Fillable Florida Transfer-on-Death Deed Document

The Florida Transfer-on-Death Deed form offers a straightforward way for property owners to designate beneficiaries who will inherit their real estate upon their passing. This deed allows individuals to maintain full control of their property during their lifetime, as it does not transfer ownership until death occurs. By completing this form, property owners can avoid the often lengthy and costly probate process, simplifying the transfer of assets to loved ones. It is important to note that the form must be properly executed and recorded to be valid. Additionally, property owners can revoke or change the designated beneficiaries at any time before their death, providing flexibility in estate planning. Understanding the nuances of this deed can empower individuals to make informed decisions regarding their property and ensure their wishes are honored after they are gone.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are nine essential dos and don'ts to keep in mind:

- Do ensure that the property description is complete and accurate.

- Do include the names of all beneficiaries clearly.

- Do sign the deed in front of a notary public.

- Do file the deed with the county clerk's office where the property is located.

- Do keep a copy of the completed deed for your records.

- Don't forget to check for any outstanding liens on the property.

- Don't use vague terms when identifying the beneficiaries.

- Don't neglect to review state-specific requirements that may apply.

- Don't assume that verbal agreements about the deed are sufficient.

Following these guidelines will help ensure that the Transfer-on-Death Deed is executed properly and serves its intended purpose.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Chapter 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | The deed can be revoked at any time by the property owner, as long as they are alive and competent. |

| Filing Requirements | The deed must be recorded in the county where the property is located to be effective. |

| Tax Implications | There are no immediate tax consequences when creating a Transfer-on-Death Deed. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property, such as timeshares or properties held in certain trusts. |

| Effectiveness | The Transfer-on-Death Deed becomes effective only upon the death of the property owner. |

Key takeaways

When filling out and using the Florida Transfer-on-Death Deed form, there are several important points to keep in mind. This deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- Eligibility: Only individuals can create a Transfer-on-Death Deed. This means that the property must be owned by a person, not a business entity.

- Property Description: Clearly describe the property being transferred. Include the address and legal description to avoid confusion.

- Beneficiary Information: List the full names of the beneficiaries. Ensure the names are spelled correctly to prevent any legal issues later.

- Signing Requirements: The deed must be signed in the presence of two witnesses. Their signatures are crucial for the deed's validity.

- Recording the Deed: After completing the form, it must be recorded with the county clerk’s office where the property is located. This step is essential for the deed to take effect.

- Revocation: The Transfer-on-Death Deed can be revoked at any time before the owner's death. This allows for flexibility if circumstances change.

- No Immediate Tax Consequences: The transfer does not trigger property taxes or gift taxes during the owner's lifetime. However, beneficiaries may face tax implications upon the owner's death.

Understanding these key points can help ensure that the Transfer-on-Death Deed is filled out correctly and serves its intended purpose effectively.

Popular State-specific Transfer-on-Death Deed Forms

Problems With Transfer on Death Deeds Ohio - The Transfer-on-Death Deed can be used in tandem with a will to enhance your overall estate strategy.

When engaging in the sale of a dirt bike in New York, it is essential to utilize the New York Dirt Bike Bill of Sale form, which serves as a legal documentation of the transaction. This official record not only outlines the details of the sale but also protects the rights of both the buyer and the seller. For those looking for a reliable template to ensure a smooth transaction, you can find one at newyorkform.com/free-dirt-bike-bill-of-sale-template.

Tod Deed Georgia - It is advisable to keep the original deed in a safe place and inform beneficiaries about it.

Problems With Transfer on Death Deeds - Creating a Transfer-on-Death Deed can be quick and does not require a lawyer in all jurisdictions.

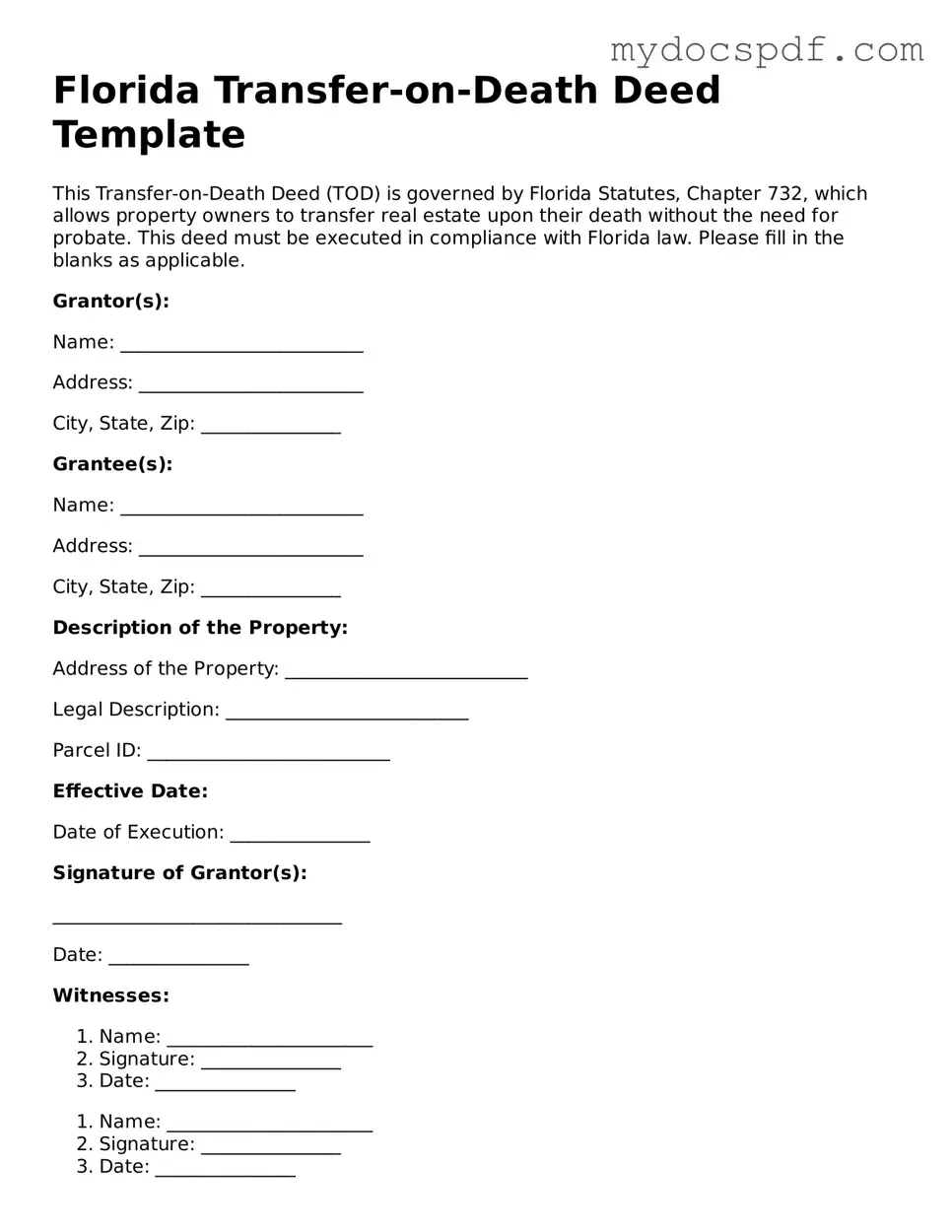

Example - Florida Transfer-on-Death Deed Form

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed (TOD) is governed by Florida Statutes, Chapter 732, which allows property owners to transfer real estate upon their death without the need for probate. This deed must be executed in compliance with Florida law. Please fill in the blanks as applicable.

Grantor(s):

Name: __________________________

Address: ________________________

City, State, Zip: _______________

Grantee(s):

Name: __________________________

Address: ________________________

City, State, Zip: _______________

Description of the Property:

Address of the Property: __________________________

Legal Description: __________________________

Parcel ID: __________________________

Effective Date:

Date of Execution: _______________

Signature of Grantor(s):

_______________________________

Date: _______________

Witnesses:

- Name: ______________________

- Signature: _______________

- Date: _______________

- Name: ______________________

- Signature: _______________

- Date: _______________

Notary Acknowledgment:

State of Florida

County of _________________

On this _____ day of __________, 20__, before me, a notary public, personally appeared _______________________, known to me to be the person who executed the foregoing Transfer-on-Death Deed, and acknowledged that he/she executed the same for the purposes therein expressed.

_______________________________

Notary Public Signature

My Commission Expires: _______________

Detailed Instructions for Writing Florida Transfer-on-Death Deed

Once you have obtained the Florida Transfer-on-Death Deed form, you are ready to begin the process of designating beneficiaries for your property. This form allows you to transfer ownership upon your death without going through probate. Follow these steps carefully to ensure that the deed is completed correctly.

- Begin by entering the name of the current owner(s) of the property at the top of the form.

- Provide the address of the property you wish to transfer. This should include the street address, city, state, and zip code.

- Identify the legal description of the property. This can usually be found on your current deed or property tax bill.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon your death. Ensure you include their full legal names.

- Specify the relationship of each beneficiary to the owner(s). This helps clarify the connection between the parties involved.

- Sign and date the form in the presence of a notary public. Your signature must be notarized to validate the deed.

- Ensure that the notary public also signs and stamps the form, confirming their acknowledgment of your signature.

- File the completed deed with the appropriate county clerk’s office where the property is located. This step is crucial for the deed to be legally effective.

After filing the deed, keep a copy for your records. It is advisable to inform the beneficiaries about the deed and its implications. This proactive communication can prevent confusion in the future.

Documents used along the form

When considering a Florida Transfer-on-Death Deed, it's important to understand that several other documents may be necessary to ensure a smooth transition of property ownership. These documents help clarify intentions, provide necessary legal backing, and facilitate the transfer process. Below is a list of commonly associated forms and documents.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. While a Transfer-on-Death Deed allows for direct transfer of property, a will can address other assets and specify guardianship for minors.

- Rental Application Form: This document collects essential information from potential tenants, including personal details and rental history, and is crucial for a smooth rental process. For a template, visit NY Templates.

- Living Trust: A living trust is a legal entity that holds ownership of a person's assets during their lifetime and allows for the management and distribution of those assets after death. This can help avoid probate and simplify the transfer process.

- Beneficiary Designation Forms: These forms are used for accounts such as life insurance policies or retirement accounts. They specify who will receive the benefits upon the account holder's death, complementing the Transfer-on-Death Deed for real property.

- Property Deed: The original deed to the property being transferred should be reviewed. This document contains vital information about ownership and any liens or encumbrances on the property.

- Affidavit of Heirship: This document can establish the heirs of a deceased person, especially when there is no will. It helps clarify who is entitled to inherit property, which can be important if disputes arise.

- Change of Ownership Form: After the Transfer-on-Death Deed is executed, this form may be required by local property appraisers to update the public records and reflect the new ownership.

Understanding these documents and their roles can provide clarity and peace of mind during the estate planning process. Each plays a significant part in ensuring that your wishes are honored and that your loved ones are taken care of after your passing.