Fillable Georgia Real Estate Purchase Agreement Document

When navigating the world of real estate transactions in Georgia, understanding the Georgia Real Estate Purchase Agreement form is essential for both buyers and sellers. This comprehensive document serves as the foundation for the sale of residential property, detailing critical elements such as the purchase price, earnest money deposit, and closing date. It outlines the responsibilities of both parties, ensuring that expectations are clear from the outset. Key provisions include contingencies that allow buyers to back out of the deal under specific circumstances, such as financing or inspection issues. Additionally, the form addresses the allocation of closing costs and any required disclosures, helping to protect both parties' interests. By familiarizing oneself with this agreement, individuals can navigate the complexities of real estate transactions more confidently and effectively.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it is important to adhere to certain guidelines to ensure clarity and legal compliance. Below are four things you should do and four things you should avoid.

Things You Should Do:

- Provide accurate and complete information about the property, including the address and legal description.

- Clearly outline the terms of the sale, including the purchase price and any contingencies.

- Ensure all parties involved in the transaction sign the agreement to validate it.

- Consult with a real estate professional or attorney if you have questions about the form.

Things You Shouldn't Do:

- Do not leave any sections of the form blank, as this can lead to misunderstandings.

- Avoid using vague language that may cause confusion regarding the terms of the agreement.

- Do not rush through the process; take the time to review all details carefully.

- Refrain from making alterations to the form without proper guidance, as this may invalidate the agreement.

PDF Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Real Estate Purchase Agreement is governed by the Official Code of Georgia Annotated (O.C.G.A.) Title 44, Chapter 3. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be legally capable of entering into a contract. |

| Property Description | A detailed description of the property being sold is required, including the address and legal description. |

| Purchase Price | The purchase price must be clearly stated in the agreement, along with any deposit or earnest money requirements. |

| Contingencies | The agreement may include contingencies, such as financing, inspections, or the sale of another property. |

| Closing Date | The closing date, when the property transfer occurs, should be specified in the agreement. |

| Disclosures | Georgia law requires sellers to provide certain disclosures about the property, including known defects. |

| Default Terms | The agreement outlines the consequences of default by either party, including potential remedies. |

| Signatures | Both parties must sign the agreement for it to be legally binding, along with the date of signing. |

Key takeaways

When dealing with the Georgia Real Estate Purchase Agreement form, it is essential to understand its components and how to properly fill it out. Here are some key takeaways to keep in mind:

- Understand the Parties Involved: Clearly identify the buyer and seller. This includes full names and contact information to avoid any confusion later.

- Property Description: Provide a detailed description of the property. This should include the address and any relevant details that help specify the property being sold.

- Purchase Price: Clearly state the agreed-upon purchase price. This amount should be prominently displayed to ensure all parties are aware of the financial terms.

- Contingencies: Include any contingencies that may affect the sale. Common contingencies involve financing, inspections, or the sale of another property.

- Closing Date: Specify the closing date. This is the date when the ownership of the property will officially transfer from the seller to the buyer.

- Earnest Money: Detail the earnest money deposit. This shows the buyer’s commitment to the purchase and should be outlined in the agreement.

- Review and Sign: Ensure all parties review the agreement thoroughly before signing. This step is crucial to avoid misunderstandings and ensure that everyone agrees to the terms.

These takeaways can help streamline the process of filling out the Georgia Real Estate Purchase Agreement form and ensure that all necessary information is included for a successful transaction.

Popular State-specific Real Estate Purchase Agreement Forms

Free Florida Real Estate Forms - By detailing the commitment, this document minimizes potential disputes down the line.

Buying a House in Ma - This agreement may specify the timeframe for the buyer's due diligence.

Sample Real Estate Purchase Agreement - All parties should ensure they understand their rights and duties outlined in the agreement.

The New York Room Rental Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant renting a room in a residential property. This agreement protects the rights of both parties and provides clarity on important aspects such as rent, security deposits, and maintenance responsibilities. To ensure compliance with local regulations and to draft a comprehensive agreement, utilizing templates like those available from NY Templates can be immensely helpful. Understanding this form is essential for anyone involved in room rentals in New York.

How to Make a Purchase Agreement - It specifies the purchase price and the method of payment for the property.

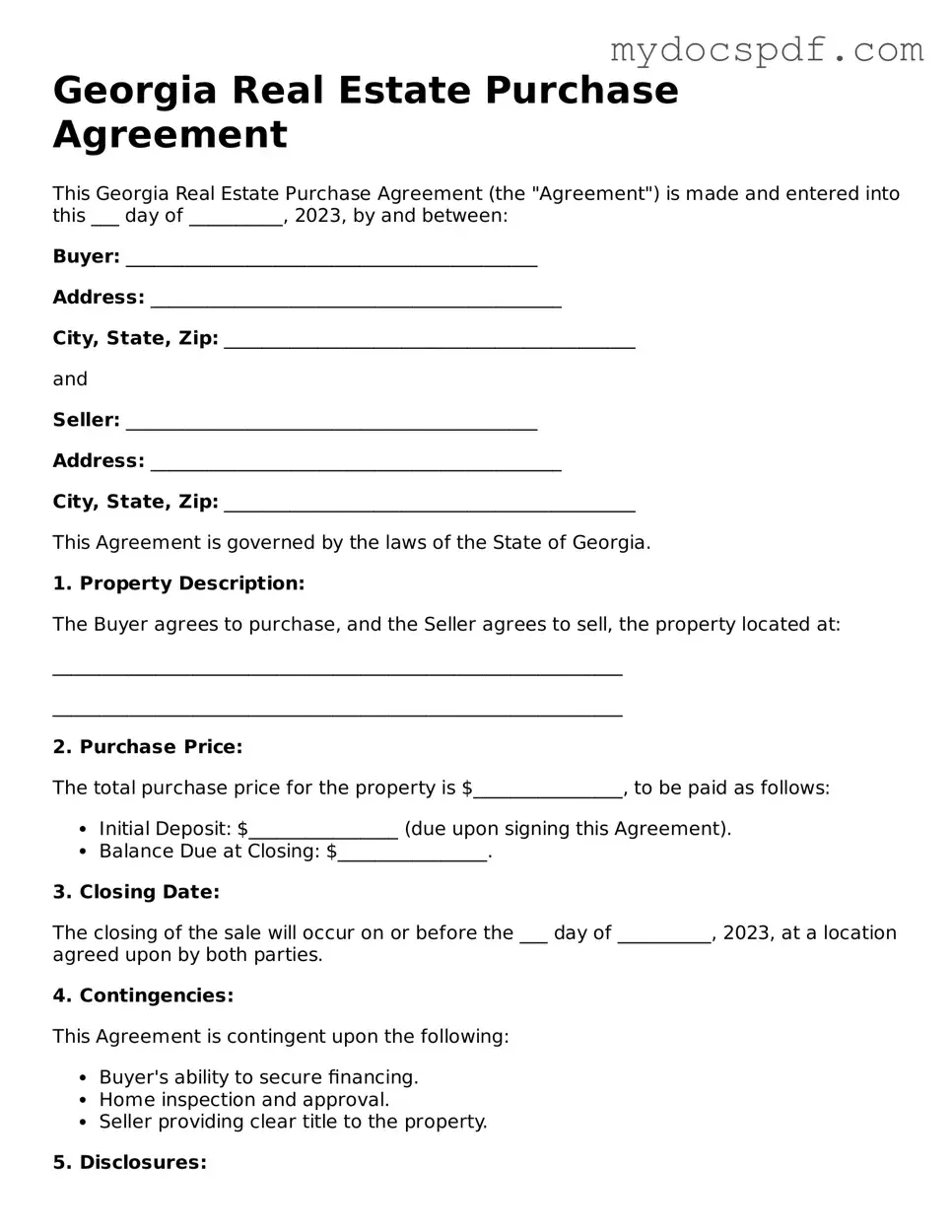

Example - Georgia Real Estate Purchase Agreement Form

Georgia Real Estate Purchase Agreement

This Georgia Real Estate Purchase Agreement (the "Agreement") is made and entered into this ___ day of __________, 2023, by and between:

Buyer: ____________________________________________

Address: ____________________________________________

City, State, Zip: ____________________________________________

and

Seller: ____________________________________________

Address: ____________________________________________

City, State, Zip: ____________________________________________

This Agreement is governed by the laws of the State of Georgia.

1. Property Description:

The Buyer agrees to purchase, and the Seller agrees to sell, the property located at:

_____________________________________________________________

_____________________________________________________________

2. Purchase Price:

The total purchase price for the property is $________________, to be paid as follows:

- Initial Deposit: $________________ (due upon signing this Agreement).

- Balance Due at Closing: $________________.

3. Closing Date:

The closing of the sale will occur on or before the ___ day of __________, 2023, at a location agreed upon by both parties.

4. Contingencies:

This Agreement is contingent upon the following:

- Buyer's ability to secure financing.

- Home inspection and approval.

- Seller providing clear title to the property.

5. Disclosures:

The Seller agrees to provide all required disclosures as mandated by Georgia law, including any known material defects.

6. Signatures:

By signing below, both the Buyer and Seller agree to the terms and conditions outlined in this Agreement.

Buyer Signature: ____________________________________ Date: ______________

Seller Signature: ____________________________________ Date: ______________

Detailed Instructions for Writing Georgia Real Estate Purchase Agreement

Completing the Georgia Real Estate Purchase Agreement form is an essential step in the property buying process. Once filled out, this form will facilitate the negotiation and finalization of the sale between the buyer and seller. The following steps will guide you through the process of filling out the form accurately.

- Begin by entering the date of the agreement at the top of the form.

- Identify the parties involved. Fill in the names and addresses of both the buyer and the seller.

- Provide the legal description of the property. This may include the address, lot number, and any relevant parcel identification numbers.

- Specify the purchase price. Clearly state the total amount the buyer is offering for the property.

- Outline the earnest money deposit. Indicate the amount and the method of payment (check, wire transfer, etc.).

- Detail the financing terms. Include information about the type of financing the buyer will use, such as conventional, FHA, or VA loans.

- Set the closing date. Agree upon a date when the transaction will be finalized and the property will change hands.

- Include any contingencies. Specify conditions that must be met for the sale to proceed, such as inspections or financing approvals.

- Sign and date the agreement. Both parties must sign the document to make it legally binding.

Documents used along the form

When engaging in a real estate transaction in Georgia, several forms and documents may accompany the Real Estate Purchase Agreement. Each document serves a specific purpose, ensuring clarity and protection for all parties involved. Below is a list of commonly used forms.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues with the property, such as structural problems or past pest infestations, providing transparency to the buyer.

- ATV Bill of Sale: This important document provides proof of ownership and transfer of an All-Terrain Vehicle within New York, ensuring legality in the transaction. You can find a template for it here: https://newyorkform.com/free-atv-bill-of-sale-template/.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead-based paint hazards, ensuring they are aware of any health risks.

- Property Inspection Report: Conducted by a licensed inspector, this report details the condition of the property, highlighting any repairs or maintenance needed before purchase.

- Appraisal Report: An independent appraisal assesses the property's market value, which helps both the buyer and lender determine a fair price for the transaction.

- Financing Addendum: This document outlines the terms of the buyer's financing, including loan type and contingencies, ensuring all parties understand the financial obligations.

- Title Report: A title report verifies the ownership of the property and checks for any liens or encumbrances, ensuring that the buyer receives clear title upon closing.

- Closing Disclosure: This form provides a detailed account of all costs associated with the transaction, including loan terms, closing costs, and other financial obligations, allowing for informed decision-making.

- Bill of Sale: If personal property is included in the sale (like appliances or furniture), a bill of sale formally transfers ownership from the seller to the buyer.

- Power of Attorney: This document allows one party to act on behalf of another in the transaction, which can be useful if the buyer or seller cannot attend the closing in person.

Understanding these documents is crucial for a smooth real estate transaction. Each form plays a vital role in protecting the rights and interests of both buyers and sellers, fostering a transparent and efficient process.