Fillable Georgia Promissory Note Document

The Georgia Promissory Note form serves as a crucial document in financial transactions, providing a clear outline of the terms under which one party borrows money from another. This legally binding agreement details the borrower's promise to repay the loan, including the principal amount, interest rate, and repayment schedule. By specifying the due dates and any penalties for late payments, the form protects both the lender's and borrower's interests. Additionally, it may include provisions for acceleration, which allows the lender to demand full repayment if the borrower defaults. Understanding the components of this form is essential for anyone engaging in lending or borrowing, ensuring that all parties are aware of their rights and obligations. As a straightforward tool for facilitating loans, the Georgia Promissory Note is an important resource in personal and business finance, helping to foster trust and clarity in monetary exchanges.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Here are ten things to do and avoid:

- Do read the instructions carefully before starting.

- Do provide accurate personal information, including names and addresses.

- Do clearly state the loan amount.

- Do specify the interest rate, if applicable.

- Do include the repayment schedule.

- Do sign and date the document in the appropriate places.

- Don’t leave any fields blank; complete all required sections.

- Don’t use vague language; be specific about terms and conditions.

- Don’t forget to keep a copy for your records.

- Don’t rush through the process; take your time to review the document.

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by Georgia state law, specifically O.C.G.A. § 10-3-1 et seq. |

| Parties Involved | The note typically involves two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate must be clearly stated in the note. Georgia law allows for a maximum interest rate of 16% per annum unless otherwise specified. |

| Payment Terms | Payment terms should include the due date, installment amounts, and payment methods. |

| Default Clause | A default clause outlines the consequences if the maker fails to make payments as agreed. |

| Signatures | The note must be signed by the maker to be legally binding. The payee's signature is not required. |

Key takeaways

When filling out and using the Georgia Promissory Note form, there are several important points to keep in mind. Here are key takeaways that can help ensure clarity and legality in the process:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This information is crucial for legal identification.

- Specify the Amount: Clearly indicate the total amount of money being borrowed. This figure should be accurate and precise.

- Outline the Terms: Detail the repayment terms, including the interest rate, payment schedule, and due dates. This helps avoid confusion later.

- Include Default Terms: Define what constitutes a default and the consequences that follow. This could include late fees or acceleration of the debt.

- Signatures Required: Ensure that both parties sign the document. Without signatures, the note may not be enforceable.

- Witness or Notary: Consider having the document witnessed or notarized. This adds an extra layer of legitimacy and can be beneficial in disputes.

- Keep Copies: Both parties should retain copies of the signed promissory note. This is important for record-keeping and future reference.

- State Law Compliance: Ensure that the note complies with Georgia state laws. Familiarize yourself with any specific requirements that may apply.

- Consult Legal Advice: If there are uncertainties, seeking legal advice can provide clarity and help avoid potential pitfalls.

By following these key points, individuals can better navigate the process of creating and using a promissory note in Georgia.

Popular State-specific Promissory Note Forms

Idaho Promissory Note Descargar - Clear terms outlined in a promissory note can help prevent misunderstandings between parties.

When entering into a room rental arrangement, having a formal agreement is crucial, and the New York Room Rental Agreement form serves this purpose effectively by detailing essential terms. To ensure all parties are fully informed and protected in the rental process, it's beneficial to refer to resources such as NY Templates, which provide valuable templates and guidance for creating these agreements.

Promissory Note Template Florida Pdf - A promissory note can be secured or unsecured based on the agreement.

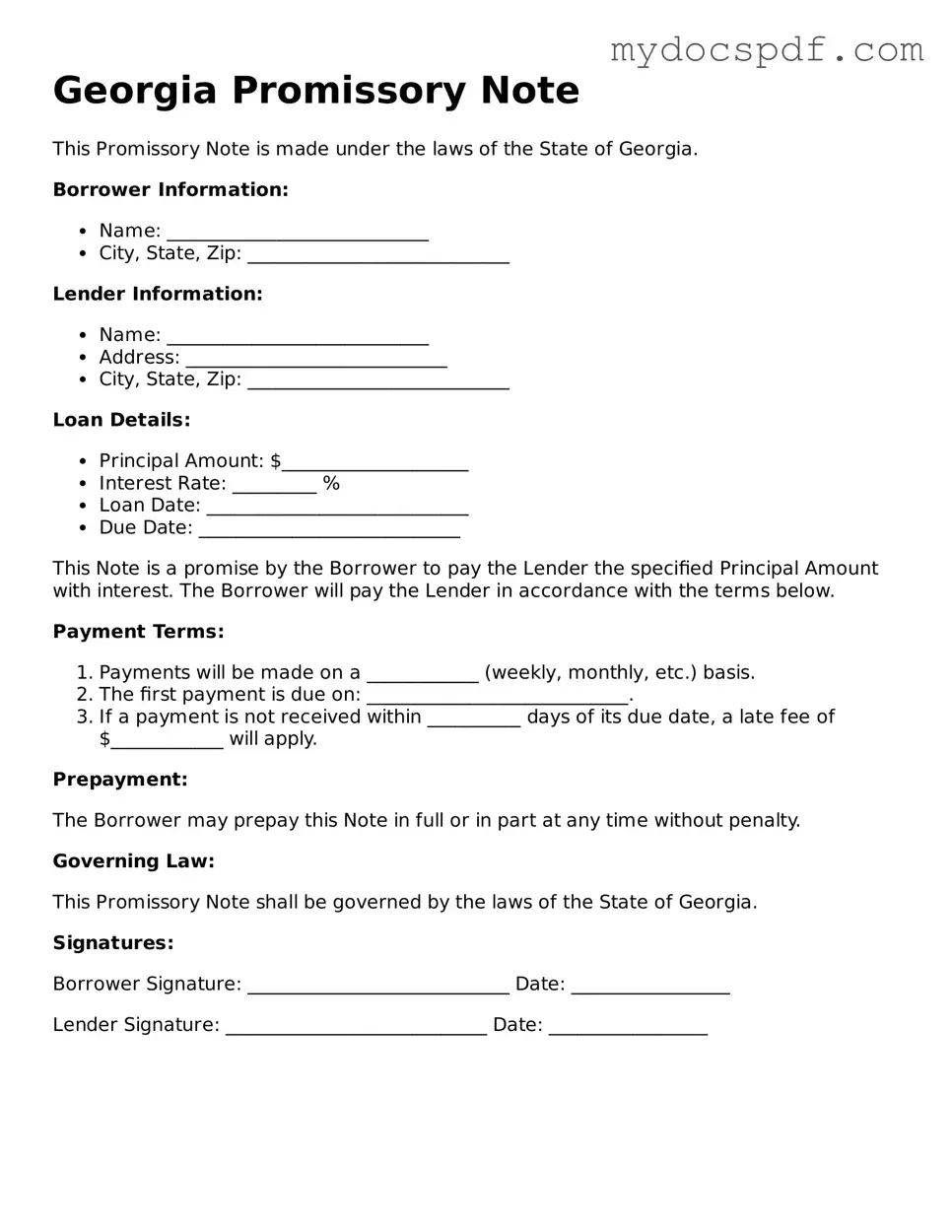

Example - Georgia Promissory Note Form

Georgia Promissory Note

This Promissory Note is made under the laws of the State of Georgia.

Borrower Information:

- Name: ____________________________

- City, State, Zip: ____________________________

Lender Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

Loan Details:

- Principal Amount: $____________________

- Interest Rate: _________ %

- Loan Date: ____________________________

- Due Date: ____________________________

This Note is a promise by the Borrower to pay the Lender the specified Principal Amount with interest. The Borrower will pay the Lender in accordance with the terms below.

Payment Terms:

- Payments will be made on a ____________ (weekly, monthly, etc.) basis.

- The first payment is due on: ____________________________.

- If a payment is not received within __________ days of its due date, a late fee of $____________ will apply.

Prepayment:

The Borrower may prepay this Note in full or in part at any time without penalty.

Governing Law:

This Promissory Note shall be governed by the laws of the State of Georgia.

Signatures:

Borrower Signature: ____________________________ Date: _________________

Lender Signature: ____________________________ Date: _________________

Detailed Instructions for Writing Georgia Promissory Note

After completing the Georgia Promissory Note form, the next steps typically involve ensuring all parties involved understand the terms outlined in the document. It is advisable to keep a copy for personal records and provide copies to all parties involved in the agreement.

- Begin by entering the date at the top of the form.

- Fill in the name of the borrower, including their address and contact information.

- Next, provide the lender's name, address, and contact information.

- Specify the principal amount being borrowed in the designated space.

- Indicate the interest rate, if applicable, and specify whether it is fixed or variable.

- Outline the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Detail any late fees or penalties for missed payments, if applicable.

- Include any collateral securing the loan, if relevant.

- Both the borrower and lender should sign and date the document at the bottom.

- Make copies of the completed form for all parties involved.

Documents used along the form

When dealing with a Georgia Promissory Note, several other forms and documents often accompany it to ensure clarity and enforceability. Each of these documents plays a vital role in the lending process, providing additional context and legal backing.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured, this agreement details the collateral being used to back the loan, specifying the rights of the lender in case of default.

- Disclosure Statement: This statement provides borrowers with important information about the loan, including fees, interest rates, and other costs associated with borrowing.

- Guaranty Agreement: In some cases, a third party may guarantee the loan. This document outlines the responsibilities of the guarantor should the borrower default.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal balance.

- ATV Bill of Sale: This form is crucial for the sale and transfer of an All-Terrain Vehicle in New York, ensuring proper documentation of the transaction. For more information, visit https://newyorkform.com/free-atv-bill-of-sale-template/.

- Payment Receipt: After each payment, a receipt can serve as proof of payment, documenting the date and amount paid, helping to avoid disputes later.

- Default Notice: If the borrower fails to make payments, this document notifies them of their default status and outlines the lender's rights moving forward.

- Release of Lien: Once the loan is paid off, this document releases any claims the lender had on the collateral, clearing the borrower's title.

Understanding these documents can help borrowers and lenders navigate the lending process more effectively. Each document serves a unique purpose, contributing to a clear and enforceable agreement between parties.