Fillable Georgia Transfer-on-Death Deed Document

In Georgia, the Transfer-on-Death Deed (TOD) offers a straightforward and effective way for property owners to transfer their real estate to designated beneficiaries upon their passing. This legal instrument allows individuals to maintain full control of their property during their lifetime while ensuring a seamless transition to heirs without the need for probate. By filling out and recording the TOD deed, property owners can specify who will inherit their property, thereby eliminating uncertainty and potential disputes among family members. The form requires essential details, such as the property description and the names of the beneficiaries, and must be executed in accordance with Georgia law to be valid. Importantly, the transfer occurs automatically at death, making it a popular choice for those seeking to simplify their estate planning. Understanding the nuances of the Transfer-on-Death Deed can empower property owners to make informed decisions about their assets and ensure their wishes are honored in the future.

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what to do and what to avoid:

- Do provide accurate property details, including the legal description.

- Do include the full names of all parties involved, including the beneficiary.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill out all required fields.

- Don't use outdated forms; ensure you have the latest version.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Georgia to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Georgia Code § 44-6-31 through § 44-6-34. |

| Eligibility | Any individual who owns real property in Georgia can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the deed can specify how the property will be divided among them. |

| Revocation | The property owner can revoke or change the deed at any time during their lifetime, as long as they follow the proper procedures. |

| Filing Requirements | The deed must be filed with the county clerk’s office where the property is located to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes, but beneficiaries may be responsible for property taxes once the property is transferred. |

Key takeaways

Filling out and utilizing the Georgia Transfer-on-Death Deed form can be a straightforward process when you understand its key components. Here are some important takeaways to keep in mind:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- It must be signed by the property owner in the presence of a notary public to be valid.

- Beneficiaries do not gain any rights to the property until the owner's death, ensuring the owner retains full control during their lifetime.

- It is essential to file the deed with the county's probate court to make it effective; failure to do so may invalidate the transfer.

- Consulting with a legal professional can help clarify any questions and ensure that the deed aligns with your estate planning goals.

Popular State-specific Transfer-on-Death Deed Forms

How to Avoid Probate in California - Can be a more cost-effective alternative to setting up a living trust.

A Texas Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction and outlines important details such as the buyer, seller, and item being sold. For those looking for a template to assist in this process, Texas Forms Online provides an excellent resource. Understanding how to properly complete this document is essential for both buyers and sellers in Texas.

Transfer on Death Deed Form Florida - A helpful tool for ensuring that specific assets go to designated individuals.

Problems With Transfer on Death Deeds - This deed provides a simple way to ensure your assets are transferred as you wish after your death.

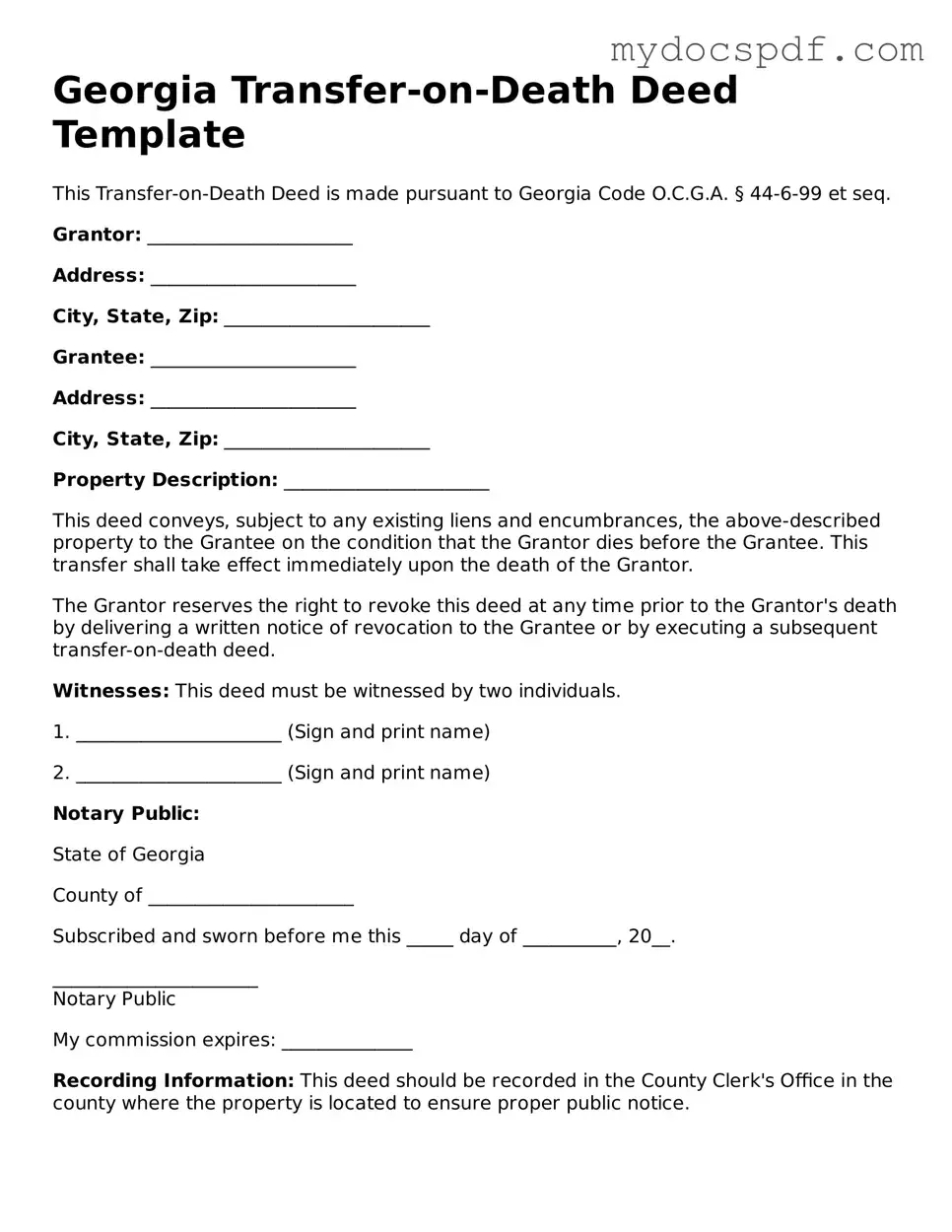

Example - Georgia Transfer-on-Death Deed Form

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to Georgia Code O.C.G.A. § 44-6-99 et seq.

Grantor: ______________________

Address: ______________________

City, State, Zip: ______________________

Grantee: ______________________

Address: ______________________

City, State, Zip: ______________________

Property Description: ______________________

This deed conveys, subject to any existing liens and encumbrances, the above-described property to the Grantee on the condition that the Grantor dies before the Grantee. This transfer shall take effect immediately upon the death of the Grantor.

The Grantor reserves the right to revoke this deed at any time prior to the Grantor's death by delivering a written notice of revocation to the Grantee or by executing a subsequent transfer-on-death deed.

Witnesses: This deed must be witnessed by two individuals.

1. ______________________ (Sign and print name)

2. ______________________ (Sign and print name)

Notary Public:

State of Georgia

County of ______________________

Subscribed and sworn before me this _____ day of __________, 20__.

______________________

Notary Public

My commission expires: ______________

Recording Information: This deed should be recorded in the County Clerk's Office in the county where the property is located to ensure proper public notice.

Detailed Instructions for Writing Georgia Transfer-on-Death Deed

Filling out the Georgia Transfer-on-Death Deed form is a straightforward process that allows property owners to designate beneficiaries who will receive their property upon their passing. Once you have completed the form, it will need to be signed and notarized before being filed with the appropriate county office. This ensures that your wishes are documented and legally recognized.

- Obtain the Georgia Transfer-on-Death Deed form. This can typically be found online or at your local county clerk's office.

- Fill in your name as the grantor. Make sure to include any middle names or initials to avoid confusion.

- Provide the address and legal description of the property you wish to transfer. This information can often be found on your property deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property. Include their full names and any relevant identifying information.

- Indicate whether the transfer is to be made to one beneficiary or multiple beneficiaries. If there are multiple beneficiaries, clarify how the property will be divided.

- Sign the form in the presence of a notary public. This step is crucial for the form to be legally binding.

- File the completed and notarized form with the county clerk’s office in the county where the property is located. There may be a small fee for filing.

Documents used along the form

The Georgia Transfer-on-Death Deed is a useful tool for property owners looking to pass their real estate directly to a beneficiary upon their death. However, several other forms and documents often accompany this deed to ensure a smooth transition of ownership and to clarify the intentions of the property owner. Below is a list of commonly used forms that complement the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets, including real estate, should be distributed after their death. It can specify beneficiaries and include instructions for any remaining property not covered by the Transfer-on-Death Deed.

- Room Rental Agreement: It is important to have a comprehensive agreement in place to ensure both landlords and tenants are aware of their rights and obligations. For a solid template, visit https://newyorkform.com/free-room-rental-agreement-template/.

- Beneficiary Designation Form: Used for financial accounts or insurance policies, this form allows individuals to name beneficiaries who will receive the assets upon their death, similar to how a Transfer-on-Death Deed works for real estate.

- Power of Attorney: This legal document grants someone the authority to act on behalf of another person in financial or legal matters. It can be particularly useful if the property owner becomes incapacitated and needs someone to manage their affairs.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person when there is no will. It can help clarify who is entitled to inherit property and may be necessary if disputes arise among potential heirs.

- Real Estate Purchase Agreement: If the property is being sold or transferred before the owner's death, this agreement outlines the terms of the sale, including price, contingencies, and the responsibilities of both the buyer and seller.

Understanding these documents can greatly assist in the effective management and transfer of property. Each serves a unique purpose and can help ensure that your wishes are honored, making the process smoother for your loved ones during a difficult time.