Get Goodwill donation receipt Form in PDF

When you donate items to Goodwill, you not only contribute to a worthy cause but also create an opportunity for potential tax deductions. Central to this process is the Goodwill donation receipt form, which serves as a crucial document for both the donor and the organization. This form provides essential details, including the donor's name, address, and a description of the donated items. It also indicates the date of the donation and the estimated value of the items, which is vital for tax purposes. Importantly, the receipt acts as proof of your charitable contribution, ensuring you have the necessary documentation should you choose to claim a deduction on your tax return. Understanding how to fill out and use this form effectively can help maximize your charitable impact while navigating the complexities of tax benefits. Whether you are a seasoned donor or new to charitable giving, familiarizing yourself with the Goodwill donation receipt form is an essential step in the donation process.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it's important to ensure accuracy and clarity. Here are some guidelines to follow:

- Do provide your name and contact information clearly.

- Do list all items you are donating, including a brief description of each.

- Do estimate the fair market value of your donated items.

- Do keep a copy of the receipt for your records and tax purposes.

- Don't leave any sections of the form blank unless instructed.

- Don't overestimate the value of your items; be honest and realistic.

- Don't forget to sign and date the receipt before submitting it.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of charitable contributions for tax purposes. |

| Tax Deduction | Donors can claim a tax deduction for the value of donated items, provided they have a valid receipt. |

| Itemized List | The receipt should include an itemized list of donated items, detailing their condition and estimated value. |

| Non-Cash Donations | The form is specifically for non-cash donations, such as clothing, furniture, and household goods. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California requires a specific form under Revenue and Taxation Code Section 170. |

| Signature Requirement | The receipt must be signed by a Goodwill representative to validate the donation. |

| Retention Period | Donors should keep the receipt for at least three years after filing their tax return. |

| IRS Guidelines | The IRS provides guidelines on how to value donated items, which donors should follow to ensure compliance. |

Key takeaways

When donating items to Goodwill, filling out the donation receipt form correctly is essential for your records and potential tax deductions. Here are five key takeaways to keep in mind:

- Accurate Itemization: List each item you donate clearly. This will help you keep track of your contributions and provide necessary details for tax purposes.

- Value Assessment: Estimate the fair market value of your donated items. Goodwill provides guidelines on how to determine this value, which is crucial for tax deductions.

- Keep a Copy: Always retain a copy of the completed receipt for your records. This documentation is important if you need to verify your donations during tax season.

- Sign and Date: Ensure you sign and date the receipt. This validates the donation and confirms that you are aware of the items you are donating.

- Understand Tax Implications: Familiarize yourself with IRS guidelines regarding charitable donations. Knowing the rules can help you maximize your deductions while remaining compliant.

By following these key points, you can ensure that your donation experience is smooth and beneficial for both you and Goodwill.

Other PDF Templates

Aao Form - This form also discusses any recommendations for retaining your results post-treatment.

For those navigating the complexities of estate planning, a crucial element to consider is the method of transferring assets. A well-crafted Transfer-on-Death Deed can serve as an effective tool in this process, facilitating a smooth transition of real estate to your intended beneficiaries. To learn more about effectively utilizing this document, visit our detailed guide on the Transfer-on-Death Deed options.

Load Calculation Formula - This document can save time during the inspection phase.

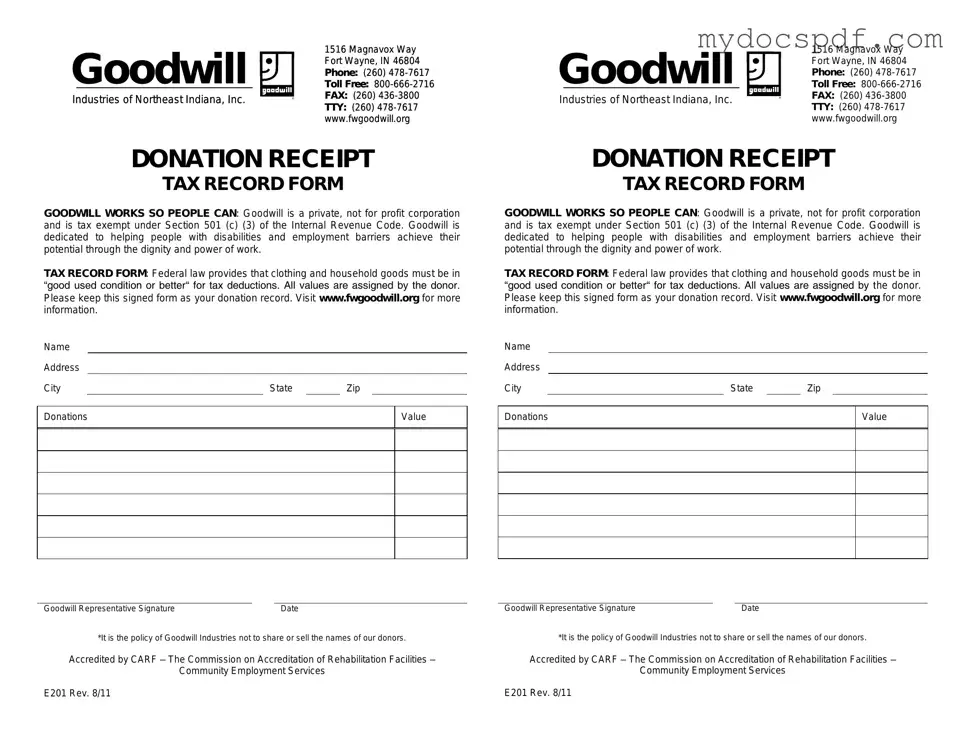

Example - Goodwill donation receipt Form

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Detailed Instructions for Writing Goodwill donation receipt

After gathering your items for donation, you will need to fill out the Goodwill donation receipt form. This form serves as a record of your contributions, which can be important for tax purposes. Completing it accurately ensures you have the necessary documentation for your records.

- Start by writing the date of the donation in the designated area.

- Enter your name and address. This information is crucial for tax documentation.

- List the items you are donating. Be specific about each item to provide a clear record.

- Estimate the value of each item. This can be based on what you believe the items would sell for in a thrift store.

- Sign the form to confirm the donation. Your signature indicates that the information provided is accurate.

- Keep a copy of the completed form for your records. This will be useful when filing taxes.

Documents used along the form

When donating items to Goodwill or similar organizations, several forms and documents can accompany your Goodwill donation receipt. Each of these documents plays a specific role in ensuring that your donation is properly recorded and that you receive the benefits associated with your charitable contributions. Here’s a list of common forms and documents you might encounter:

- Donation Inventory List: This document details the items you donated, including descriptions and estimated values. Keeping this list helps you track your donations for tax purposes.

- Tax Deduction Worksheet: A worksheet that assists in calculating the potential tax deduction for your charitable contributions. It can help you organize your donations and their respective values.

- Charitable Contribution Statement: This statement outlines the total amount of your donations for the year, which can be useful when filing your taxes.

- Form 8283: If your non-cash donations exceed $500, this IRS form is required. It provides detailed information about the items donated and their fair market value.

- Appraisal Report: For high-value items, an appraisal report may be necessary. This document provides a professional valuation of the donated item, ensuring you receive the correct tax deduction.

- Goodwill Donation Policy: This document outlines the guidelines and policies regarding what can and cannot be donated. Understanding these rules can help ensure your donations are accepted.

- Bill of Sale: A necessary document for transferring ownership of items sold, especially if you’re dealing with higher-value personal property. For templates and guidance, check out Texas Forms Online.

- Thank You Letter: After your donation, you may receive a thank you letter from Goodwill. This letter can serve as an additional record of your contribution and may be useful for tax purposes.

Having these documents on hand can streamline the donation process and enhance your experience. They also provide essential records that can be beneficial when it comes time to file your taxes or for personal record-keeping. Being organized and informed will make your charitable giving more rewarding.