Fillable Georgia Deed in Lieu of Foreclosure Document

The Georgia Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows property owners to voluntarily transfer their property to the lender in exchange for the cancellation of their mortgage debt. By opting for a deed in lieu, homeowners can avoid the lengthy and often stressful foreclosure process, preserving their credit score and providing a more dignified exit from homeownership. The form outlines essential details, such as the property description, the parties involved, and any agreements regarding the condition of the property. It is important to understand the implications of this choice, as it can impact future borrowing opportunities and the homeowner's financial standing. Additionally, this form may include clauses that address potential deficiencies, ensuring both parties are aware of their rights and responsibilities. Overall, the Georgia Deed in Lieu of Foreclosure is a significant option for those seeking a more manageable resolution to their mortgage challenges.

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Here are four important things to keep in mind:

- Do ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any questions or uncertainties about the process.

- Don't rush through the form. Take your time to understand each section before signing.

- Don't forget to keep a copy of the completed form for your records after submission.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The deed is governed by Georgia state law, specifically O.C.G.A. § 44-14-162. |

| Eligibility | To qualify, the borrower must be experiencing financial hardship and unable to continue mortgage payments. |

| Process | The borrower must negotiate with the lender to agree on terms before signing the deed. |

| Benefits | This option can help avoid the lengthy and costly foreclosure process while potentially minimizing damage to the borrower's credit. |

| Risks | Borrowers may still be liable for any remaining mortgage debt if the property value is less than the loan amount. |

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Understanding the key aspects of this process can help you make informed decisions.

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure.

- Eligibility Criteria: Not all homeowners qualify. Typically, you must be in default on your mortgage and unable to continue making payments.

- Negotiation with Lender: Before filling out the form, it’s essential to communicate with your lender. They may have specific requirements or conditions that need to be met.

- Complete the Form Accurately: Ensure that all information is filled out correctly. This includes property details, borrower information, and lender information.

- Seek Professional Help: Consulting with a legal expert or a real estate professional can provide valuable guidance and ensure that you understand the implications of the deed.

- Record the Deed: After completing the form, it must be recorded with the county clerk’s office to be legally effective. This step is crucial to finalize the transfer of ownership.

By keeping these key takeaways in mind, you can navigate the process of a Deed in Lieu of Foreclosure more effectively. Always remember that you have options and support available during this challenging time.

Popular State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Sample - The completed deed may include a waiver of the borrower's future liability for the mortgage balance.

For anyone looking to navigate the process of vehicle transfers, understanding the vital role of the Arizona RV Bill of Sale is crucial. This document ensures all necessary information is accurately reported, providing both parties with confidence during the transaction. To learn more about this essential document, check out our guide on the RV Bill of Sale procedures.

California Voluntary Property Surrender Document - In some cases, lenders may offer relocation assistance to homeowners.

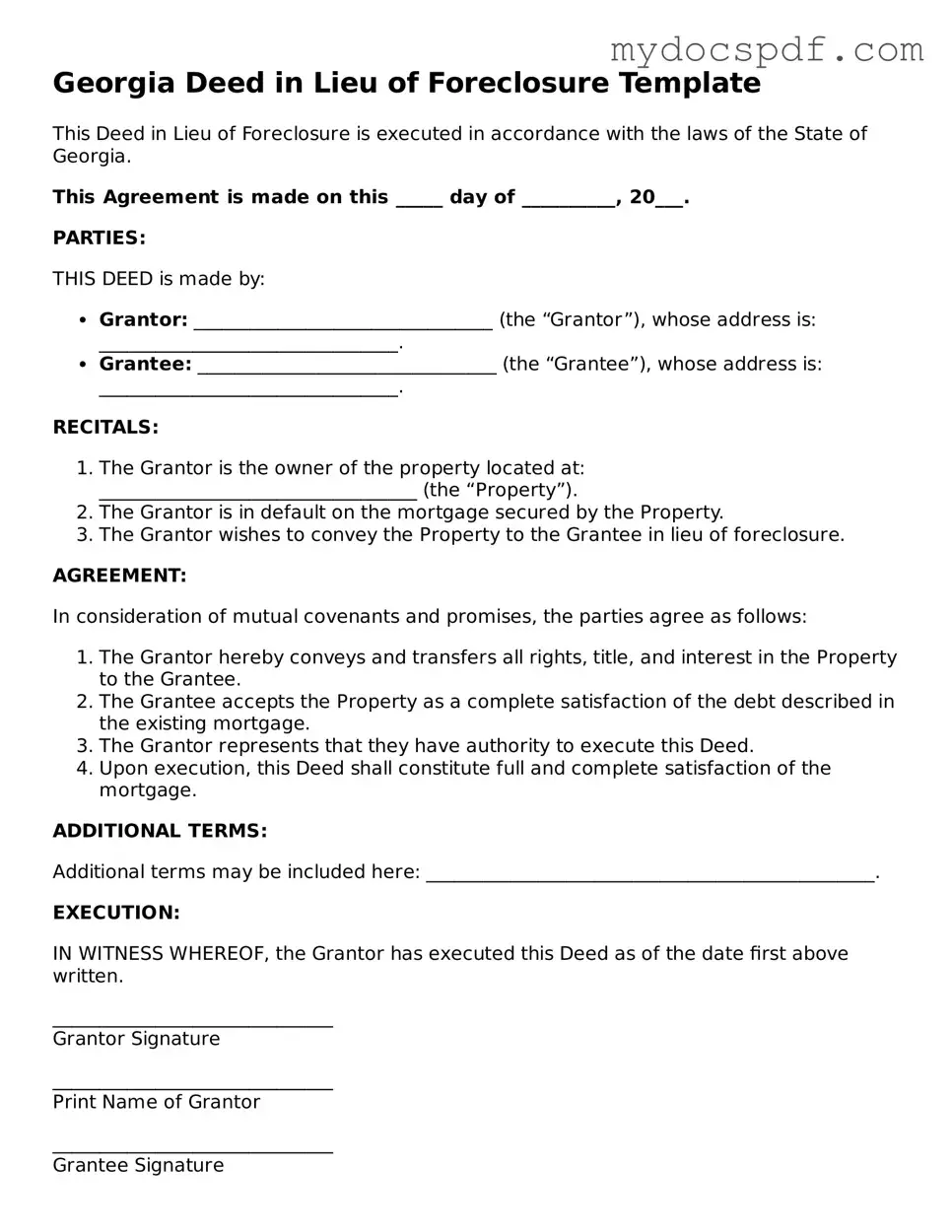

Example - Georgia Deed in Lieu of Foreclosure Form

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of Georgia.

This Agreement is made on this _____ day of __________, 20___.

PARTIES:

THIS DEED is made by:

- Grantor: ________________________________ (the “Grantor”), whose address is: ________________________________.

- Grantee: ________________________________ (the “Grantee”), whose address is: ________________________________.

RECITALS:

- The Grantor is the owner of the property located at: __________________________________ (the “Property”).

- The Grantor is in default on the mortgage secured by the Property.

- The Grantor wishes to convey the Property to the Grantee in lieu of foreclosure.

AGREEMENT:

In consideration of mutual covenants and promises, the parties agree as follows:

- The Grantor hereby conveys and transfers all rights, title, and interest in the Property to the Grantee.

- The Grantee accepts the Property as a complete satisfaction of the debt described in the existing mortgage.

- The Grantor represents that they have authority to execute this Deed.

- Upon execution, this Deed shall constitute full and complete satisfaction of the mortgage.

ADDITIONAL TERMS:

Additional terms may be included here: ________________________________________________.

EXECUTION:

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the date first above written.

______________________________

Grantor Signature

______________________________

Print Name of Grantor

______________________________

Grantee Signature

______________________________

Print Name of Grantee

STATE OF GEORGIA

COUNTY OF ________________________________

On this _____ day of __________, 20___, before me personally appeared ________________________________ (Grantor), and ________________________________ (Grantee), to me known to be the persons described in and who executed the foregoing instrument, and they acknowledged that they executed the same.

______________________________

Notary Public

My Commission Expires: ________________

Detailed Instructions for Writing Georgia Deed in Lieu of Foreclosure

Once you have decided to proceed with a Deed in Lieu of Foreclosure in Georgia, the next step involves carefully filling out the appropriate form. This process requires attention to detail, as each section must be completed accurately to ensure that the deed is valid and enforceable.

- Begin by obtaining the Georgia Deed in Lieu of Foreclosure form. You can usually find this form online or through your lender.

- At the top of the form, enter the date on which you are completing the deed.

- Fill in the names of the parties involved. This typically includes the borrower (or grantor) and the lender (or grantee).

- Provide the address of the property involved in the deed. This should include the street address, city, state, and zip code.

- Include a legal description of the property. This may be found on your mortgage documents or property tax records. It is essential for identifying the property accurately.

- Indicate any outstanding mortgage amounts or liens against the property. This information helps clarify the financial obligations associated with the property.

- Sign and date the form in the designated areas. Make sure that all signatories are present and that the signatures match those on the original mortgage documents.

- Have the deed notarized. A notary public must witness the signing of the document to ensure its validity.

- Once notarized, make copies of the completed deed for your records and for the lender.

- Submit the original deed to the lender. Ensure that you keep a record of the submission date and any correspondence related to it.

After completing the form and submitting it to your lender, they will review the document. It is essential to follow up to confirm that the deed has been processed and recorded appropriately. This will help ensure that the property is officially transferred and that your obligations are resolved.

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Georgia, several other forms and documents may be necessary to ensure a smooth transaction. Each document plays a crucial role in the process, providing clarity and legal backing to the agreement between the borrower and the lender. Below is a list of commonly used documents that accompany the deed in lieu of foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the loan if the borrower is attempting to modify their existing mortgage instead of proceeding with foreclosure.

- Homeschool Letter of Intent: This formal document informs the state of a parent's decision to homeschool, ensuring compliance with educational regulations. For more information, visit https://arizonapdfs.com.

- Notice of Default: This serves as a formal notification to the borrower that they are in default on their mortgage payments, often required before initiating a foreclosure process.

- Release of Liability: A document that releases the borrower from any further obligations related to the mortgage once the deed in lieu is executed.

- Property Condition Disclosure Statement: This statement provides information about the condition of the property, ensuring the lender is aware of any issues before accepting the deed.

- Affidavit of Title: This sworn statement verifies the ownership of the property and confirms that there are no undisclosed liens or encumbrances.

- Title Insurance Policy: This policy protects the lender against any future claims to the property that may arise after the deed in lieu transaction.

- Settlement Statement: A detailed document that outlines all financial transactions related to the deed in lieu, including any costs or fees involved.

- Quitclaim Deed: This document transfers the borrower’s interest in the property to the lender, often used in conjunction with the deed in lieu.

- Authorization to Release Information: A form that allows the lender to obtain necessary information from third parties regarding the borrower's financial situation.

- Borrower’s Financial Statement: This document provides an overview of the borrower’s financial situation, helping the lender assess the borrower's ability to meet their obligations.

Understanding these documents can help clarify the process and ensure that all parties are protected. By being informed about each form's purpose, borrowers and lenders can work together more effectively to navigate the deed in lieu of foreclosure process in Georgia.