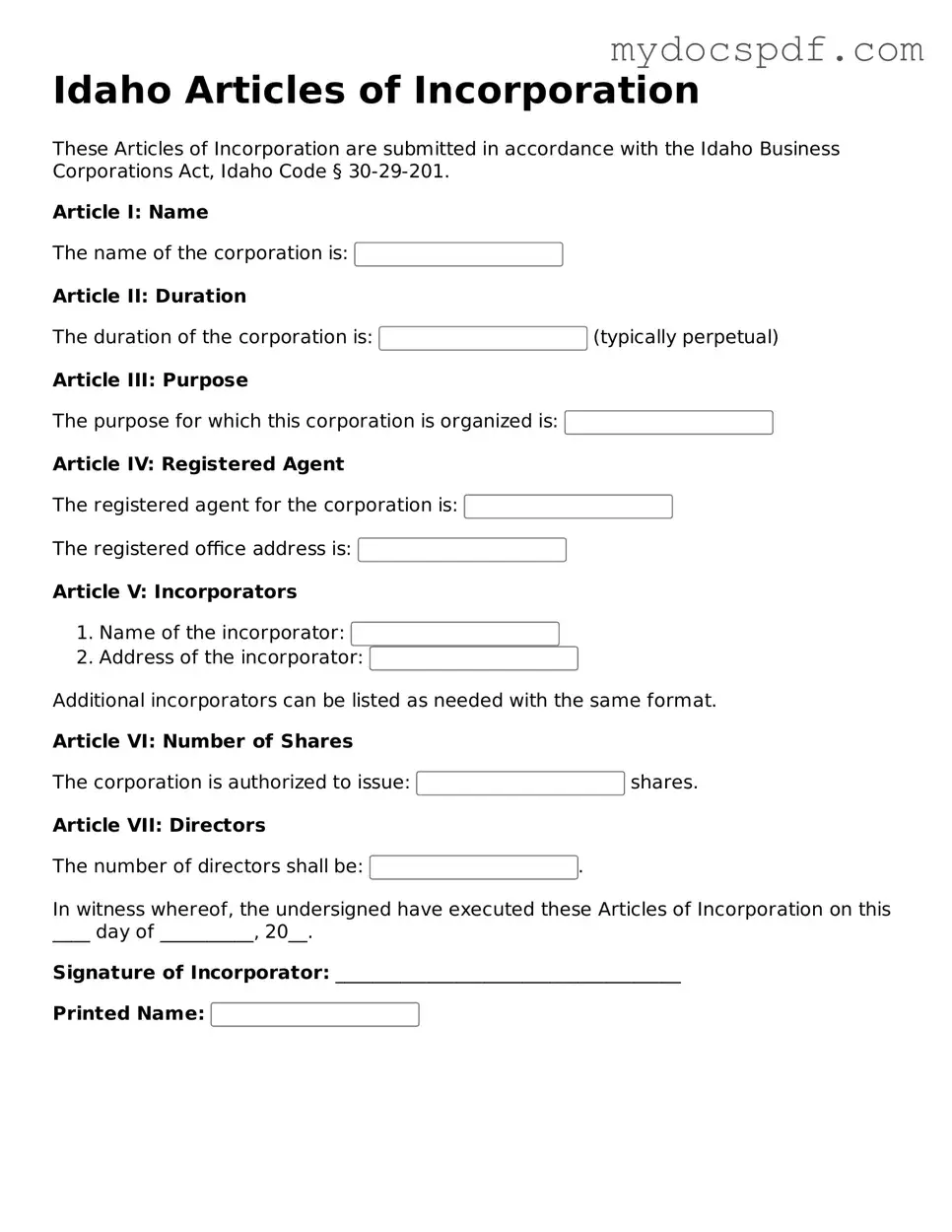

Example - Idaho Articles of Incorporation Form

Idaho Articles of Incorporation

These Articles of Incorporation are submitted in accordance with the Idaho Business Corporations Act, Idaho Code § 30-29-201.

Article I: Name

The name of the corporation is:

Article II: Duration

The duration of the corporation is: (typically perpetual)

Article III: Purpose

The purpose for which this corporation is organized is:

Article IV: Registered Agent

The registered agent for the corporation is:

The registered office address is:

Article V: Incorporators

- Name of the incorporator:

- Address of the incorporator:

Additional incorporators can be listed as needed with the same format.

Article VI: Number of Shares

The corporation is authorized to issue: shares.

Article VII: Directors

The number of directors shall be: .

In witness whereof, the undersigned have executed these Articles of Incorporation on this ____ day of __________, 20__.

Signature of Incorporator: _____________________________________

Printed Name:

Detailed Instructions for Writing Idaho Articles of Incorporation

After gathering the necessary information, you are ready to fill out the Idaho Articles of Incorporation form. This document is essential for establishing your business as a corporation in Idaho. Make sure you have all required details at hand, as accuracy is crucial.

- Begin by entering the name of your corporation. Ensure that it complies with Idaho naming requirements and is unique.

- Provide the principal office address. This should be a physical address in Idaho where the corporation will conduct business.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of your corporation. Be clear and concise about the business activities you plan to engage in.

- State the number of shares your corporation is authorized to issue. Specify the par value of those shares if applicable.

- Include the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that the signatures are from the incorporators listed in the document.

- Review the form for accuracy. Double-check all entries to avoid delays in processing.

- Submit the completed form to the Idaho Secretary of State, along with the required filing fee.

Once submitted, the state will review your application. If everything is in order, you will receive confirmation of your corporation's formation. This confirmation is an important document for your business records.

Documents used along the form

When forming a corporation in Idaho, the Articles of Incorporation is a crucial document. However, several other forms and documents are often needed to complete the incorporation process. Here’s a list of important documents that may accompany the Articles of Incorporation.

- Bylaws: These are the rules that govern the internal management of the corporation. They outline the roles and responsibilities of officers and directors, as well as procedures for meetings and decision-making.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document typically includes basic information about the corporation, such as its address and the names of its officers.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. It is necessary for opening a bank account and hiring employees.

- Business Licenses: Depending on the nature of the business, various local, state, or federal licenses may be required to legally operate.

- Homeschool Letter of Intent Form: To fulfill homeschooling requirements in California, parents can refer to the necessary Homeschool Letter of Intent documentation for proper submission and compliance.

- Operating Agreement: Although more common in LLCs, this document outlines the management structure and operational procedures of a corporation, especially if there are multiple owners.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders. It can address issues such as the transfer of shares and voting rights.

- Consent to Serve as Director: This form is often signed by individuals who will serve on the board of directors, indicating their acceptance of the role.

- Certificate of Good Standing: This document may be required to show that the corporation is compliant with state regulations and is authorized to do business.

- Annual Reports: Many states require corporations to file annual reports to maintain good standing. These reports often include financial information and updates on corporate activities.

Incorporating a business involves more than just filing the Articles of Incorporation. Understanding and preparing these additional documents can help ensure compliance with state laws and facilitate smoother operations for the new corporation.