Fillable Georgia Gift Deed Document

The Georgia Gift Deed form serves as a crucial legal document for individuals wishing to transfer property ownership without any exchange of money. This form is particularly significant because it outlines the donor's intent to gift the property to the recipient, known as the grantee. Essential details included in the form encompass the description of the property being gifted, the names of both the donor and the grantee, and any relevant legal descriptions necessary for clarity. Additionally, the form requires the donor’s signature, signifying their consent and understanding of the transaction. In Georgia, the execution of a Gift Deed may also necessitate notarization, which adds a layer of authenticity and helps prevent disputes in the future. Understanding the implications of this form is vital for both parties involved, as it not only facilitates the transfer but also ensures that the gift is legally recognized, thereby protecting the rights of the grantee. This article will explore the various components of the Georgia Gift Deed form, including its requirements, benefits, and potential pitfalls, offering a comprehensive overview for anyone considering this type of property transfer.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it's important to approach the task with care. Here are some essential dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly.

- Do provide a clear description of the property being gifted.

- Do include the correct tax parcel number if applicable.

- Do have the form signed in front of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank.

- Don't forget to check for any local requirements that may apply.

- Don't submit the form without verifying that all information is accurate.

- Don't assume that the form is valid without proper notarization.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | The Georgia Gift Deed is governed by Georgia state law, specifically under O.C.G.A. § 44-5-30. |

| Parties Involved | The form requires a grantor (the person giving the gift) and a grantee (the person receiving the gift). |

| Property Description | It must include a clear description of the property being gifted, such as the address and legal description. |

| Consideration Clause | The deed typically states that the transfer is made "for love and affection," indicating no monetary consideration. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public to make it legally binding. |

| Recording | To ensure public notice, the completed Gift Deed should be recorded at the county clerk’s office where the property is located. |

| Tax Implications | Gift tax may apply, and it’s important to consult a tax professional regarding potential implications. |

| Revocation | Once executed, a Gift Deed is generally irrevocable unless specific conditions are met. |

| Legal Advice | It is advisable to seek legal advice before executing a Gift Deed to ensure all legal requirements are met. |

Key takeaways

When filling out and using the Georgia Gift Deed form, keep these key takeaways in mind:

- Understand the purpose: A Gift Deed transfers property ownership without payment. It’s a way to give property to someone without expecting anything in return.

- Complete all required fields: Ensure that you fill out the names of both the giver and the recipient, along with a clear description of the property being gifted.

- Include the date: Always date the document. This helps establish when the gift was made, which can be important for legal and tax purposes.

- Sign in front of a notary: To make the Gift Deed valid, both parties must sign it in front of a notary public. This step adds an extra layer of authenticity.

- Consider tax implications: Be aware that gifting property may have tax consequences. It’s wise to consult a tax professional to understand any potential impacts.

- File the deed: After signing, file the Gift Deed with the local county clerk’s office. This officially records the transfer of ownership.

Popular State-specific Gift Deed Forms

Gift Deed California - Understand the implications before executing a Gift Deed, especially regarding potential future liabilities.

In order to create a clear understanding between landlords and tenants, utilizing the New York Room Rental Agreement form is essential, as it details the responsibilities of each party. For those seeking a comprehensive template to fill out, you can refer to the newyorkform.com/free-room-rental-agreement-template, which provides a useful resource to ensure all necessary terms are covered.

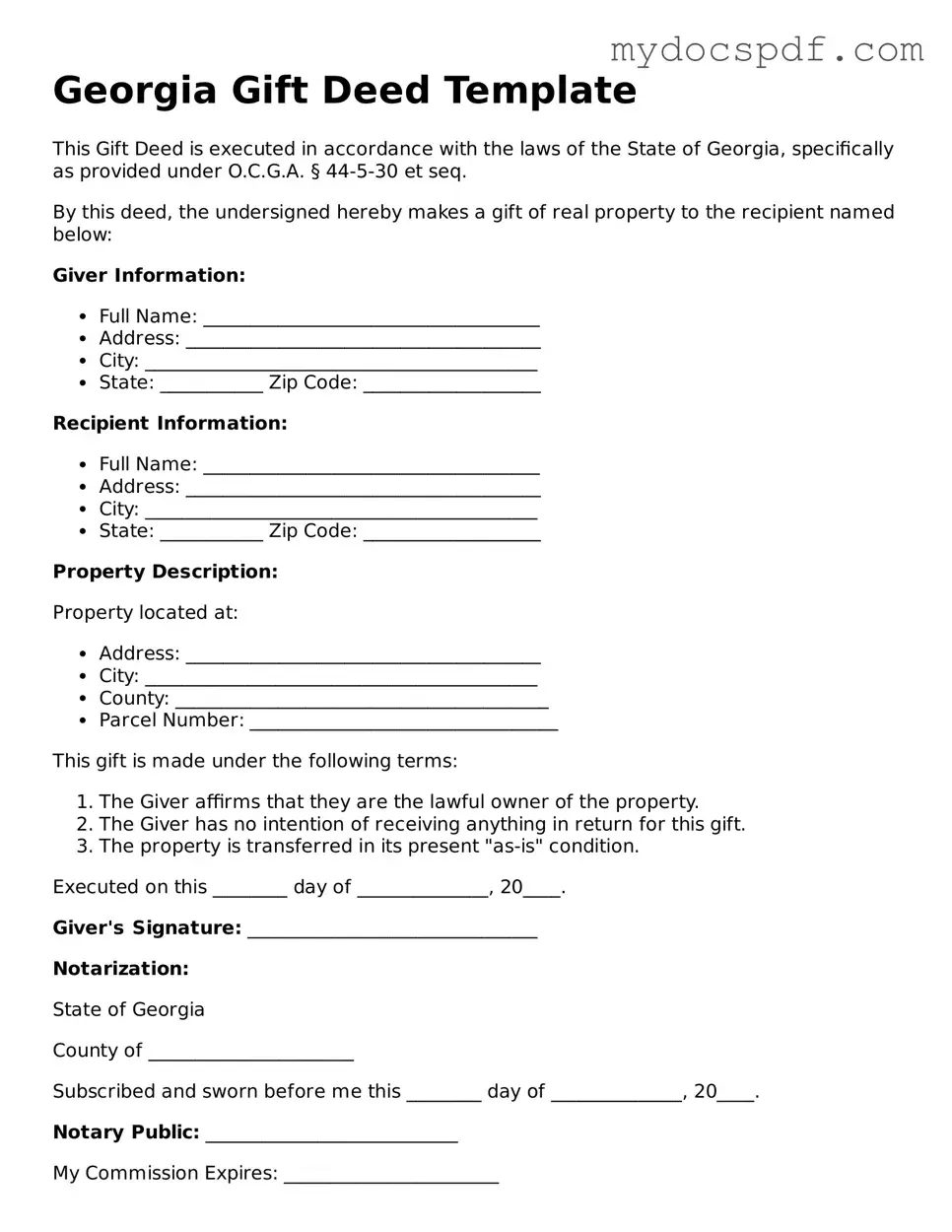

Example - Georgia Gift Deed Form

Georgia Gift Deed Template

This Gift Deed is executed in accordance with the laws of the State of Georgia, specifically as provided under O.C.G.A. § 44-5-30 et seq.

By this deed, the undersigned hereby makes a gift of real property to the recipient named below:

Giver Information:

- Full Name: ____________________________________

- Address: ______________________________________

- City: __________________________________________

- State: ___________ Zip Code: ___________________

Recipient Information:

- Full Name: ____________________________________

- Address: ______________________________________

- City: __________________________________________

- State: ___________ Zip Code: ___________________

Property Description:

Property located at:

- Address: ______________________________________

- City: __________________________________________

- County: ________________________________________

- Parcel Number: _________________________________

This gift is made under the following terms:

- The Giver affirms that they are the lawful owner of the property.

- The Giver has no intention of receiving anything in return for this gift.

- The property is transferred in its present "as-is" condition.

Executed on this ________ day of ______________, 20____.

Giver's Signature: _______________________________

Notarization:

State of Georgia

County of ______________________

Subscribed and sworn before me this ________ day of ______________, 20____.

Notary Public: ___________________________

My Commission Expires: _______________________

Detailed Instructions for Writing Georgia Gift Deed

Filling out the Georgia Gift Deed form is an important step in transferring property ownership without a sale. Once completed, the form must be signed and notarized before being filed with the county clerk's office. Follow these steps to ensure the form is filled out correctly.

- Obtain the Form: Download the Georgia Gift Deed form from a reliable source or visit your local county clerk’s office to get a physical copy.

- Identify the Parties: Clearly write the names and addresses of the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Property: Provide a detailed description of the property being gifted. Include the address and any relevant identification numbers.

- State the Gift: Clearly state that the property is being given as a gift. Use straightforward language to avoid confusion.

- Sign the Form: Both the donor and the recipient must sign the form. Ensure that the signatures are in the appropriate places.

- Notarize the Document: Take the signed form to a notary public. The notary will verify the identities of the signers and notarize the document.

- File the Form: Submit the notarized Gift Deed to the county clerk’s office where the property is located. Pay any applicable filing fees.

Documents used along the form

The Georgia Gift Deed form is an important document for individuals transferring property without compensation. However, several other forms and documents are often utilized in conjunction with the Gift Deed to ensure a smooth and legally compliant transfer. Below is a list of these documents, each serving a specific purpose in the process.

- Quitclaim Deed: This document transfers any interest the grantor has in the property without making any guarantees about the title. It is often used when the grantor is not certain about the property’s status.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed guarantees that the grantor holds clear title to the property and has the right to transfer it. This document provides greater protection to the grantee.

- Property Transfer Tax Exemption Form: This form is necessary to claim an exemption from property transfer taxes when a gift deed is executed. It helps ensure that the transfer is not subject to taxation.

- Affidavit of Value: This affidavit is often required to declare the value of the property being gifted. It assists in determining any applicable taxes and ensures transparency in the transaction.

- Title Search Documentation: A title search report verifies the ownership and any liens or encumbrances on the property. This document helps confirm that the grantor has the right to gift the property.

- Consent of Spouse: If the property is jointly owned or if one spouse holds the title, this document may be needed to ensure that the other spouse consents to the transfer.

- Trailer Bill of Sale: This document is essential when transferring ownership of a trailer. It includes important details about the trailer and the parties involved, ensuring a clear transaction. For more information, you can visit NY Templates.

- Gift Tax Return (Form 709): This federal form must be filed if the value of the gift exceeds the annual exclusion limit. It is essential for tax reporting purposes and compliance with IRS regulations.

Understanding these associated documents is crucial for anyone involved in the property transfer process. Each form plays a vital role in ensuring the legality and efficiency of the transaction, thereby protecting the interests of both the giver and the recipient.