Get Free And Invoice Pdf Form in PDF

In today's fast-paced business environment, efficient invoicing is crucial for maintaining cash flow and ensuring timely payments. The Free And Invoice PDF form serves as a valuable tool for both small business owners and freelancers looking to streamline their billing processes. This user-friendly template simplifies the creation of professional invoices, allowing users to input essential details such as client information, services rendered, and payment terms. With customizable fields, it accommodates various business needs while ensuring compliance with standard invoicing practices. Moreover, the PDF format guarantees that the document retains its layout and design, regardless of the device used for viewing. By leveraging this form, businesses can enhance their professionalism and save time, ultimately contributing to a more organized financial operation.

Dos and Don'ts

When filling out the Free And Invoice Pdf form, it is important to follow certain guidelines to ensure accuracy and efficiency. Here are some dos and don'ts to consider:

- Do read all instructions carefully before starting.

- Do fill in all required fields completely.

- Do double-check your information for accuracy.

- Do save your progress frequently to avoid losing data.

- Don't leave any required fields blank.

- Don't use abbreviations unless specified.

- Don't rush through the process; take your time to ensure correctness.

- Don't submit the form without reviewing it first.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Free And Invoice PDF form is designed to facilitate the creation and management of invoices for businesses and freelancers. |

| Format | This form is typically available in PDF format, ensuring easy sharing and printing. |

| Customization | Users can customize the form with their branding, including logos and contact information. |

| State-Specific Compliance | In some states, invoices must comply with local laws, such as including specific tax information. |

| Governing Laws | For example, California requires invoices to include a seller's permit number under California Revenue and Taxation Code. |

| Accessibility | The PDF form can be accessed on various devices, making it user-friendly for all business owners. |

| Record Keeping | Using this form helps maintain accurate records for tax purposes and financial tracking. |

| Payment Terms | Invoices generated can include payment terms, such as due dates and late fees, to clarify expectations. |

| Distribution | The completed invoice can be easily emailed or printed for distribution to clients. |

Key takeaways

When filling out and using the Free And Invoice PDF form, consider the following key takeaways:

- Accurate Information: Ensure all information entered is accurate and up-to-date to avoid any potential issues.

- Clear Formatting: Maintain clear formatting throughout the form to enhance readability and professionalism.

- Save Regularly: Save your progress frequently to prevent data loss, especially if the form is lengthy.

- Review Before Submission: Always review the completed form for errors or omissions before submitting it.

- Include All Necessary Details: Provide all required details, such as contact information and item descriptions, to ensure completeness.

- Use Standard Fonts: Stick to standard fonts and sizes to ensure compatibility across different devices and software.

- Follow Submission Guidelines: Adhere to any specific submission guidelines provided to ensure timely processing.

- Keep a Copy: Retain a copy of the completed form for your records, as it may be needed for future reference.

Other PDF Templates

Post Office Hold Mail Form 8076 - This service is helpful for vacations, business trips, or any time you'll be away from your residence.

When completing a transaction, understanding the necessary documents is crucial. Our guide on the Illinois bill of sale details essential information to ensure a smooth transfer of ownership. Explore this valuable resource for your needs and consider the Illinois bill of sale today.

Florida Commercial Real Estate Contract - Events leading to defaults are clearly defined, providing a framework for resolution.

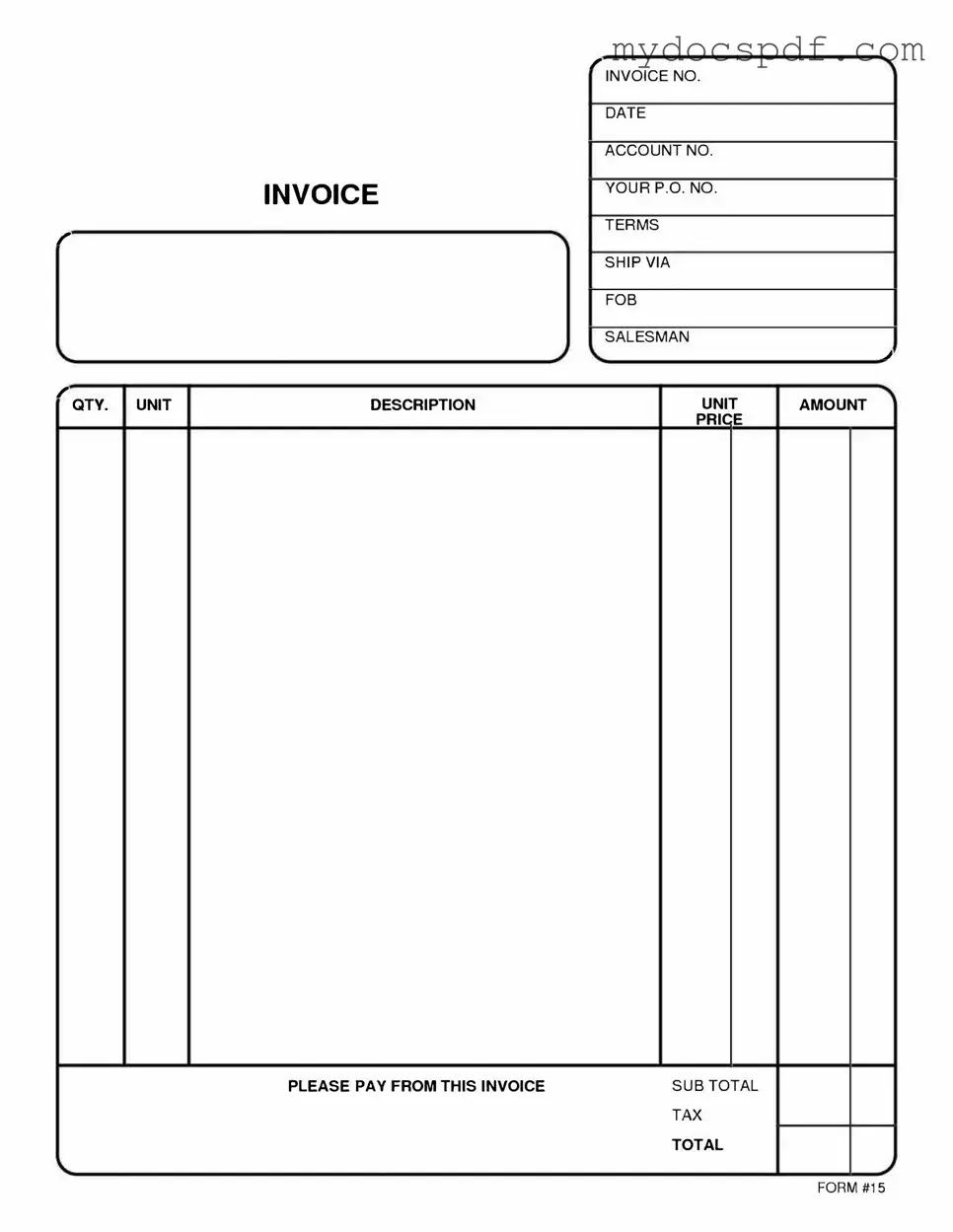

Example - Free And Invoice Pdf Form

, INVOICENO.

|

|

DATE |

|

|

|

|

INVOICE |

A CCOUNTNO. |

|

|

|

|

|

YOUR Р.О. NO. |

r |

|

TERMS |

|

SHIPVI A |

|

|

|

|

|

|

|

|

|

FOB |

|

|

|

|

|

SALESMAN |

|

|

|

|

� |

, QTY. UNIТ |

DESCRIPTION |

UNIT |

AMOUNT |

|

|

|

PRICE |

|

|

|

|

|

|

|

PLEASE РАУ FROM THIS INVOICE |

SUBTOTAL |

|

ТАХ |

|

TOTAL |

FORM #15

Detailed Instructions for Writing Free And Invoice Pdf

Filling out the Free And Invoice PDF form is a straightforward process. You will need to provide specific information to ensure accuracy and completeness. Follow these steps to successfully complete the form.

- Begin by downloading the Free And Invoice PDF form from the designated source.

- Open the PDF file using a PDF reader or editor that allows you to fill in forms.

- Locate the section for your personal or business information. Enter your name, address, and contact details as required.

- Next, move to the itemized section. List the products or services you are invoicing, including descriptions, quantities, and prices.

- Ensure that the total amount due is calculated correctly. This may involve adding up individual item costs and any applicable taxes.

- If necessary, include payment terms and conditions in the designated area of the form.

- Review all the information you have entered for accuracy. Make any necessary corrections.

- Once you are satisfied with the information, save the completed PDF file to your device.

- Finally, print the form if you need a hard copy, or send it electronically to the intended recipient.

Documents used along the form

When dealing with financial transactions and record-keeping, several forms and documents complement the Free And Invoice PDF form. Each of these documents serves a specific purpose and helps ensure clarity and organization in business dealings. Below is a list of commonly used forms that can enhance the invoicing process.

- Purchase Order: This document is issued by a buyer to a seller, indicating the types and quantities of products or services required. It serves as a formal agreement before the invoice is generated.

- Receipt: A receipt is proof of payment. After a transaction, the seller provides this document to the buyer, confirming that payment has been received for goods or services.

- Sales Agreement: This contract outlines the terms and conditions of a sale between two parties. It includes details such as price, delivery, and payment terms, ensuring both parties understand their obligations.

- Asurion F-017-08 MEN Form: This essential document not only streamlines claims management for electronic devices but also aids users in understanding service options. For more information, visit Fast PDF Templates.

- Credit Note: Issued by a seller to a buyer, a credit note serves as a document that reduces the amount owed by the buyer. This can occur due to returns, discounts, or billing errors.

- Payment Voucher: This document is used to authorize a payment. It includes details about the payment, such as the amount, date, and purpose, ensuring proper record-keeping.

- Statement of Account: This summary shows all transactions between a buyer and seller over a specific period. It provides a clear view of outstanding balances, payments made, and any credits or debits.

- Expense Report: Employees use this document to detail expenses incurred while conducting business. It helps in tracking and reimbursing costs effectively.

- Tax Form: Various tax forms are necessary for reporting income and expenses to the IRS. These documents ensure compliance with tax laws and can affect financial reporting.

Using these documents alongside the Free And Invoice PDF form can streamline financial processes and improve communication between parties. Maintaining organized records is essential for effective business management.