Attorney-Approved Gift Deed Template

When it comes to transferring ownership of property without any expectation of payment, the Gift Deed form serves as a vital instrument in the realm of real estate and personal property transactions. This legal document outlines the voluntary transfer of property from one individual, known as the donor, to another, referred to as the donee. It is essential for the Gift Deed to be executed with clear intent, as it must demonstrate that the donor is willingly relinquishing their rights to the property. Key elements of the form typically include the names and addresses of both parties, a detailed description of the property being gifted, and any specific conditions or restrictions associated with the gift. Furthermore, the form often requires the signature of the donor, and in many jurisdictions, it may also necessitate the presence of witnesses or a notary public to validate the transaction. Understanding the nuances of the Gift Deed form is crucial, as it not only facilitates a seamless transfer of ownership but also ensures that both parties are protected under the law, minimizing the potential for disputes in the future.

Dos and Don'ts

When filling out a Gift Deed form, there are important steps to follow. Here are some things you should and shouldn't do:

- Do ensure that all information is accurate and complete.

- Do include the full names and addresses of both the donor and the recipient.

- Do clearly describe the gift, including its value and any specific conditions.

- Do sign the form in the presence of a notary public if required by your state.

- Don't use vague language when describing the gift.

- Don't forget to keep a copy of the completed form for your records.

Gift DeedTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property without any exchange of money. |

| Consideration | In a Gift Deed, no monetary consideration is required. The transfer is made voluntarily. |

| State-Specific Forms | Each state may have its own specific form for a Gift Deed. Always check local requirements. |

| Governing Laws | Gift Deeds are governed by state laws, which can vary significantly. For example, in California, the Civil Code Section 1146 applies. |

| Execution Requirements | Most states require the Gift Deed to be signed by the donor and sometimes witnessed or notarized. |

| Revocation | A Gift Deed can typically be revoked before it is executed, but once executed, it is generally irrevocable. |

| Tax Implications | Gifts may have tax implications. Donors should be aware of federal gift tax rules and state tax laws. |

| Recording | It is advisable to record the Gift Deed with the local county recorder's office to establish legal ownership. |

Key takeaways

When it comes to filling out and using a Gift Deed form, there are several important points to keep in mind. Here’s a straightforward list to guide you through the process:

- Understand the Purpose: A Gift Deed is a legal document that allows one person to transfer ownership of property to another without any payment.

- Identify the Parties: Clearly state the names and addresses of both the giver (donor) and the receiver (donee) on the form.

- Describe the Gift: Provide a detailed description of the property being gifted, including any relevant identification numbers or legal descriptions.

- Consider Tax Implications: Be aware that gifting property may have tax consequences for both the giver and receiver. Consult a tax professional if needed.

- Signatures Are Crucial: Ensure that the Gift Deed is signed by both parties. Notarization may also be required in some states.

- Witnesses May Be Required: Some jurisdictions require witnesses to sign the document. Check local laws to confirm.

- Record the Deed: After signing, consider recording the Gift Deed with the appropriate local government office to make the transfer official.

- Keep Copies: Always keep a copy of the completed Gift Deed for your records. This can be important for future reference.

- Review State Laws: Each state may have different requirements for Gift Deeds. Familiarize yourself with your state’s laws to ensure compliance.

By following these key takeaways, you can navigate the Gift Deed process more confidently and ensure that your intentions are clearly documented and legally recognized.

Popular Gift Deed Documents:

Quitclaim Deed Form New Jersey - It is beneficial when all parties are in agreement regarding property interests.

For those seeking to navigate the complexities of room rentals, reviewing the New York Room Rental Agreement is crucial. This form clearly delineates the rights and responsibilities of both landlords and tenants, ensuring that key areas such as rent, security deposits, and maintenance obligations are explicitly stated. Resources like NY Templates can provide templates and guidance to streamline the rental process and prevent misunderstandings.

Example - Gift Deed Form

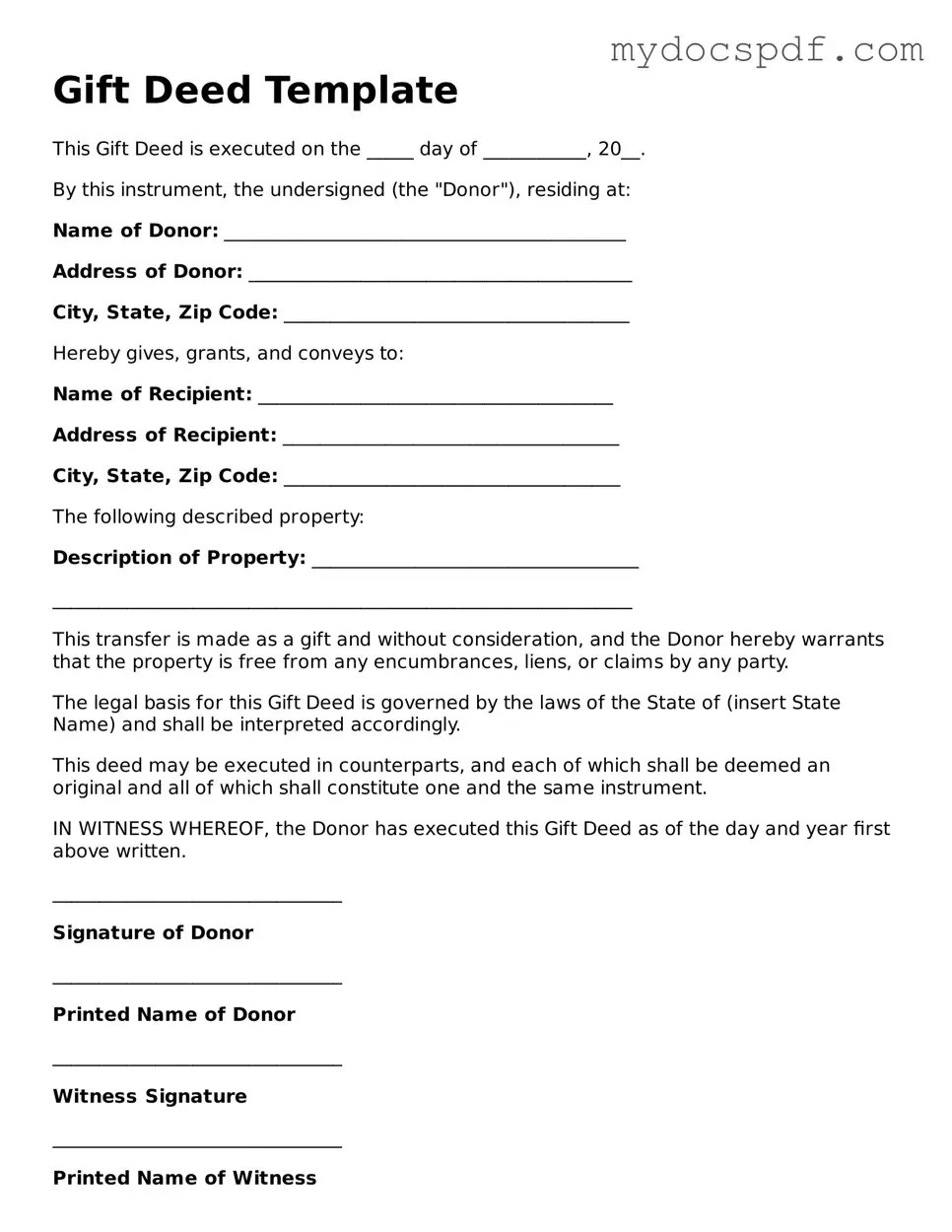

Gift Deed Template

This Gift Deed is executed on the _____ day of ___________, 20__.

By this instrument, the undersigned (the "Donor"), residing at:

Name of Donor: ___________________________________________

Address of Donor: _________________________________________

City, State, Zip Code: _____________________________________

Hereby gives, grants, and conveys to:

Name of Recipient: ______________________________________

Address of Recipient: ____________________________________

City, State, Zip Code: ____________________________________

The following described property:

Description of Property: ___________________________________

______________________________________________________________

This transfer is made as a gift and without consideration, and the Donor hereby warrants that the property is free from any encumbrances, liens, or claims by any party.

The legal basis for this Gift Deed is governed by the laws of the State of (insert State Name) and shall be interpreted accordingly.

This deed may be executed in counterparts, and each of which shall be deemed an original and all of which shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Donor has executed this Gift Deed as of the day and year first above written.

_______________________________

Signature of Donor

_______________________________

Printed Name of Donor

_______________________________

Witness Signature

_______________________________

Printed Name of Witness

_______________________________

Date

Detailed Instructions for Writing Gift Deed

Once you have the Gift Deed form in front of you, it’s time to fill it out carefully. This document will require some important details about both the giver and the recipient. Make sure you have all necessary information ready before you start. Follow these steps to complete the form accurately.

- Begin by entering the date at the top of the form. This should be the date when the gift is being made.

- Provide the full name and address of the person giving the gift. This is known as the "Donor."

- Next, fill in the full name and address of the person receiving the gift. This person is referred to as the "Recipient."

- Clearly describe the gift being given. Include details such as the type of property, its location, and any identifying information.

- Indicate whether the gift is made with any conditions or restrictions. If there are none, you can simply state that it is an unconditional gift.

- Both the donor and recipient should sign and date the form. Make sure signatures are clear and legible.

- If applicable, have a witness sign the form as well. This adds an extra layer of validity to the document.

- Finally, make copies of the completed form for both the donor and the recipient. Keep the original in a safe place.

After filling out the Gift Deed form, review it to ensure all information is correct. Once completed, the form can be filed or recorded as needed, depending on local requirements. This step is crucial to ensure that the transfer of the gift is legally recognized.

Documents used along the form

A Gift Deed is an important document used to legally transfer ownership of property or assets from one person to another without any exchange of money. Several other forms and documents may accompany a Gift Deed to ensure that the transaction is properly recorded and legally binding. Below is a list of commonly used documents that often accompany a Gift Deed.

- Affidavit of Gift: This document serves as a sworn statement confirming that the gift was made voluntarily and without any coercion. It often includes details about the property being gifted and the parties involved.

- Notice of Gift: This form notifies relevant parties, such as financial institutions or local authorities, about the transfer of ownership. It helps to maintain transparency and may be required for certain types of gifts.

- ATV Bill of Sale: A vital document to ensure the legal transfer of ownership for an All-Terrain Vehicle (ATV) in New York, which can be found at newyorkform.com/free-atv-bill-of-sale-template/.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain threshold, the donor may be required to file a gift tax return with the IRS. This document reports the value of the gift and any applicable taxes owed.

- Title Transfer Document: For real estate gifts, a title transfer document is necessary to officially change the ownership on public records. This document ensures that the new owner is recognized legally as the property owner.

These documents help facilitate a smooth transfer of ownership and ensure that all legal requirements are met. It is advisable to consult with a legal professional to ensure that all necessary forms are completed accurately and filed appropriately.