Fillable Florida Real Estate Purchase Agreement Document

The Florida Real Estate Purchase Agreement form is a crucial document for anyone looking to buy or sell property in the state. This form outlines the terms and conditions of the sale, ensuring that both parties understand their rights and obligations. Key aspects include the purchase price, financing details, and the timeline for closing the deal. Additionally, it addresses contingencies, such as inspections and appraisals, which can protect buyers from unexpected issues. Sellers also benefit from this agreement, as it clearly defines the terms under which they will transfer ownership. By using this standardized form, both buyers and sellers can navigate the complexities of real estate transactions with greater confidence and clarity.

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, it's essential to approach the task with care. Here are nine things to keep in mind:

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate information about the property, including the address and legal description.

- Do specify the purchase price clearly to avoid any misunderstandings.

- Do include all necessary contingencies, such as financing or inspection clauses.

- Do sign and date the agreement in the appropriate places.

- Don't leave any blank spaces; fill in every section of the form.

- Don't use vague language; be specific in your terms and conditions.

- Don't forget to include any agreed-upon repairs or concessions.

- Don't rush through the process; take your time to ensure accuracy.

Following these guidelines will help ensure that your Real Estate Purchase Agreement is complete and clear, minimizing potential issues down the line.

PDF Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by the laws of the State of Florida. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement typically involves at least two parties: the buyer and the seller. |

| Property Description | The form requires a detailed description of the property being sold, including the address and legal description. |

| Purchase Price | The purchase price must be clearly stated, along with any deposit amounts and payment terms. |

| Contingencies | Common contingencies may include financing, inspections, and appraisal conditions that must be met for the sale to proceed. |

| Closing Date | The agreement specifies a closing date, which is the date when the transaction is finalized and ownership is transferred. |

Key takeaways

When navigating the Florida Real Estate Purchase Agreement, understanding its key components can significantly enhance your experience. Here are some essential takeaways to keep in mind:

- Clarity is Crucial: Ensure that all terms, including purchase price, closing date, and any contingencies, are clearly stated. Ambiguities can lead to misunderstandings down the line.

- Review Contingencies: Pay close attention to any contingencies included in the agreement. These might involve financing, inspections, or the sale of another property, and they can affect the overall transaction.

- Legal and Financial Advice: It’s wise to seek advice from a legal or financial professional before signing. They can help you understand your rights and obligations under the agreement.

- Documentation is Key: Keep copies of the signed agreement and any related documents. This will help you stay organized and provide a reference point if any disputes arise later.

By keeping these points in mind, you can approach the Florida Real Estate Purchase Agreement with greater confidence and clarity.

Popular State-specific Real Estate Purchase Agreement Forms

Sample Real Estate Purchase Agreement - This form serves as a legally binding contract between buyer and seller.

When engaging in the sale of an ATV, it is essential to utilize a New York ATV Bill of Sale form to ensure clarity and legality throughout the process. This document not only facilitates the transfer of ownership but also protects both parties involved. For those looking for a reliable template, you can access one at newyorkform.com/free-atv-bill-of-sale-template/, simplifying the task of documenting the sale.

Buying a House in Ma - Buyers should review all sections of the agreement carefully before signing.

Ga Real Estate Forms - A Real Estate Purchase Agreement is a legal document between a buyer and a seller.

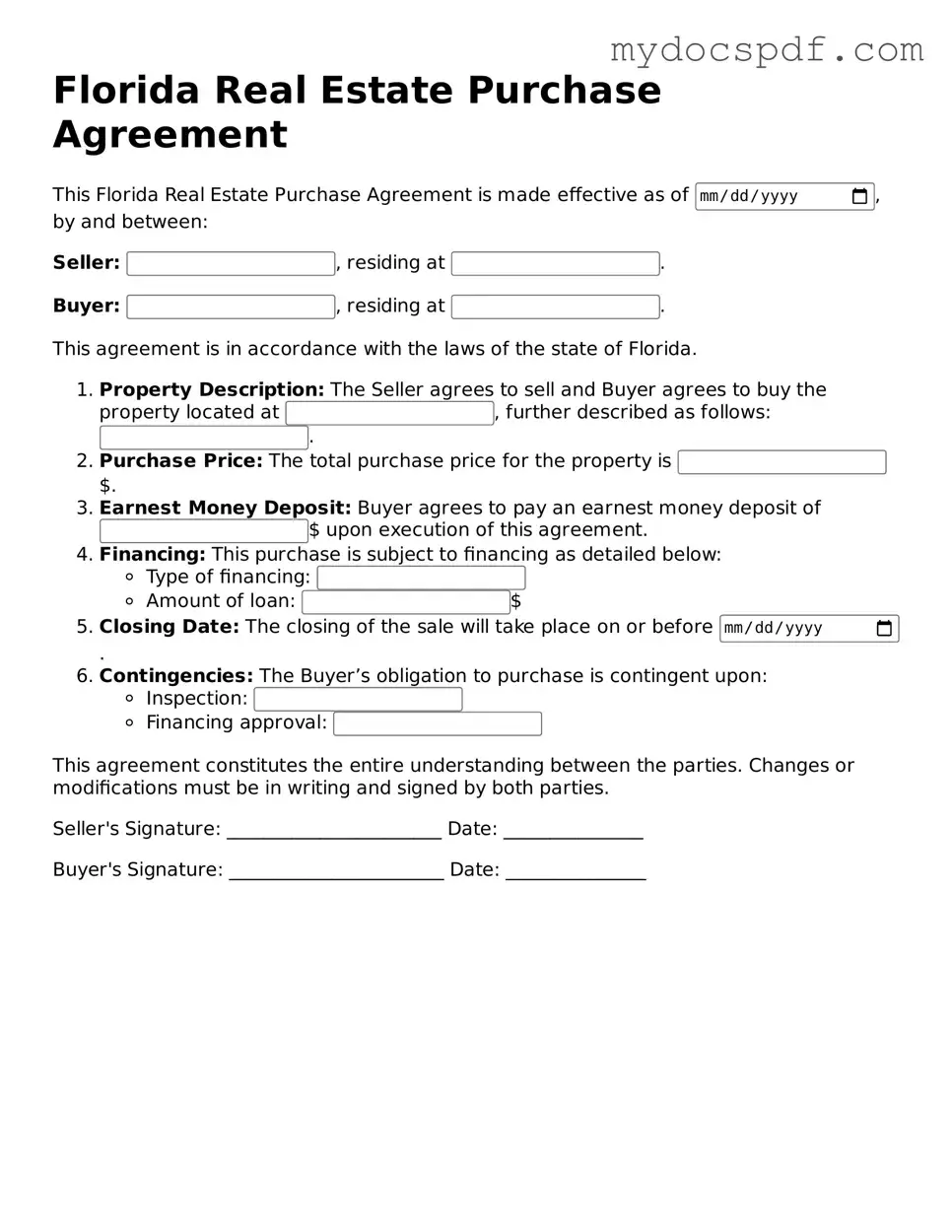

Example - Florida Real Estate Purchase Agreement Form

Florida Real Estate Purchase Agreement

This Florida Real Estate Purchase Agreement is made effective as of , by and between:

Seller: , residing at .

Buyer: , residing at .

This agreement is in accordance with the laws of the state of Florida.

- Property Description: The Seller agrees to sell and Buyer agrees to buy the property located at , further described as follows: .

- Purchase Price: The total purchase price for the property is $.

- Earnest Money Deposit: Buyer agrees to pay an earnest money deposit of $ upon execution of this agreement.

-

Financing: This purchase is subject to financing as detailed below:

- Type of financing:

- Amount of loan: $

- Closing Date: The closing of the sale will take place on or before .

-

Contingencies: The Buyer’s obligation to purchase is contingent upon:

- Inspection:

- Financing approval:

This agreement constitutes the entire understanding between the parties. Changes or modifications must be in writing and signed by both parties.

Seller's Signature: _______________________ Date: _______________

Buyer's Signature: _______________________ Date: _______________

Detailed Instructions for Writing Florida Real Estate Purchase Agreement

Completing the Florida Real Estate Purchase Agreement form requires careful attention to detail. After filling out the form, both parties will need to review it before signing to ensure all information is accurate. This step is crucial for a smooth transaction.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of the buyer(s) and seller(s).

- Provide the property address, including the city, state, and zip code.

- Specify the purchase price of the property.

- Outline the deposit amount and the method of payment.

- Indicate the closing date and any contingencies, such as financing or inspections.

- Include any additional terms or conditions that are agreed upon by both parties.

- Review the completed form for accuracy.

- Sign and date the form where indicated for both the buyer(s) and seller(s).

Documents used along the form

When engaging in a real estate transaction in Florida, several documents accompany the Real Estate Purchase Agreement to ensure a smooth process. Each of these documents serves a specific purpose and helps protect the interests of both the buyer and the seller.

- Property Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It helps buyers make informed decisions based on the property's condition.

- Title Insurance Policy: Title insurance protects the buyer against any potential disputes over property ownership. It ensures that the title is clear and free from liens or other claims.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document outlines all the financial details of the transaction. It lists the costs associated with the sale, including closing costs and any adjustments.

- Lead-Based Paint Disclosure: For homes built before 1978, sellers must provide a lead-based paint disclosure. This document informs buyers about the potential risks of lead exposure from paint in older homes.

- Trailer Bill of Sale: This document is essential for transferring ownership of a trailer between parties, ensuring all requisite information is included for a seamless transaction. For more information, you can refer to NY Templates.

- Homeowner's Association (HOA) Documents: If the property is part of an HOA, relevant documents must be provided. These include rules, regulations, and financial statements that outline the responsibilities and fees associated with the HOA.

Understanding these documents is crucial for anyone involved in a real estate transaction. They help clarify responsibilities and protect rights, making the buying or selling process more transparent and secure.