Get Gift Letter Form in PDF

When it comes to securing a mortgage, understanding the financial support you receive from family and friends can be crucial. One important document in this process is the Gift Letter form. This form serves as a formal declaration that funds provided to a homebuyer are indeed a gift, not a loan, which can significantly impact the mortgage approval process. Typically, it includes essential details such as the donor's name, relationship to the recipient, the amount of the gift, and a statement confirming that repayment is not expected. By clarifying these points, the Gift Letter helps lenders assess the buyer's financial situation more accurately. Additionally, it may require the donor's signature, which adds an extra layer of authenticity. Understanding the Gift Letter form is vital for anyone looking to navigate the complexities of home financing, ensuring that both the giver and receiver are on the same page regarding the terms of the gift.

Dos and Don'ts

When filling out a Gift Letter form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do clearly state the relationship between the giver and the recipient.

- Do specify the amount of the gift being given.

- Do include the date the gift is being made.

- Do sign and date the letter to validate it.

- Don't leave out any required information; incomplete forms can cause delays.

- Don't use vague language; be specific about the terms of the gift.

- Don't forget to keep a copy of the letter for your records.

- Don't alter the form in any way that could be seen as misleading.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A gift letter is a written statement that outlines the transfer of funds from one individual to another without expectation of repayment. |

| Purpose | Gift letters are commonly used in real estate transactions to document monetary gifts that assist in down payments. |

| Tax Implications | The IRS allows individuals to gift up to a certain amount each year without incurring gift tax, which is $17,000 for 2023. |

| State-Specific Forms | Some states require specific gift letter forms, governed by state laws regarding financial transactions and gift taxes. |

| Required Information | A typical gift letter includes the donor's name, recipient's name, amount of the gift, and a statement confirming it is a gift. |

| Signatures | Both the donor and recipient should sign the gift letter to validate the transaction and ensure clarity. |

Key takeaways

Filling out a Gift Letter form is an important step when receiving financial assistance for a property purchase. Here are some key takeaways to keep in mind:

- Clearly State the Relationship: It’s essential to specify the relationship between the donor and the recipient. This helps lenders understand the context of the gift.

- Document the Amount: Clearly indicate the amount of the gift. This transparency is crucial for the lender’s records and for ensuring compliance with financial regulations.

- Include a Declaration: The donor should declare that the funds are indeed a gift and do not require repayment. This statement reassures lenders that the recipient is not taking on additional debt.

- Provide Contact Information: The donor’s contact information should be included. This allows lenders to reach out if they have any questions or need further verification.

- Sign and Date: Both the donor and the recipient must sign and date the letter. This adds legitimacy and ensures that all parties acknowledge the terms of the gift.

Understanding these key points will make the process of filling out and using the Gift Letter form smoother and more efficient.

Other PDF Templates

Test Drive Form - Make sure you understand each condition before signing the agreement.

For anyone involved in agreements that require a degree of risk management, understanding the Hold Harmless Agreement form is crucial in California. This essential document ensures that one party is protected from liability, providing clarity and security in various contractual situations. For further insights, check out the informative resource on navigating the Hold Harmless Agreement within your legal contracts.

Can One Parent Take a Child on a Cruise Royal Caribbean - It's a vital part of the booking process for families traveling with minors.

Letter of Intent to Purchase - Termination can occur at any time, giving flexibility to the buyer.

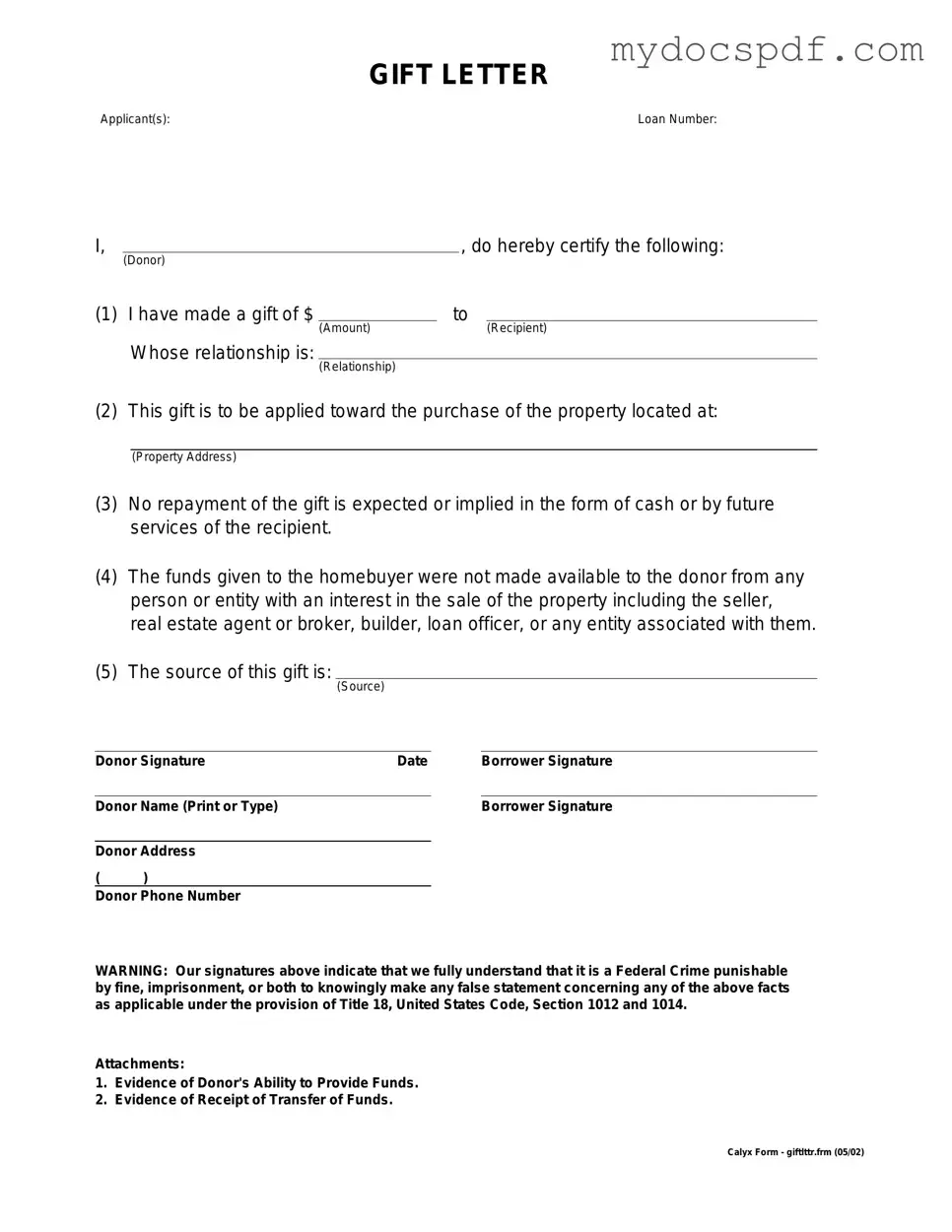

Example - Gift Letter Form

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Detailed Instructions for Writing Gift Letter

Filling out a Gift Letter form is an important step in documenting a financial gift, especially when it comes to purchasing a home. Once the form is completed, it will be submitted to the lender as part of the mortgage application process. This ensures transparency and helps clarify the source of funds being used for the purchase.

- Begin by entering the date at the top of the form.

- Provide the name and address of the donor, the person giving the gift.

- Next, include the recipient's name and address, the person receiving the gift.

- Clearly state the amount of the gift in the designated space.

- In the section for the donor's relationship to the recipient, specify how the two individuals are connected, such as parent, sibling, or friend.

- Sign and date the form in the appropriate areas. The donor must sign to confirm the gift.

- Finally, make a copy of the completed form for your records before submitting it to the lender.

Documents used along the form

When applying for a mortgage or seeking financial assistance, a Gift Letter is often required to confirm that funds received from family or friends are indeed a gift and not a loan. Along with the Gift Letter, there are several other documents that may be necessary to provide a complete picture of your financial situation. Here are some commonly used forms and documents that accompany the Gift Letter:

- Proof of Funds: This document shows the donor’s ability to provide the gifted amount. It typically includes bank statements or account statements that clearly display the funds available for gifting.

- Operating Agreement: An important document for LLCs in Texas, the Operating Agreement defines the management structure and operational procedures for the company. For more information, see the Texas Forms Online.

- Donor’s Affidavit: This sworn statement from the donor affirms that the funds are a gift. It may also include details about the relationship between the donor and the recipient, reinforcing the authenticity of the gift.

- Recipient’s Bank Statements: These statements provide insight into the recipient’s financial situation. They help lenders assess whether the recipient has the means to cover any additional costs associated with the mortgage.

- Gift Tax Return (if applicable): If the gift exceeds a certain amount, the donor may need to file a gift tax return. This document helps clarify any tax implications related to the gifted funds.

Having these documents prepared and organized can streamline the mortgage application process. They provide clarity and assurance to lenders about the source and nature of the funds involved. Being thorough in your documentation can make a significant difference in securing the financing you need.