Get Generic Direct Deposit Form in PDF

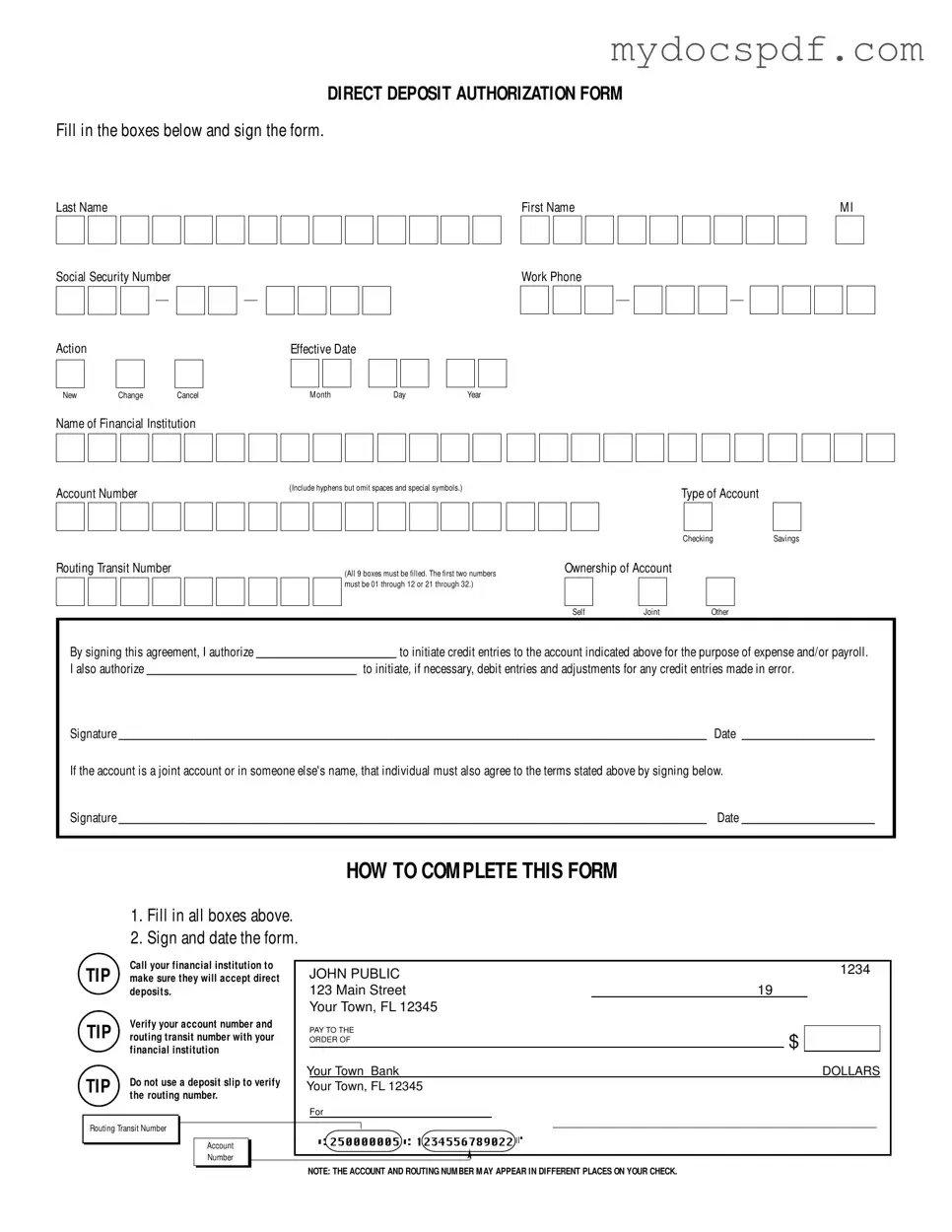

When it comes to managing your finances, setting up direct deposit can be a game changer. The Generic Direct Deposit Authorization Form is designed to streamline this process, allowing you to authorize your employer or another entity to deposit funds directly into your bank account. This form requires you to provide essential information, including your name, Social Security number, and contact details. You'll also need to specify the type of account—whether it’s a checking or savings account—and include both your account number and the routing transit number. These numbers are crucial, as they ensure the funds are directed to the correct financial institution. Additionally, the form includes options for new setups, changes, or cancellations of existing direct deposits. By signing this form, you give permission for your employer to initiate credit entries, and if necessary, to make corrections for any errors. If you share your account with someone else, their signature is also required to confirm their agreement. Completing the form accurately is vital, as it ensures that your funds are deposited without delay or complications.

Dos and Don'ts

When filling out the Generic Direct Deposit form, it’s essential to ensure accuracy and completeness. Here’s a list of what you should and shouldn’t do:

- Do fill in all boxes completely. Missing information can delay your direct deposit.

- Do double-check your account number and routing transit number with your financial institution.

- Do sign and date the form to validate your authorization.

- Do confirm that your financial institution accepts direct deposits before submitting the form.

- Do use the correct format for the routing transit number; it must be all 9 digits.

- Don’t use a deposit slip to verify your routing number; always confirm directly with your bank.

- Don’t leave any boxes blank. Each section is important for processing your request.

- Don’t forget to include the type of account, whether it’s checking or savings.

- Don’t submit the form without ensuring that all necessary signatures are obtained, especially for joint accounts.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize electronic deposits into their bank accounts for payroll or expense reimbursements. |

| Required Information | Individuals must provide their name, Social Security number, account details, and signature to complete the form. |

| Account Types | Depositors can choose between a checking or savings account when filling out the form. |

| Routing Number | The routing transit number must be nine digits long, starting with numbers between 01-12 or 21-32, ensuring accurate processing of transactions. |

| Governing Law | In Florida, the use of direct deposit forms is governed by the Florida Statutes, specifically under Title XXXI, Chapter 655 regarding financial institutions. |

Key takeaways

Here are some key takeaways about filling out and using the Generic Direct Deposit form:

- Ensure that you fill in all required boxes accurately, including your name, Social Security Number, and account details.

- Decide whether you are setting up a new direct deposit, changing an existing one, or canceling it.

- Include your work phone number for any necessary follow-up from your employer.

- Clearly state the name of your financial institution and your account number, making sure to include hyphens.

- Verify the routing transit number with your bank; all nine boxes must be filled correctly.

- Understand the type of account you are using—whether it’s a savings or checking account.

- Sign and date the form to authorize your employer to initiate credit entries to your account.

- If the account is joint or under someone else’s name, that person must also sign the form.

- Do not use a deposit slip to verify the routing number; always confirm with your financial institution directly.

Other PDF Templates

Ahcd California - It helps ensure your wishes regarding medical treatment are understood and honored.

Completing the Homeschool Letter of Intent can be a straightforward process for parents ready to take charge of their children's education. For detailed guidance, consider visiting the information on the Homeschool Letter of Intent requirements, which can help clarify the necessary steps for proper submission.

Tanzania Visum - Gather all supporting documents before submission.

Example - Generic Direct Deposit Form

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

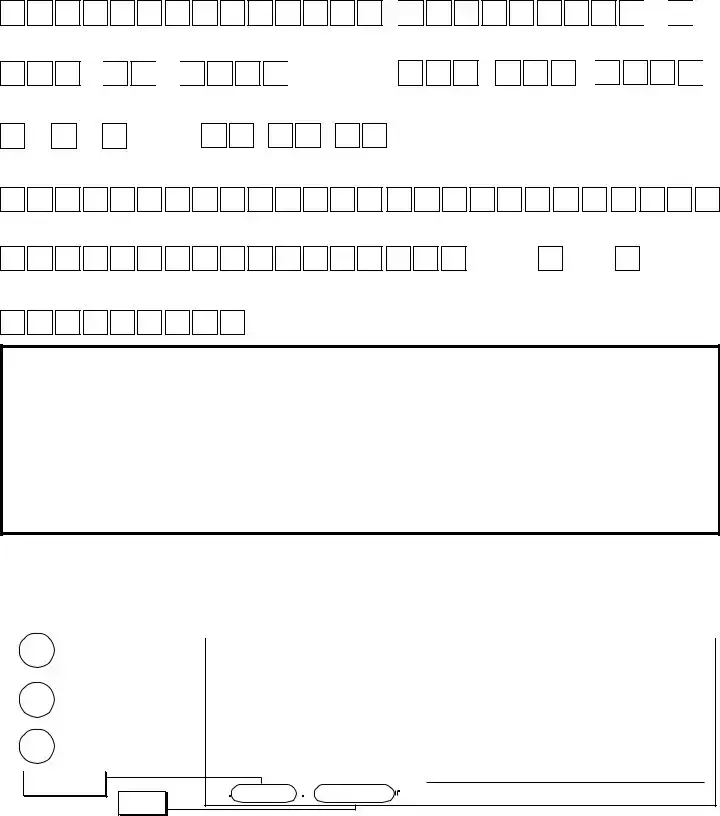

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Detailed Instructions for Writing Generic Direct Deposit

After completing the Generic Direct Deposit form, the next step involves submitting it to the appropriate department or financial institution. Ensure that all information is accurate to avoid any delays in processing.

- Fill in your last name, first name, and middle initial in the designated boxes.

- Enter your Social Security Number in the format: XXX-XX-XXXX.

- Select the action you wish to take: New, Change, or Cancel.

- Provide the effective date by filling in the month, day, and year.

- Input your work phone number in the format: XXX-XXX-XXXX.

- Write the name of your financial institution in the appropriate box.

- Fill in your account number, including hyphens but omitting spaces and special symbols.

- Select the type of account: Savings or Checking.

- Enter your routing transit number, ensuring all 9 boxes are filled correctly.

- Indicate the ownership of the account by selecting Self, Joint, or Other.

- Sign the form and date it.

- If the account is a joint account, the other account holder must also sign and date the form.

Be sure to verify your account and routing transit numbers with your financial institution. This verification helps prevent errors and ensures smooth processing of your direct deposits.

Documents used along the form

When setting up direct deposit, several additional forms and documents may be required. These documents help ensure that the process is smooth and that all necessary information is accurately recorded. Below is a list of common forms that accompany the Generic Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax withholding from each paycheck.

- Bank Account Verification Letter: This letter, provided by the bank, confirms the account holder's details and ensures the account is eligible for direct deposit.

- Employee Information Form: This document collects essential personal information about the employee, including contact details and emergency contacts.

- Payroll Authorization Form: This form authorizes the employer to process payroll for the employee, including direct deposit instructions.

- Tax Identification Number (TIN) Form: This form is often required for tax purposes. It provides the employer with the employee's Social Security Number or Employer Identification Number.

- Change of Address Form: If an employee moves, this form updates their address in the employer's records, ensuring that tax documents and other important information are sent to the correct location.

- Joint Account Holder Authorization: If the account is jointly held, this document secures the agreement of all account holders to the terms of the direct deposit.

- Direct Deposit Cancellation Form: This form is used if an employee wishes to stop direct deposit. It formally notifies the employer of the cancellation.

- Power of Attorney Form: This legal document allows you to designate someone to make decisions on your behalf. For more information and a useful template, visit Texas Forms Online.

- Employer Direct Deposit Policy: This document outlines the employer's policies regarding direct deposit, including any deadlines and eligibility requirements.

These forms and documents play a crucial role in the direct deposit process. Each serves a specific purpose, ensuring compliance and clarity between the employee and employer. Properly completing and submitting these documents can help avoid potential issues with payroll and banking transactions.