Fillable Georgia Loan Agreement Document

In the state of Georgia, a Loan Agreement form serves as a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Clarity is vital, as the agreement protects both parties by specifying their rights and responsibilities. Additionally, it often includes provisions for default, which outline the steps to be taken if the borrower fails to meet their obligations. Understanding the nuances of this form can help prevent misunderstandings and disputes down the line. By ensuring that all terms are clearly defined and agreed upon, both lenders and borrowers can engage in a financial transaction with confidence and security.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, it is crucial to be diligent and careful. Here are some essential dos and don’ts to guide you through the process:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and truthful information. Inaccuracies can lead to legal issues.

- Do double-check all numbers and dates for correctness.

- Do sign and date the form in the appropriate sections.

- Don’t leave any required fields blank; this can delay the processing of your agreement.

- Don’t use white-out or make any alterations to the form after it has been printed.

- Don’t hesitate to ask for clarification if you do not understand a section of the form.

By adhering to these guidelines, you can ensure a smoother experience when completing the Georgia Loan Agreement form. Remember, attention to detail is key.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Georgia, ensuring compliance with state regulations. |

| Parties Involved | The form requires the full names and addresses of both the lender and the borrower to establish clear identification. |

| Loan Amount | The specific amount of money being loaned must be clearly stated in the agreement to avoid any confusion. |

| Interest Rate | The form includes the interest rate applicable to the loan, which can be fixed or variable based on the agreement. |

| Repayment Terms | Details regarding repayment schedules, including due dates and payment methods, are crucial components of the agreement. |

| Default Clause | The agreement outlines the consequences of defaulting on the loan, protecting the lender's interests. |

| Signatures | Both parties must sign the agreement to make it legally binding, confirming their acceptance of the terms. |

Key takeaways

When filling out and using the Georgia Loan Agreement form, it is important to keep several key points in mind. These takeaways will help ensure that the process goes smoothly and that all parties are protected.

- Ensure all parties involved in the loan are clearly identified with full names and addresses.

- Specify the loan amount clearly to avoid any misunderstandings.

- Outline the interest rate, including whether it is fixed or variable.

- Detail the repayment schedule, including due dates and payment amounts.

- Include provisions for late payments, such as fees or penalties.

- State the purpose of the loan to provide context for both parties.

- Include a section on collateral if the loan is secured.

- Clarify the consequences of defaulting on the loan, including potential legal actions.

- Ensure that all parties sign and date the agreement to make it legally binding.

- Keep a copy of the signed agreement for your records.

By following these guidelines, you can help protect your interests and ensure that the loan agreement is clear and enforceable.

Popular State-specific Loan Agreement Forms

Promissory Note Template Florida - It is a crucial tool for managing financial relationships.

Understanding the significance of a well-structured lease is essential for both landlords and tenants; resources like the NY Templates provide valuable templates that simplify the process, ensuring that all pertinent details are included and reducing the likelihood of disputes arising from misunderstandings.

Sample Promissory Note California - It may include conditions for loan renewal or extension.

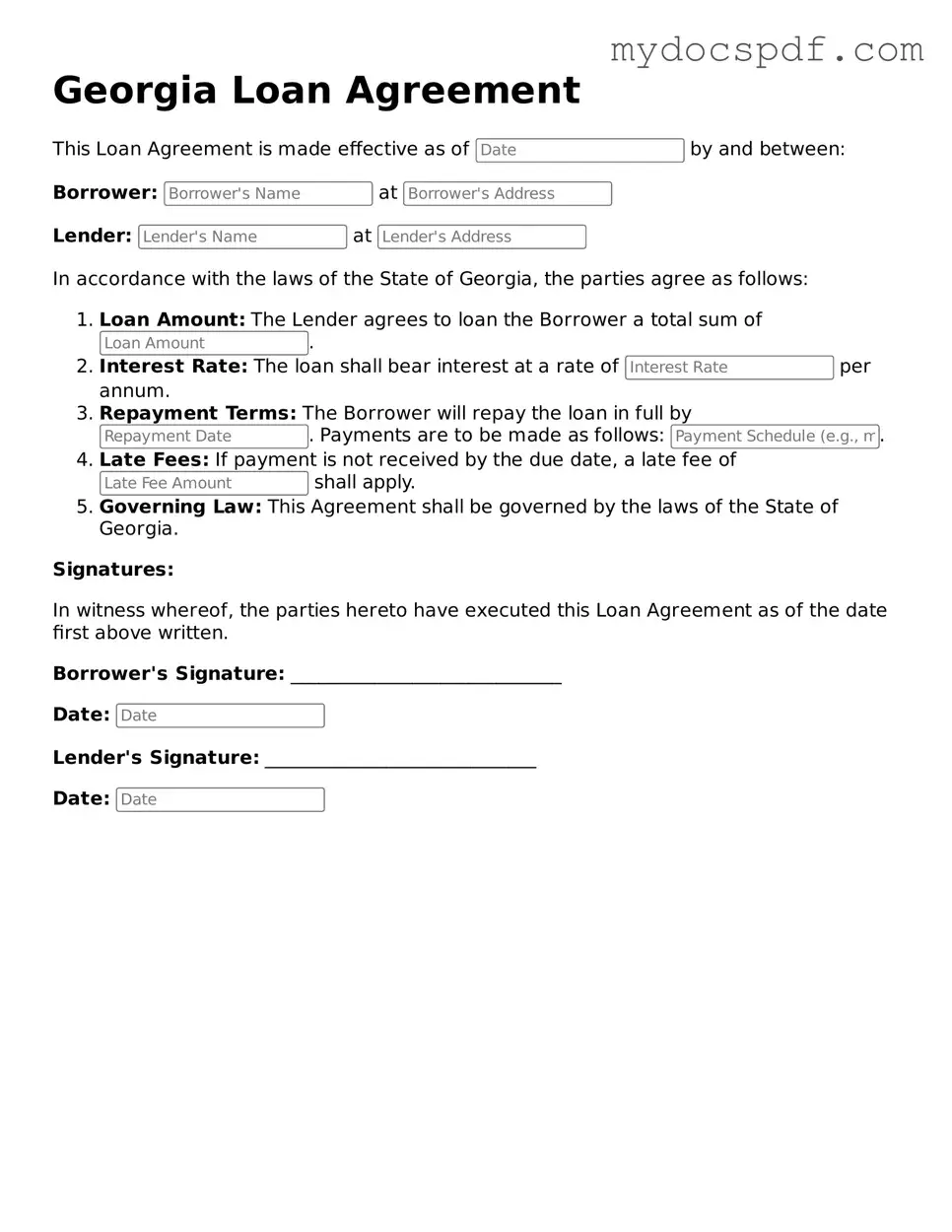

Example - Georgia Loan Agreement Form

Georgia Loan Agreement

This Loan Agreement is made effective as of by and between:

Borrower: at

Lender: at

In accordance with the laws of the State of Georgia, the parties agree as follows:

- Loan Amount: The Lender agrees to loan the Borrower a total sum of .

- Interest Rate: The loan shall bear interest at a rate of per annum.

- Repayment Terms: The Borrower will repay the loan in full by . Payments are to be made as follows: .

- Late Fees: If payment is not received by the due date, a late fee of shall apply.

- Governing Law: This Agreement shall be governed by the laws of the State of Georgia.

Signatures:

In witness whereof, the parties hereto have executed this Loan Agreement as of the date first above written.

Borrower's Signature: _____________________________

Date:

Lender's Signature: _____________________________

Date:

Detailed Instructions for Writing Georgia Loan Agreement

After you have gathered all the necessary information, you can begin filling out the Georgia Loan Agreement form. Make sure to have your personal details and loan specifics handy. Follow these steps to complete the form accurately.

- Start by entering your full name in the designated space at the top of the form.

- Provide your current address, including the city, state, and ZIP code.

- Fill in your phone number and email address for contact purposes.

- Next, specify the loan amount you are requesting.

- Indicate the purpose of the loan clearly, such as for home improvement or debt consolidation.

- Enter the repayment terms, including the interest rate and payment schedule.

- Sign and date the form at the bottom to confirm your agreement.

Once the form is filled out, review it for any errors or missing information. After that, you can submit it to the appropriate party for processing.

Documents used along the form

When preparing a Georgia Loan Agreement, several other forms and documents may be necessary to ensure a smooth transaction. These documents provide additional details, clarify terms, and protect both parties involved in the loan. Below is a list of commonly used forms that accompany the Georgia Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged as security. It details the rights of the lender in case of default.

- Disclosure Statement: This form provides important information about the loan terms, including fees, interest rates, and other costs. It ensures that the borrower fully understands the financial obligations.

- Loan Application: This document collects personal and financial information from the borrower. It helps the lender assess the borrower's creditworthiness and ability to repay the loan.

- Motor Vehicle Bill of Sale: This legal document is crucial for recording the transfer of ownership from one party to another and can be essential when finalizing vehicle transactions. For more details, you can visit https://arizonapdfs.com.

- Guaranty Agreement: If a third party guarantees the loan, this document outlines their obligations. It protects the lender by ensuring that someone else is responsible for repayment if the borrower defaults.

Each of these documents plays a crucial role in the lending process. Ensure you have them prepared and reviewed to avoid any issues during the loan agreement execution.